Quick Comment – Why iRobot May be iScrewed

Even with its stock clobbered, Red Flag Alert continues to fly

***Head’s up: Big changes are coming to On the Street. We’re evolving, expanding... reimagining. Stay tuned!***

With news this morning that Amazon ($AMZN) is killing its iRobot ($IRBT) deal, the obvious question: What happens next?

The bigger question: What does iRobot’s key lender do?

Carlyle Group loaned the company $200 million last year just so it could stay afloat while trying to close its merger with Amazon. It seemed like a risk worth taking.

Then, as antitrust regulators moved to block the deal, something strange happened: Amazon didn’t push back.

As I wrote last Wednesday, in “Red Flag Alert – Don’t Get Sucked In”...

That’s another way of saying, it would appear, that after having time to think it through – it no longer wants iRobot.

Then, today, the two announced the deal was dead.

Looking Grim

iRobot, in its press release, said it’s taking all kinds of action aimed at “rightsizing” its cost structure, including laying off 31% of its employees. Among those leaving are CEO Colin Angle, the company’s visionary and founder. He is being replaced, in an interim basis, by Glen Weinstein, iRobot’s chief legal officer.

Whenever a lawyer steps in to run a situation like this, interim or otherwise, the outlook is often grim.

One look at the numbers tells that story...

Revenue last year, based on preliminary estimate, fell 25% from last year, with a loss of between $265 million and $285 million. On a non-GAAP basis, it’s only slightly better: A loss of 200 million.

Shark Attack

That’s no surprise, given the intense competition iRobot now faces from the likes of Shark Ninja ($SN) and others, which are stealing share. This chart from a Jefferies report last September tells a chilling story (for iRobot)...

In the span of three years, Shark Ninja’s share of the robotic vacuum market spiked to 25% from 15%. That’s a 67% gain.

The Well is Running Dry

Worse, iRobot is nearly out of money (or entirely out of it, depending on your interpretation of cash)....

As of the end of the quarter, iRobot had $185 million in cash. However, almost all or most of it is from the Carlyle loan. In other words, operations are generating little to no cash.

And if you’re thinking the $94 million breakup fee from Amazon will help, think again...

As I wrote last week, instead of getting to pocket the $94 million breakup fee, $19 million will go to Carlyle in the form of a financial advisor fee. Another $35 million will go directly to paying back the loan. The remainder will be set aside to pay back the rest of the loan, subject to the company’s needs to dip into it to buy inventory.

Even with all of the cost-cutting, the company is trying to dig itself out of a hole so deep it may not have enough cash to survive.

Think about it this way, giving the company the benefit of the doubt...

Using Wall Street estimates, before today’s revised guidance: This year iRobot was expected to post an operating loss of $116 million on revenues of $930 million. With the new guidance, it could be argued that by chopping off as much as $150 million in expenses, the company could very well earn $34 million in operating profit – and that’s best case.

Wrong Time to Cut Spending

Keep in mind, however, part of whittling down those costs involves cutting R&D and sales and marketing expenses. And doing so while iRobot is losing share and facing the stiffest competition ever… all while Shark Ninja has been raising the amount it spends on R&D.

If that wasn’t enough, all of this is happening as iRobot is trying to adjust to having lost its onetime biggest customer, Bed Bath & Beyond, which lured in customers with its 20% discount coupons. Now, while in a hobbled financial state, iRobot has to bid for rankings on Amazon and elsewhere against sponsored online listings by Shark Ninja others with considerably larger budgets.

On the plus side, thanks to the termination fee, iRobot has a plan in place to nearly halve its debt. But even if it does, since it’s paying nosebleed subprime-like rates in the range of 13% to 14%, it will still have an enormous interest expense, after which it likely still won’t be able to earn a net profit.

The Endgame

What happens next? Impossible to say, but… Since Carlyle in all likelihood signed off on this deal, it’s highly unlikely they would pull the plug on iRobot – at least not yet. It would appear they’re more interested in getting their money back, rather than outright buying or revitalizing the company.

That suggests that at some point iRobot may need to raise more cash. The only way that could happen, it seems, would be by issuing more shares.

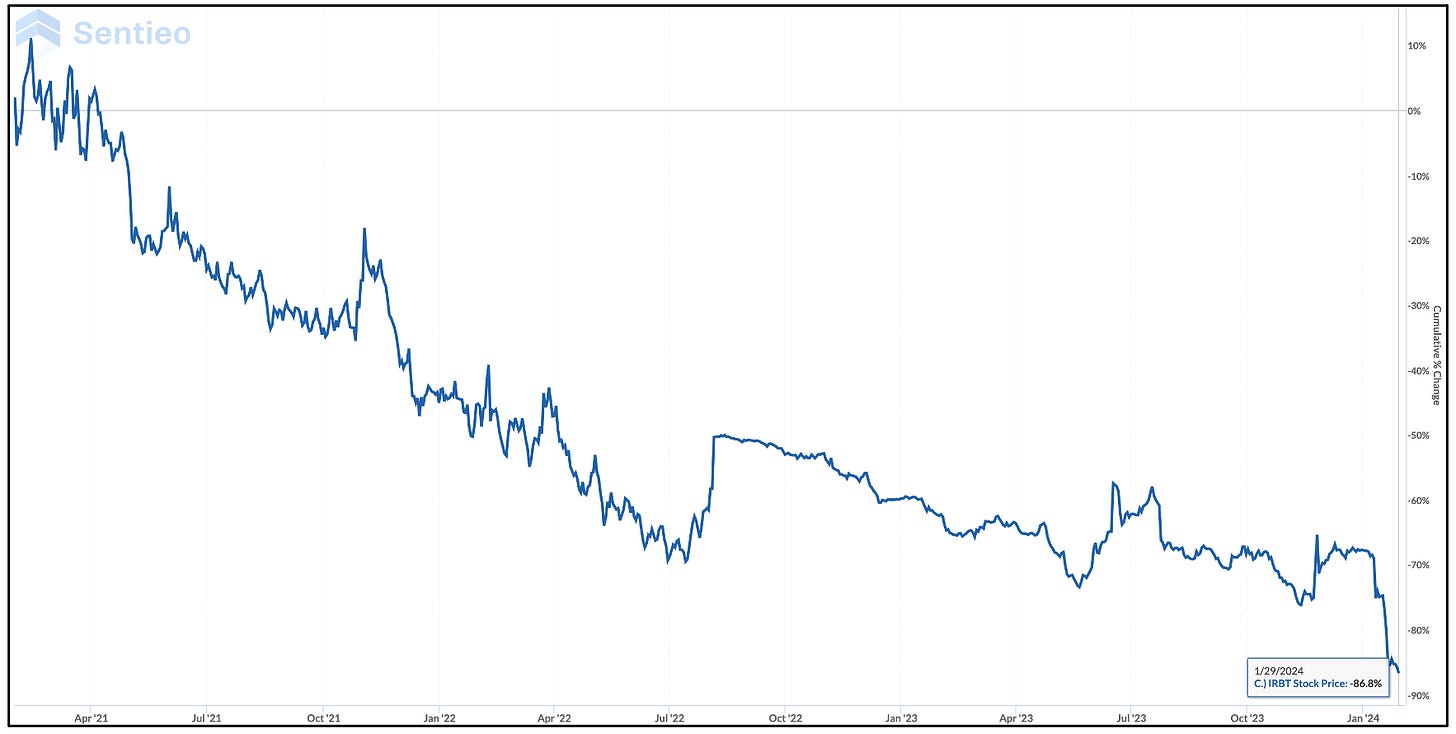

The stock has already lost half its value in less than a month – 14% alone since I red-flagged it last week.

More shares will be good for Carlyle, bad for shareholders. That’s why, as clobbered as the stock has been, red flags continue to fly.

Please click the heart below if you liked this, and feel free to share with your friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg

If Bart Simpson was an investor in iRobot he would say "Ay, caramba!"

Who's going to buy any additional shares? The existing shares have fallen 63% in the past year, and now would be diluted.

If you could buy new shares at $1-2 per, but you couldn't sell them for a year or two, would you? I'm pretty sure I wouldn't.