Two nights ago I started writing an update to my Stocks to Avoid List. Here’s what the first sentence said...

This market is brutal to almost anything that isn’t reporting results or guidance exactly as expected, especially for companies that are on thin ice to begin with.

Before I could hit send Thursday morning, the market took off... and almost every stock in the dumpster suddenly looked like found treasure.

Bad News Became Good News

Overnight, bad news in general became good news...

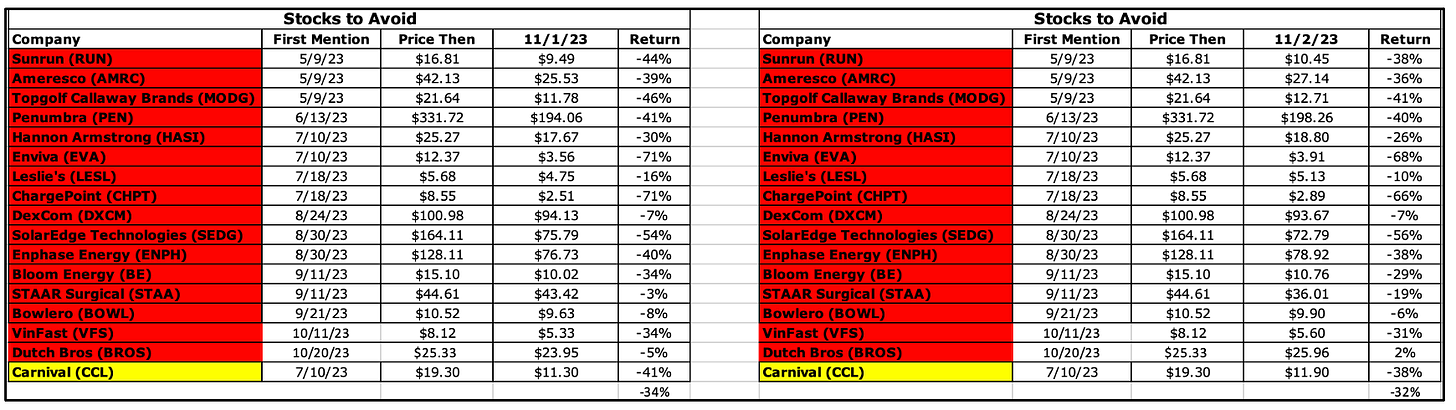

But then I stumbled on something I found interesting, and it has to do with my Stocks to Avoid list, which is the centerpiece of my Red Flag Alerts... which you can access in the Red Flag Alerts tab at the top of this page. (Or click right here.) Below are the closings prices from Wednesday and Thursday...

As you can see, the average rise was a meager 2 percentage points. At the time, the S&P 500 and the Nasdaq 100 were flat-to-up, and the Russell 2000 was down 4%. To be fair, it would’ve been better if Staar Surgical hadn’t plunged by 18% on earnings. A few others also fell, notably SolarEdge, which had horrific guidance. (And, by the way, they’re both up today.)

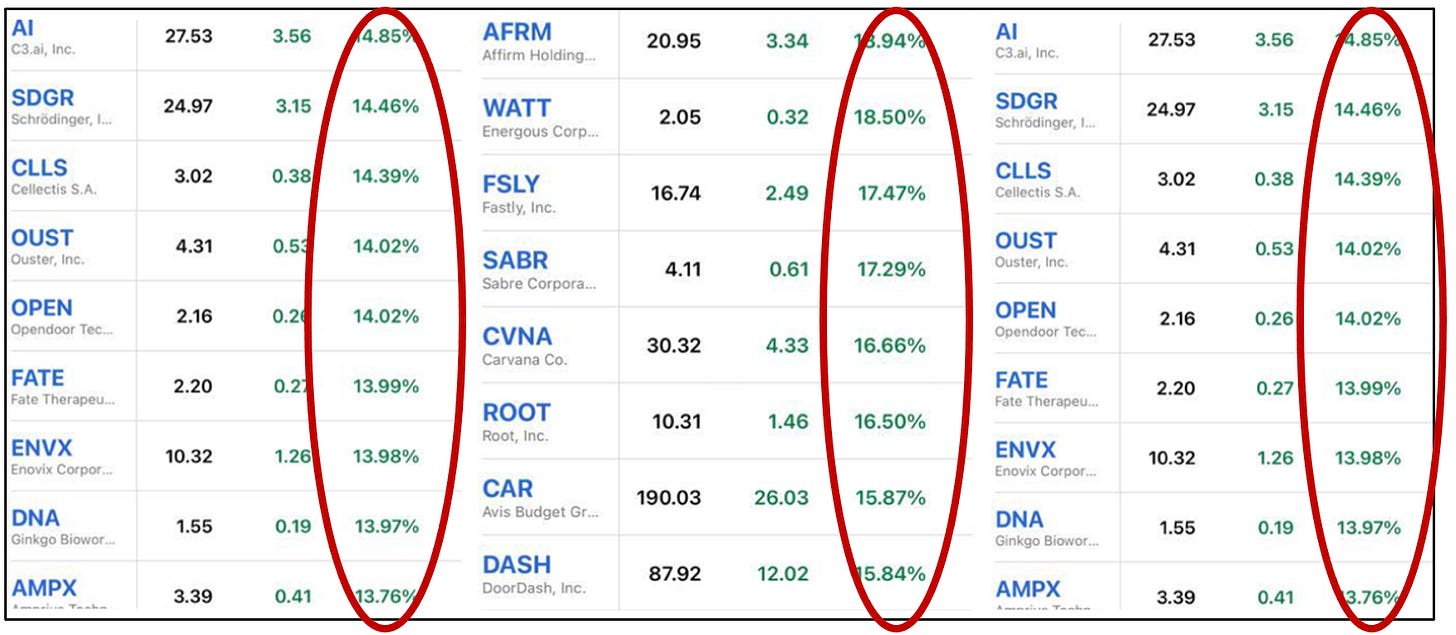

But keep in mind, this was on a day when seemingly every heavily shorted stock that belongs in the dumpster lifted between 10% and 20% on zero news, including those below. Today most are up even more.

One notable exception among heavily shorted stocks from my list was Bowlero, which barely budged even though its short interest, at 88%, must be among the highest anywhere. (I’m sure it’ll join the party before long, even though the terms of a recent sale-leaseback to raise cash suggests a deal out of desperation.)

Comparing Dumpsters

The obvious question, of course, is what’s the difference between the above dumpster list and my dumpster list?

It really may boil down to the fact that little more than most of the names on my list are less in the mainstream.

Therein lies the moral of this story: Never underestimate the laziness of the herd to go after the lowest-hanging fruit.

The reality is that with these companies, nothing has fundamentally changed.

That’s the thing with dumpster diving... no matter what you come away with, the stench is always there and many of these stocks will ultimately wind up right back in the bin.

Meanwhile…

Market technicians have their favorite fear/greed indexes, but my favorite is the Doomsday Dozen Fear/Greed monitor from my friends at MyLongbow.com, which measures a dozen signals of potential market risk.

On Monday it hit 43...

For perspective, the January low was 36, and the March low was 38... both just before the market sprang higher. It’s 50 now.

Interpret at will…

Have a great weekend, everybody.

If you liked this, please feel free to hit the heart below… and share with your friends, family and neighbors!

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

Curious for the thinking behind having DexCom on the list?

Why do you have MODG on your red flag list? I mean what is the longer or more fundamental story other than the price? Just curious.