Warren Buffett's first rule of investing is, "Never lose money"...

Rule No. 2 is, "Never forget rule No. 1."

Welcome to The Red Flag Alert, a rolling roster of stocks to avoid.

When I did short research, the greatest compliment we could get would be from investors who said we kept them out of a stock... or kept them from buying more before it tumbled.

That's the idea behind the Red Flag Alert...

And right now, there are no shortage of companies whose financials are flashing red flags...

Or as Cornell business professor Sanjeev Bhojraj told Bloomberg, in an article about how manipulation hasn't been this bad in three decades...

Managers are under so much pressure to deliver earnings that they're using a lot more accounting than they have in the past to make their earnings look good. If my dollar of earnings has no cash or negative cash, that's poor quality because all the earnings that I have are just accounting.

Bhojraj also is a co-founder of Kailash Concepts (KCR), whose data I'm using, at least initially, to help spot these companies.

Specifically, I'm focusing on stocks on two lists...

One shows “unattractive” high-debt small- and mid-cap stocks. (Let’s just say some are worse than others.)

The other, dubbed "The Terrible 23," whittles down potential earnings manipulators to a few dozen out of the hundreds that do. (There are currently more than 23!)

Historically, companies on these lists typically underperform the market… even if their stocks have already fallen.

Keep in mind, this not a deep dive into the filings or businesses. I'm just flagging companies that the data is triggering... the kind of data that should be a good jumping off point for further research.

Where there's smoke, there's often fire.

Now, for the inaugural crop...

🚩 First up is solar installation company Sunrun (RUN), which has been a longtime favorite among short sellers...

For that very reason, I debated using it here. But as it turns out, it's the perfect name to kick off the Red Flag Alert... because perhaps not surprisingly, it shows up on not just one, but both of KCR's lists.

The debt list focuses on the most egregious examples, where debt is rising but net income and/or free cash flow aren't. The chart below tells that story pretty clearly...

That's not a situation companies want to find themselves in today. As interest rates rise, they'll be forced to constantly roll higher-cost debt against lower earnings and cash flow.

The intriguing part? Even though its earnings are falling, Sunrun still winds up on the earnings manipulation list. Put another way, even with what might be viewed as aggressive accounting, its earnings are falling.

And it ticks almost every box that would (or should) cause an investor to dig deeper...

These are all accounting metrics, but to put it in perspective, the higher the number, the more likely the company underperforms.

As a backup, I ran it through a screen KCR developed for me, which we use as part of the research process for ideas that go into my QUANT-X System newsletter. (You can find more information on the newsletter here.)

There, its ranks 1,576 out of 1,611 small- and mid-cap stocks, with extremely low earnings quality. If you knew nothing else, a free cash flow yield of a negative 22% should at the very least cause you to do a double take.

And don't use the "but it's a growth stock" line, because it's not. Sales last quarter were down from the same period a year earlier and well below where they were prior to the pandemic.

While the stock has plunged from its post-pandemic highs, it remains vulnerable. Avoid.

🚩 Next is Ameresco (AMRC), a self-proclaimed 'cleantech integrator and renewable asset energy developer'...

This company has been on the lists of shorts for years. In fact, I knew the company's name rang a bell when I saw it. We wrote about it in 2020 at Pacific Square Research – the short research firm I co-founded – citing a laundry list of concerns.

I have no idea if they all still apply, but what I do know is that Ameresco has also landed on both of KCR's lists.

The chart below shows that in addition to a rising debt load, free cash flow is somehow rising while net income is falling. That discrepancy is often a red flag, since it suggests the company is using something other than earnings to goose its cash flow.

In this case, it's especially worrisome because net income was barely positive... In fact, it's the lowest it has been in any quarter in years.

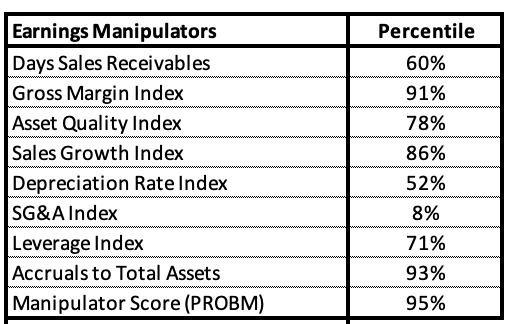

That's what makes the below chart from KCR on potential earnings manipulation so interesting...

As always, interpret at will. But the numbers are the numbers, and if there's such a thing as off the charts, this one comes close. Even with the possible maneuvering, its earnings growth is plunging.

It should come as no surprise, then, that with a free cash flow yield of a negative 19%, this ranks toward the bottom of all small and midcaps. And while the stock is well off its highs, it's still above where it was back we wrote about it as a possible short.

Based on the data, avoid Ameresco.

🚩 The last red flag is on Topgolf Callaway Brands (MODG)...

This the old Callaway Golf, which now makes golfing equipment, runs golfing entertainment centers, and makes golf apparel. It's been trying to get its footing after Callaway's 2021 acquisition of Topgolf golf-themed sports entertainment business, which may very well be why it has landed on both the debt and earnings manipulation lists.

As you can see in the chart below, debt is spiraling higher while free cash flows have fallen off a cliff.

The company says it plans to be cash flow positive this year, and it very well may. But thanks to the abysmal scores in KCR's earnings manipulation table below, landing it on KCR's Terrible 23 list, investors might want to see just where that cash flow comes from...

As the table shows, among other things, Topgolf seems to be growing sales by giving customers better and better terms.

At the same time, it's growing earnings via accruals at an usually high rate – a sign the company might be resorting to accounting adjustments, rather than more sales – to make earnings look better than they really are.

What's clear from the numbers is this: Leverage is going up and earnings and cash flows are going down. Avoid Topgolf Callaway Brands.

Finally, a quick heads up about this month's issue of my QUANT-X System, published last Friday...

In it, I wrote about a 99-year-old financial services company that not only benefits from higher interest rates, but also from market volatility.

Despite its age, the company believes it has only scratched the surface of its incredible potential market opportunity. The QUANT-X System helped unearth this hidden gem.

Almost no one has even heard of this company. I know I hadn't! That's why the stock trades at a bargain-basement valuation... at least, for now.

To learn how to get access to this brand-new research, click here.

Do you agree or disagree on these red flags? Do you have a company you think I should take a look at?

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter

The "voting machine" can render the "weighing machine" for extended periods of time....but eventually, the weighing machine takes its measure!

Wonderful piece!

Gee, I kinda like Top Golf .. I'm a non-golfer, I think they call us hackers. It's a great place for work cartharsis - whacking those little white orbs to relieve the job stress. It is fun.