Red Flag Alert – One Hand Washing the Other

Related parties gone wild at VinFast

“How is this stuff still happening?”

That’s the question a friend who trades his own account asked when I sent him this morning’s press release from VinFast Auto, the Vietnamese electric vehicle (“EV”) maker, saying that it’s buying 99.8% of VinES Energy Solutions.

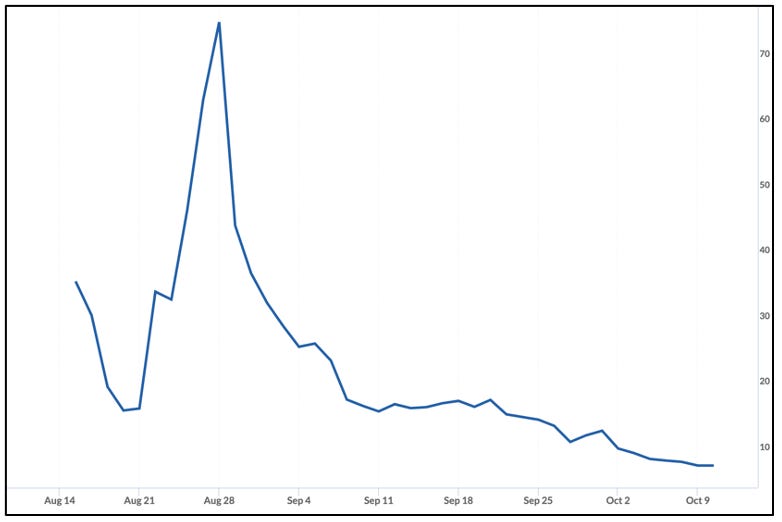

VinFast hit the headlines in August (including here) after it went public via a special purpose acquisition company (“SPAC”) on the Nasdaq, jumping 68% to nearly $70 on its first day of trading. That gave VinFast a market value greater than either Ford (F) or General Motors (GM)... even though it’s making zero money and barely selling any cars.

Within days it crashed and now trades below its so-called “de-SPAC” price of $10... but it still has a market value of $18 billion... not quite as much as Ford or GM, but still absurdly egregious.

Enter this deal with VinES, which makes lithium batteries...

The stated reason is VinES will help “transition VinFast into a fully integrated” EV maker.

Fair enough, but there’s something else much more compelling...

This deal is a glaring example of related parties gone wild.

You see, even after going public VinFast has remained a “member company” of Vingroup, which is publicly traded in Vietnam and claims to be Vietnam’s largest conglomerate.

Under the current structure, Vingroup owns 50.8% of VinFast’s shares. Pham Nhat Vuong, Vingroup’s chairman, is also VinFast’s chairman.

Through two other entities that own another 45.8% of VinFast, Vuong controls 99.6% of the company.

If that’s not confusing enough, here’s the fun part...

As part of this deal, VinFast is actually acquiring VinES not from Vingroup, but from Vuong.

At least that’s my interpretation after reading the press release, which said…

VinFast will acquire VinES from its Chairman, Mr. Pham Nhat Vuong, for no consideration other than assuming borrowings of approximately VND11,122 billion ($462 million) which VinES has outstanding to finance the construction of its manufacturing facilities and its operations. To support the ramp up for VinES until its operations stabilize, Mr. Pham will agree to provide grants to VinFast for all interest payments relating to these existing VinES borrowings up to 2027.

The good news, from a governance perspective… it’s not paying Vuong a dime.

But instead of paying money outright, VinFast is assuming $462 million in debt from VinES.

That’s right, based on what the company has disclosed, Vingroup is, in effect, unloading $462 million in debt... to a related party.

Not that this should be surprising. This is a company whose IPO prospectus includes 12 pages of related party disclosures.

And if you’re wondering – that’s a lot... and not just a lot of pages, but a lot of one hand washing the other.

Oh, and by the way – yes, it’s all disclosed, which is a good thing. But just because something is disclosed doesn’t mean anything more than... it’s disclosed.

Lots of murky water here. Good luck figuring out who’s on first.

P.S.: As with any controlled company that has a razor thin public float, this stock can move up as fast as it can move down, on a mere wisp of a breeze… like today’s news, which caused the stock to jump by 8%.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

Wild Cowboy investing will never go away. Too many players with unbridled greed and no conscience in ripping off anybody and everybody. Be vigilant above all.