Red Flag Alert – Drilling Deeper into Piping

Why Otter Tail is highly likely to get clipped

I can’t stop thinking about the piping story I wrote the other day and wondering… who’s next?

To get you up to speed…

A week ago, I wrote about a short-seller’s allegations of price-fixing among manufacturers of PVC pipe used in residential, commercial and municipal construction.

There were four names on the list. So far only one, Atkore ATKR 0.00%↑, which makes electrical pipes, has had a comeuppance. And that’s because of disappointing guidance, not anything doing with the allegations.

The other three have barely budged.

Of those, one stands out among the rest as the one most worthy to wind up on my Red Flag Alerts list... and as a result, I’m adding it today.

A Utility at Heart

With its roots as an electric utility in the Upper Midwest, Otter Tail OTTR 0.00%↑ has diversified into metal and plastics fabricating as well as PVC piping that is sold to municipalities for water, waste water and storm drains.

Otter Tail is the fourth-largest manufacturer of pipes for municipalities, and as mundane as that may seem, that part of the company has single-handedly driven a near-tripling of the company’s stock over the past four years.

As I wrote in my last report...

In that segment, operating margins more than quadrupled to an insanely high 61% from 14% from 2018 to 2023... on a product price increase of (wait for it!) 198%.

Let that sink in... 61% for a commodity product that historically has been around 14%. That isn’t just insane, but seemingly unsustainable.

All of the run-up was driven by supply/demand imbalances from back-to-back-to back impacts from the pandemic coupled with resin supply shortages caused by several hurricanes and the now infamous Texas deep freeze.

Insane Margins

They’re all long gone, but you wouldn’t know it from the numbers...

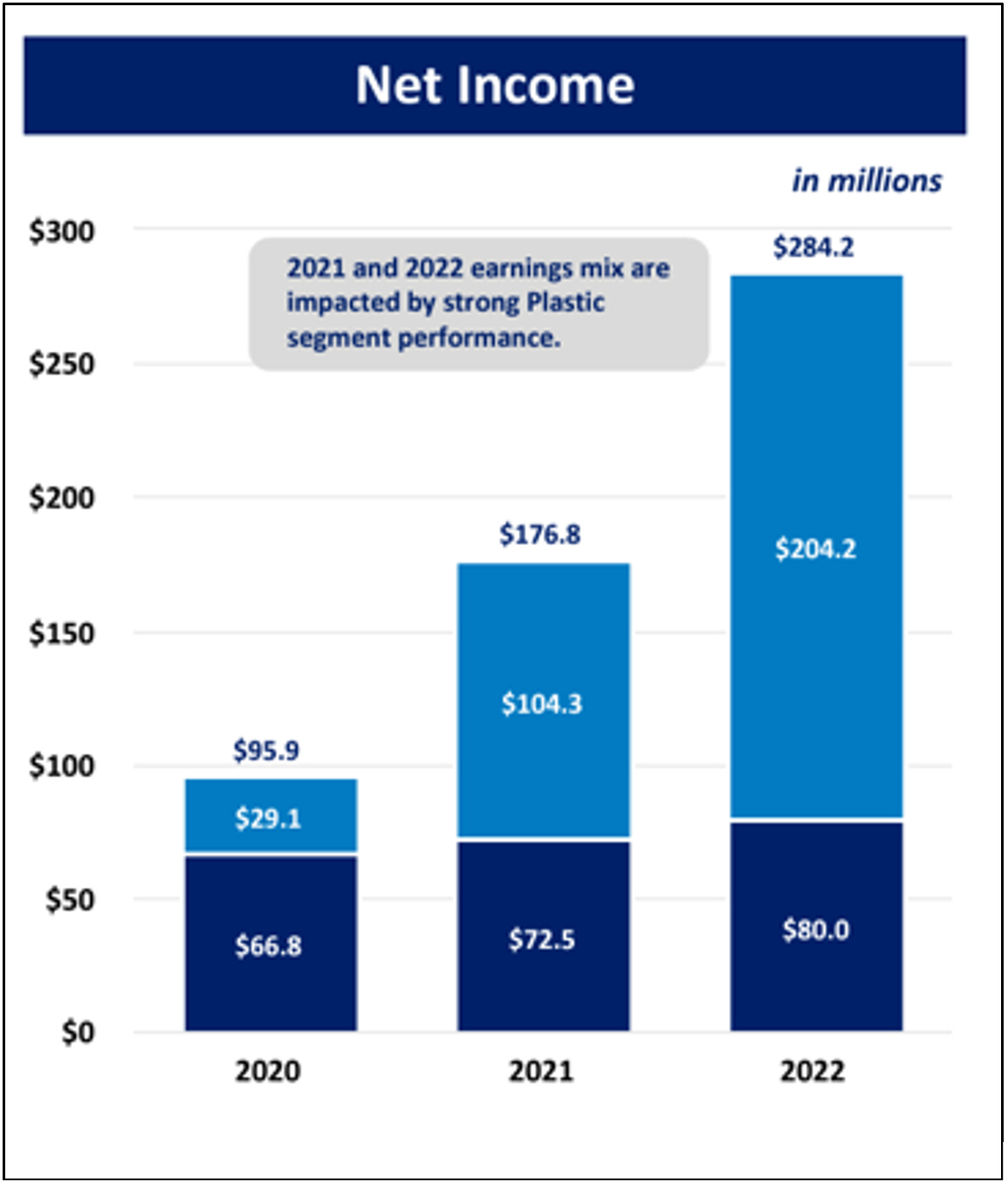

With margins what they are, piping was nearly 70% of Otter Tail’s earnings at their peak in 2022 versus sales at 34%. Compare that with 2019, when earnings and sales were a mere 24% and 20%, respectively.

The company does an exceptional job laying all of this out in its quarterly results... down to diluted earnings per share of each segment. This slide from the 2022 earnings presentation shows the distortion most clearly...

Since then, piping earnings have started to slide as a percentage of the whole at 64% of earnings and 31% of sales.

Connecting the Dots

Don’t be surprised if the slide accelerates. All you have to do is connect the the dots of what Otter Tail itself has been saying…