(Enjoy this free On the Street. This friendly reminder: My Red Flag Alerts and selected On the Street content are no longer free. But while the paint is still drying on my paywall, my introductory price remains. Here’s more on my decision to go paid, and what to expect from my Red Flag Alerts.)

I’m dubious about this market, and have written more than once before the recent cracks about how tenuous this market seems.

I’ve also written on both sides of the buyback debate, pro and con.

But I also have learned, the hard way, to keep an open mind…

So I was more than fascinated when I saw my pal Fil Zucchi, who tends to view the investing world from the credit side of the ledger, write in the wake of the most recent rout that stock buybacks may help save this market… again. (His full site is called Fil’s Randoms on the Markets. Check it out.)

From his latest, headlined, “A Day for the History Books”...

So what to make of the shellacking in the stock market? Day-to-day, week-to-week, equities will do whatever they do. Machines, ETFs, 0dTE option players, story stocks, technical levels, etc. are the near term market movers, and most investors or traders are pawns in that game. But what has been true for the last 30+ years is that, as long as corporate credit is in good enough shape to fund buybacks, once the buyback desks decide that stocks have dropped enough and their programs kick in, no one can stop them. As I pointed out on Twitter, new buyback announcements this year will top $1T, after $840B last year, and those bids usually hit the market 6-18 months after they are announced.

He added...

So some patience and scaling (rather than jumping in with both feet) make sense, but for my money, as long as credit remains in good shape, more weakness remains an opportunity to get longer as I wait for buybacks to - once again - break the will of the bears.

That’s An Interesting Take…

But there are a few obvious questions – two to be specific…

Just because a buyback is announced doesn't mean it’ll happen.

Who says the credit markets are or will be in fine shape?

Fil’s response…

They are the unknowns of this story, but this is what I go on: since (at least) 2009 the track record is that as long as companies can access the bond market, they will fund their buybacks with that money and free cash flow. If the bond market gets squirmy (like it did in Aug/Sep 2022 when the September issuance surge did not materialize) then the companies pause the buybacks altogether.

The one exception was 2020 when the companies gorged on bonds after rates went to zero, but held on to the money because they did not know what would happen with Covid.

As for the quality of credit, his focus is credit spreads…

The two “surge seasons” of September (most important) and January usually shape the rest of the year, and risk spreads are the tell in between those periods – in case things turn in the wrong direction.

Right now spreads are near decades tights so there’s a long way to go before they would signal problems.

For reference, investment-grade spreads less than 150bps and high yield less than 500bps are OK for credit; above that it can get messy fast. Right now they are 91 and 316.

And keep in mind, he adds, “the action in investment-grade bond spreads is 10-times more important than high-yield.”

If That Isn’t Convincing Enough…

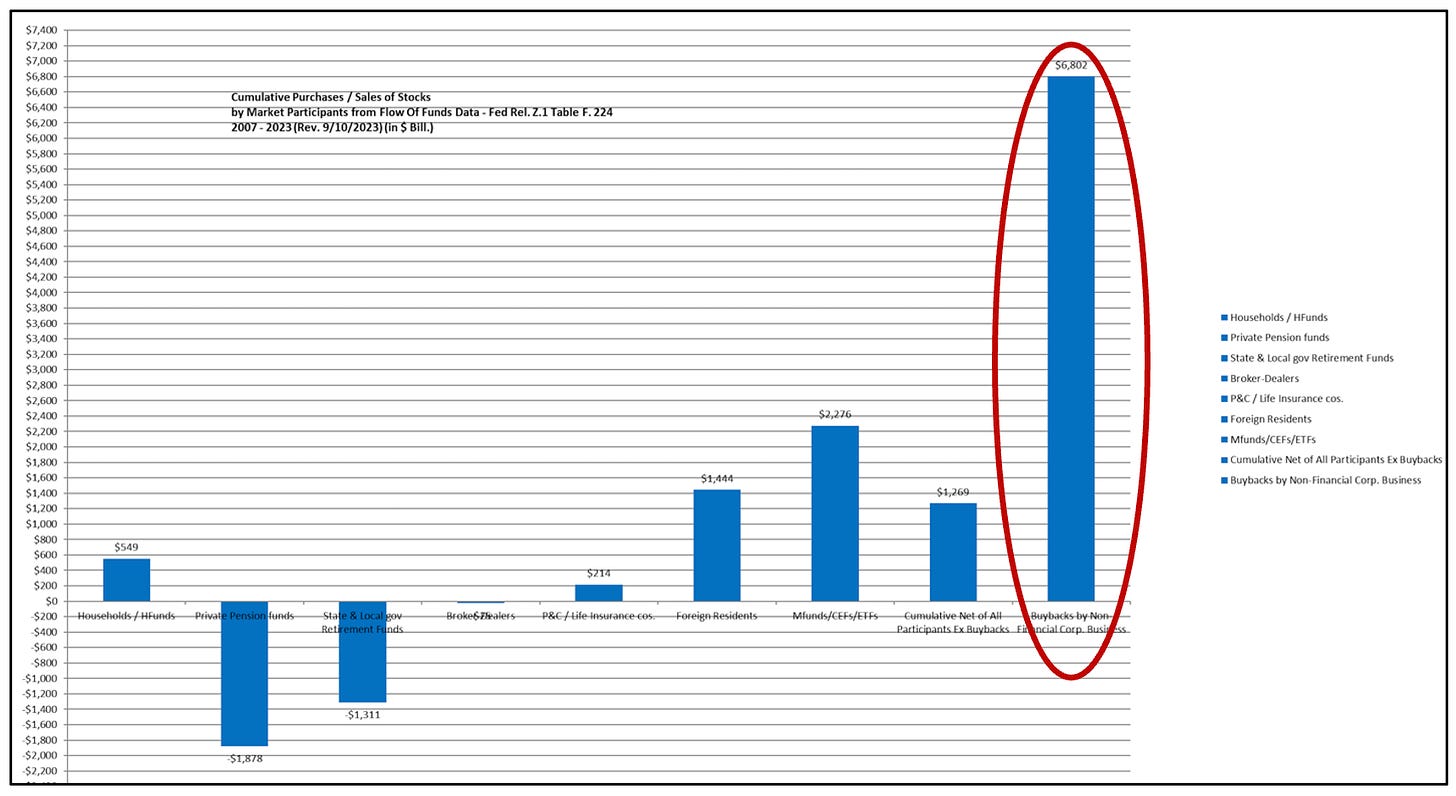

Perhaps more importantly, Fil stresses that since 2007, buybacks have pretty much been the biggest (by a long shot) net buyers of stocks.

Taking that one step further, Fil says, “The overwhelming majority of buybacks are done by investment-grade companies – and those proceeds typically get rolled into investment-grade indices, i.e. the S&P 500 and the Nasdaq 100 – hence the levitation of those indices as compared to the Russell 2000.”

The beauty of Fil’s view is that it’s coming from someone who is more focused on bonds than stocks, which is generally the less noisy, often smarter side of the street.

Agree? Disagree? Feel free to weigh in below. Remember – there are NO right answers. That’s why they call these markets! And if you liked this, a click of the heart is always nice. Even better, share this with your friends. And of course, consider upgrading to get access to my Red Flag Alerts.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

I can be reached at herb@herbgreenberg.com.

Let's get the comments rolling with this one from a friend, who never posts anywhere but who is never shy with an opinion:

Who knows what the market will do but not sure he is right about this. When interest rates were 0%, you borrow to fund buybacks, because it is accretive. Apple prime example.

Now if you have to borrow at 5%-7%, and your PE is 20 or more, the buyback is not accretive to EPS. That would be dilutive.

So obviously, there is still borrowing going on, but that is probably to fund operations as opposed to fund buybacks.

Obviously there are still buybacks going on too, but they are being funded by the cash already borrowed previously (but not used up yet), or by cash from operations.

Anyway, my point is I wouldn’t draw too much linkage now between the debt markets and buybacks.

Then the other thing is you have to look at buybacks not just in gross $, but as a % of total market cap out there. Market cap and multiple on some of these companies is so high now, they are no longer reducing share count with their buybacks.

Then as you point out, they are announced, but always hard to know the rate at which they will happen.

My 2 cents, market could go up, could go down, but I do not think buybacks funded by the current debt market will be part of why.

Thanks for the research and concise presentation. As a novice in the bond market world, I wonder where can one obtain data on investment and high yield credit spreads?