Everybody has their favorite market indicator. I named mine after me because it’s based on what I see, hear and feel – and it almost never fails…

And right now the Greenberg Indicator is screaming that if we’re not at an inflection point in this market, we’re awfully close.

It’s this simple: Things have moved too far, too fast. And, yes, I know the old saw, meant for short-sellers, that the markets can remain irrational more than you can remain solvent.

But there’s irrational and there’s unhinged…

Red Flags as a Bellwether

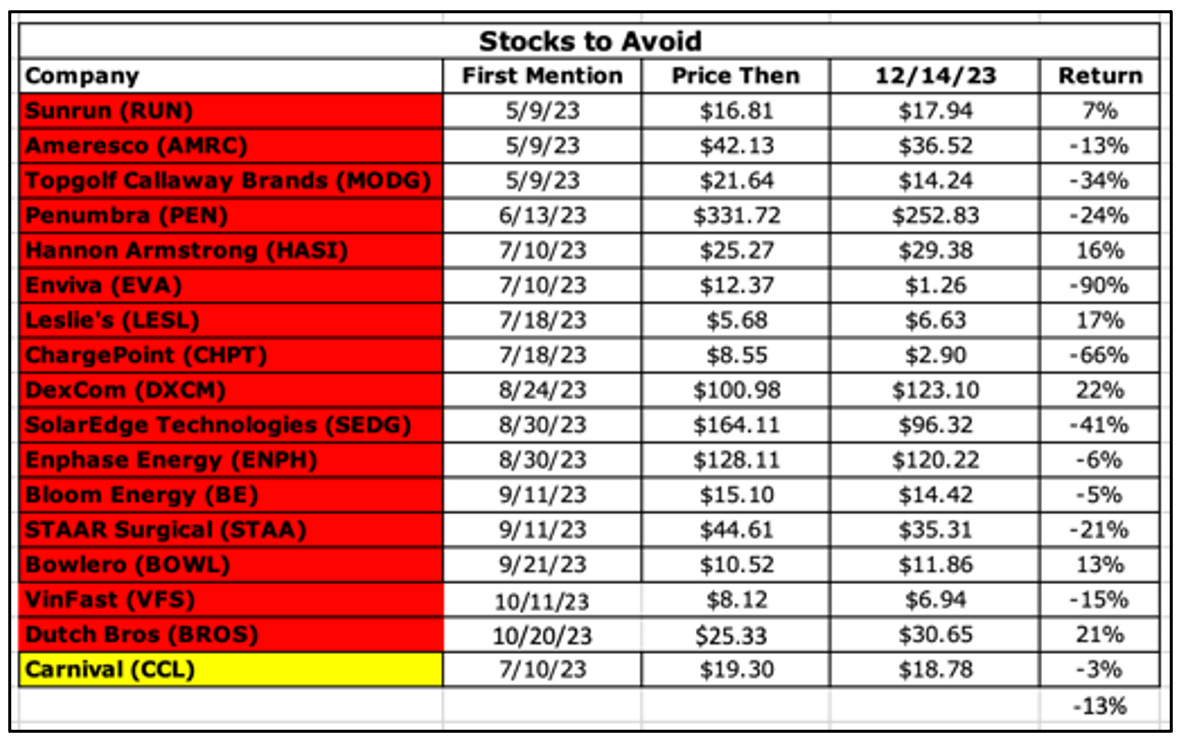

We are arguably close to unhinged, and you can see it in the history of the performance of my Red Flag Alerts, which have become a bellwether of sorts...

Since I started it in May, as a list of companies to avoid, it almost immediately started making me look smart.

By late September, the 15 names on the list were down an average of around 19%. As I wrote at the time..

I (half) joke that by publishing this list I'm probably jinxing myself. If history is any guide, their rapid declines could very well be a sign this market – with as little conviction that it has – is at an inflection point and could spring higher. Historically, when my red flags start making me look smart – and people start paying attention – watch out!

Except, by early November, with 17 names, they fell even further, with a decline 32%.

But then, within a month, as the market sprang to life, they were down 22%...

And two weeks later – today – they’re down a mere 13%.

That’s too far, too fast.

Or is it?

‘Sky is the Limit’

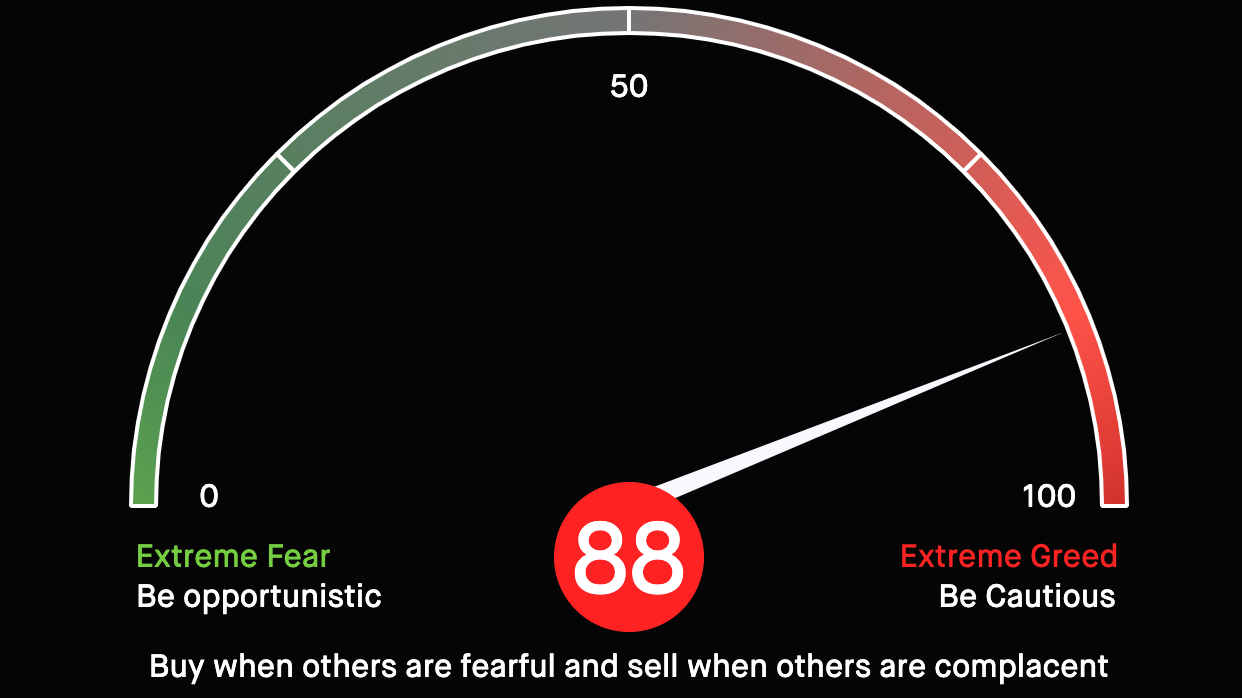

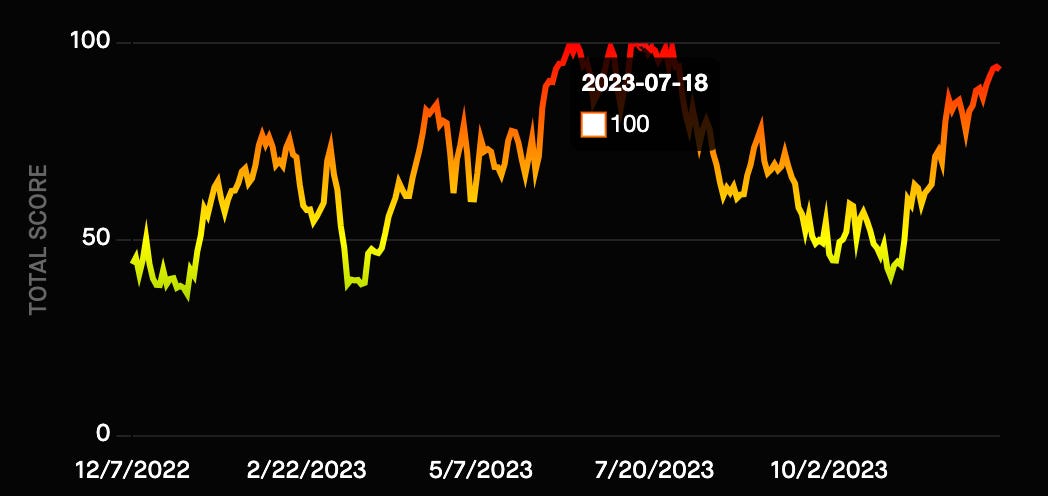

Not that it can’t go further. The Doomsday Dozen Fear/Greed indicator from my friends at MyLongbow, as of today, was 88.

For context, it was 93 yesterday and 94 the day before that. But it hit 100 back in July, as the market was dancing around what then were new highs....

Now, the market is even higher but as my friend – a contrarian’s contrarian – Peter Atwater pointed out earlier today in his Financial Insights newsletter...

Like September, I see asymmetric risk on the surface. Today’s bullish victory laps demand extreme caution. That said, I also see a low probability event that must be taken especially seriously here, given the elements of conjoined sentiment now in place. A true blow-off top could be on the table.

Why?

Consider what further falling rates will do to C-suite interest in stock buybacks. The lower rates go, the more financial engineering will come back into play. So, too, will hedge funds’ appetite for leverage. As we’ve all seen, there is no greater aphrodisiac than free money.

Then, there is FX. If the dollar keeps dropping, all those off-shore corporate profits will provide a natural tailwind to earnings.

Then, there are further rising stock prices themselves. As we’ve seen repeatedly, nothing draws a crowd like a crowd. And with all that cash in money market funds, we could easily see retail investors dive in anew, just like they did in 2021.

Which brings me to my punchline: So long as market sentiment remains as conjoined as it is today, among stocks, bonds and the dollar, the sky is the limit. This is a self-fueling rocket in which a bull move in one asset brings a comparable move in the others, that in turn feeds back on the first. This is the ultimate virtuous market spiral. And all those one-day options (and their related hedging) have only compounded the self-fueling nature of the ship.

And I repeat... he’s typically a contrarian.

From Humbling to Humiliating

As I wrote earlier this month: It’s important not to confuse brains with any market. People feel embolden when stocks are going in whatever direction they’re positioned for... and like dopes if they do the opposite.

It’s never that bad, but it’s often always that hard... increasingly so in recent years as the market structure has changed.

About the only people who have the right to be smug are patient investors who invest in real companies that make real things and produce real goods and services that have real profits and cash flow. And who who don’t hang on every last headline… or Fed move.

Beyond that, the markets have a way of not just humbling, but humiliating even the smartest of the smart.

Just remember… nobody ever has it entirely figured out, and if they tell you they do, run the other way.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Threads @herbgreenberg.

I recall 87', dotcom, GFC, now Covid and all different. 87' was telegraphed. Garzarelli, and Granville (OBV) called it. I went to a TA presentation in 99? by Louis Yamada, in which she said the market could correct by going sideways. She had charts of the new Utility stocks, like Enron. Before GFC you could take out an LOC on your investments and move the money offshore, VC and internet casinos, and Cayman banks. Nobody trusted the system, something everyone needs to think about before they vote. I have some shorts I am still holding from 2020, the market selloff left a lot of unfinished business.

That top image is really cool, even far out man.