Last Friday a friend pinged me to say...

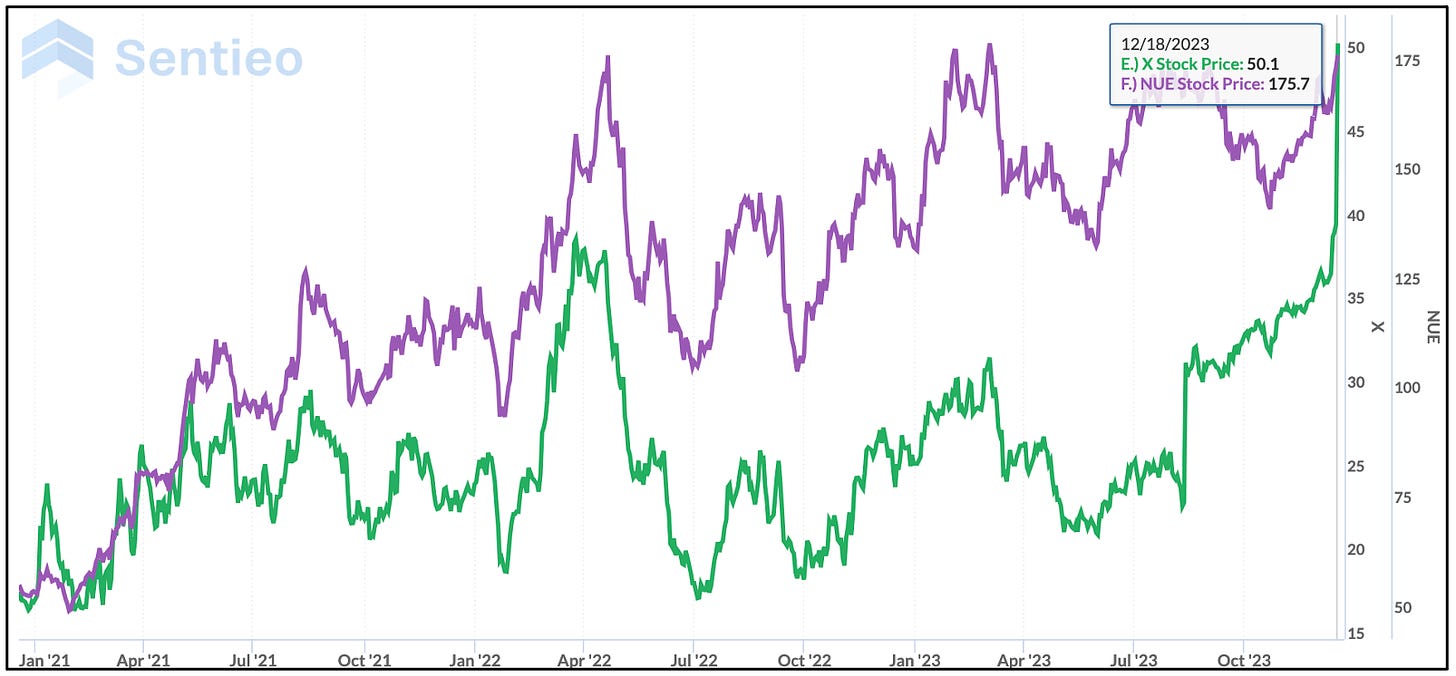

Here’s a story - X saying multiple bids to acquire the company. NUE at 10x eps and analysts think EPS are going to collapse from 18 this year to 12 next…. Just as the Fed is cutting?

I was busy so I barely paid attention – and, to be candid – saw the “X” and somehow thought he was talking about Twitter. X is the symbol for U.S. Steel; NUE, Nucor.

Then, first thing today the news hit: that United States Steel – symbol “X” – agreed to be bought by Japan’s Nippon Steel.

‘Free Money’

U.S. Steel’s stock, already moving with the market last week, lifted nearly 30% on the news… almost as if it was making up for lost time. Nucor – NUE – rose, but just a bit.

“X/NUE were free money on Friday,” my friend said.

He went on to add...

X said they had multiple bids above the current stock price.

The obvious question, where does that leave Nucor?

“People are short it,” my friend responded.

Why?

“Because of recession talk. That’s backwards.”

With tariffs on Chinese steel on one hand, and bans on Russian steel on the other, his point is that demand for U.S.-produced steel will only continue to rise, especially if there is no recession and rates fall… leading to stronger demand.

That’s the wild card, of course...

Valuation Discrepancy

Nucor still trades at roughly 9x earnings, just a bit more than U.S. Steel, and by all metrics is a considerably better company, generating enormous amounts of free cash flow.

“Yet,” as my friend says, “everybody thinks its earnings are about to collapse.”

But here’s the reality...

Using its EBITDA, Nucor has traditionally traded at a 40% to 50% premium over U.S. Steel. At its acquired price that spread is closer to 33%. Yet Nucor is a superior company.

So, arguably, if its earnings don’t collapse, Nucor could move 30% higher… meaning it’s still free money.

At least that’s one way some people like my friend are thinking about it, knowing full well that valuation arguments can be the trickiest and toughest.

Agree? Disagree? Feel free to weigh in below.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Threads @herbgreenberg.

I got interested in X as a potential long about 18 months ago. Valuations across the space were absurdly low as investors prepped for the Great Recession That Never Was. My 2 cents is that you’re right--Nucor will likely re-rate higher, but an additional tailwind will be the continued acceleration of industrial expansion in the U.S.