Red Flag Alert – Two Former Short Activist Names to STILL Avoid. Also, a Yellow Flag and a Counter View on Penumbra.

Just because short activists come out with ideas, and the stocks fall, doesn’t mean the danger is over.

This study a few years ago by two prominent securities law professors said as much when it concluded...

Although some of our negative activists no doubt take only short-term short interests in their targets, on balance their targets continue to underperform the market long into the future, and extended short positions would continue to be profitable.

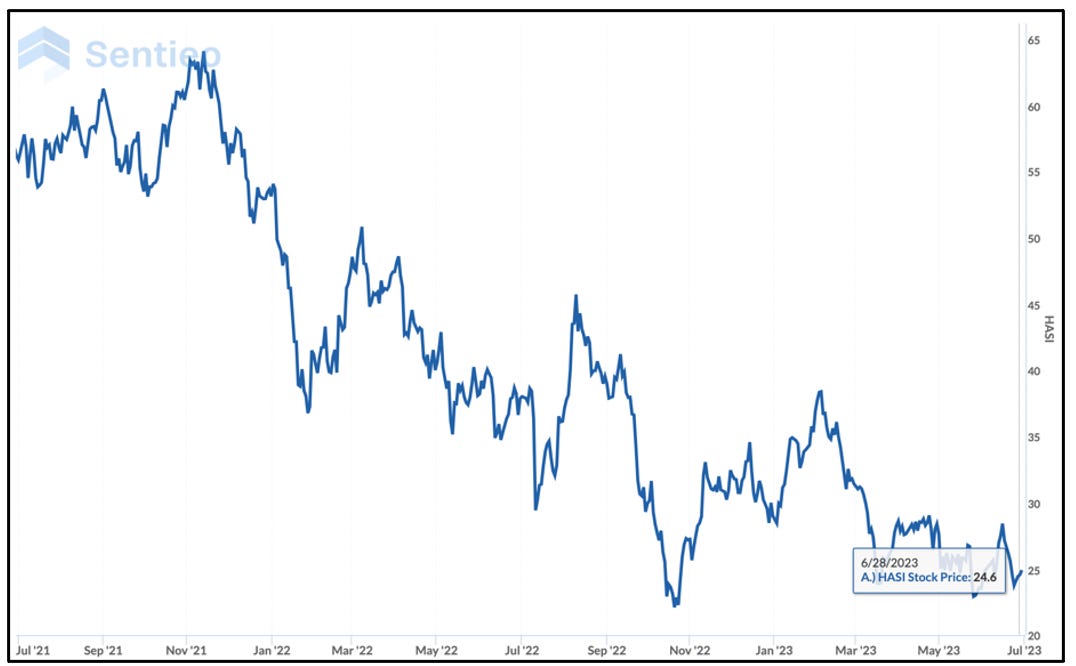

That’s something to keep in mind if either HASI (formerly known as Hannon Armstrong Sustainable Infrastructure Capital Inc.) (HASI) hits your radar as a bargain.

HASI, with a yield of more than 6%, might look irresistible to some investors as a great energy play now that its stock has plunged by roughly half from its highs last summer.

That’s after it was the focus of two activist short reports, first by Muddy Waters Research and a few weeks later – for totally different reasons – by Jehoshaphat Research. The stock initially lifted after both reports, before crashing considerably lower and then gyrating up and down until settling back where it is now... well below where it was when both reports were written.

But even here, there is a case to be made that the stock remains vulnerable. As a friend who has researched the company shared with me in this note...

HASI invests in renewable-energy and energy-efficiency projects, primarily through debt financing... hoping to achieve a higher return after costs and credit losses than it costs the company to raise the money to invest. HASI has about $4.7 billion of investments on its balance sheet. To keep growing, it continuously has to tap the equity and debt markets to fund its new investments. The company is currently structured as a REIT but is considering abandoning that structure to widen its range of potential investments.

Investors might be tempted by the company’s 6.7% dividend yield. But there’s a big red flag – the company isn’t generating enough cash from its investment earnings to cover the cost of the dividend.

Instead, it relies on cash from new investors and liquidations of existing investments to supply the rest of the cash needed to pay the quarterly dividends. Over the past six years, HASI generated only about 50% of the cash earnings needed to cover the dividend. Since 2014, the year after coming public, an average of 88% of the dividends paid to investors each year have been simply “returns of capital” rather than “ordinary income” from the company’s earnings.

Here's where it gets interesting: Shares trade at about a 50% premium to their book value, even though HASI has been exposed to the same force that has battered bank stocks in recent months – rising interest rates. Similar to banks, my friend adds, HASI is hurt by rising interest rates in two ways:

Cost of funding – While more than two-thirds of HASI’s debt has been borrowed at fixed rates, interest costs on its credit facilities and term loan increase each time the Fed raises rates. And relative to its current cost of debt, HASI will pay higher rates when it likely taps the debt markets later this year to fund its growth. Then the company will have to refinance more than $1.7 billion of unsecured and convertible notes that mature in the next three years. The largest chunk, a $1 billion, 3.38% note maturing in 2026, undoubtedly will be more expensive to refinance, especially if HASI’s unsecured debt continues to be rated below investment grade. HASI could end up paying as much or more on that debt than the 7.5% yield it currently receives on its investment portfolio. It’s tough to make that up on volume. In fairness, chances are good that if interest rates stay high, HASI’s future investments will have higher yields.

Value of existing investments – Many of HASI’s investments are essentially loans that are to be paid back at fixed rates over many years (18 years is the current weighted average). Similar to the way in which banks suffered (unrecognized) losses on safe-but-long-dated U.S. Treasury notes, the current market value of HASI’s $2 billion in “receivables” is certainly less than their stated value on the balance sheet. The same is true for a large portion of HASI’s $2.3 billion in “equity method investments” in joint ventures. The fact that these losses are unrecognized (and unquantified by HASI) means that HASI’s “true” price-to-book is some degree higher than the 1.5x you’ll see on financial sites.

For perspective, two categories of HASI’s assets are marked as “available-for-sale” securities, meaning that although the company doesn’t have to recognize market-value losses in the P&L, they are recognized on the balance sheet. These two assets (“securitization residual assets” and “investments”) started last year valued at $228 million before losing a whopping $64 million during last year’s interest-rate increases. If they had been sold at the end of the year, those losses would have had to be recognized on the income statement, more than wiping out HASI’s GAAP net income of $42 million.

His bottom line...

Though it might be tempting to invest in HASI as a way to participate in renewable energy and other climate solutions, it is better to think of HASI as a lender to (and occasionally equity investor in) companies actually doing the work. There seem to be better investment opportunities out there that capture either the “green” aspect (e.g., an energy efficiency company like Johnson Controls (JCI) or lending function (such as banks trading for less than book value).

From a quant perspective, using my QUANT-X System, which is part of my QUANT-X System newsletter at Empire Financial Research: HASI ranks near the bottom of the heap among small/midcap companies in terms of earnings and balance sheet quality. Overall, it scored 1,463 out of 1,627 companies. As a result... Avoid.

Next up, another stock that has been clobbered since first being mentioned by an activist short seller, but still looks vulnerable...

Enviva (EVA) makes wood pellets that it sells around the world as an alternative to coal to generate power and heat. On the surface, it looks like the perfect pure play on Environmental, Sustainability and Governance, better known as ESG.

Since being featured in a critical report last October by Blue Orca Capital, its stock has been crushed... down more than 80%. It lost half its value after reporting earnings a few weeks ago.

If I’ve learned anything, it’s that just because a stock has fallen by a great amount, doesn’t mean it can’t go even lower.

My only interest in mentioning Enviva now is because it keeps showing up on various high conviction lists published by the quantamental research firm Kailash Concepts, a key source of data I use. Most recently it showed up as second-to-worst in terms of overall financial quality among the Russell 1,000.

More broadly, it ranks 1,173 out of 1,191 small/mid-cap stocks. And when I run it through QUANT-X, it couldn’t score more horribly, especially on earnings and balance sheet quality, where high net debt, negative free cash flow and plunging earnings.

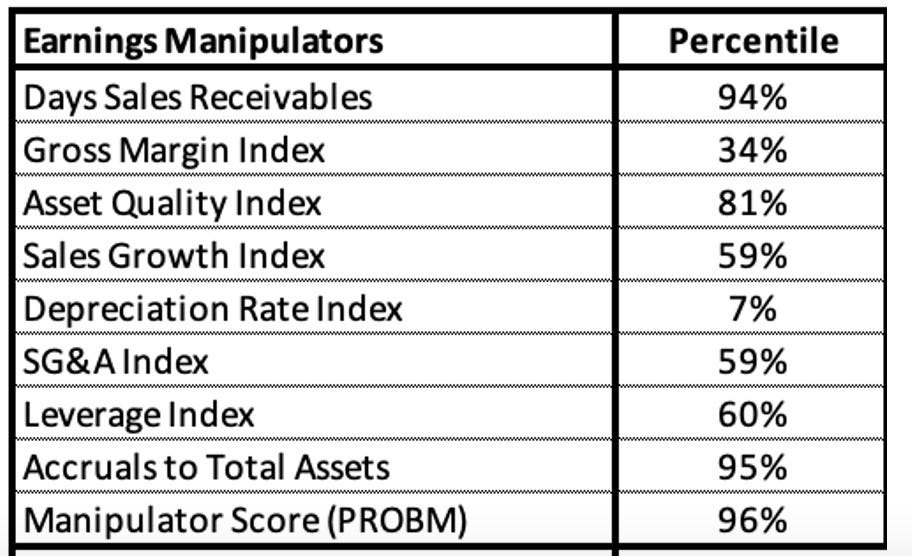

The only good news for Enviva, if you can call it that, is that after months of getting worse, its M-Score is showing slight improvement. The M-Score is designed to help weed out possible earnings manipulators. Enviva’s M-score last month fell back to 80% from 91% out of 100. The higher the score, the more likely earnings are being manipulated.

There’s something else...

Shortly after Blue Orca did its short report on the company, as this article shows management loaded up on stock....

And therein lies a big moral of this story: Not all insider buying is the same, and buying for the sake of showing “a vote of confidence” can be misleading, as it was with Enviva.

Since those purchases, the stock has lost three-fourths of its value... falling even more after bouncing higher on the news. As one friend joked...

That management team again proved it is not too savvy with finances.

To be sure, things are so bad that last month the company eliminated its dividend. As a result… Avoid.

Moving on, one yellow flag...

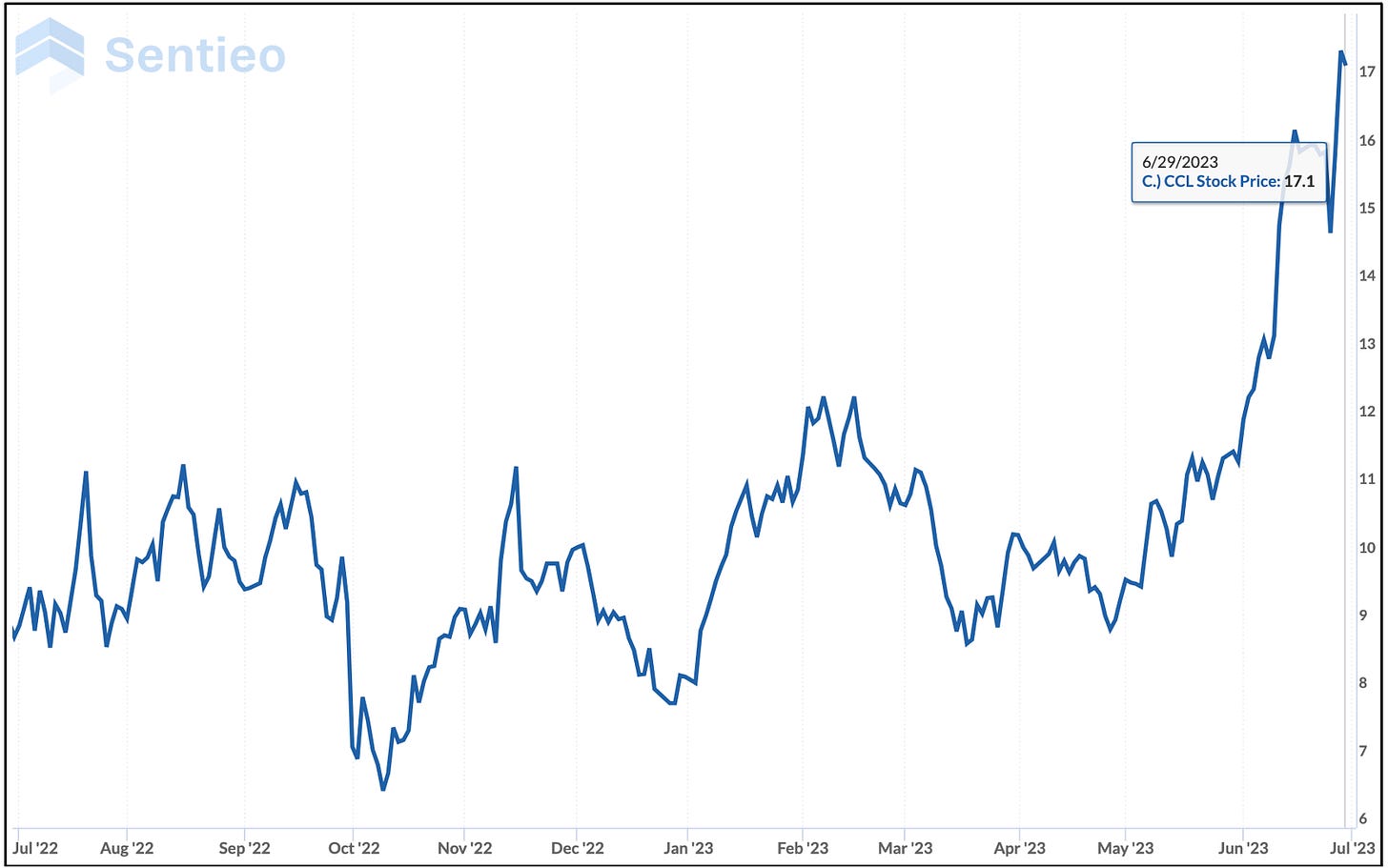

Cruise line stocks have been climbing out of their pandemic-driven pummeling, in part because of strong “bookings.” The below chart is Carnival (CCL) over the past year...

The question I have: What is the quality of those bookings?

I just returned from a cruise on the Carnival-owned Seabourn brand. Seabourn is higher end, so called “luxury,” with considerably smaller ships.

The ship we were on carries 600 passengers and was nearly full. I later learned that it included 140 deeply discounted passengers, booked by a travel agent who tends to specialize in lower-end cruises. The passengers, in fact, had to be schooled by the travel agent on how to dress and act on this kind of ship. (I was told this by somebody who was in that group.) I suspect that without the discount, most would not be on Seabourn. But let’s face it, occupied cabins are better than empty cabins, since the ship is fully staffed.

And there apparently have been quite a few empty cabins. The cruise before ours apparently was roughly half full; ditto the cruise after ours.

Those two trips were to and from Iceland; ours was up to the North Cape in Norway, which like anything related to Iceland is so popular that this time of year you would think they’d be full, without any discounts other than the normal promotions offered by cruise lines.

Important to note: In the past Carnival has said that the luxury segment is less price-sensitive than its mainstream brands.

Obviously, my observation is anecdotal. I’m not sure what to make of it, but it’s something to keep in mind if you’re investing in the sector.

Finally, a counter-view to my recent Red Flag Alert on Penumbra (PEN), whose shares have continued to move higher since I first mentioned them here on May 25th. Jonathan C. writes...

I know PEN well. I invested in it when it was private in 2004 and have held a portion of my shares to this day.

I am not going to state that this company is cheap at this multiple. But maybe I can explain some of the issues that you have raised.

The near term growth has been driven by algorithm controlled thrombectomy devices. Effectively the company has made it both faster and easier to remove a clot from anywhere in the body. The amount of training needed to operate these devices has dropped and they have greatly expanded the market because more physicians can do the procedure without as much training because the machine assists them.

The patents on older products may be expiring but it is this new set that is driving the company's future and these will not expire for over a decade. CEO Adam Elsasser historically has been conservative in his statements and his statement on the market you quote reflects that. He may not actually know how quickly the market will expand but he has said that it will. In my almost two decades of investment here generally what Adam states has more or less come true.

Finally, the company is both growing and expanding margins. They are cash flow positive and look to increase both top line and margin here. Adam has said that he thinks that they could do 400,000 cases a year. While they have never mentioned a time frame or pricing but have said "five plus years". Generally I estimate that they get $10k/case. That would be 4bn dollars. Let’s say it takes as long as 5-7 years - at seven that is 20%+ growth if five years 30%. Meanwhile they are targeting increased margins from ~63% increasing to ~70% with operating margins and FCF increasing significantly as well.

Thanks, Jonathan, for sharing. Always great to get multiple views and insights. I should note that since my last report, the M-Score rose a notch to 96%.

There are, of course, are exceptions to every rule and data point. Penumbra ultimately may prove to be among them. Or not.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg.

"If I’ve learned anything, it’s that just because a stock has fallen by a great amount, doesn’t mean it can’t go even lower."

Reminds me of one of Lynch's lines (paraphrasing): "What's a stock that's fallen 95%? One than fell 90% and then got cut in half."