One Overlooked Bullish Biotech Indicator?

And why one veteran healthcare analyst couldn't be more excited.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

From the contrarian files…

When it comes to biotech, is the real “tell” and contra indicator the real estate market?

Consider that three years and a few weeks ago, as biotech was seemingly in its death throes, I wrote…

Based on commercial real estate in San Diego – or in any biotech hub, for that matter – you would never know that stocks in the sector have gone bust...

It's like boomtown here in San Diego, where I live. It seems that every time I go out, which is often, I see another new sign for a biotech company I've never heard of.

It also seems like hardly a week goes by without a story in the local press about a biotech-related commercial real estate transaction, such as this one from the San Diego Union-Tribune, involving "near record price" being paid... in this case by a biotech real estate unit of asset-management giant Blackstone (BX).

Perhaps nothing sums it up more than this story in the Times of San Diego, headlined, "Biotech Firms in Hot Race for Space – Demand Outstripping Supply in San Diego, Other Top Markets," about how the high demand is causing rents to spike.

A lot of that involves a steep rise in demand for lab space. The reason: A boom in biotech research and development hiring – according to a mid-2021 report from commercial real estate firm CBRE Group (CBRE), this is up 79% from 2014 to 2021 compared to the prior seven years.

As a result, it's hard to find space, with vacancies in San Diego running around 2%.

What a difference three years makes…

Can’t Give It Away

Now you can’t give that space away. Two weeks ago this headline in the Union-Trib caught my attention…

But the real story was in that story, which started off saying…

The glut of life science office and lab space in San Diego County rose to an all-time high in 2024 and it’s expected to continue growing this year.

Although leasing activity has picked up in recent months, the demand for life science space has not kept pace with the increasing amount of real estate entering the market.

But it was this chart deeper down that was all you really needed to see…

And it’s not just San Diego. In Boston, for example, for the first time ever lab vacancy rates last year surpassed 30%, having increases for 10 straight quarters – another first.

I raise this because it got me thinking about whether there’s an inverse relationship to the boom/bust cycles in biotech real estate with the actual performance of biotech stocks.

Inverse Relationship?

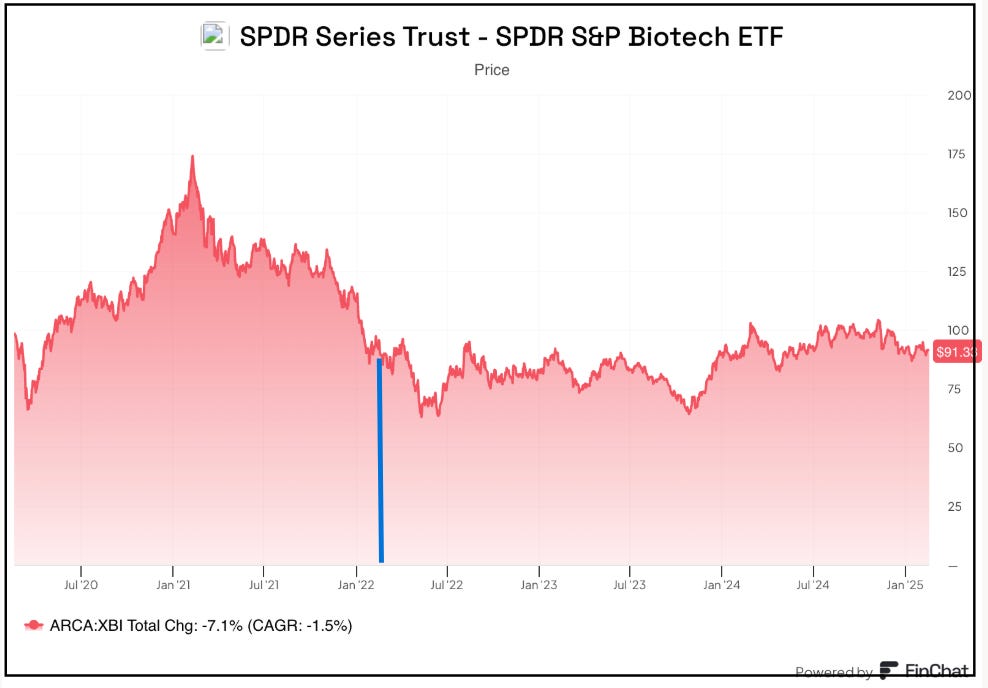

After all, when I wrote my original piece, biotech stocks – through the lens of the SPDR S&P Biotech ETF XBI 0.00%↑ – tells an interesting tale.

That’s because as biotech stocks were unwinding crashing, demand for lab space was insatiable. VCs were throwing zero-interest rate money at anything with a door. And companies that had no product and no potential for even approval for at least seven years ere going public with valuations of nearly $1 billion. Now it’s just the other way around…

Now they can’t give lab space away because so many of those startups failed… or existing companies that had expanded have cut back.

According to Fierce Biotech, there were more biotech bankruptcies in 2023 than anytime since 2010, and they’re continuing, albeit at a slower pace in 2024.

And just the other day my friend and former colleague Adam Feuerstein, who has been covering biotech for a very long time, wrote in STAT, which is all things biotech..

My recent conversations with folks in the biotech investing world can only be described as bleak. The market offers one beatdown after another. Sentiment is lousy and the bad mood is relentless, to the point where people are seriously wondering if a sector turnaround is ever possible.

Which Gets to the Question…

Are things seemingly so bad they’re actually good? Or in the least, improving?

Or, now that the riff-raff has been cleared out – after way too much money with nowhere else to go poured into biotech – is the stage set for the next phase of growth?

I have no idea, but I may be onto something. Just look at the 20% rise so far this year in Vertex Phamaceuticals VRTX 0.00%↑ after announcing a new non-opioid. And that rise is on a market value that is now (wait for it!) $120 billion.

It’s not just me thinking this, but when it comes to biopharma, people who know what they’re talking about…

Like Len Yaffe, an MD by training, whom I first met and probably tangled with decades ago when he was the healthcare analyst at the old Montgomery Securities during the go-go days of biotech.

Four Themes

He now runs Kessef Capital Management, a healthcare hedge fund, where he isn’t just bullish on biopharma, but for the first time in years, is forecasting healthcare stocks – especially biopharma – to outperform the averages.

More specifically, as he told me when we caught up in recent days, he has four specific themes and a few favorite stocks within those. As he explains…