Case of Mistaken Identity...

Can create great inefficiencies in price

Some companies simply fall through the cracks for any number of reasons...

One of my favorites is a case of mistaken identity… like Dole (DOLE), the world's largest distributor, grower, and marketer of fresh produce. It also happens to be a busted IPO from the ill-fated class of the summer of 2021.

This was an IPO that couldn't have been timed worse. You had this boring, slow-growing, 171-year-old produce company going public the same week during peak "meme" mania as Robinhood (HOOD)... and getting lost in an avalanche of hot new offerings, most of which rapidly collapsed.

But timing was only part of the problem...

It appears to me that most people still thought of Dole as the old Dole, which went private in 2013 after a few years of being public.

This is the same Dole that for decades was controlled by billionaire tycoon David Murdock. During his reign, Dole had gone private and public and private again.

Murdock tried to take it public one more time in 2017, but he pulled the deal in favor of pursuing a sale that never happened.

Instead, while nobody was looking, in 2018 Murdock sold a 45% stake in Dole to Total Produce, Europe's biggest produce vendor, which is based in Ireland.

The Dole/Total relationship ultimately led to Total buying the entire company a month before the new Dole's IPO.

The enigmatic Murdock, who turned 100 last month, still has a 12.5% stake. But the important point: It's no longer his company.

This was all news to me when I started poking around Dole in early 2022...

We were looking at some broken IPOs to include in the inaugural model portfolio for my QUANT-X System newsletter, which launched in March of last year. The idea was a backdoor way into an IPO at a deeply discounted price, in effect beating the pros at their own game.

Dole was perfect for the kind of company we wanted: A real company with real products and real sales and real earnings... and unlike the memes, it had been around for more than a century. Plus, it leaned into the trend toward healthier, more diverse eating.

None of that mattered. Even after having gone public at the low end of the expected range, the stock cratered.

A big reason was a packaged-salad recall, which hurt results, in turn leading to further investor apathy on the name.

That's where this story gets really interesting...

Investors are always looking for an edge, and that's not easy these days. But with Dole, investors with a history following Total Produce were well ahead of the curve... and still are.

I learned that within a week after my recommendation, when I stumbled on a tweet by Conor Maguire, a former private equity analyst who publishes the excellent Value Situations newsletter.

It turns out he's been writing about Dole's IPO since June 2021. He also happens to live in Ireland, knows European companies, and used to follow Total Produce.

As a result, he had (and has) an edge...

He knew the management, the history and the nuances that would be easy to miss. His view...

Excellent management who now control Dole – true industry operators. I'm amazed to hear many people still saying, "Oh Dole? Isn't that David Murdock again?" and I think that misconception is part of reason stock is so mispriced.

We've swapped some observations since, and before long his knowledge of the company from a European perspective took on even greater significance.

Months after I published and about a year after the IPO, as the stock was now pummeled, there was a filing that Bruce Taylor, who owns California-based Taylor Fresh Foods, had bought a 6.5% stake in Dole.

I thought it was interesting because Taylor's private company is a Dole competitor... and it's cited as such in Dole's regulatory filings.

But Conor, because of his history following Total Produce, knew an even more compelling element...

He knew that Taylor and his family had been one of the 10 largest investors in Total Produce. They had sold out shortly before Dole and Total Produce merged. (I alerted my QUANT-X subscribers the minute I learned this added twist to the plot.)

Since it would seem that Taylor knows the ins and outs of this business better than most, his investment – along with at least one other former large Total Produce holder – would seem to be exceedingly bullish.

But because both Taylor and Dole are off the radar of the mainstream media and most investors, it went generally unnoticed... evidenced by the stock, which not only didn't budge, but continued to sink. Taylor has since raised his stake.

Even a European activist's entry into the stock didn't initially sway U.S. investors.

Meanwhile, Dole is selling off its fresh packaged-salads business, which has been its biggest liability and the biggest drag on its results.

And with its first-quarter earnings last week, the company is startingto show signs of life...

It's as if investors suddenly realized what they had been missing.

People can argue as much as they want about whether the market is efficient, but Dole is an example of just how inefficient individual stocks can be.

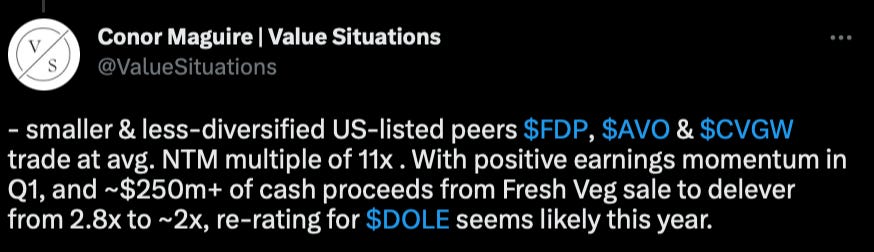

Dole still has to get from here to there, but as Conor recently tweeted...

This, after all, is the world's largest produce distributor and most investors still don't seem to know it exists... or if they do, that it isn't any longer David Murdock's Dole.

The biggest risk I see is the most obvious, which is why it's the first risk cited in its filings: Dole's main business is agriculture, which in the best of times can be risky.

The stock has now nearly doubled off its lows, and my readers are almost even from where I recommended it. Assuming something doesn't come out left field – and I'm not talking just locusts or blights – it ultimately may prove too appetizing to ignore.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg.

Great work & terrific call! Thank you for the wonderful update!

Good piece. I still have a recording saved of Conor sharing his research and thesis on a Twitter Space in Oct 2021. His understanding of the business are second-to-none of those I have come across. I have no current exposure, but thoroughly enjoy following along as everything unfolds.