Welcome to another edition of the Red Flag Alert...

Before we get going, I’d say, “read my lips,” but since that’s not possible, read the words I’m typing: Unless otherwise stated, the Red Flag Alert does not reflect a deep dive.

These data-driven ideas are sourced from various screens and lists from my friends at Kailash Concepts (“KCR”) based on data that suggests these companies are likely to underperform the market.

Put another way, with thousands of public companies, there are better ideas. And if those I mention are in your portfolio or shopping list, make sure you are fully aware of what might trip things up.

Going forward, I intend to publish the Red Flag Alert when I have ideas I believe are worthy of publishing, rather than publishing for the sake of publishing... sometimes one idea, sometime more. Sometimes once a week. Sometimes once a month.

This time, just one... Penumbra, a medical devices maker focusing on catheters to remove blood clots and treat stroke victims.

Somebody mentioned this to me the other day, in passing, and my first reaction was that this had been a big activist short name a few years ago... and the stock got clobbered. There were safety concerns, and the company wound up recalling one of its products. I hadn’t peeked at it since.

Imagine my surprise when I took a look and saw that the stock – after ultimately having lost half its value has regained all of those losses, and then some... nearly tripling from its lows of less than a year ago.

Imagine my further surprise when I took a look at KCR’s list of what it regards as possible large cap earnings manipulators for May, and among the two dozen: Penumbra.

Keep in mind, the KCR list uses KCR’s quantitative algorithms, and the list I’m pulling from highlights names that score toward the very bottom of its rankings.

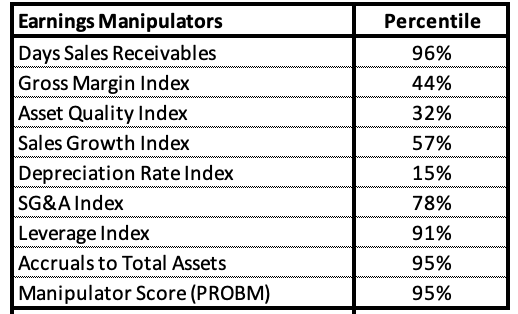

I confirmed the KCR data by running Penumbra through my KCR-driven QUANT-X System, where it scored nearly off the charts on several known earnings manipulators, with a so-called M-Score of 95% out of 100%. (The higher, the worse.)

Again, this is a single month but its M-Score has been ticking into the danger zone in January and has consistently been getting worse… as its net income has been getting better.

Digging just a little deeper, I was struck by four things....

The first is competition...

The company has plenty – from the major device makers, as well as upstarts. The number, especially from newcomers, is increasing, which is something to pay attention to if earnings quality gets stretched. (For its part, management says more competition results in a “more disjointed” market, which “makes it easier, not harder.”)

My comment: I know what he’s trying to say, but in general more competition is not a positive. And when it comes to the vein-clot part of the business – currently the biggest part of the business – as one insider told me...

Tools that don't need capital equipment are typically good winners. There's plenty of room and players in the market. I don't see a finish line, just a big field with lots of activity!

The second is growth of the broader market...

Asked on the most recent earnings call if the market is growing, CEO Adam Elsesser said...

It’s hard to quantify really market growth across the board versus share right now. It’s easier to define share. So we’re optimistic. Let’s wait a few quarters to see.

My comment: In my opinion, “Wait a few quarters” is not generally the correct answer to that question unless the current answer doesn’t fit a desired narrative. I would think every CEO of every company knows the state of their market and where and how they fit.

The third is the amount the company is spending on research & development...

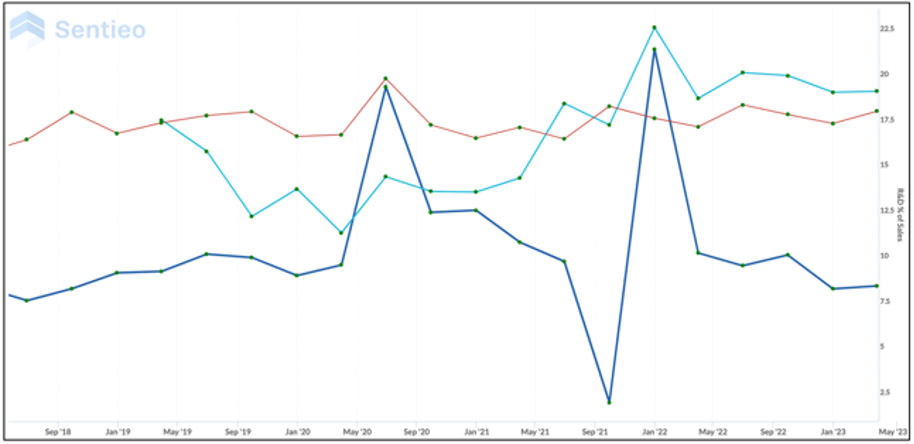

At Penumbra, R&D spending as a percent of revenue hasn’t just been erratic, but over the past year it has been falling. The real story is in the chart below...

Penumbra, the blue line, at last count was around 8.28%. By contrast, its closest competitor, Inari (NARI), is closer to 19%. That’s an enormous spread. By contrast, Edwards Lifesciences, which is a pure play on heart valves – consistently spends a steady 17% to 18%, as it has for years.

My comment: I don’t like to see R&D as a percent of sales falling, especially if competition is rising... and especially if its direct competitor is spending roughly double. It smacks of a company that is pulling levers for the sake of making margins and earnings look better. I’m not saying that’s what Penumbra is doing; I’m saying it’s an obvious tool management of any company has to use as a way to manage earnings.

The fourth is patents. Penumbra says it has 16 patents that expire by 2025 and 2026, with 13 related to the company’s two top products. What’s more one of those patents covers 19 separate products.

My comment: I hate discussing anything related to patents because there are so many nuances amid the complexities. And to be fair, Penumbra has plenty more patents where those others came from that expire years from now. But the expirations are laid out in their SEC filings, the number tied to a single patent is right here, on their website. The question investors might want to ask is whether any of the impacted products are significant enough that the company would be vulnerable if generic med tech companies filed applications to manufacturer the same products... in theory, then, pressuring sales and margins. Or, have they been replaced by newer, better products?

Based on the above... Avoid.

P.S.: If you have a different opinion, you know where to find me.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg