I have no idea what's going to happen tomorrow, let alone next week, next month, or next year...

Neither does anybody else, but that's where the fun and challenging parts comes in.

As much as nobody can see the future, and as much as I hate making predictions, it's wise to think ahead – whether you're driving, traveling or, yes, investing.

So when Empire Financial Research's brilliant young (as in roughly half my age) Editor in Chief Sam Latter approached me with an idea, I jumped on it.

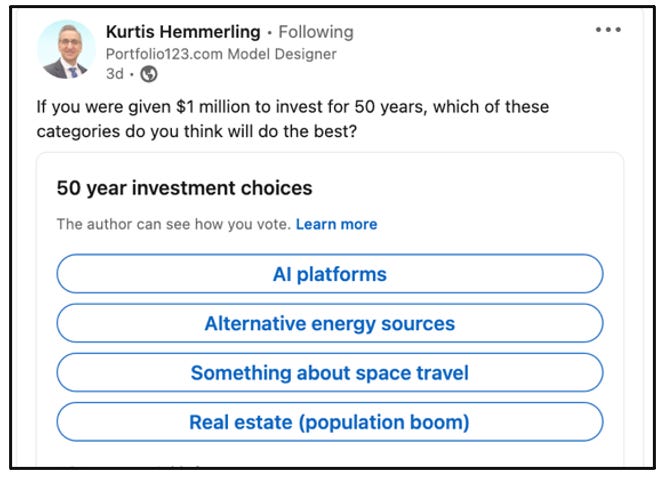

He had seen a poll on LinkedIn...

Sam suggested I ask my social media followers something similar...

Old soul that this 37-year-old is, his thought was that these kinds of ideas would create a "coffee can" kind of portfolio based on a theme... in other words, good long-term ideas.

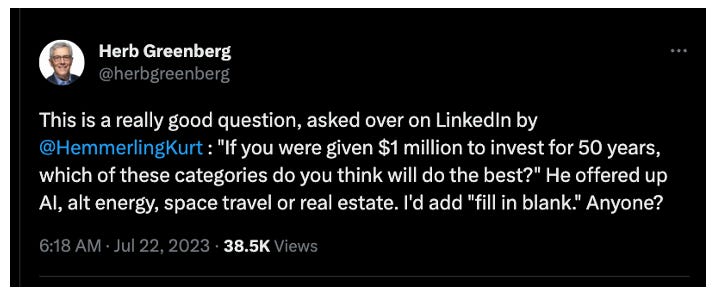

So I tweeted – or X’d or whatever you want to call it –out...

I followed it up by adding...

Let me rephrase this question: If you genuinely were "investing" for the "long term" as in a decade or two, what would you buy? Not even what company, what themes would you be zeroing in on?

It didn't take long for responses to start to roll in...

There were a few silly responses, like "forever stamps" and "OnlyFans," which is still private... and even "Antarctica real estate," which this person said, "Likely only inhabitable land in 2073."

But sifting through the answers, I saw some solid themes and ideas...

Perhaps the most frequent was the most vanilla: to buy the SPDR S&P 500 Fund (SPY), which arguably makes sense for the very long-term, as does the Invesco QQQ Trust (QQQ), which invests in the tech-heavy Nasdaq 100 Index.

While that might be the most logical, that's not quite what I was looking for.

So let's drill a bit deeper ...

The most repeated themes were health care, real estate, water, and alternative energy. Space travel got a few nods. (I was happy to see water in there, because for some reason it often falls through the cracks of future shortages.)

Artificial intelligence ("AI") was also mentioned, but as one person said...

"AI" seems too narrow to be relevant for 50 years. What we call AI companies today may just be thought of tech companies by then.

Other thoughts included...

Blockchain.

Cannabis.

Music, cement, or fertilizer. I don't know where music comes from, but cement and fertilizer make tremendous sense. (Earlier this month, we recommended buying a cement-related company in my QUANT-X Systems newsletter, which you can find out how to gain instant access to by clicking here[HS1] .)

India and Southeast Asia – both are potentially enormous areas of future growth, especially India.

Biotech and semiconductors. This person then added, "I think latter are where software was 10 years ago. Biotech is where the internet was when we were using 28.8k modems."

Rebuilding Ukraine (or whatever country might be next).

High-dividend oil companies (that's not a typo).

And within alt-energy, one person said, "We need to be able to shift investments within that category because it may not look like anything we anticipate today."

Consumer staples.

"Stocks that have some connection with Lululemon, Chipotle, Starbucks and ADP. I think these have great brands, good balance sheets, and good businesses."

That's not all...

I thought this one was especially good...

Healthcare, especially nursing homes & hospice; agriculture as scarcity increases in a climate warming age; water utilities for the same reason; military tech.

There was also "managed health care, oil refining (not exploration and production) and chip foundries." Another one was...

Copper with some gold. Being "early" in new asset classes can be painful as there will be a lot more losers than winners when the dust settles. Stick with the tried, tested and TRUE.

I was surprised there wasn't more on defense or “military tech,” as was mentioned earlier, but there was this from one of my more sardonic friends...

Food, energy, defense – in that order. Dividend stocks would be and if there's a "trouble in paradise" ETF out there, let me know.

Give the marketers time... I'm sure there will be one soon.

What do you think? If you have thoughts about themes not mentioned here – or want to add comments about some that were already listed – I'd love to hear it. Feel free to leave a comment.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

The large basket of difficult-to-define commodities, I would argue, includes water and other natural resources that will become increasingly challenging in future years.

I'd suggest CRISPR therapies, fusion energy, and in light of today's scientific news.. super conducting materials.