Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

1. Recaps, My Playlist…

If you missed it, from this past week:

My two pieces on Apple AAPL 0.00%↑, here and here. That last one focuses on how China is using Apple as a pawn in a game of geopolitical chess.

And quoting short-seller Jim Chanos, who knows a thing or two about variable interest entity accounting, I wrote, “Echos of Boston Chicken and Enron?” The focus was a deeper dive into the accounting at Erie Indemnity ERIE 0.00%↑ – no stranger to Herb On the Street subscribers.

Meanwhile, my daily walk time is my private time to tune out everything but whatever I’ve clicked to play. This past week’s highlights…

Highly instructive. My friend Stephen Clapham’s interview in his Behind the Balance Sheet podcast with growth investor Tom Slater, who runs the U.S. equity team at Baillie Gifford and manages its $10 billion Scottish Mortgage Investment Trust. If you’re at all interested in how the pros think, I would add Steve’s podcast to your playlist. One is better than the next. (He also writes the Behind the Balance Sheet newsletter.) Another favorite was his interview of Egerton Capital’s John Armitage, one of the best investors you’ve likely never heard of.

Laugh out-loud funny. I can only imagine what I looked like walking down the street laughing loudly to myself listening to actor Ted Danson’s interview with comedy writer Phil Rosenthal. A wonderfully entertaining great escape.

2. Diving into Deckers

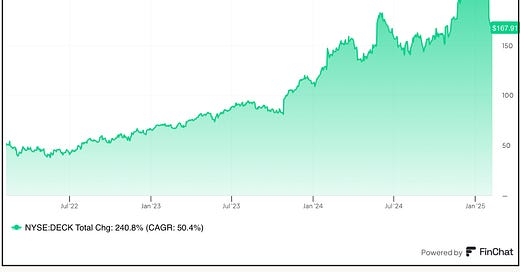

No question Deckers DECK 0.00%↑ has been a supersonic stock. Fueled by its Hoka and Ugg’s brands, the company has been unstoppable, rising 240% over the past three years.

But for those paying attention, there have been a number of warning signs along the way…

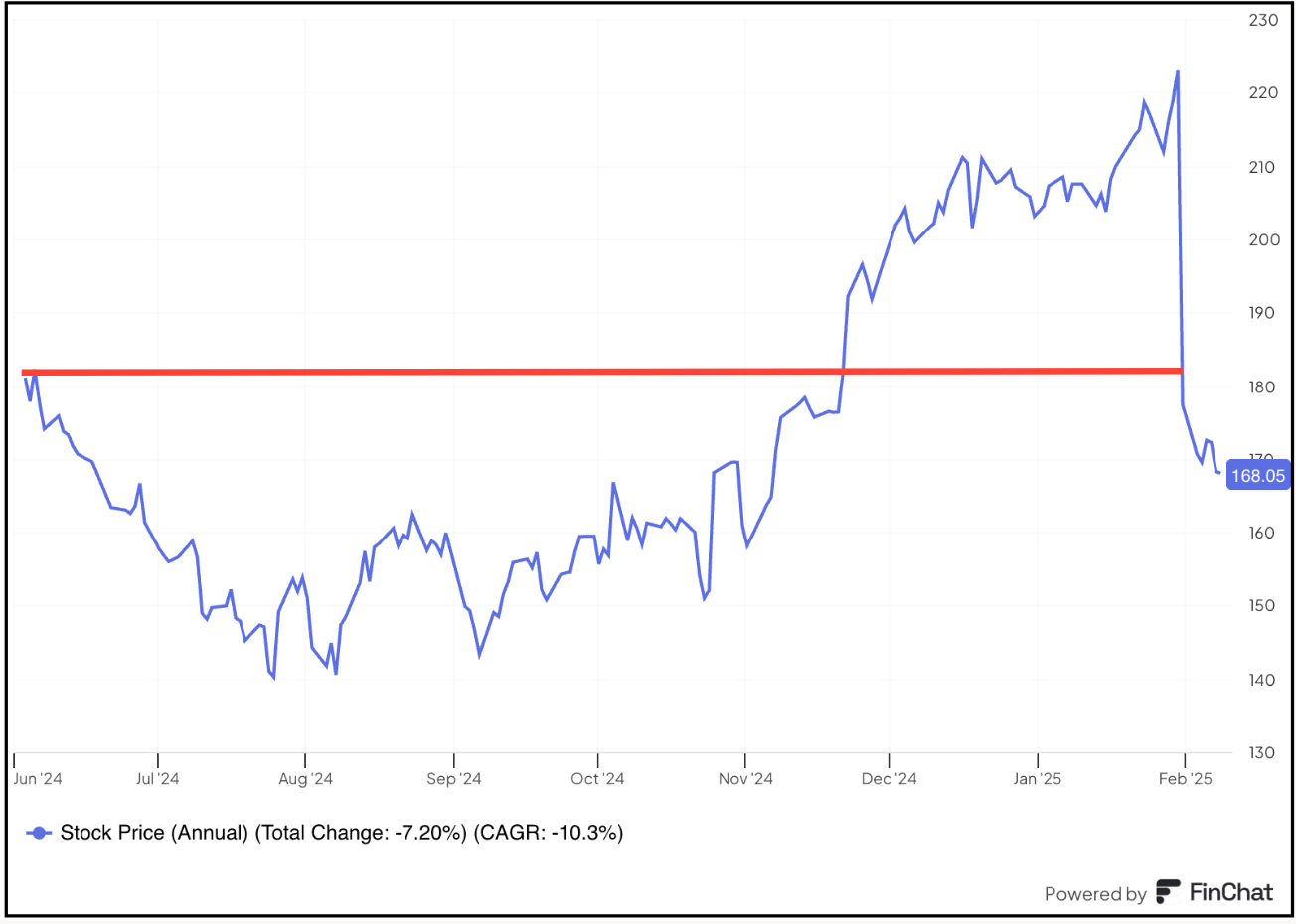

Such as the one I first wrote about last June about how the company had deleted a single word – “pairs” – from its 10-K, which at the time may have seemed meaningless, but as it turns out, may have been an important part of an emerging mosaic.

Since then, the stock has gone down, then up but in general – sideways... now trading below where it was when I wrote that first comment.

Now instead of one deleted word, perhaps even more significant is a single added word, this time to its most recent 10-Q.