Does Nvidia Take the Money... Or Wait to See What's Behind the Curtain?

Bubble bubble, toil and trouble...

It seems everybody has an opinion on what Nvidia's (NVDA) latest blowout earnings and guidance means...

But to me, the bigger question boils down to: Is the euphoria surrounding Nvidia really signaling the dawn on the Internet part deux? Or is it a sign of the market's last hurrah before a blow-off top?

As somebody who raised a red flag or two (or three) in the mid-to-late 1990s – based on historic metrics, logic, and common sense... all suggesting that today's bubble should burst any day – don't look at me for an answer. Trying to get this one right is like trying to guess the number of gumballs in a giant jar...

What I do know is that artificial intelligence ("AI") is real... so real that it was here long before ChatGPT arrived on the scene.

Nvidia, in fact, has been talking about AI since at least 2011... back then, for the way it enhanced the realistic nature of video games.

Now, AI has become a quiet force in everybody's everyday life... mostly without fanfare. It's what makes the camera on your phone so good, and your Ring doorbell capable of determining whether it just saw a person or a dog. It's why you know how much traffic you're about to face, what the best detour will be, and why you can get an alert that "light rain" will start in five minutes.

The rollout of ChatGPT changed the narrative in a huge way...

It was obvious in Nvidia's most recent earnings report, which was so good that it sparked a whodunit of sorts about the real meaning of such strong demand so early in the game.

It's one thing for Nvidia CEO Jensen Huang to declare as he did during a speech over the weekend in Hong Kong, "We have reached the tipping point of a new computing era."

It's another to know when it will actually tip... or something simpler, like whether the current wave of orders was a one-time event.

While the company didn't come right out and say so, it's hard to believe that most if not all of last quarter's demand came from anyone other than the current kingpins of generative AI: Microsoft (MSFT), Alphabet (GOOGL), Meta (META), and Amazon (AMZN)... each jockeying to make sure they don't get left behind.

Such so-called "pull-forward" of demand is fine, as long as there's a greater amount of demand right behind it.

And that's the wildcard here...

As one friend who is no neophyte when it comes to tech companies put it in a note to friends...

Four companies, but primarily two, can create the perception of something much broader going on if you look at the results of their much smaller suppliers.

Interestingly, this just may be a big one-time lift, that could roll back over once whatever they are doing is complete, or just be hard to anniversary and grow from. The bulk of the orders may have already been placed.

Importantly, he adds...

It is impossible to know. Does not mean that the suppliers can't get another bounce up (especially if the channel reloads on their other stuff), or that it can't sustain at these levels for a while. It just means nobody knows... including NVDA.

That's the important point here: Even Nvidia doesn't how all of this will shake out.

That's where this gets even more interesting...

I'd bet most investors missed the fact that in February, Nvidia filed a $10 billion "shelf offering" in various types of securities, including stock and debt. (Shelf filings give companies flexibility to sell securities either in the open market or private transaction at any time over the course of three years.)

Nvidia did the same thing in 2020 and 2021, but within days of each filing wound up issuing $5 billion in debt... a brilliant move, given how low interest rates were.

This time, it filed the shelf after its stock had more than doubled to $232.

Nvidia has said it was merely a replacement of an earlier offering that was set to expire in March... and that it has no intentions of tapping it anytime soon.

But with its stock now flirting with $400, you can't help but wonder what management, which has a history of being exceedingly opportunistic, has in mind. As my pal points out...

My guess is they filed the shelf offering once those massive orders started to hit and they had a good sense this was going to happen!

Watch what they do, not what they say. If NVDA knew with certainty this was going to keep going to infinity for a while, they would not be looking to sell this stock now. They don't even need the money. This is a cash rich company. Why not build a war chest when the getting is good?

As of now, the company hasn't sold any shares, but that raises yet another question...

If (and when) it does issue the shares, will that be management's signal that it thinks the stock is fairly valued for this go-round? Or will it merely mean it's taking no chances and seizing the moment, even if shares are on their way to even greater heights?

And what about insiders? With the stock at record highs, a lack of selling at these levels would be a surprise... and a bullish one, at that.

Ditto for the company.

Then again, taking the money would be prudent.

It’s like the classic game show, “Let’s Make a Deal,” where the contestants have to choose to take the money or wait to see what’s behind the curtain.

Monty... I'll take the money.

Final point... AI bubble or no bubble?

It's easy to get caught up in the fear of missing out ("FOMO") over AI. Just don't ever forget the last time you let your guard down on FOMO. This time will be no different. Human nature never wants to miss out on something good!

And, no, my crystal ball is no better than anybody else's on who, what, when, where, or why.

But since you asked...

There was a good story late last week in the Wall Street Journal by Charley Grant that made a strong case we’re not yet in bubble territory for AI. He quoted the chief investment officer (“CIO”) of an advisory firm as saying that so far, there hasn’t been enough interest from mom-and-pop investors to suggest there’s a new bubble. The CIO added...

If I were to use past frenzies as a reference point, it’s nothing like people saying to me two years ago, what coins should I buy? The crypto craze was on a whole other level.

In response, another friend disagrees, telling me…

Two dinners on weekend with normals, and AI came up nonstop.

Four Uber drives last week, and AI came up in three, and Nvidia in two.

Screenwriter friends says he's getting nonstop emails from friends holding NVDA, all with screenshots of their Robinhood accounts.

Those are monster tells.

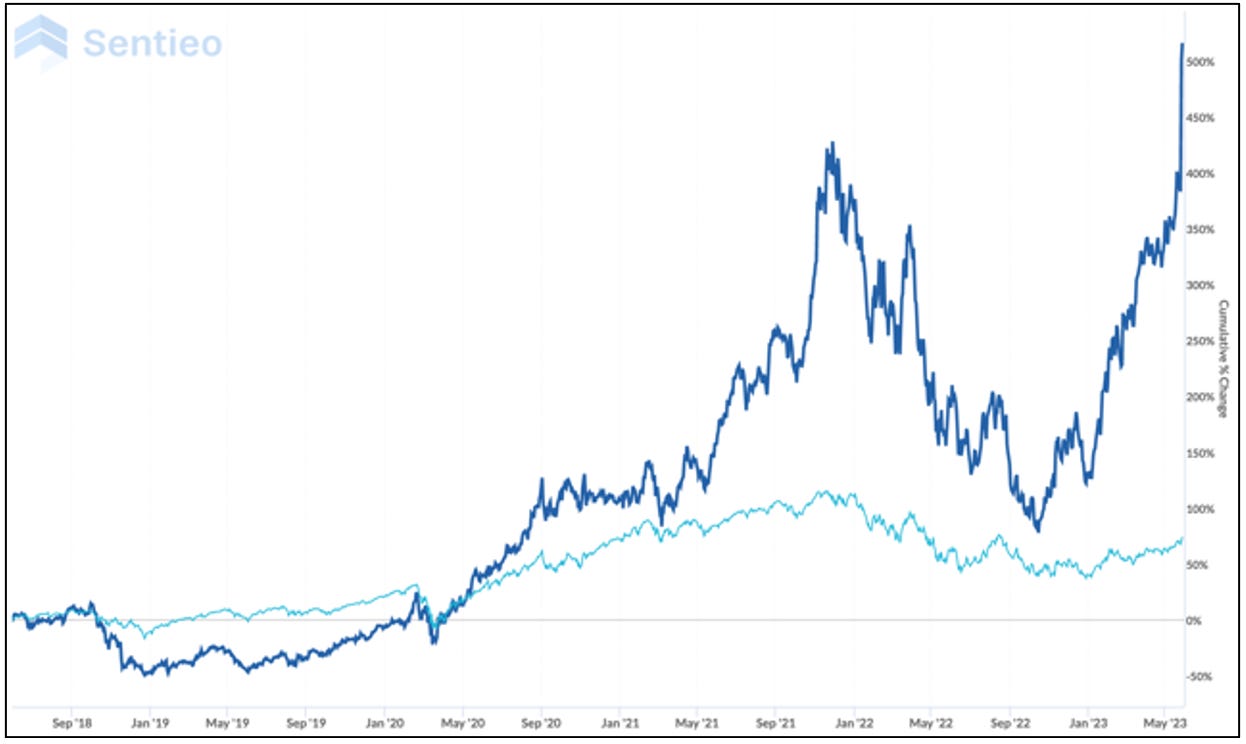

So are the below charts, which show the percentage gain of Nvidia (dark blue line) versus the Nasdaq.

No matter the timeframe or whether it’s paired with the four other key AI “plays” or their overall contributions to the index, there’s only one seemingly obvious bubble there I see, and it’s not the market.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg.