(Note: After more than a year of providing my content for free, I’ll soon be adding the dreaded paywall. Stay tuned for details!)

Short-seller whose report exposed price-fixing in the chicken industry alleges price fixing among four major PVC piping producers.

Insanely high margins for producers of commodity products even as supply/demand normalizes.

Based on the allegations, the margins are unsustainable and each company is over-earning.

One stock has already fallen by around 40%, with half that drop in a single day on disappointing earnings.

Management offers up a vague denial.

Some stories fall through the cracks of coverage just because they’re not exciting enough to spark widespread interest.

That doesn’t mean they’re not good stories.

Like allegations of price-fixing in the piping industry.

Doesn’t get more contra-click bait than that. And in a world where eyeballs matter –even in the news media – price fixing in the piping industry ranks somewhere near the bottom.

It doesn’t help when the allegations show up one day in an obscure newsletter on Substack written by an anonymous poster who is short the stocks of four pipe manufacturers – and whose moniker is ManBearChicken, no less.

Skipping the Middleman

But one thing I’ve learned over the years, starting with the advent of social media, was that not every anonymous poster is a crackpot...

As I saw for myself over the years, plenty of my own “sources” started skipping the middleman (me!) by going direct with their ideas via their own blogs, newsletters and for some – their own websites.

It was the natural evolution, for better and many times worse, of the democratization of information.

That’s why I started posting on Twitter back in 2008...

And that’s why, years after leaving traditional journalism, I’m here on Substack.

Rise of Activist Shorts

I realized early on that just because the idea wasn’t in the news media didn’t mean it wasn’t well-researched or credible.

That’s obvious from the stories broken by the likes of Carson Block of Muddy Waters Research and Nate Anderson of Hindenburg Research... and more recently by an intriguing hybrid journalistic/hedge fund concept launched by Hunterbrook Media. (Disclosure, I tried my hand at activist shorting for a mere three months, and realized I was miscast, but I digress...)

These so-called “activist shorts” have sparked plenty of controversy, but as this study shows, they’re often ahead of the curve – and stocks they out tend to lag the market.

Not that some of their reports aren’t horrifically written and worse – downright sloppy – but overall they’ve been able to police parts of the market the media will never touch… because they’re too small or simply too esoteric to warrant diminished resources.

Which Gets Us Back to Price Fixing and Pipes...

A few weeks ago I was pinged by someone going under the name ManBearChicken that he had just written a report on Substack regarding price fixing in the piping industry.

I was tied up with business-related issues, so couldn’t really pay attention until just the other day.

When I did, I realized... this is quite a story. And other than a few mentions here and there, it hadn’t received much attention.

Obviously, the name ManBearChicken didn’t help, but neither did the piping industry.

Still, it’s a good story and the author, it turns out, is credible. He disclosed in the report that he worked at a long/short money management firm. That suggests the report not only passed muster with his firm’s compliance department, but has been vetted by legal counsel.

More importantly is his prior body of work, which is a mere four reports, all of which have hit the bullseye.

It Started With Chickens

But it was his first in 2016 that stands out the most, and explains the name, ManBearChicken...

That report broke the story of price fixing in the chicken industry, resulting in quite a few indictments and a $107 million fine for Pilgrim’s Pride PPC 0.00%↑ .

Now, he alleges that four companies – Atkore ATKR 0.00%↑ Otter Tail OTTR 0.00%↑Westlake WLK 0.00%↑ and Core & Main CNM 0.00%↑ – are “over-earning” in an industry of just a few players that make a commodity product... making it an industry “ripe for collusion.”

Atkore is the largest manufacturer of electrical PVC conduit, sold to contractors and builders. The others are more focused on selling to municipalities, which are always replacing piping, and which the report notes are “relatively unsophisticated customers that pass along cost inflation to consumers in the form of higher utility bills.”

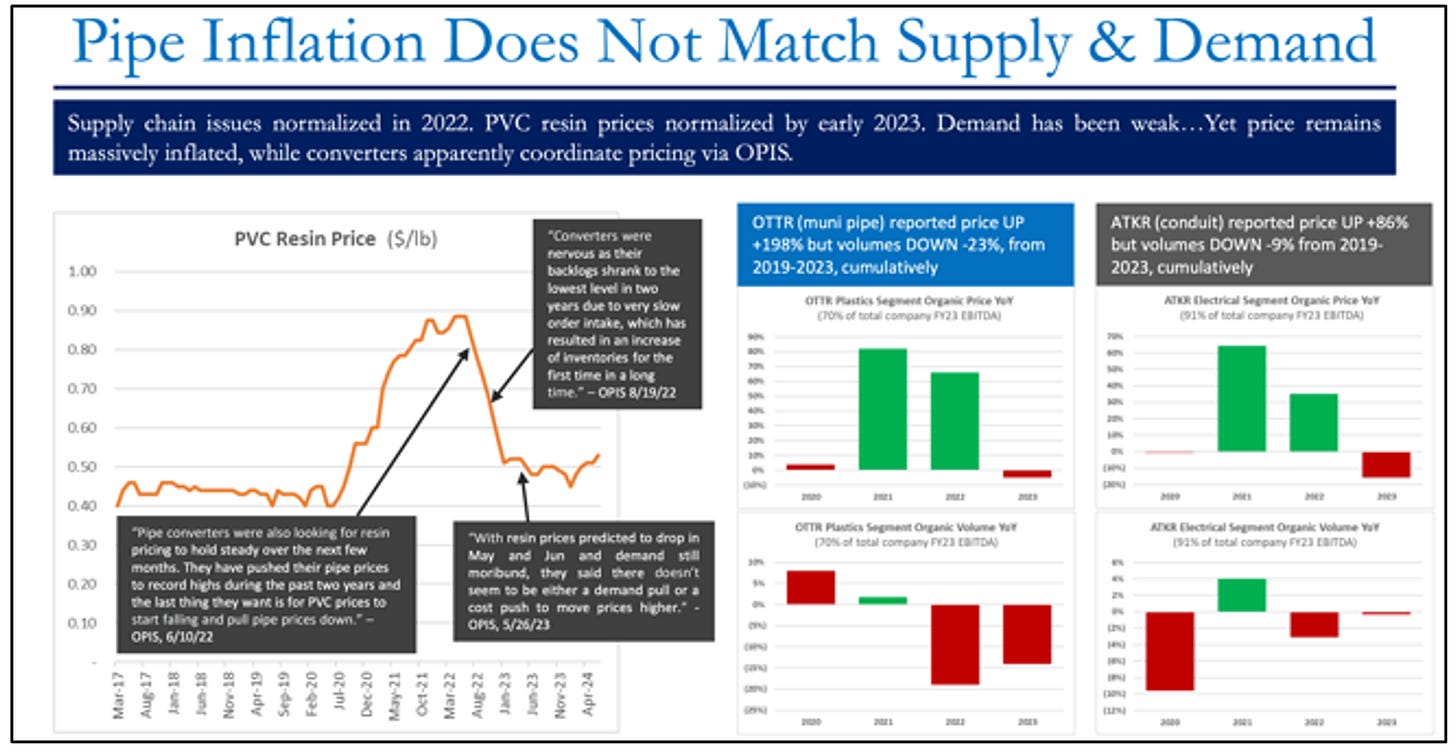

ManBearChicken’s piping report, which you can read in its entirety here, alleges the big four use the trade publication, OPIS – which doubles as a commodity pricing service – to communicate the need to raise prices. This was after the post-pandemic supply/demand surge had started to normalize.

‘Everyone...Working Together’

ManBearChicken posts example after example of snippets from OPIS that suggest price fixing by the piping manufacturers, known in the industry as “converters.”

Among them...

And…

And…

The Proof Is In the Margins...

The evidence, if you can call it that, is in the margins of the fabulous four. Keep in mind, these are commodity products…

None is more outrageous than the piping segment of Otter Tail, an electric utility that gets 70% of its profits from its PVC piping business, all of which is sold to municipalities. In that segment, operating margins more than quadrupled to an insanely high 61% from 14% from 2018 to 2023... on a price increase of (wait for it!) 198%.

Atkore’s EBITDA margins nearly doubled to 38% from 20% – for a commodity product.

Westlake’s EBIETDA margins jumped an equally crazy amount to 22.5% from 13.5%.

Ditto Core & Main, whose EBITDA margins spiked to 13.5% from 8.3%.

The full story is summed up in this chart from the report, which compares input prices and margins...

And this one, which compares the inflated pricing with supply/demand...

Here’s Where It Gets Interesting...

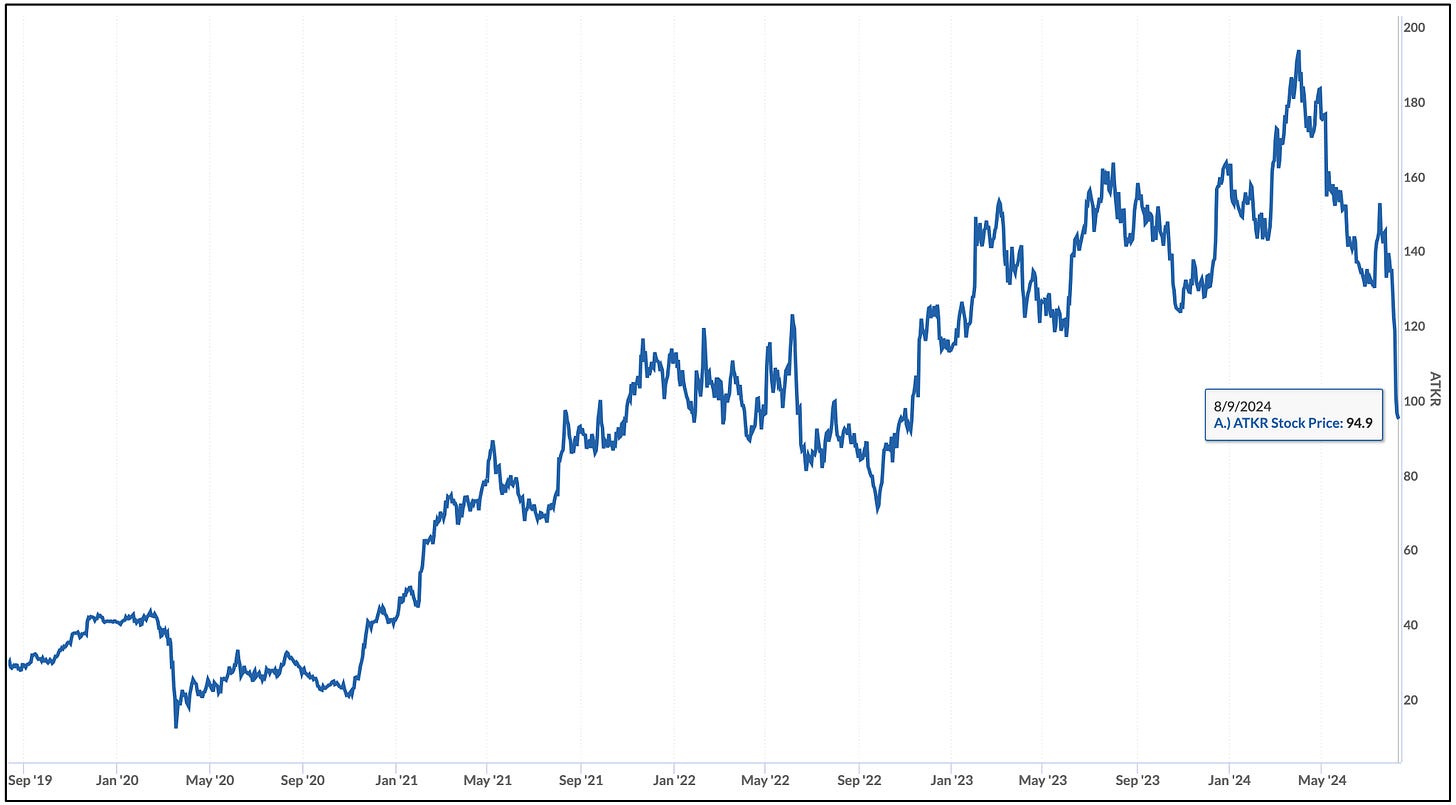

Last week Atkore – whose CFO suddenly resigned to take a job outside of the industry – reported disappointing earnings. Its stock, sliding since the ManBearChicken report two weeks ago, tumbled on the news. One big reason: Disappointing results thanks, in part, to “softer than expected” pricing.

Asked by an analyst on the company’s earnings call about allegations of collusion, and whether they could be substantiated, CEO William Waltz responded...

So I'm going to tell you, first, is if you saw some of the stuff going around, it's from a short seller. And Deane, to your question, you've asked over the decade, I am so proud of our internal pricing mechanisms, weekly calls, scatter diagrams, apps that tell us pricing that we drive our business and I'm going to claim that report is unsubstantiated from the conclusions it tries to make.

To which I say...

Saying that a negative report is from a short-seller is the wrong answer. ManBearChicken’s report discloses the author’s short position at the very top...

In my opinion, Waltz’s answer is the typical response to virtually every report by every short-seller, activist or otherwise. It has almost become boilerplate in an effort to discredit the report not on the facts, but because the author is short, without addressing the issues.

But note that Waltz doesn’t say with conviction the allegations are wrong. Instead, he stuck with the exact wording the analyst used, and merely said that he is “going to claim” the report “is unsubstantiated from the conclusion it tries to make.”

As for the other companies, none was asked about the report on its earnings call in recent days. (Core & Main’s call was held in June; there were no analysts on Westlake’s call.)

The Most Important Question Of All…

That gets us to what happens to the stocks of the fabulous four going forward.

Arguably, the three-year chart below as of Friday tells that story…

Atkore (blue), having slid 40% in recent weeks, is now just above ManBearChicken’s $90 target.

Otter, Westlake and Core & Main, meanwhile, have been holding firm. In his report, ManBearChicken sees them falling roughly 46%, 26% and 38%, respectively

Interpret at will.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stocks mentioned here.

I can be reached at herb@herbgreenberg.com.

Good Stuff Herb! Manbearchicken for the win!