***Get ready for a bigger, better, reimagined On the Street... coming soon to a browser near you.***

On December 14 of last year, I wrote…

Everybody has their favorite market indicator. I named mine after me because it’s based on what I see, hear and feel – and it almost never fails.

And right now The Greenberg Indicator is screaming that if we’re not at an inflection point in this market, we’re awfully close.

It’s this simple: Things have moved too far, too fast. And, yes, I know the old saw, meant for short-sellers, that the markets can remain irrational more than you can remain solvent.

But there’s irrational and there’s unhinged…

Since then, the market has gone straight up, from irrational and unhinged to downright, some might say... insane.

Here we are two months later and it would appear we’ve gone from “we’re awfully close” to any day now.

Doomsday Dozen… Danger

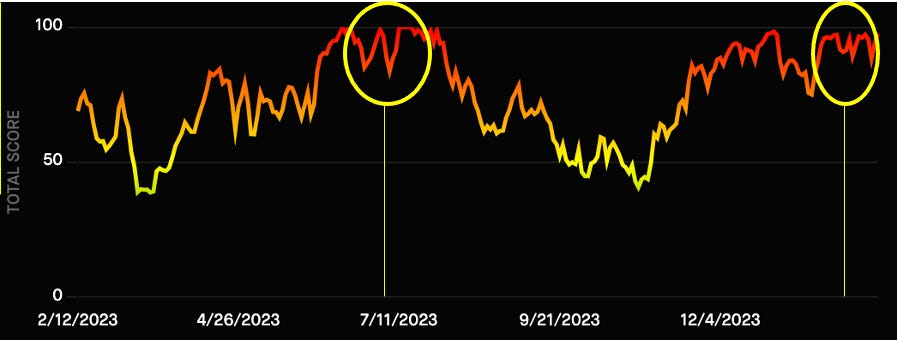

There are signs aplenty, like the Doomsday Dozen fear/greed index, from my friends at Longbow Trade Signals. On Friday it hit a nosebleed 98, which is at the far edges of extreme greed.

For perspective, the last time it hit 100 was in July 2023, just before the market began a multi-month 10% slide... which, of course, was just before its recent 20%-plus spike to new highs.

If I were a chartist – and I’m not! – I’d say it looks like it’s setting up to be a near repeat of July.

What I do know is this: With this latest spiral higher, hubris among the bulls – at least based some of the recent gains in individual stocks after earnings – is palpable.

But so, too, is the end-of-their-world despair among the shorts, which is a key component of The Greenberg Indicator...

Tossing in the Towel

We’re back to hearing of hedge funds that are once again swearing off shorting – and if they haven’t, they’re doing it differently and considerably more selectively than before.

It’s to the point that I get PTSD today when I talk with some short-selling friends, triggering flashbacks (no – make that nightmares) of doing short-biased research in 2020 and 2021… until finally tossing in the towel. (So classic! Within six months the market started a 25% correction that spread over the course of the subsequent nine months.)

Which gets us back to today...

As was the case then, some short-sellers now sound as though they’re not just losing their confidence but questioning their own competence. Or simply whether they want to continue to fight the battles.

While there are still occasional stories like Roku ($ROKU) which plunged 20% last week on dubious guidance, there seem to be more like Toast ($TOST), which skyrocketed after revenue growth stumbled. And that’s even after the company guided revenue down by a third for the current quarter. Keep in mind since it still isn’t profitable, revenue growth has been a significant part of the Toast story. Now, unlike a year ago, it isn’t offering guidance for the full year. In the old days of not that long ago, a stock like that would get crushed.

Then there’s ARM Holdings (ARM), which has skyrocketed 71% over the past week as investors seem to be thinking it’s an AI play akin to Nvidia ($NVDA) (Hint: It’s not, and all bets are off what happens when 90% holder Softbank’s lock-up agreement expires next month. Note to me: Consider ARM and Toast as for the Red Flag Alert.)

Red Flags as a Bellwether

Speaking of which...

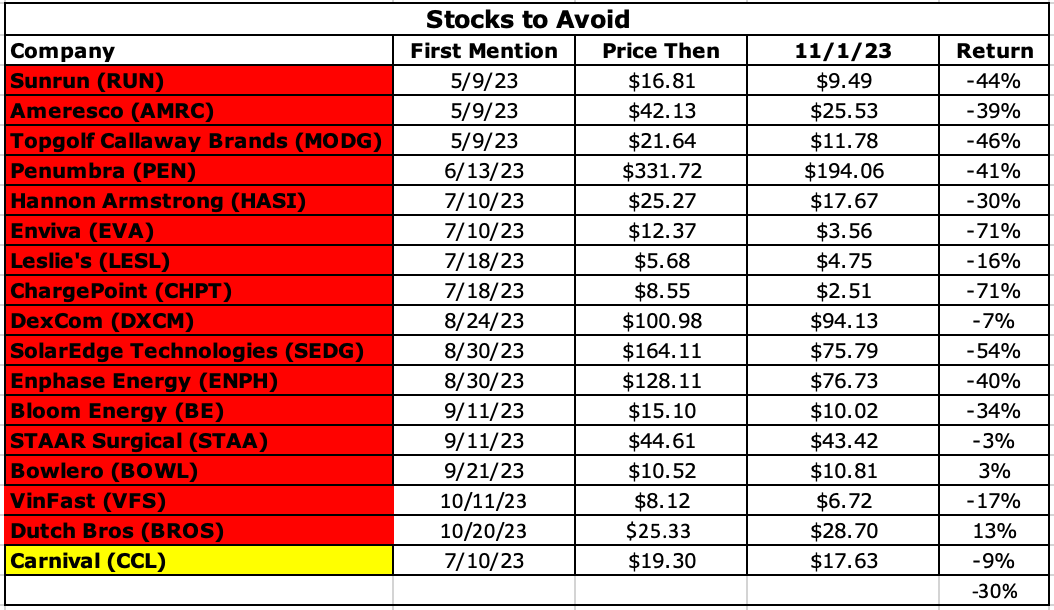

Since I launched it last May, my Red Flag Alert itself pretty quickly had a “too far, too fast” component to it... suggesting the market was due for a liftoff.

That was clear by early November, when I posted the Red Flag Alert roster for the first time. Back then, it had 17 names on it, and was down an average of 30%.

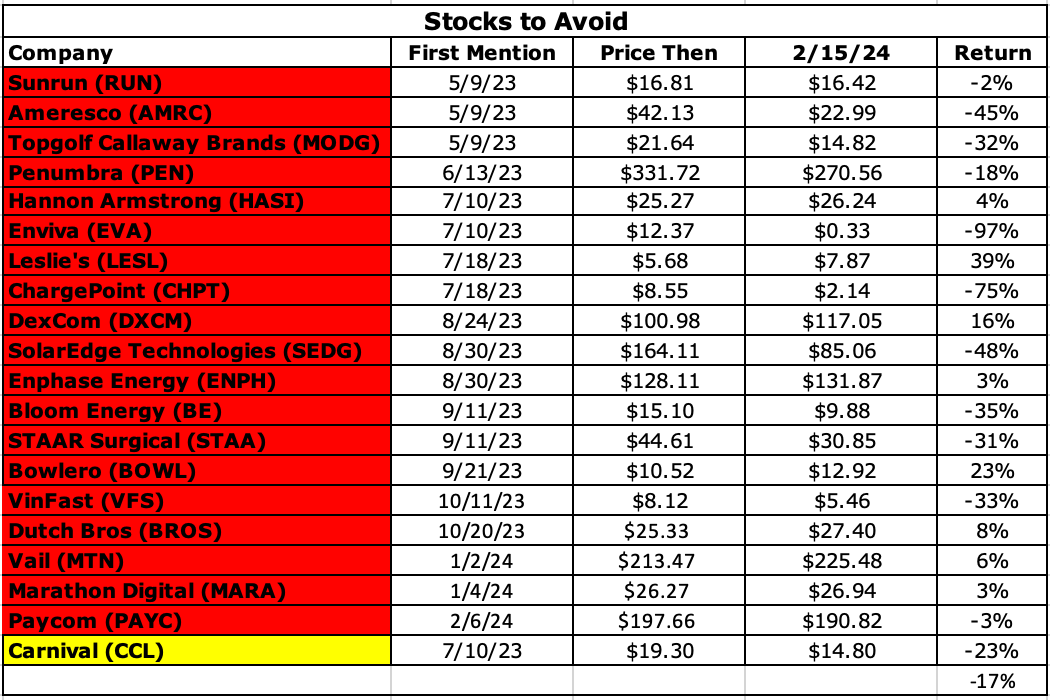

Now with to 20 names, as of Friday it was down 17% vs down 13% a week or two ago.

Does that slight deterioration mean things are beginning to crack again? I have no idea (and neither does anybody else!)

This market could very well continue to shoot higher, but if it does, it will no doubt get considerably choppier.

(Note: In coming days I’m taking one name off the red flag list, and will be pointing out that it may very well be worthy of a green flag. Can you guess which one?)

Who knows? Maybe the fact that I’m doing that is yet another sign that an inflection point is closer than ever. But I digress…

Finally – Is short-selling Dead?

One thing I keep hearing is that short-selling, as we knew it, is dead.

I’ve gone over this with a few friends who have steep histories in short-selling. As one explained to me...

Understand the game you’re playing. After Covid the whole game changed.

He went on to say...

Markets are always changing. Like the weather, we assume a constant but the very nature of the markets means constant change. The world of long/short has structurally changed.

Another I spoke to – who runs a short-biased fund – says that today a short-seller has to think like an optimist, and accept that narratives change. Or as he explained it (and this is somewhat edited):

Venture capitalists build their careers on a single bet, planting numerous seeds and looking like geniuses if just one comes to fruition. Short-sellers, on the other hand, operate in the opposite direction of this dynamic.

He went on to say…

Typically, short sellers manage a portfolio of 10 to 20 stocks, dedicating extensive time and effort to each. However, if one of these stocks, such as ARM, works against them or gains traction as a meme stock, the short seller's career could be jeopardized – they're essentially out of business.

Today's short sellers must recognize the potential for one of their positions to result in exponential risk, especially given the proliferation of meme stocks. Short sellers consistently find themselves facing significant losses.

Ironically, the more effort one puts into a short idea, the stronger their conviction grows, leading to increased concentration in their portfolio – their best idea becoming a larger percentage of their holdings.

However, if the idea gains widespread recognition, the short seller becomes susceptible to ‘path dependency.’ This means they lose control over the meme risk, and the compelling narrative works against their position, ultimately leading to significant losses and potential closure of their business.

Truth is, short-selling isn’t any more dead than stocks were in 1979 when the now-infamous cover story on Business Week proclaimed: “Death of Equities.”

In fact, asked whether short-selling is dead on a recent Capitalisn’t podcast by Bethany McLean and economist Luigi Zingales, short-seller Jim Chanos perhaps summed it up best by saying...

If markets are ruled by liquidity and positioning, will fundamentals ever count on the short side? The traditionalist in me says, “Yes, of course it will.” It may take time; it may take a cycle. But if that doesn’t happen, then we can ask much broader questions about markets as a whole, in all aspects. If you just say one side of the market isn’t working, I think by definition, then you have to worry about many sides of the market not working.

That’s another way of saying, rather than being broken, the market is just different than it once was.

It really may be as simple as that.

If you liked this, feel free click the heart below, and also to share this with anybody.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

🤔... No, though Vail is intriguing.

PEN. We are overdue for a 10%+ correction for some multiple mean reversion back to historical averages and to shake out some hot money. Maybe Nvidia is the catalyst when they report this week.

There is a lot of money waiting for the 10% pullback, but the 10yr yield creeping higher will scare some of that money.

We will see! Great article.