My Favorite AI Research Tools

Here's a rundown of services I've actively woven into my research process.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

I’ve increasingly been using various AI and related programs as part of my research.

Even with hallucinations, or the overall need to check and double-check everything these programs spit out, I’ve found it has sped up the process – if nothing else, pointing me in the right direction.

Whether I’m trying to quickly ferret out something from a proxy or get answers to questions as I dive down some obscure rabbit hole, it’s clearly making a difference.

To be sure, some of what I’m using are merely new variations of existing machine learning rather than being true generative AI, whatever that really is. But they all incorporate the newest iteration of AI in one form or another.

Seeking Perfection

From a pure search standpoint, and the way they use their algorithms and data – and whichever large language models they’re built on – they all have their strengths and weaknesses… and distinct personalities.

To say that there’s only one way to research – and that it’s the old-fashioned way – is foolhardy. It’s like me, as a kid, demanding the dentist use the slow drill instead of the fast drill on cavities because I figured it would hurt less. (Hint: It didn’t.)

The only issue I have is that I haven’t harnessed the full power of any of these tools because… there’s only so much time in the day.

I often do bakeoffs, asking the same question of all programs regardless of whether it’s Perplexity, Claude, ChatGPT or Google’s Gemini – or as I go deeper, the rapidly evolving field of programs build specifically for investors and financial research.

Out of habit, even with all of these new programs at my disposal, my first stop is usually the search bar on top of my browser, where Google is my default for search. Sometimes a Gemini-derived answer automatically shows up, sometimes old fashioned “results” do. With Gemini and the others, I prefer when they include sources; even then, especially with Perplexity, I’ve found the interpretation of what the original source said can be misleading.

Reader-supported On the Street and Red Flag Alerts highlight the risks of investing so you don’t get hoodwinked. Whether you’re interested in individual stocks or just trying to learn about why someone is betting against you, consider becoming a premium subscriber today.

Digging Deeper

For more sophisticated uses, I use speciality financial/investment AI-driven sites, notably, in no particular order….

All of them seem to be under constant renovation, with new features and other bells and whistles. What I’ve found: no single site is consistently better or more correct than the other. It’s totally random depending on the topic, prompt, or focus. In fact, for the purpose of just speed-searching for financial answers, it would appear the biggest risk for all of them in terms of search is rapid commoditization as more services spring up.

My favorite test is asking a program to search proxy statements for specific bonus structures and how they’ve changed over the past five years. Or how many meetings the audit and compensation committees have had each year for the past five years. Given the sheer complexities and legalese, the process of ferreting through proxies is ripe for this technology.

Full Disclosure: I’ve been comped with all but one of these services as a trade for their access to my content… or, while not explicitly spelled out, their ability to include my searches as part of their program’s learning process. I also have an “affiliate” relationship with one, and may with others in the future. That means if you subscribe by clicking a link, if I have a formal relationship I get a percentage of that subscription. It’s like a sponsorship, which is a necessary evil of generating income when you are an independent writer, as I am.

FinChat.io incorporates Co-Pilot into its platform. But to be honest, its real strength is its extensive pool of data. While I found it had a fairly steep learning curve, the more I used it, the more I came to not just like it but love it – especially for charts and financials. The level of detail it offers for charts is exceptional, and the visuals for its charts are fantastic… down to the minutia of key performance indicators. So much so that as regular readers may have noticed, FinChat has become my go-to for turning financials into charts. I have an affiliates deal with FinChat. That said… I’d be this enthusiastic if I were a paying customer.

You’ve likely never heard of TenzingMemo, which I’ve been testing for several months. It’s available only to professional investors. Unlike the others, which are proving to be exceptional tools as part of the process, TenzingMemo clearly differentiates itself with a mission of helping professional investors quickly get up to speed on a company. I refer to this part of the research process as “cozying up,” and TenzingMemo does an exceptional job – from laying out the bull and bear cases to valuation and a solid overview. The only downside: It can be slow, but it’s also still young. It’s good enough that I experimented with using TenzingMemo to help give my premium subscribers an overview of a company’s pros and cons (including my edits and modifications after fact-checking) with my original report on Yeti…

P.S.: Even before I tweaked what the program gave me, I was surprised how good it was. If nothing else, a great starting point. I hope to start including those snippets in full reports going forward.

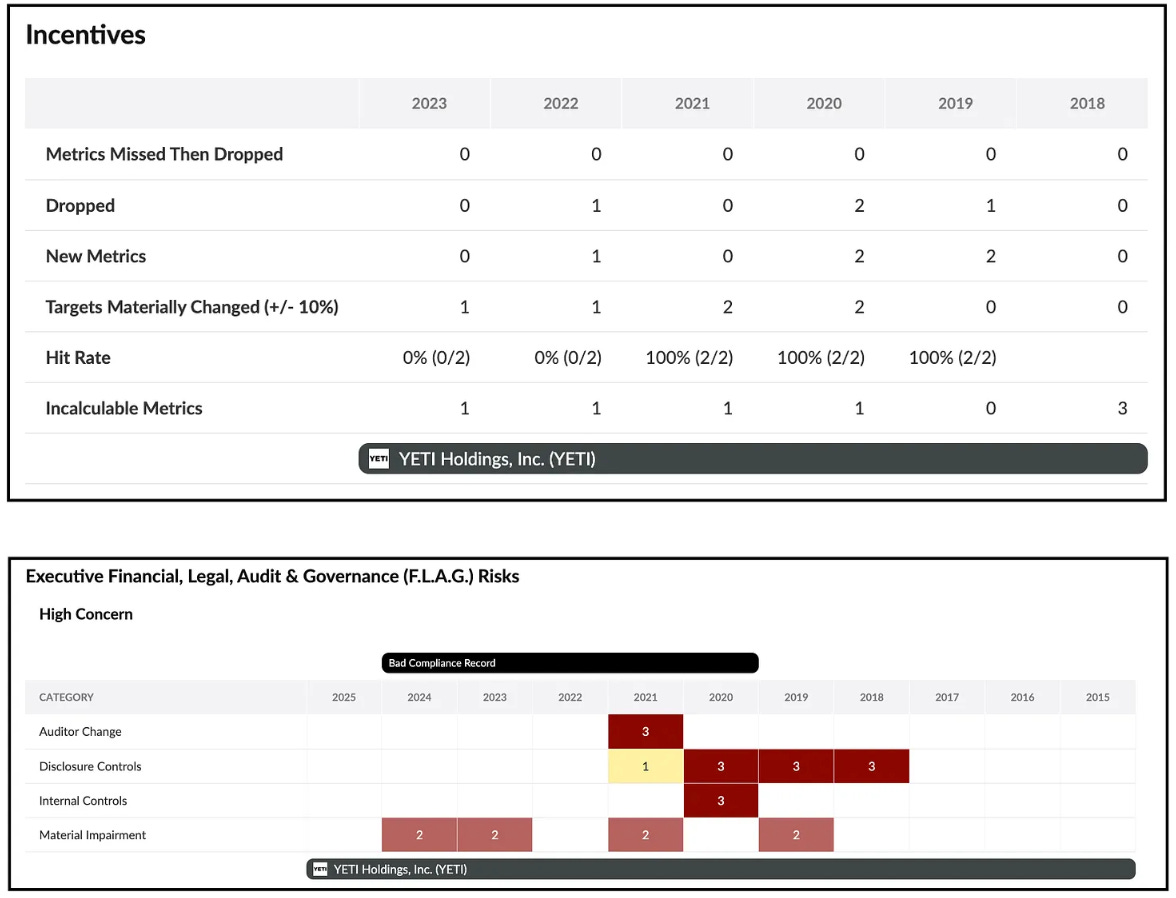

ManagementTrack, which I’ve discussed here previously, has increasingly been a go-to for flagging evasiveness of management on earnings calls (I’m not sure any other service does this) as well corporate governance and other issues. It’s also the only site I know that flags and gives a checklist of changes in bonus structures. Plus, there’s the service’s main business: Reviewing, investigating and rating management. A few samples below…

FinTool is the most filings-centric focused of the bunch, constantly adding features and expanding its data and coverage. It’s in the mix of virtually every significant search I do and claims its accuracy is 90% vs. ChatGPT. More often than not, rather than give me the wrong answer, it says it can’t find the answer… sometimes when another site can. Of course, that happens with the other sites, too. FinTool is also the simplest and most elegant to use… and may be the fastest. I don’t feel I’ve fully utilized it, especially its screening function, given my workflow. I expect that to change.

AlphaSense is my most indispensable tool – my crutch to quickly searching, comparing and analyzing filings and transcripts. I’ve been a paid subscriber (previously via Sentieo, which AlphaSense acquired) from the early days. I loved Sentieo, and I’ve transferred that infatuation to AlphaSense. This was AI at its best before gen-AI was “a thing,” helping rummage through the rafters of detail in minutes if not seconds. The downside: Sometimes some transcripts never show up… or can take an excruciatingly long time after a call has ended and after I know they’ve been published elsewhere. I had been using Sentieo/AlphaSense for financial statements and charting as well. I have since morphed most of that to FinChat, for the depth of its data combined with the excellence of its charts, which are not the star of the AlphaSense show. AlphaSense has added its own gen-AI searching tool, which given its extensive transcript/filings database (in theory) has exceptional potential. It’s still clearly a work in progress. AlphaSense also owns the Tegus expert network, which is not part of my subscription. But the service’s gen-AI can include a quick snapshot of what experts have been saying. It’s not as good as having full expert access, but for my purposes is additive. (Assuming I’m not now blocked from those searches!)

Also worth mentioning is Aiera, which has the single-most comprehensive coverage of earnings and investor calls… period. It features live calls, with the ability to listen to multiple calls at the same time. That’s not something I need or use, but have friends who do. One thing I know for sure: If I can’t find calls on AlphaSense – or they take hours if not longer to show up – I know where I’ll find them. Unlike AlphaSense, the transcripts aren’t easily searchable… certainly not for my purposes, but that’s not what it was built for. I’d love to find away to incorporate links to calls on Aiera into my content – something, full disclosure, we have discussed.

Final shout-out to the very private Canary Data. I don’t have access, but they’re kind enough to cite my work in their Sunday newsletter, which without question is the most comprehensive listing of the most compelling, usually short-biased research and various elements of data that any investor – even long-biased – should want to see. Canary was started by Joe O’Donnell, who used to run a short book at Tiger Global. Canary has evolved into a worldwide database of everything from insider to legal to management and accounting-related issues…and in-between – or as it likes to bill itself: “The world’s largest and most comprehensive database of investment risk.” Friends who use it swear by it. It’s priced for and geared to institutions.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com.