In Light of Everything That Has Happened at Boeing...

The real story is how putting shareholders first backfired

The legacy of Boeing might be why putting shareholders first isn’t always the right call.

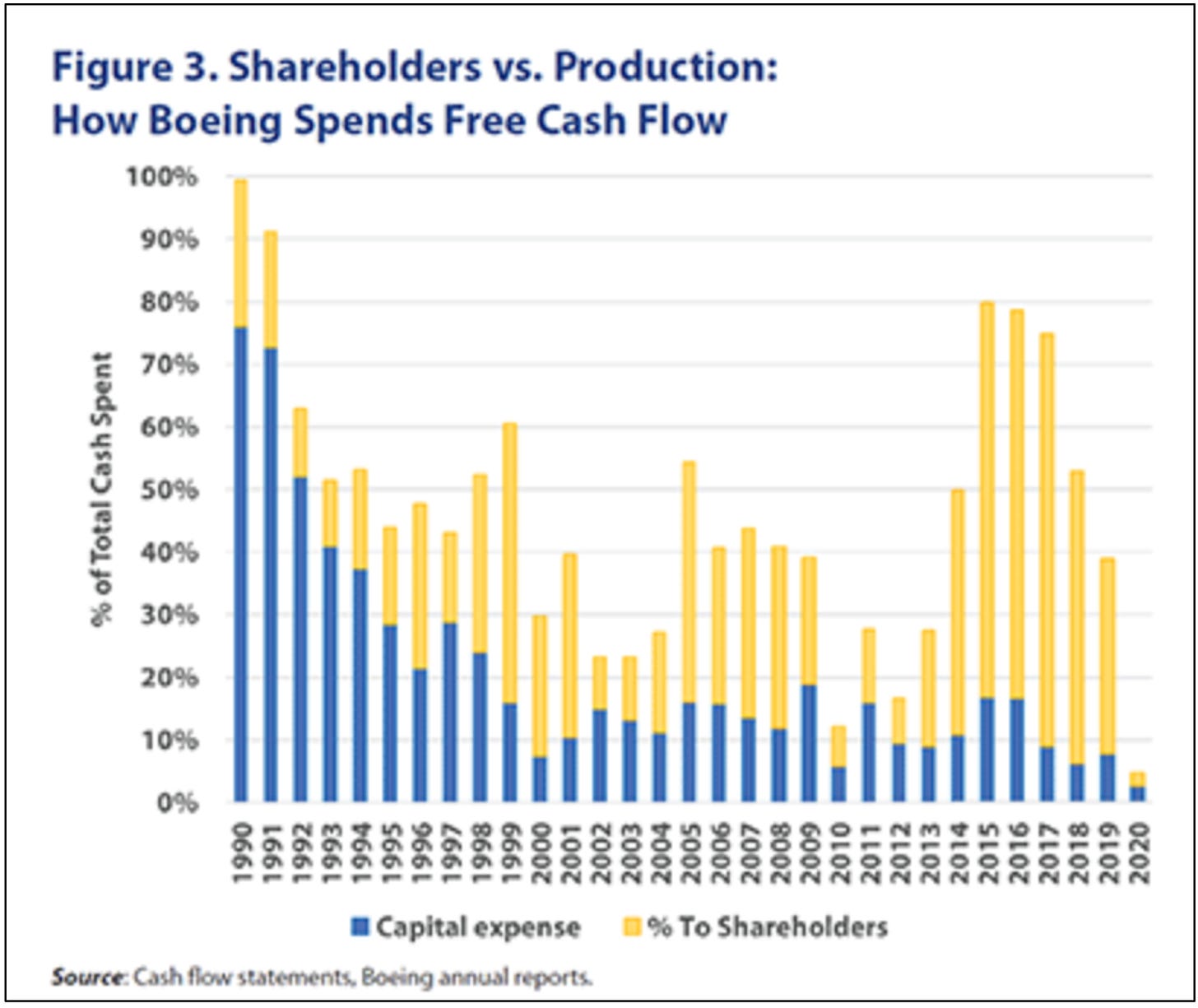

This chart above, published in 2021 in Dollars & Sense, pretty much says it all. And not surprisingly, it very much aligns with growing problems at the big aircraft manufacturer.

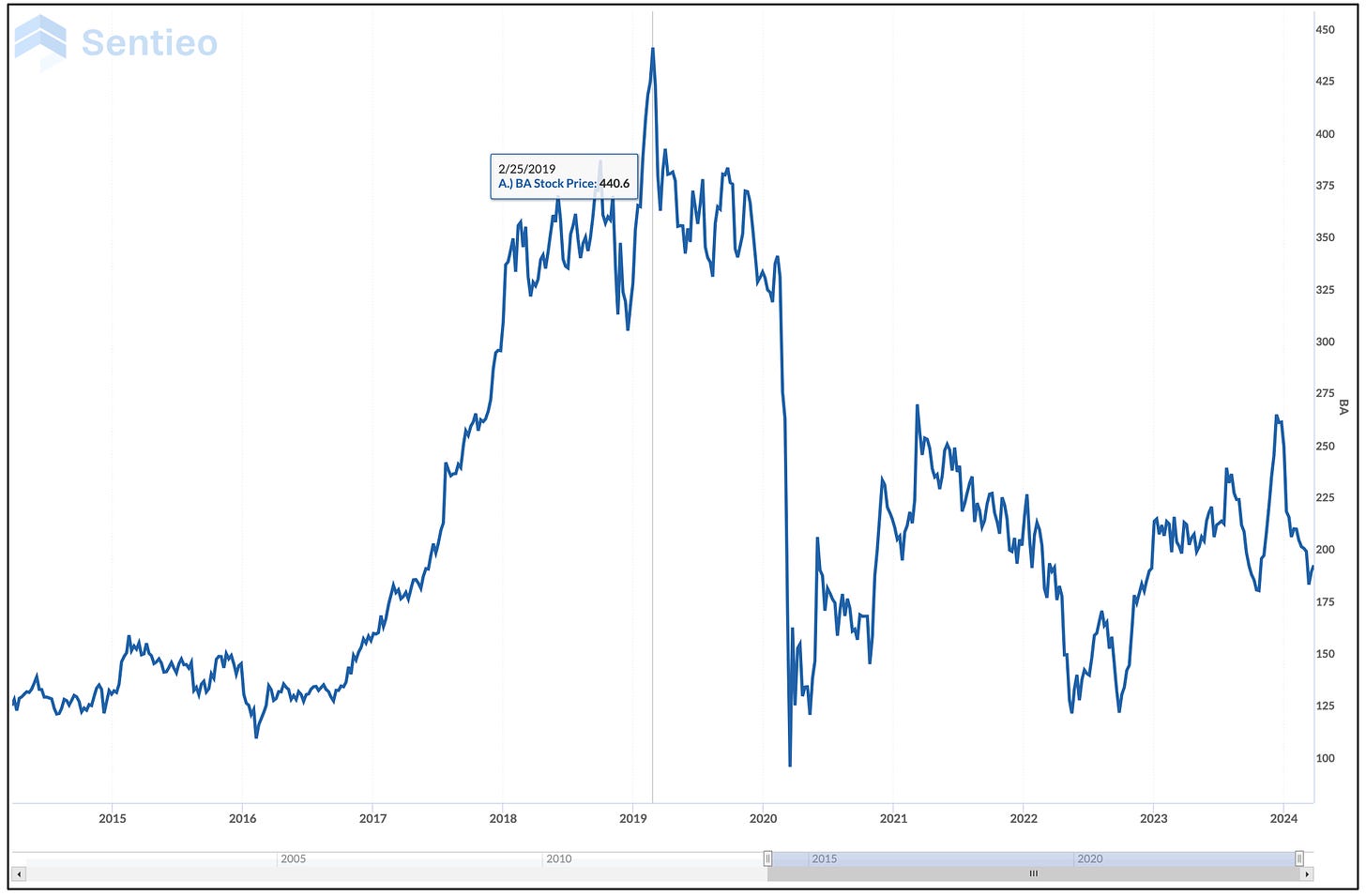

In an obvious effort to prop up its stock, the company spent more on shareholders than reinvesting in the company.

And it worked… until it didn’t!

History of Mismanagement

What’s clear, in retrospect, is just how mismanaged Boeing has been, evident by the revolving door of four CEOs over the past 20 years. Ironically, the one hailed as the best during much of his tenure – James McNerney, formerly of 3M – probably will go down as having been the worst.

McNerney’s run was summed up in this Forbes piece, headlined, “Boeing Will Pay High Price For McNerney’s Mistake of Treating Aviation Like It Was Any Other Industry.” As the story put it…

McNerney’s focus on the company’s stock price and cash flow at the expense of the long term wasn’t merely due to short-sightedness and greed. It was also likely due to a misunderstanding of how the aviation industry works. If a CEO comes from a different industry and doesn’t try to learn what makes aviation distinct, he’s likely to apply a one-size-fits-all template.

But no story perhaps put what was really going on at Boeing perspective than this one from Dollars & Sense, written in 2021 by Marie Christine Duggan, a professor in business management at Keene State College in New Hampshire.

Wrong Incentives

I stumbled on it while researching the history of Boeing’s management, and was struck by this passage…

The mismanagement of Boeing—and the struggle of its employees to stem the decline—is not simply the story of one company gone terribly wrong. It is the story of incentives for all publicly held corporations in the United States gone horribly wrong. And it is also the story of many in lower levels of the hierarchy inside the firm putting their jobs on the line in a struggle to retain a focus on quality.

She added…

Many observers have attributed the decline in Boeing’s production quality to its merger with McDonnell Douglas back in 1997. But it seems likely that the bubble in the stock market between 1997 and 2000 was the real cause of the change. That bubble was facilitated by ultra-low interest rates, similar to the ones we have now. Anytime a bubble emerges in financial markets, that is going to stimulate people to take money out of production and gamble it on bets in the stock market—especially if insiders are permitted to use company profits to rig the outcome of the bets.

She concluded…

A share price that is impervious to the declining quality of the new products that the firm introduces is dangerous because it means that U.S. corporate executives will be rewarded even if they spend company profits in a way that destroys product quality. And that is in fact why this story is worth telling. Executives have a clear incentive to siphon cash from the large publicly held corporations they run in order to push up share price because that is how to make their stock options pay off. And they do.

That’s not always the case, of course, and it’s not always that simple.

But it was with Boeing, which as we all now know, isn’t just another company… and can’t be run like one for the sake of shareholders.

The surprise, if there is one, is that it’s taken this long to figure that out.

If you liked this, please click the heart button below and feel free to share with friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

Herb, you need to include info of what was Spent on Shareholders?? How much as Dividends, how much was Stock Buybacks. Then you need to recognize the accounting fact - which is also a “this ‘one-size’ really does fit all listed listed companies fact” - that management has failed their fiduciary duty to the remaining/continuing shareholders when any stock buyback price-per-share-paid is greater than the Equity-book-value-per-share (i.e., a Price/Book Ratio greater than 1/1). Because such a transaction represents management giving to a select few shareholders the excess Cash paid, which was in reality owned by - and belonged to - the remaining/continuing shareholders. Even though the shares of the remaining/continuing shareholders after a buyback own a slightly larger percentage of a company, when that larger % is multiplied time the now lower company Equity (which has been reduced by every dollar paid in the buyback), the dollars of Equity owned by each remaining/continuing shareholder are less than they owned before the buyback!

Almost like the second chapter of GE. Everyone hailed Jack Welch until it came out that an industrial giant had been turned into a speculative financial mess. Truly unfortunate. Thank you for the thoughtful and even-handed piece as always.