There's no question that in recent months we've gone back to the future with things you only expected to see in a stock market bubble...

This has been a theme of mine lately because intellectually it makes my head hurt... because so much of it makes no sense.

Then again, it never has... but it's fun to write about.

As long as I've been doing what I do for a living, I never ceased to be amazed (not to mention amused) by the downright stupidity of people who buy into some of this garbage.

The latest example was this week's initial public offering ("IPO") of five-year-old Sacks Parente Golf (SPGC), which makes $400 putters that it claims can "naturally improve your stroke."

On its first day of trading, the stock rose by more than 600%, the best first day for any IPO this year.

I’m taking a not-so-wild guess that any investor who bid up the stock did so without ever reading its filings with the U.S. Securities and Exchange Commission ('SEC').

If they had, they would have seen something you rarely if ever see in the filings of a company going public…

Sacks Parente warned not just once, or twice, but 23 times that there is doubt it can continue "as a going concern." That is, stay in business. (Tip of the hat to Margaret Ruschmann, head of content and social media at ClearingBid, for pointing this out to me. ClearingBid bills itself as an IPO network that is trying to democratize the IPO process.)

As the below disclosure from Sacks Parente's IPO prospectus shows, to remain in business it needs people to "raise additional funds" and then "implement its business plan"...

But there’s a catch….

even after raising the additional funds, the company later warns that “the proceeds of the offering will be be insufficient to fully implement our business plan.”

Wait…what?

That’s right, even after the IPO the company said it will need to raise even more money, and if it can’t, it’s curtains.

The good news is, Sacks Parente raised $13 million on its first day of trading.

The bad news… after those spectacular gains gravity kicked in and it not only crashed back to earth but through its IPO price. As of the end of trading today, it was down 37% from its IPO price and 91% from its highs.

And that gets to another interesting point…

I was wondering Sacks Parente did an IPO rather than merge with a special purpose acquisition company ("SPAC")?

Think about it...

Sacks Parente has almost zero revenues, but given its business (golf) and its pedigree (its co-founders have a history in the world of golf, including the first president of Callaway Golf) and the way its spinning its story (as a "technology-forward golf company) it was a marriage made in SPAC heaven.

And as I pointed out in the earlier this week, there's no shortage of SPACs looking for partners.

So – me, speculating here – either Sacks Parente was too dicey even for a SPAC to touch... or management thought it would gamble that it could raise money the old-fashioned way, via an IPO. After all, one of the downsides of SPACs is that thanks to a loophole in how they're created, companies have found themselves shortchanged once the marriage is official. And with an IPO, where the cash is a sure thing, for every seller there always seems to be an eager buyer.

Not that any of this matters, because either way its stock ultimately would have likely landed in a sand trap.

Speaking of SPACs, as I noted in that same SPAC essay, more of them are being liquidated before finding a merger partner than created...

Then along came Vietnamese electric vehicle ("EV") manufacturer VinFast Auto (VFS) on Monday, ringing the Nasdaq's opening bell in a downpour of confetti...

VinFast went on to jump 68% the first day, giving it a market value of greater than Ford Motor (F) or General Motors (GM)... even though it's making zero money and barely selling any cars.

And that's in a market in which competition is heating up and unsold EVs are piling up... and for VinFast, its flagship SUV is racking up one horrific review after another. Earlier this year, Jalopnik published an entertaining collection of those reviews, which it summarized by saying...

The real commonality between all of these accounts is that overnight, the VF8 has obliterated the notion that there are no terrible cars for sale anymore.

The bottom line, as the Wall Street Journal recently pointed out...

In its focus on speed to market and low-cost manufacturing, VinFast might seem more akin to Chinese companies such as NIO and Li Auto, which trade at around two times 2023 revenue forecasts, but VinFast isn't targeting the Chinese market.

It has taken the likes of Hyundai decades to gain the trust of U.S. consumers. Even with the shift to EVs, VinFast is hardly likely to crack the code overnight in the way its frothy valuation implies. This stock has a very rough road ahead.

I had a few choice comments myself on CNBC's Last Call earlier this week with host Brian Sullivan, when I said I wouldn't touch this one "with a 10,000-foot pole." (You can see a clip of it here.)

Since then, VinFast's stock has crashed well below its first-day price.

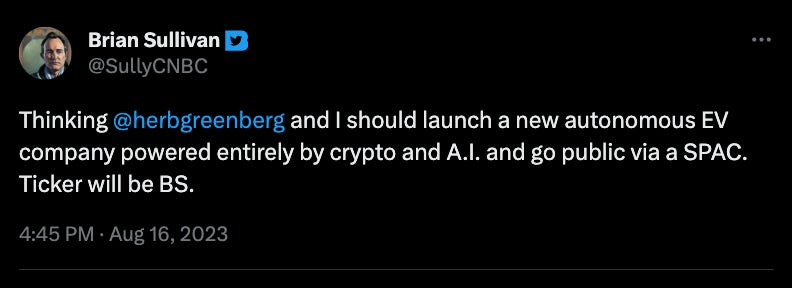

Maybe Brian had the right idea: He and I should start a SPAC, or as he explained...

In this market, that makes as much sense – maybe even more – than some of the trash that somehow is treated like gold.

The sad reality is that some people can't tell the difference. Or maybe, caught up in the celebration and all of that confetti, they simply don't care.

That’s almost always a sign of froth, which is why it’s no surprise these two deals were floated just as the market was on the other side of its tippy top for this cycle… almost as if they were trying to get out before the window slammed shut.

On a final note, and a bit of shameless self-promotion: My day job is to write two newsletters for Empire Financial Research…

Contrary to what I’ve done most of my career, they’re long biased. To sign up subscribers, we do promotions. It’s pretty straight forward. Though to be quite candid, there are parts of some of those promotions that are over-the-top… sometimes too much for me.

I do them because the actual products and recommendations are good!

Which gets me to my latest promo…

I’m sure it’ll resonate for many of you. You can skip the video and go straight to the transcript. You can see it right here. And if you like it, since you get this for free, don’t hesitate giving Empire Real Wealth a whirl! Full refund in 30 days if you don’t like it. Enjoy.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg.

Excellent read! Thanks. I am going to add you to my recommended list!

Vinfast=Vingroup=Vietnamese government