High Risk in Rare Earths.

Red-flagging MP Materials. Don’t be fooled by the ‘make American rare earths great again' story.

As if the noise surrounding rare earths could get any more deafening…

It has reached the silly bordering on irrational stage at MP Materials, which operates California’s Mountain Pass mine – the only active rare earth mine in the U.S.

It has been chatted up to me as an idea – long and short – since the day of its post-bankruptcy re-emergence as a public company, via the SPAC route, a bit over four years ago.

At the time, I figured I had better things to do than dive into the physics and geology of rare earth elements...

After All…

Unless you’re an expert in metals, minerals and mining, it’s easy to trip over nuances... assuming your eyes haven’t glazed over first.

The last time I had been involved with anything remotely related to this company dates back more than 10 years to its pre-bankruptcy era, when it was known as Molycorp.

I was senior stocks commentator at CNBC and chief red-flag flyer at the time – and was part of an interview with the company’s then-CEO. There was no shortage of controversy swirling around Molycorp, sparked mostly by short-sellers who questioned the company’s viability.

While I don’t recall the details, what I do remember was the way the CEO glared at me as he avoided answering a question I had held until the end. (Let’s just say there was no small talk after we left the set.)

That Was Then…

One thing that hasn’t changed is that in this version of being a public company, which started in late 2020, MP has once again become popular on the short circuit.

The reasons are many, including the simple fact that MP, especially right now, is arguably the perfect story stock without the underlying fundamentals to support its valuation. Or more simply...

MP’s business model – tariffs or no tariffs – would appear to make zero economic sense.

But for me the hook to go deeper was the evolution of the story over the past two weeks as the stock spiked on the tariff news and the story that MP is the only American source of rare earths.

And while my early research suggested it was just worth putting on my Red Flag Radar as a company to watch, an announcement by the company late Thursday convinced me it was worth a full-fledged Red Flag Alert.

The Setup…

Around two weeks ago, as Trump's tariff tirade kicked into high gear, China shot back by suspending shipments of certain critical rare earths to the U.S.

Investors jumping on the headlines interpreted the news as bullish on the belief that the ban would be a boon to MP… even though MP doesn’t mine any of the banned elements, notably two required for making magnets used in EV drivetrains.

Then China imposed tariffs on U.S. goods to 84%. That only created more momentum on the MP tariff trade, as the reality of how that would impact MP was blinded by misplaced patriotism.

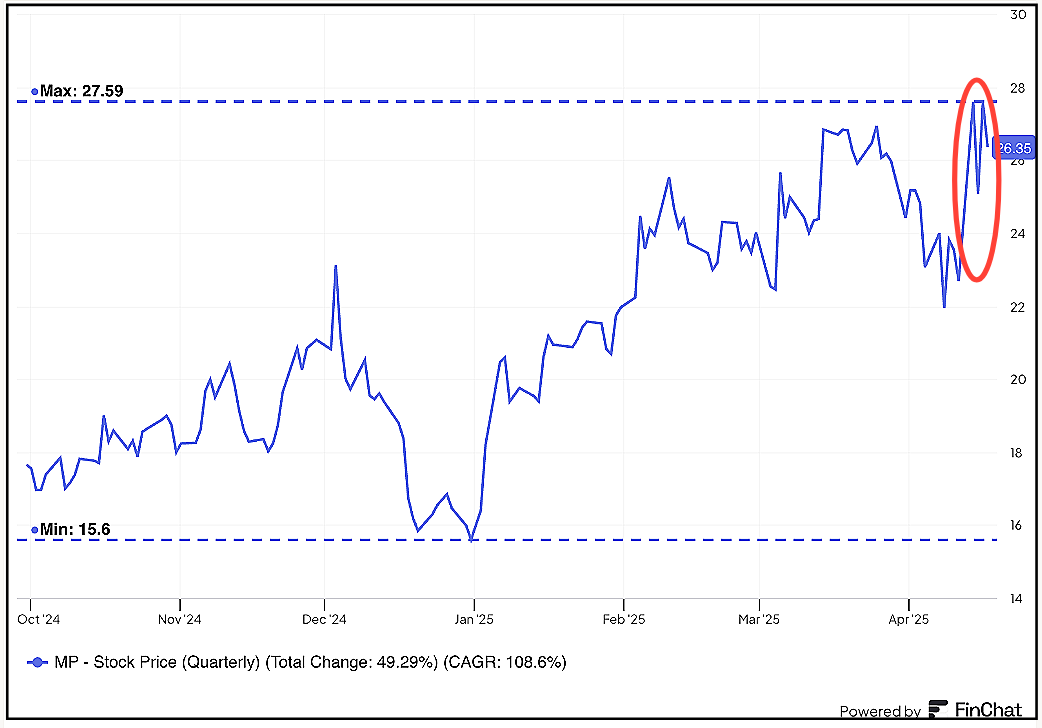

Then China raised tariffs to 125%, which pushed the stock up nearly 20% to a new 52-week high, before doing a complete round-trip today.

Once again – this was all based on the perception that this was not just good news, but great news for MP.

The reality, despite claims by company management to the contrary: It would appear to be just the opposite.