Conservative Investors, Bank Depositors Get the Last Laugh... And What Google and Microsoft's Chatbots Say about One Another

There was a point in 2021 when, if you had money in the bank or just kept it in a brokerage sweep account, you felt like a chump...

It was worse for people on fixed incomes, who relied on interest income to keep them afloat.

There was nothing they or you could do – either keep that money in cash and earn zero, or stuff it into the most overheated market in a generation.

Money markets, CDs, U.S. Treasurys... it didn't matter because they were all earning a variation of the number zero.

The U.S. Federal Reserve, by keeping rates too low for too long, was forcing even the most conservative investors to take risk...

I can't tell you the number of hedge fund analysts and portfolio managers I talked to who – in casual conversation – would muse at how family members were calling them asking them what to do.

These were people who generally knew nothing about the markets, and suddenly they were calling about special purpose acquisition companies ("SPACs"), cryptocurrencies, non-fungible tokens ("NFTs"), or just "what stock should I buy?" Everything was going up... except the interest on their cash.

Cash, after all, was trash.

Now... cash is king.

Well, a roughly 4.5% yield in an average money market account isn't king, but you get the point...

I was thinking about this last week when a Morgan Stanley (MS) analyst yanked his rating on Charles Schwab (SCHW) because so many investors have been shifting money out of their sweep accounts to higher-yielding money market accounts and CDs.

Schwab's stock tumbled, and yet I thought... this was suddenly a surprise?

Think about it...

The Schwab sweep account yields around 0.46% versus its basic money market account, which is 4.6%. Treasurys and CDs, for folks willing to lock up their money for a few months, are even higher. The right thing to do for all but active traders and others who need instant access to that cash isn't rocket science.

That's the simple economics of why stocks rise when rates fall, and vice versa...

In fact, Schwab itself for months had been warning that its sweep assets would fall, including a new risk in its November 10-Q filing when it said...

As a result of rapidly increasing short-term interest rates in the second and third quarters of 2022, the Company saw an increase in the pace at which clients moved certain cash balances out of our sweep features and into higher yielding alternatives.

And that was after telling investors on its earnings call in October that a shift of money out of the sweep account wasn't just expected, but encouraged. As CFO Peter Crawford put it at the time...

We encourage those moves. We make outbound phone calls from our financial consultants and others. We do seminars. We offer marketing that encourages clients to position their investment cash into higher-yielding alternatives...

We know that we take a revenue hit with every dollar that moves, for example, from a bank sweep to a money market fund.

But as he continued, the reason Schwab alerts its customers is because "it's the right thing to do."

Even earlier, as far back as last April, the company was saying that based on earlier cycles the move could be as much as a 20% decline in sweep cash.

And in July, Crawford said he thought it would actually "be lower than that."

Oops! Famous last words...

As it turns out, when the Morgan Stanley analyst issued his warning, he said the drawdown in sweep cash was twice what he was modeling, whatever that percentage was.

The migration is happening at banks as well, even though the rates on their money markets aren't near what the brokerages offer.

Still, while that might not be good news for investors in the brokers or the banks, it's great news for everybody else... especially those conservative investors, who are laughing all the way to the, well, bank.

Moving on...

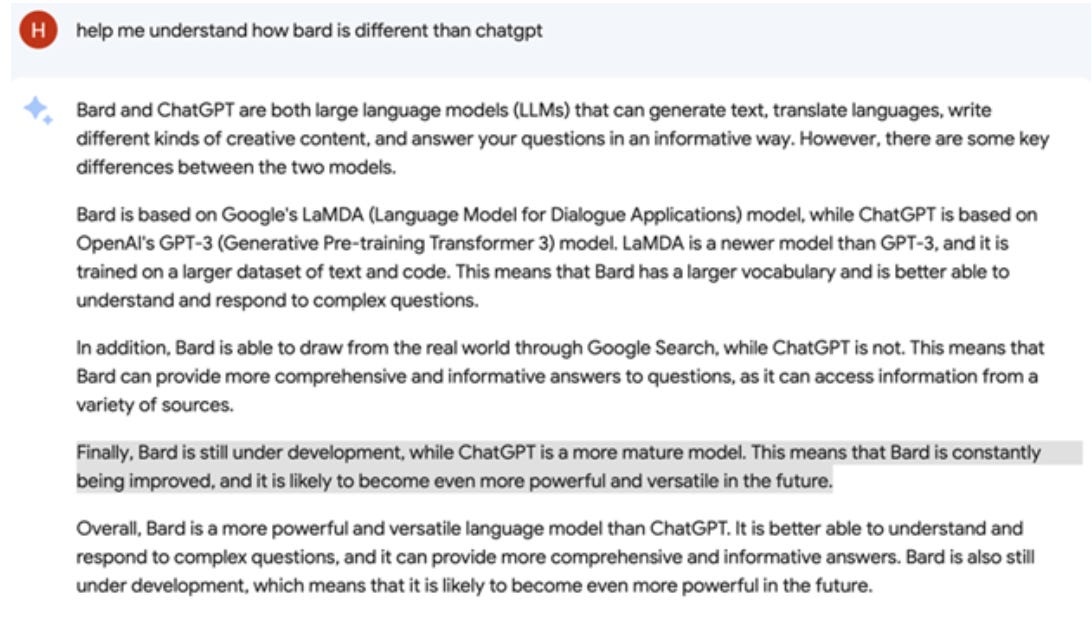

Over the weekend, I was fiddling with the new Bard artificial intelligence ("AI") chatbot from Alphabet's (GOOGL) Google over the weekend and wondered what it thought of the rival ChatGPT.

The conversation went like this...

So I asked ChatGPT, via Microsoft's (MSFT) Bing search engine, about what Bard said. Here's how that went...

ChatGPT's answer reminds me of the time I complained to Marriott about the hotel I stayed at in Barbados during my honeymoon 43 years ago. I received a printed card that said...

Thank you for your comments, both positive and negative.

ChatGPT's answer left me feeling just as empty.

(This originally ran at Empire Financial Research, where I also write two investment newsletters, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)