Hunting for Illusions in IPOs

Also, when your brain says you're one age, and your body says another...

Now that the initial public offering ('IPO') calendar is heating up, a word of warning before you get too excited about all those reported sales numbers...

At some companies, they may very well be an illusion.

You just have to search for details on reported sales, and don't expect the companies to make it easy...

There's the letter of the law on disclosure and the spirit of the law, and a huge gray area in between.

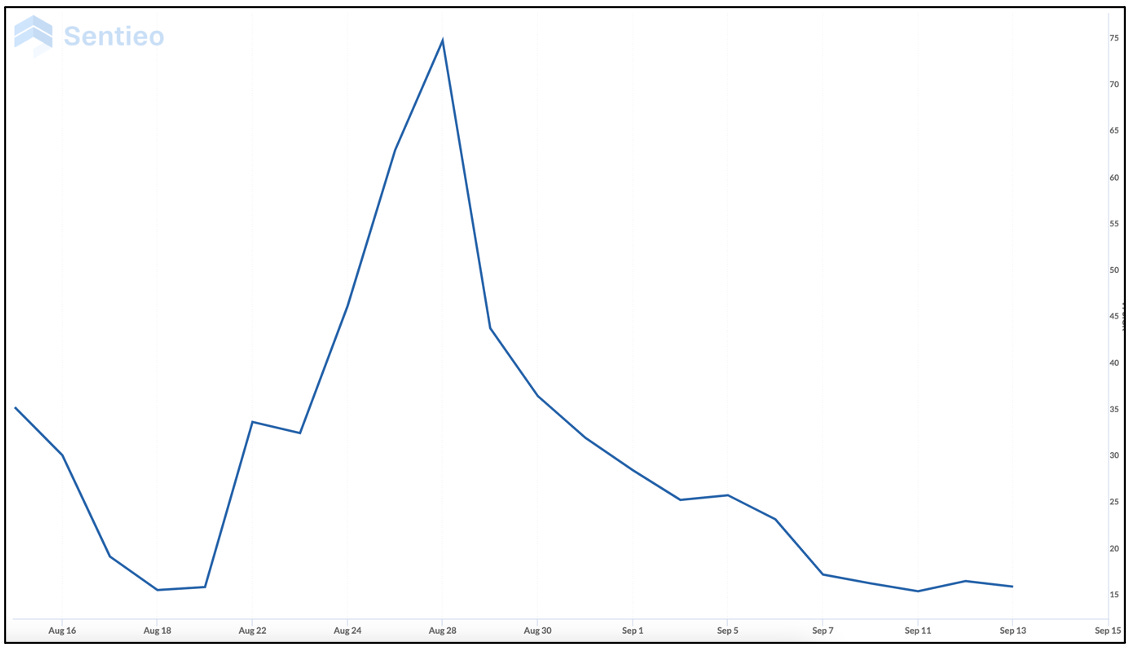

A perfect example is VinFast Auto (VFS), the Vietnamese electric vehicle ("EV") maker that recently went public in the U.S. Since its IPO a month ago, the stock has gone from boom to bust... as investors took a closer look at what they were really buying.

I've mentioned VinFast a few times here, with a few spicy tidbits, but have never done a deep dive on it. And even if I had, short of doing a line-by-line review, I may have missed one of the most important disclosures that, while buried, was hiding in plain sight.

Yet to the best of my knowledge, nobody (including me) mentioned it until this week – when it was first mentioned publicly earlier this week by Barron's, and then the Financial Times.

But there's a bigger story here, which is why I'm writing about it...

For VinFast, it's that more than half its sales so far have come from a related party – a taxi business owned by Vingroup, the Vietnamese conglomerate that owned all of VinFast before its IPO. It’s still the majority owner.

Investors have become so complacent about reading regulatory filings that it's easy to miss or simply ignore related-party dealings.

Just because they're related parties doesn't always matter. There are plenty of what I would call "legit" related-party transactions.

But intercompany sales are an enormous red flag, because they're not sales to outside independent customers... so you don't know what the real market for the products are.

What's worse is when they're not easy to quickly find, which was the case with VinFast... and which is why it wasn't likely immediately flagged.

Smart companies, or those with nothing to hide, will highlight potentially controversial transactions in summaries or high in a report or in related-party disclosures. That's smart, because by outing themselves, in a sense, it can become less of a news story.

But burying it is akin to hoping nobody will see it...

VinFast didn't just bury it, but it threw dirt, rocks, and all sorts of greenery on top of it.

It first mentioned the taxi agreement in a sentence at the end of a very long paragraph on page 11, merely as a “for example…”

But it wasn’t until midway through roughly 10 pages of related-party disclosures... which themselves were buried in the bowels of its filings, when the company mentioned the dollar amount. In the most recent filing this week, the actual transaction was spelled out on page 192. In the main prospectus filed in July, which was twice as big, it was on page 291.

I can tell you with great certainty that in a world where most investors never read the first page of an IPO filing, the great majority probably don't get to 11 let alone pages 192 or 291... or spend the time to untangle what in this case is a big mess.

That's something to keep in mind as the floodgate of IPOs stats to open wider.

After all, it's easy to be fooled by all the confetti that falls when a company rings the opening bell the day of its IPO...

Which got me thinking...

Seeing the Arm (ARM) IPO and all of the confetti that fell – and thinking about my On the Street essay earlier this week on investor overconfidence – maybe the real moral of the story should be: Beware of confetti at the opening bell of an IPO.

On another note, one of my ongoing themes of interest is longevity. One reason, obviously, is my age...

At 71, I still think I'm 40. At least that's where brain keeps telling me I am.

But I'm now wearing a boot for several weeks because of a mere toe issue.

It's nothing serious... in fact, is more a belt-and-suspenders approach to hopefully put an end to a years-long problem. But as I joked with friends...

How you knew you're getting old: You're over 70, still feel 40, but one toe goes and suddenly you're in a boot. No matter what your brain may think, your body knows the truth!

I'm sure more than a few of you can relate!

And Now a word from our sponsor…

My newest recommendation for my Empire Real Wealth newsletter plays into the longevity theme – it's a company that not only creates an incredible device to treat a life-threatening medical issue, but also has big upside potential.

The whole story will be in the September issue of Empire Real Wealth, which drops after the market closes today. If you aren't already a subscriber, find out how to get on the list to receive this brand-new recommendation when it publishes by clicking here.

You are right about "investors" not reading details - due diligence is a lost art. But don't majority owned businesses still require consolidation (and elimination entries) like in the "good old days"? Regardless, when the CFO of the IPO's tagline reads "Equity Derivatives Trading & Structuring Professional" it might be best to move on the next script anyway. Sorry about your toe; take good care and get well soon.