Red Flag Alert - The Sad Saga of Leslie's

Also, Red Flag Alert continues to prove its worth

***Note: It has been a full year since I started publishing On the Street on Substack. During that time, I’ve provided my content for free, experimenting with various approaches and features to see what works. I’ve been thrilled with the organic growth of my subscriber base. I’ve always said I don’t want to publish for the sake of publishing, but for the sake of what I enjoy writing and sharing. With both On the Street and Red Flag Alerts, by doing just that I’ve clearly added value to investors at the incredible price of FREE while walking the fine line of trying to stay this side of becoming noise. Red Flag Alerts started on a whim and has now become a cornerstone of On the Street. As On the Street evolves to the next phase, Red Flag Alerts (and more!) will soon be going behind a paywall. Stay tuned!***

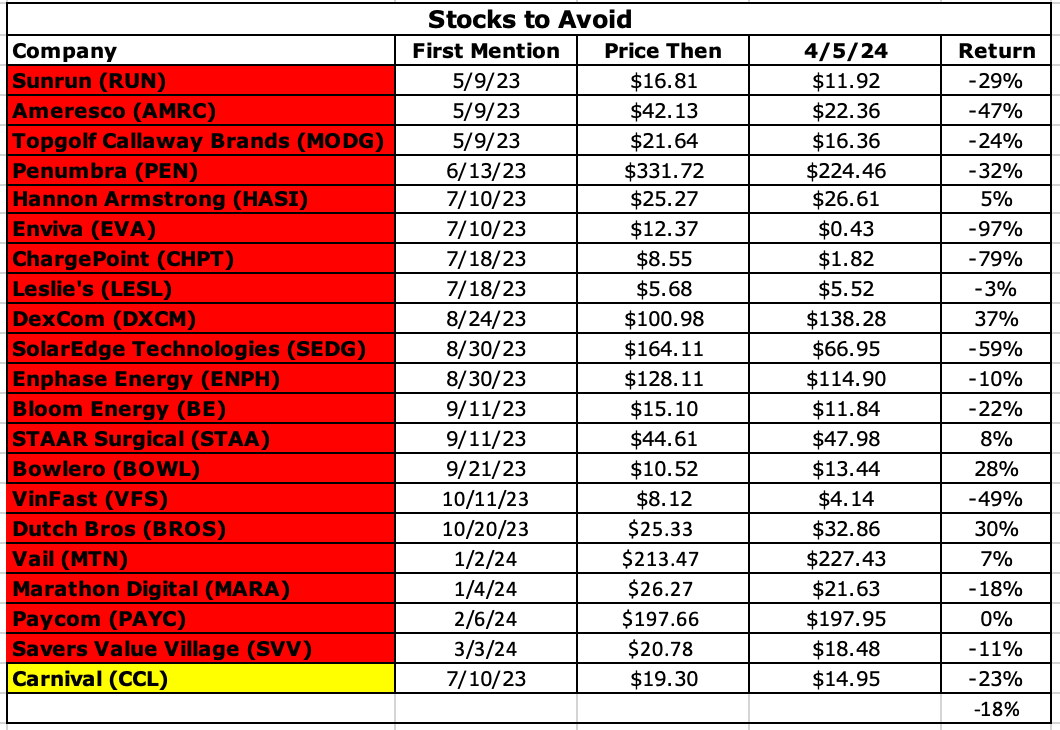

One day I’ll regret keeping score, but for now the Red Flag Alerts has proven itself as a source of spotting underperforming stocks to avoid…

There are exceptions, of course - and a few that at some point need to be revisited and likely removed. But the average return of the 21 companies on the list as of a few minutes before I hit “publish” is a negative 18%.

Dexcom DXCM 0.00%↑ and Dutch Bros BROS 0.00%↑ are the biggest gainers and may very well come off the list. (Bowlero BOWL 0.00%↑ also is up considerably, but it’s staying put!)

Then there’s Leslie’s LESL 0.00%↑, which I switched from red flag to yellow last month, after it had spiked more than 40% at its peak since being added. This was my original report on why it deserved a red flag.

The Case For Leslie’s

After reassessing the company, in a report headlined, “Is this Short Now a Long?,” I wrote…

For all its flaws, including excessive debt, the possibility of an activist showing up – or the board wising up – suggests the upside potential outweighs the downside risk.

On top of that, comparable should get easier.

There clearly are better companies to own, and surely risks remain, but given the revised thesis, at this point a yellow flag seems more prudent.

My, what a difference a month makes…

The Case Against Leslie’s

Whatever argument I may have made about potential upside of Leslie’s went out the window with last week’s announcement that Home Depot ($HD)agreed to acquire SRS Distribution, which owns (among other things) Heritage Pool Supply.

With Heritage (assuming the deal passes FTC muster), Home Depot will be able to draw more do-it-yourself pool customers – the core of Leslie’s market.

The acquisition could also open the door for equipment suppliers like Pentair ($PNR), Hayward ($HAYW)and Fluidra to sell directly to mass retailers instead of traditional distribution channels. That, in turn, would more than likely impact Leslie’s specialty chemicals business – its bread-and-butter – since Home Depot will now have more access to pool chemicals.

And Then… There’s Pool Corp

With the industry suddenly in flux, that also raises a question for Pool Corp POOL 0.00%↑), which has proven a solid brand and executor.

Pool recently announced the introduction of a full suite of software products designed for regional builders, service providers, and retailers. This offering includes point-of-sale systems and service platforms aimed at making it easier and more efficient for Pros to operate, which in turn could drive dollars to Pool.

What’s more, pros that previously worked with Heritage now may be less inclined to continue that relationship since Pool will then effectively becomes a competitor.

Needless to say, with so many moving parts at such a high level, the one likely loser will be Leslie.

Bottom Line

This doesn’t mean a buyer or activist still won’t come along, but the stock is telling a different story, suggesting that if they do it will not be at a higher price… which is why Leslie’s is back on the Red Flag list.

If you like this please feel free to click the heart and, as always, feel free to share this with friends, family and neighbors.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

Thanks for the research. Nice segment on Last Call. I enjoy reading your articles. Not easy being an umpire calling those balls and strikes. I saw some umpire hater comments directed toward some research of yours on X. Stay tough and show up for the next pitch.

Thanks, Jason!