Red Flag Alert – Don’t Get Sucked In...

Just because iRobot plunged, doesn't mean it's a bargain

It’s easy to get sucked in by a stock that has fallen by half, especially if it makes a well-known consumer product...

We’ve seen this before, as individual investors flock to the bludgeoned stocks of companies they know and maybe even use, like George Foreman Enterprises, Tupperware or maybe the best example ever, Bed Bath & Beyond.

As appealing as each one might have been to loyal and enthusiastic customers, they all flamed out… as businesses and stocks.

As investors in those companies learned the hard way, there’s the brand... and then there’s the business.

Great Story, Not-So-Great Business

Which bring us to iRobot ($IRBT), whose Roomba robotic vacuum created an innovative new niche in housewares.

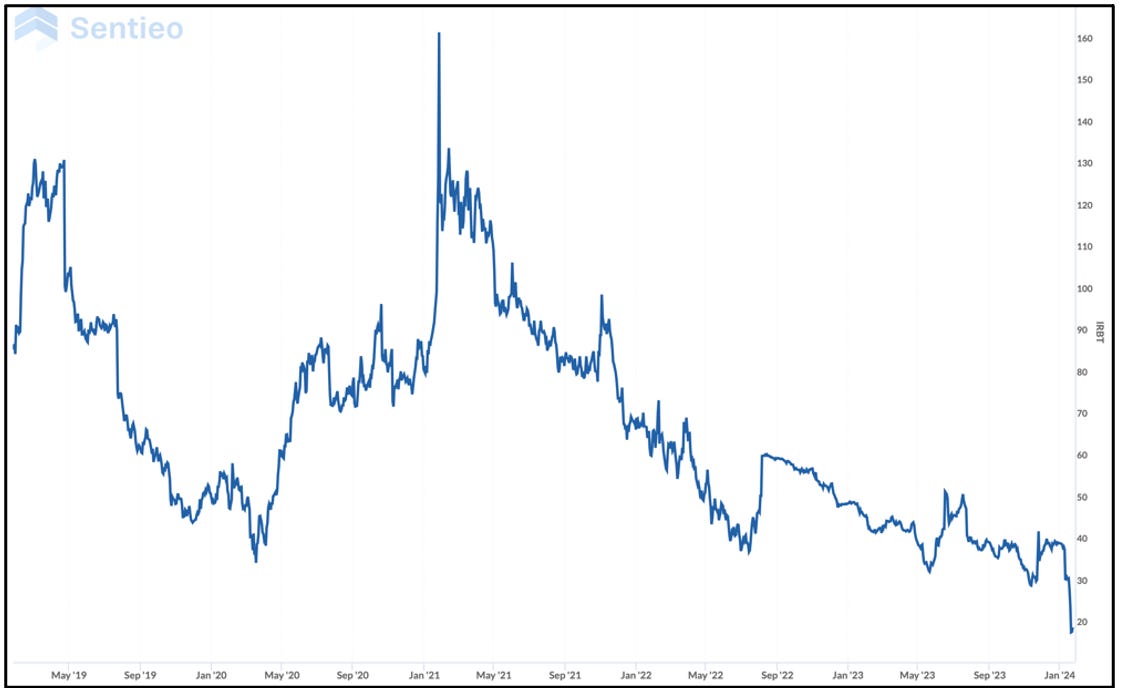

It has been great story, and everybody knows the brand. But its stock has been a tug-of-war between the bulls and bears almost from the start – with both sides claiming victories along the way...

That’s because as a business, iRobot has been a struggle, especially recently, with the company losing money every quarter for the past two years.

Then, in August 2022, it was tossed a lifesaver by Amazon, which agreed to buy it for $1.4 billion.

The deal couldn’t have been announced a moment too soon...

As promising as it may have looked, with Amazon gaining access to its existing database for mapping the homes of consumers while getting iRobot out of its financial jam, it immediately ran into trouble.

Not only were privacy advocates up in arms, but more troublesome, the deal was getting snagged by longer-than-expected U.S. and antitrust reviews.

Trouble Staying Afloat

To show just how badly iRobot was really doing, as the process dragged on, just to stay in business it took on $200 million in debt last fall to fund continuing operations. In other words, it needed the money to stay afloat. This is a company that previously had little to no debt. As a result, Amazon lowered the price it planned to pay by $300 million.

Then came last week’s news, from various news sources: Amazon was told that European antitrust regulators planned to block the deal... and that the Federal Trade Commission in the U.S. wasn’t far behind.

That news pummeled iRobot’s shares, but there was another not-so-nuanced twist...

Apparently, based on various reports, Amazon said it will not offer concessions to get the deal done. That’s another way of saying, it would appear, that after having time to think it through – it no longer wants iRobot.

If so, there may be a reason...

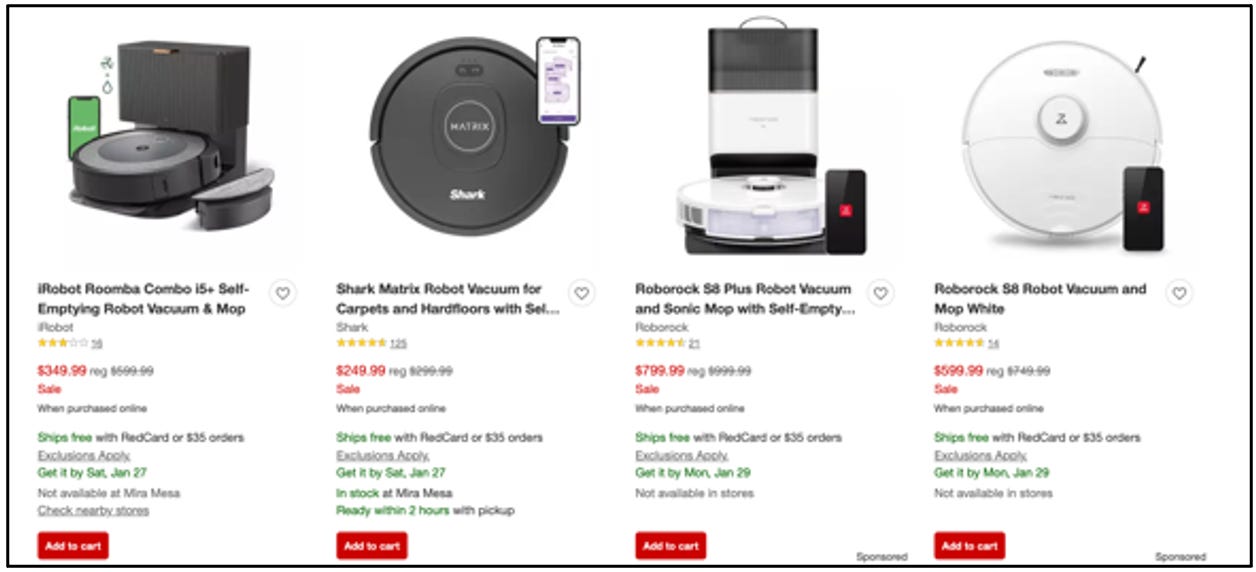

While iRobot may be the original robotic vacuum, competition is heating up... and seemingly cleaning up. Notably, Shark Ninja claims to now have the leading market share in robotic vacuums. (The two companies are currently involved in a patent dispute.)

Discounts Galore

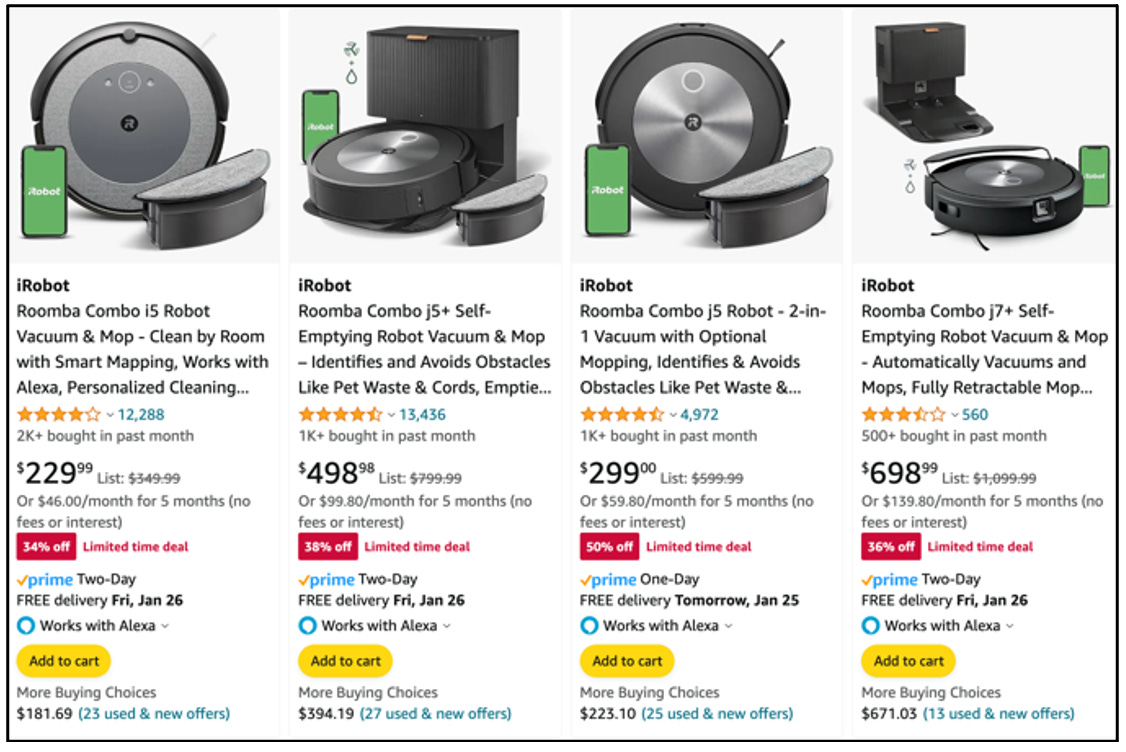

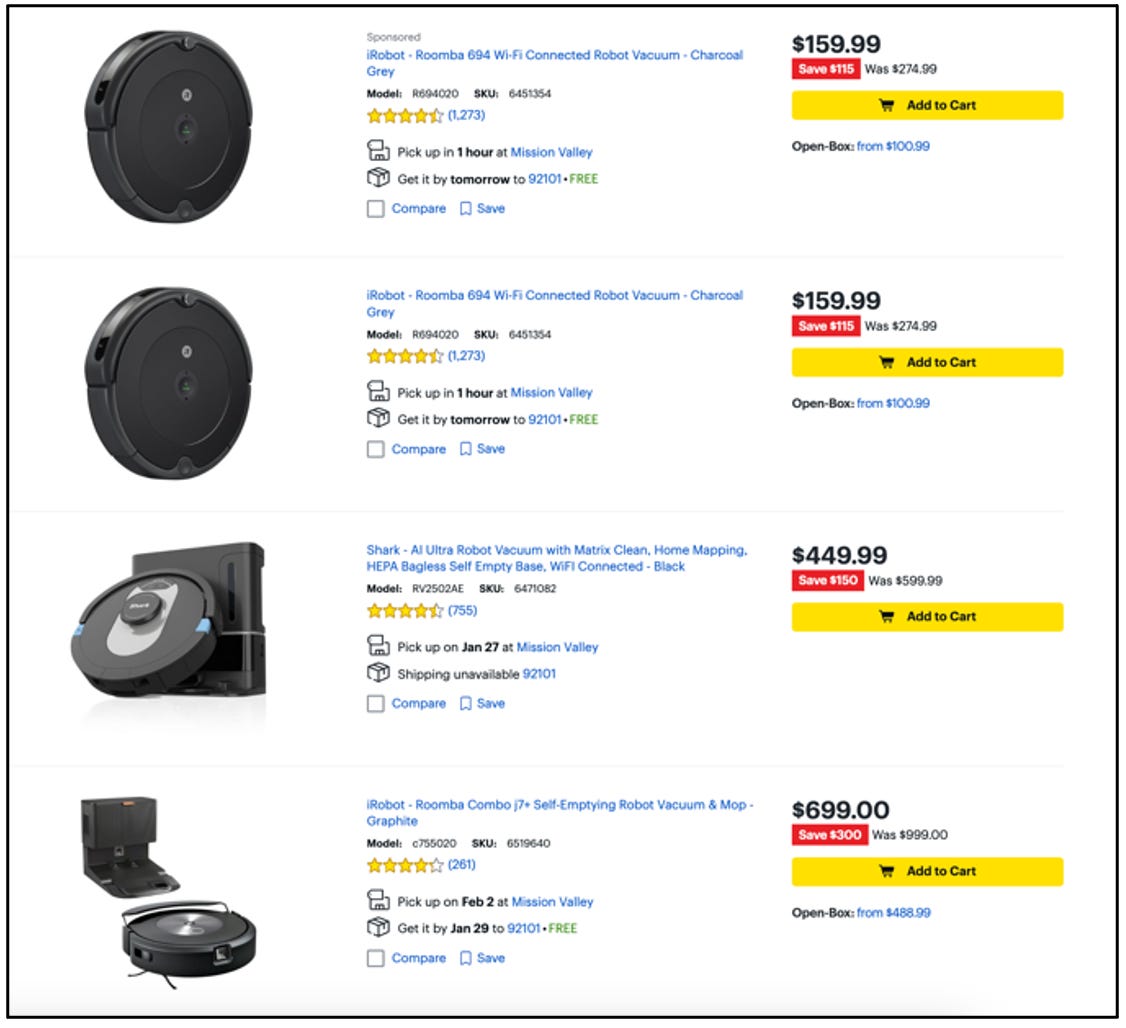

Regardless, the market for robotic vacuums is so competitive, and awash in so much inventory, that discounting across all brands is rampant.

Here’s a snippet I snagged today from Amazon...

And BestBuy...

And Target…

There are even stories, such as this one in People, touting how cheap some Roombas have become...

It’s no surprise, then, that iRobot continues to burn cash. There’s something else...

About that Breakup Fee

If the deal doesn’t go through, iRobot would get a breakup fee of from Amazon of $94 million. However, according to terms of its credit agreement, up to $35 million will “immediately” go straight lenders, with another 40 either used to repay the loan “or set aside to be used for future repayments...”

That means without a deal, iRobot is likely to continue to struggle.

The wild card here, of course, is that eventually somebody buys the company.

The real question, though, is this: Without a deal is iRobot a good investment?

The concept of the Red Flag Alert is to signal stocks to avoid, and as one friend who used to be a merger arb puts it...

Lots of ways to make money. Why be an Idiot Robot and buy the dip. Unless you shoot craps

Dice, anyone?

If you liked this, please don’t hesitate clicking the heart below and feel free to share with your friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

This should be added as another “short” story to the original Asimov book of short stories.

I bought my young grandson a small toy motorized car about the same time of the Rumba debut. The car also changed direction at an obstacle. At the time I chuckled at similar " robotic technology" with a much different price point.