(If you’re not yet among the growing number of premium subscribers to Herb On the Street and my Red Flag Alerts, and wonder why you should subscribe, I explain right here. My prices are going up to$300/year and $50/month on January 1.)

Roadmap…

Reality Check – Invulnerability.

Signet – The upshot of this ugly kryptonite quarter.

Symbotic – The moral of this messy story.

AeroVironment – The latest, uh, buzz.

1. Reality Check – Invulnerability.

Part of the mission of my Red Flag Alerts is to flag risk in individual stocks. Another is as a general reminder of risk…

That last part sounds simple and obvious enough, but from the stupid human tricks department: FOMO is FOMO, YOLO is YOLO and people will be people, especially when it comes to making money.

Look no further than what I like to call the “go with the mo, bro” crowd – especially those who weren’t around in the good ole days of 2021… but also those who were, and who think the market’s rebound has proven them to be invincible.

I’ve often said “live by the algo, die by the algo.” The algo is your friend when stocks are rising. (Unless, of course, you’re short.) It’s your enemy when they’re not. (Unless, of course, you’re short!)

Buying Exhaustion

Or as my friend Peter Atwater explained in his terrific Financial Insyghts newsletter immediately after all the high-fiving and hysteria after bitcoin hit $100,000 (emphasis by me)...

The current view that Bitcoin’s ascent is now “unstoppable” cautions that a major pullback lies ahead.

And in that regard, I would note that no matter what happens from here, what is certain is that today’s HODL’ers will never sell. They will ride Bitcoin to zero if they must, believing to their core they will be vindicated again.

Having been struck by lightning twice already twice, a third victory is assured.

In that regard, I suspect that same behavior will hold true for most retail stock investors. The core belief that “stocks always go up” will need to be proven wrong before the crowd parts ways with their MAG 7.

Why all this matters is that what is ahead is likely to come in two significant and distinct down waves. The first wave down will be driven by buying exhaustion.

Demand will cease. That is likely to result in a dramatic drop that is followed by a significant bounce as bullish investors continue to see opportunity. When that bounce rolls over, and hope is lost, we will see retail then bail out en-masse.

I will have more on that when the time comes. For now, enjoy the extraordinary invulnerability that arises from vindication. While it tastes great in the moment, history repeatedly shows that it is the exultation from which extreme humility is born.

Peter is a contrarian’s contrarian who wrote the book, “The Confidence Map: Charting a Path from Chaos to Clarity.” This is what he studies, and it’s why I quote him so often... because nobody is better not just observing but feeling the tone of the markets – all steeped in years of observation, data and mapping.

It’s something chartists also do, but Peter takes it a step further, overlaying the psychology of human nature, which often gets lost in the noise.

Go with the Mo

Along those lines, from my week in social media...

And…

And, finally – thanking my friend Tim, whose wisdom is matched by his wit, for this one…

Now, on with the show....

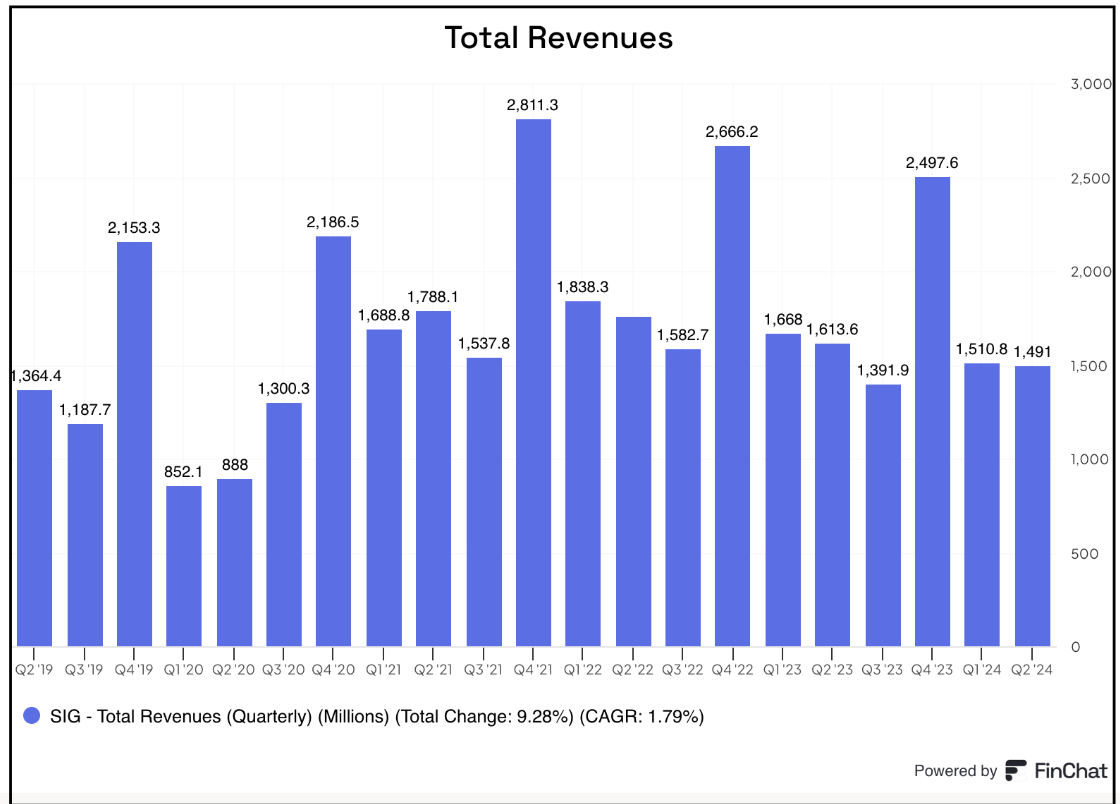

2. Signet – Upshot on Ugly Kryptonite Quarter

If you go back to my original “Sounding the Siren” Red Flag Alert on Signet SIG 0.00%↑ in April, you will see that a big part of the concern was the impact of lab-grown diamonds.

Since then, its CFO has left, a new CEO, James Symancyk, has arrived and… the company reported a dismal quarter that was considerably worse than expected.

The performance is reflected in its stock, especially last week…

But with a new CEO in, and so many issues, you have to wonder: what comes next?