There really is a sucker born every minute…

At least there is on Wall Street, where investors flock to the stocks of companies that were on the verge of going belly up if they hadn’t maneuvered a last-minute, highly complex debt-restructuring deal.

The hallmark of this specific type of deal is that some insider needs to be immediately bailed out by the stock, which even before any deal has been announced has been rising on on some kind of vague rumors… or no rumors at all.

But for this kind of deal to really work, the stock has to spike on the news, almost as if the company has received pennies from heaven… even if it really might be (for the average stockholder, at least) a deal with the devil.

Let me explain…

When a public company is in dire financial straits – with too much debt, not enough cash and financial metrics going the wrong direction – there’s usually an effort to get the banks or other lenders and/or big investors to figure out a way to work things out.

If things are really bad, that typically involves issuing new debt to replace the old debt… and doing such things as granting waivers on debt covenants to give the company one last chance to avoid having to wear the scarlet “B” for bankruptcy.

But with a certain select group of companies, there’s an additional weapon: their own stocks.

This works best if the stock is heavily shorted, has a high daily trading volume and has active options…

Oh, and these stocks are almost always of companies behind a popular brand, product or concept or former high-flyer – the very kind of companies that are like magnets to the “meme” stock crowd.

Yes, them, that same mob that came out of nowhere in the post-pandemic bubble, likely not knowing the difference between a stock and a bond… and with all their bravado classically confusing brains with a bull market. If you haven’t noticed, they’re back!

As was the case back then, a key attraction is the ability to squeeze heavily shorted stocks higher. That means buying them for no other reason of forcing short sellers to cover at higher prices, creating a self-fulfilling momentum-driven feeding frenzy.

For nimble traders, that can be a lucrative strategy…

But for most investors, it’s the same old “fear of missing out” (“FOMO”) trap… that if they don’t get in they’ll miss out on the next big home run – which for some reason always happens to involve a company on the verge of going out of business. (When there are thousands of other stocks they can choose from, that makes perfect sense, right?)

None of that really matters because these investors – almost naively – are playing straight into the hands of investment bankers behind this ingenious strategy, who it would appear are playing the FOMO crowd for for fools.

As one friend puts it, “They’re looking to exploit the combination volume and the volatility.”

In other words, their goal is to get the stock higher so either the company itself or the somebody else close – maybe having received warrants as part of the restructuring – can sell the shares at the highest price possible in the frenzy.

It’s brilliant, until it isn’t…

Look no further than Tupperware (sorry to go there again, but it’s one for the books) and Carvana, the used car dealer…

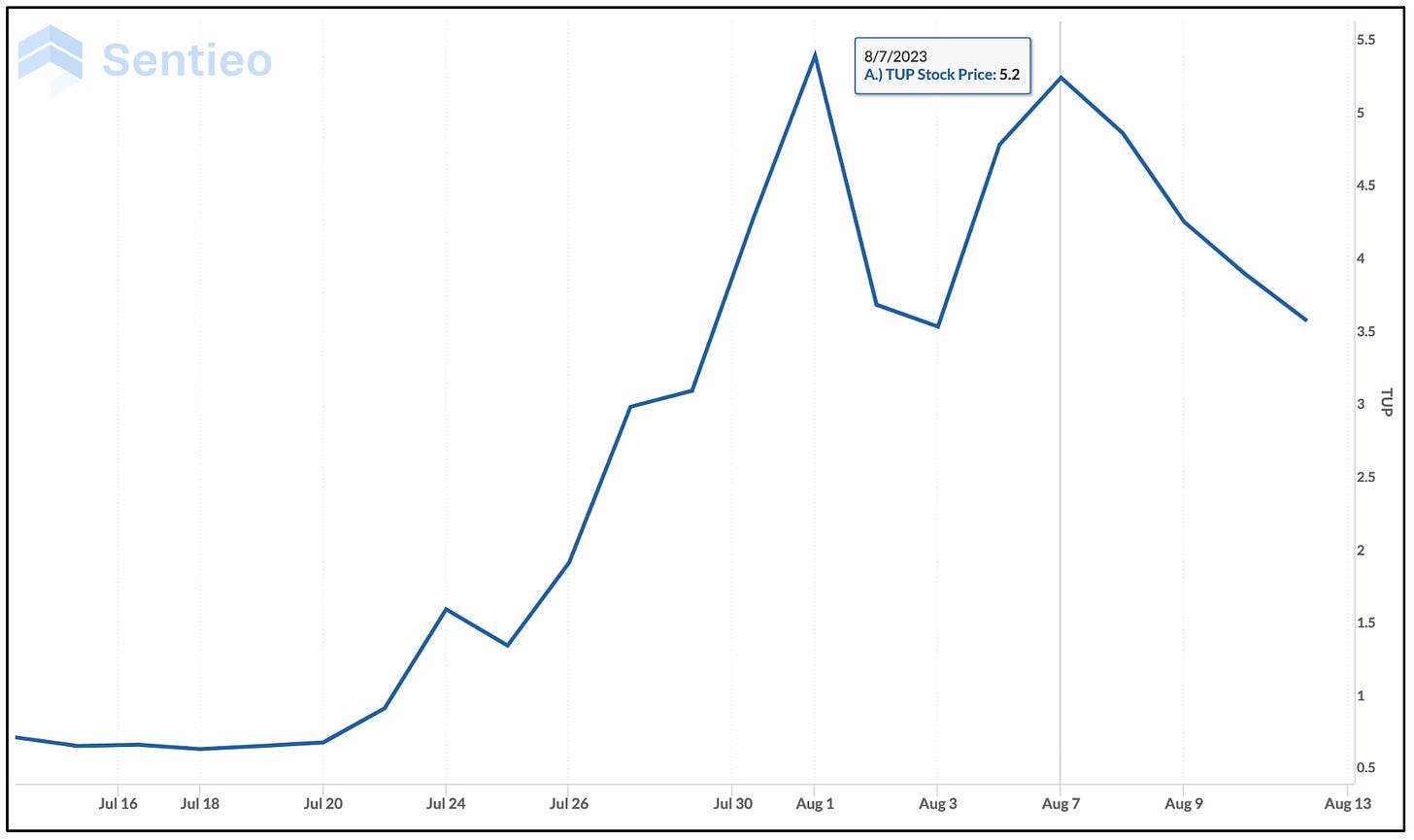

Thanks to recent last-minute debt restructuring deals, the stocks of both have risen from the near dead.

To repeat what I wrote at the tail end of my “Tupperware – Hold the Confetti” essay last week..

If you didn’t know better, you might even think these kind of debt restructurings of companies with big, well-known brands are part of a deliberate (and I’d say brilliant) strategy…

It’s a strategy designed to stoke the emotions of the Robinhood investing crowd, which in turn helps goose these types of stocks higher, with the express intention of bailing somebody out.

There I go with my silly conspiracies again.

Or maybe it’s not so silly...

In the case of Tupperware, as I pointed out, the banks were being bailed out...

They got warrants, 60% of which they could exercise immediately. You read that right... immediately, which means August 2, the day the restructuring deal was struck. Even before news on the restructuring hit on August 3, the stock was inexplicably blasting higher on nearly 5 times the average volume.

I would be stunned if the bankers had not been selling into the second bounce after the announcement... or for their sake let’s hope they had been, since the stock since then has done a complete round trip.

As for Carvana...

After nearly imploding under the weight of falling sales and rising debt, much like Tupperware its stock started rising out of nowhere shortly before the company rolled out a complex debt restructuring deal.

Like Tupperware, it had a sweetener....

In Carvana’s case, the company would issue stock to help pay off some of its debt.

As you might guess, the announcement on July 19, caused Carvana’s stock to rise... and not just rise, but skyrocket almost instantly by around 40%, thanks in large part it would seem to what I refer to as the memesters, as I like to call them, having hopped on board.

Within a week, on July 27, the company announced it had raised $225 million, “fully satisfying” a stipulation of the debt restructuring...

The suggestion was that the company had raised the cash it needed to raise...

What the press release didn’t say was that Carvana had merely satisfied a requirement to issuing stock by a certain date. Buried in the legalese of the new debt agreement in its regulatory filings, which any serious investor would have read, was that it needed to raise a total of $350 million by around August 21

In other words, Carvana was still $150 million short of the amount it needed to raise.

There was just one problem... the stock had started to slide back to where it was before it had popped higher.

Not to worry, thought, because as you might guess, there was a Plan B: Early last week Carvana issued revised its financial guidance upward.

The words “increasing,” “gross profit” and “improvements” in the headline were no doubt enough to trigger stock-trading algorithms, which in theory should cause momentum that ultimately feeds on itself... as the FOMOt kicks in.

That’s just what appeared to be happening as Carvana started to lift off.

But then, on the very same day, something clearly unexpected happened...

Within the first hour of trading the stock reversed itself and tumbled, which can happen is the flip side of a short squeeze. When the shorts are gone, so are the natural buyers.

Put another way, what goes up on hot air, plunges when it’s gone…

As it turns out, even this ingenious strategy has its limits. Or as Mike Green, Chief Strategist at Simplify Asset Management and author of the I Don’t Give a Fig newsletter tweeted last week...

Wash. Rinse. Repeat. When it comes to playing into the creativity of Wall Street, there’s always a greater fool.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg.

Plays off that famous JK Galbraith line about the financial market memory lasting about 20 years, it’s just a constant recycling of FOMO and get rich quick schemes.

When Michael Green says "it makes me pine for crypto" what does he mean? Can someone help?