Another Red Flag for Signet

The question any investor must ask is whether the likelihood for write-downs looms... and how big they'll be.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

Sometimes you need to read between the lines, such yesterday’s news involving De Beers, the world’s biggest diamond company…

More specifically, that De Beers’ parent – Anglo American – is writing down the value of its De Beers inventory by $2.9 billion. That’s a stunning amount.

And while Signet isn’t explicitly mentioned in any of the coverage, the news should be of concern to any Signet investor.

Signet, of course, is no stranger to subscribers of my Red Flag Alerts. I first wrote about it last April with my friend and former short-seller Katherine Spurlock in “Sounding the Siren” on Signet.

That report’s focus was on the rising impact of lab-grown diamonds on the company, especially on its lucrative extended service plans.

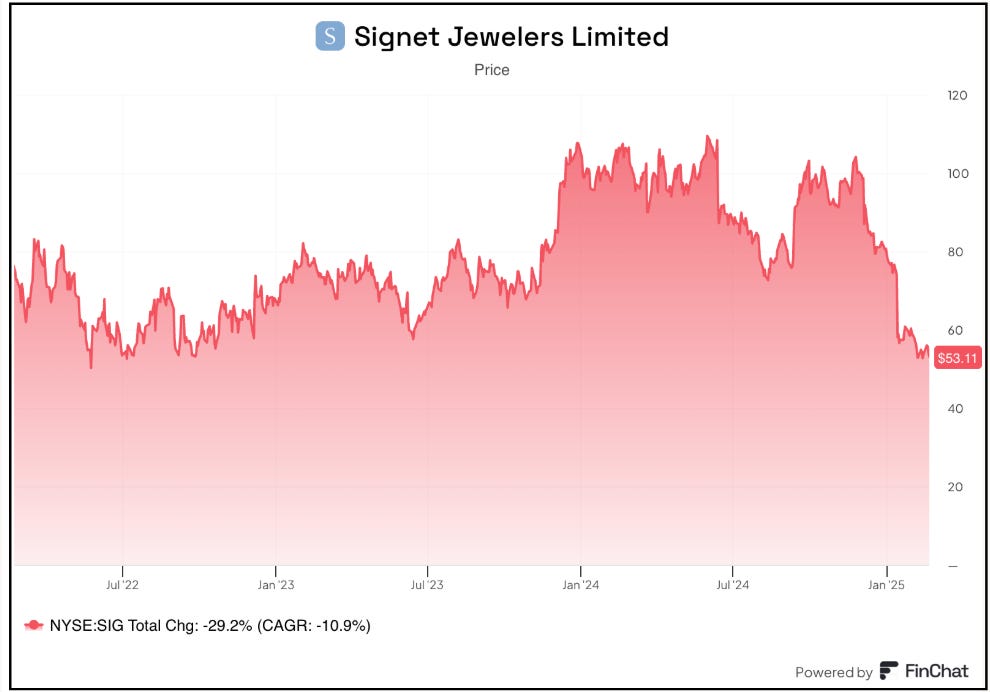

Signet’s shares have tumbled 43% since, with multiple stories here reminding subscribers of the risks involving Signet.

Which gets is to why the latest news regarding De Beers is should not be lost on Signet investors…