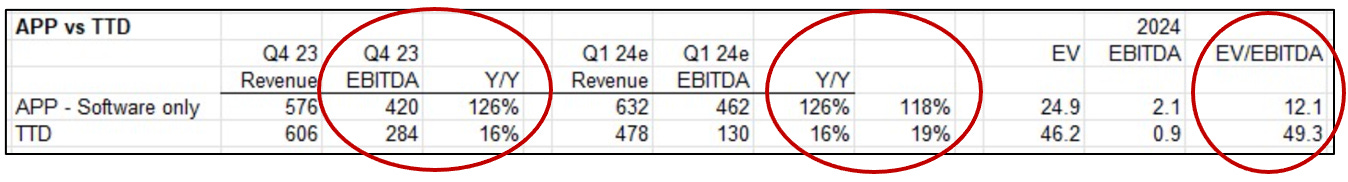

The message I got first thing this morning from my pal Russell Young of Decameron Capital was nothing more than the screen shot below from his spreadhseet, comparing AppLovin ($APP) and The Trade Desk ($TTD)…

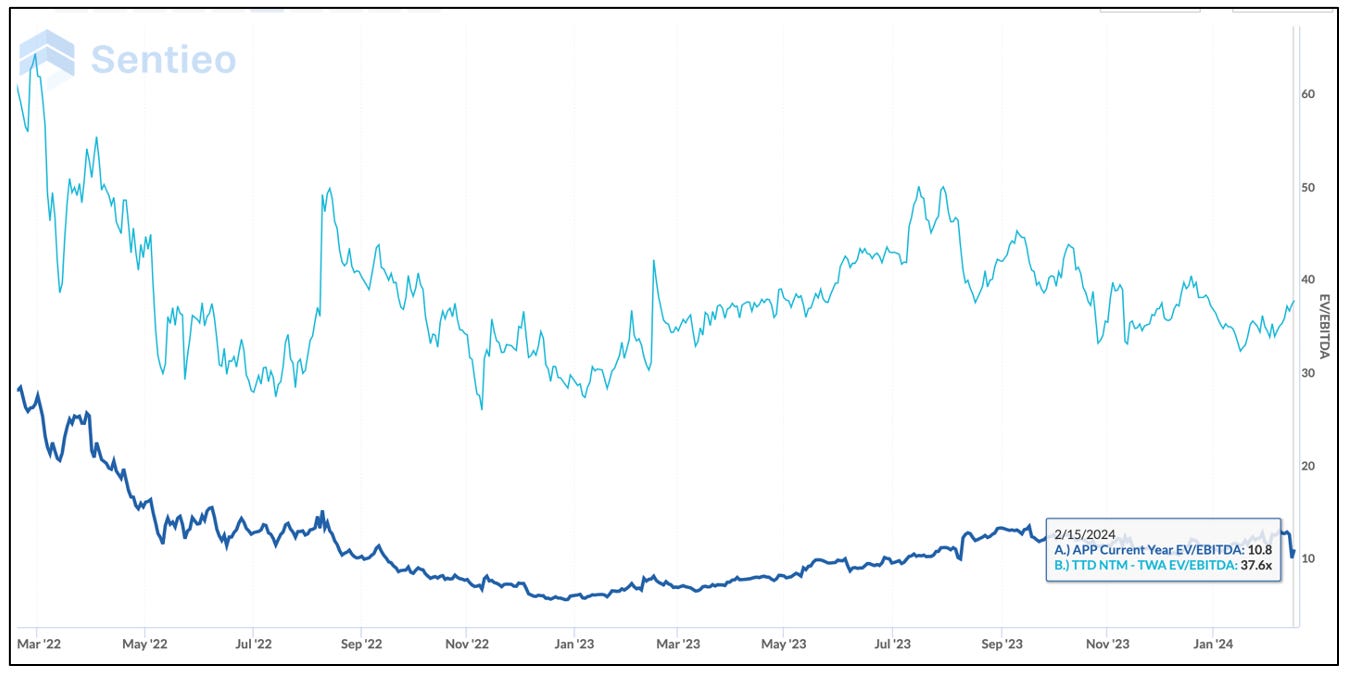

As is often the case, the story is in the numbers, with special emphasis on the far right column. If you’re still unclear, maybe this will help better visualize the valuation gap between the two...

Or put another way: Both companies have almost equal revenue, but The Trade Desk’s EBITDA growth is a fraction of the software-only portion of AppLovin’s, which accounts for the bulk of its profits.

If you’ve never heard of either company: Both are advertising monetization platforms. The Trade Desk focuses on placing ads on the open web – anything outside of the Google ecosystem. By contrast, AppLovin targets all things mobile, with a special focus on mobile games – in other words, where the real growth is.

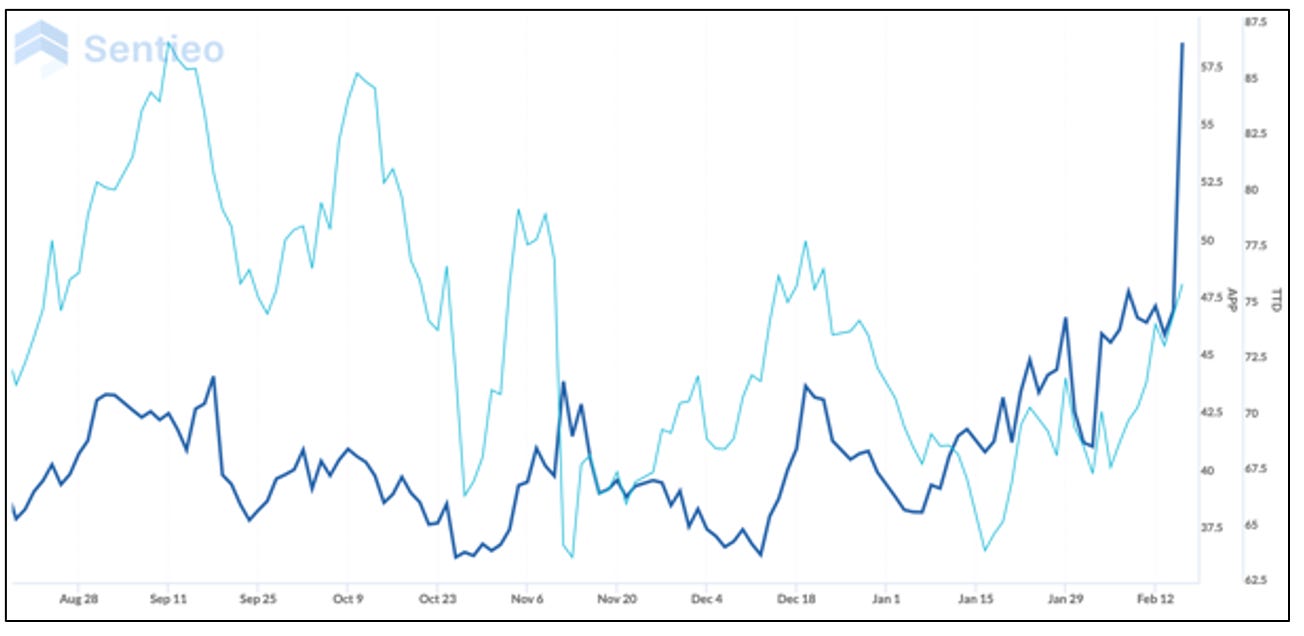

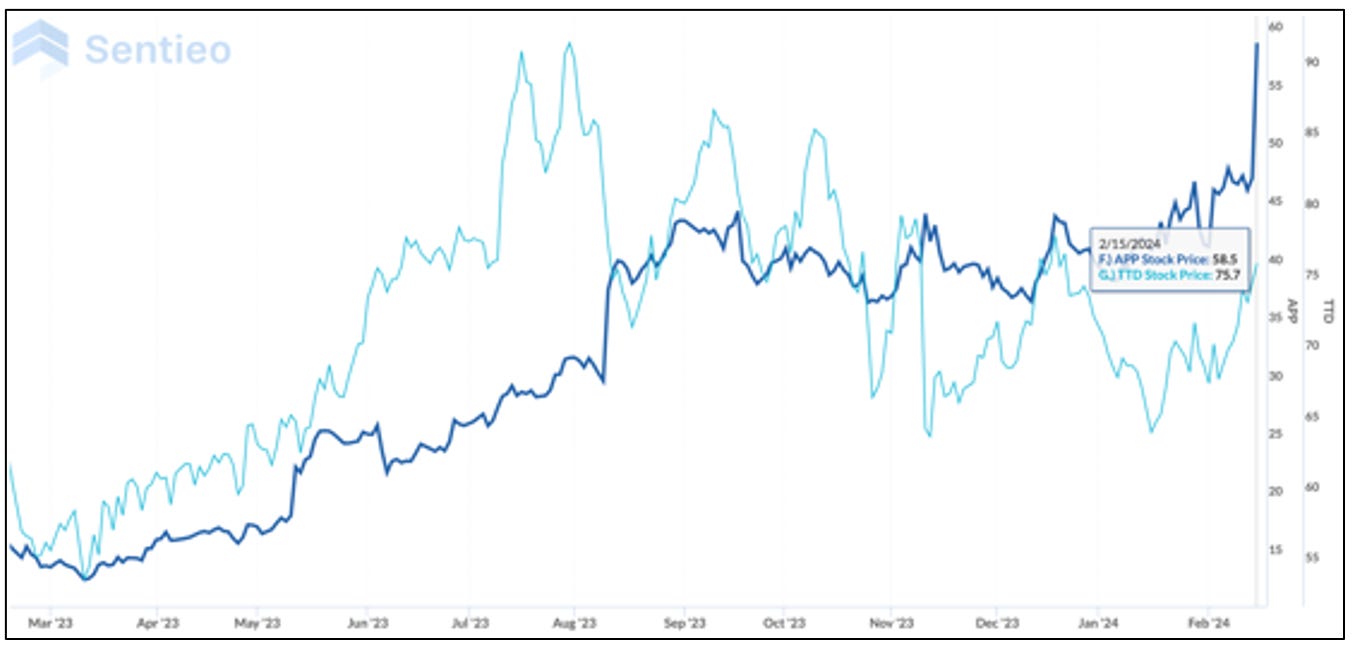

The Trade Desk is, without question, the better known of the two. AppLovin is more like the biggest giant you’ve likely never heard of. Even so, its stock is rapidly catching up and more recently is the better performer – certainly over the last six months...

And the last year...

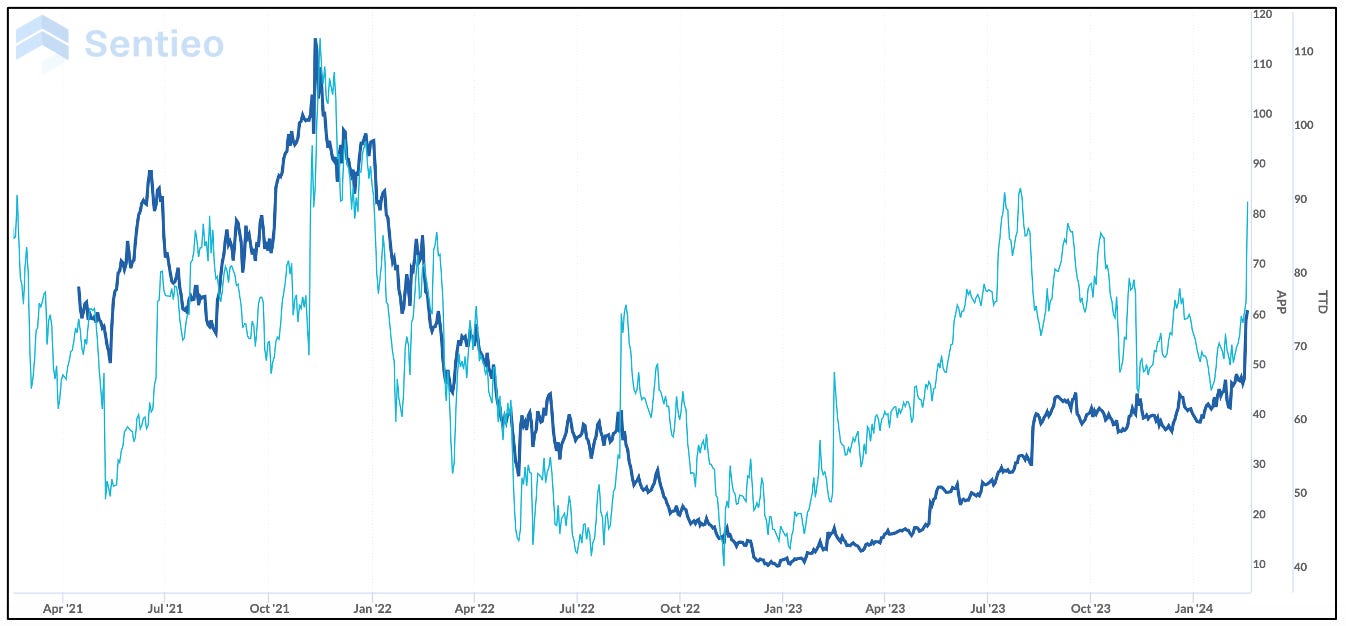

And the last three years...

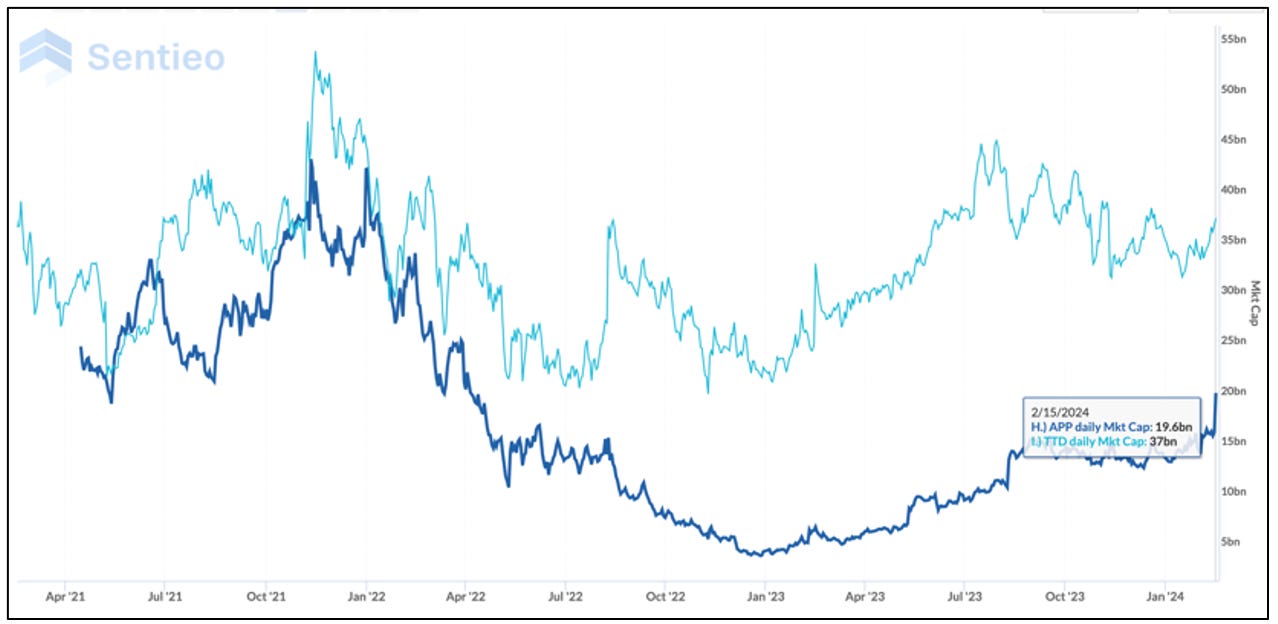

Yet despite all of this, APP’s market value is nearly half TTD’s.

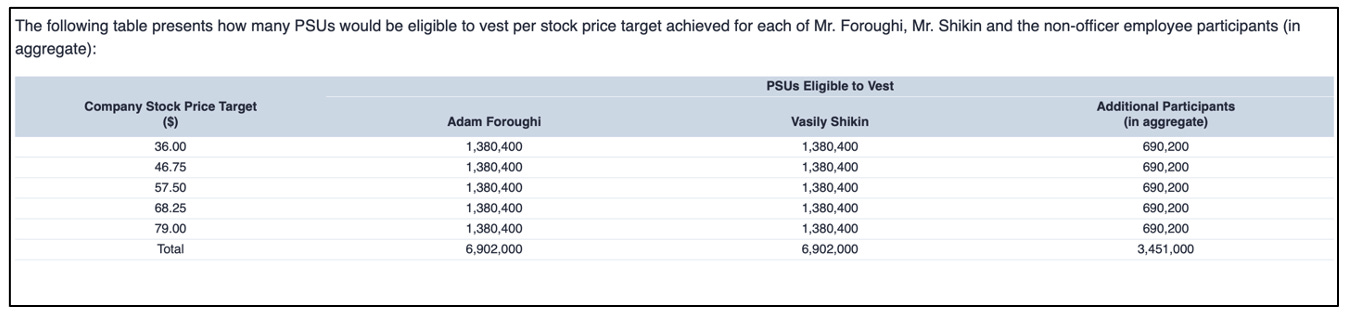

If that’s not enough, CEO Adam Foroughi and Chief Technology Officer Vasily Shikin have an enormous incentive to keep the stock high and going higher...

Last March, when the stock was trading at around $13, each was granted a total of 6.9 million performance stock units (PSUs) with five thresholds.

It has already blasted through the first three, and as I write this is currently hovering around $60. For perspective, it was in the mid-$40s – at around the second threshold – before reporting earnings yesterday.

It has to stay at each level for 30 consecutive trading days for each exec to earn their PSUs.

Equally intriguing – if you didn’t pick up the nuance earlier: they were granted to the CEO and the CTO. You don’t usually see a non-C-Suite executive sharing in the riches equally with the CEO. That suggests just how much management believes in the second version of APP’s Axon software, which was launched last year... and which has an AI-powered self-learning component.

Russell, who owns AppLovin shares, adds...

With more than $1 billion in free cash flow, they can buy back shares – or pay down debt – both accretive to the equity.

All of which gets to the question: Is TTD too expensive and APP cheap? Or is APP, even with the gains in its shares, still simply too cheap? Your call.

If you liked this, please click the heart below and feel free to share with your friends. As always, if you have a different opinion I urge you to leave a comment below.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

At the time this was published, I did not have positions in any company mentioned here. That does not mean I won’t at some point in the future.

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

APP appears to have a high level of debt. I can never convince myself to invest in such companies when there are so many others that don't.

I just listen to both CC and thought both did very well but this gives a new perspective-gracias