Red Flag Alert – Why I'm FINALLY Adding Oklo to the Red Flag Focus List

The fact that the company is public at this stage of its evolution is itself a red flag.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

It should be no surprise that I’m adding Oklo OKLO 0.00%↑ to the Red Flag Focus List, especially after its Q4 earnings call Monday.

I first red-flagged the fledgling wannabe manufacturer of small modular nuclear reactors in October along with two other nuclear names – NuScale SMR 0.00%↑ and Nano Nuclear Energy NNE 0.00%↑. I stopped short of giving all of them a full-scale alert since the market was in the middle of a nuclear frenzy. Instead, I wrote…

Make no mistake, the valuation spikes in these companies is total nonsense… like so much we’ve seen so many times before in so many different industries. These are stocks that get their 15-minutes – okay, maybe 15 days or even 15 weeks – of stardom ,whether its flying taxis, autonomous trucks or even anything remotely related to AI.

As with all of them, there will be survivors, even thrivers…

The need for small modular reactors made by the likes of Oklo, Nano and NuScale is only going to increase as data centers, big cloud service providers and even utilities embrace them as a solution to growing energy needs.

Except, there’s no guarantee any of them will be among the winners.

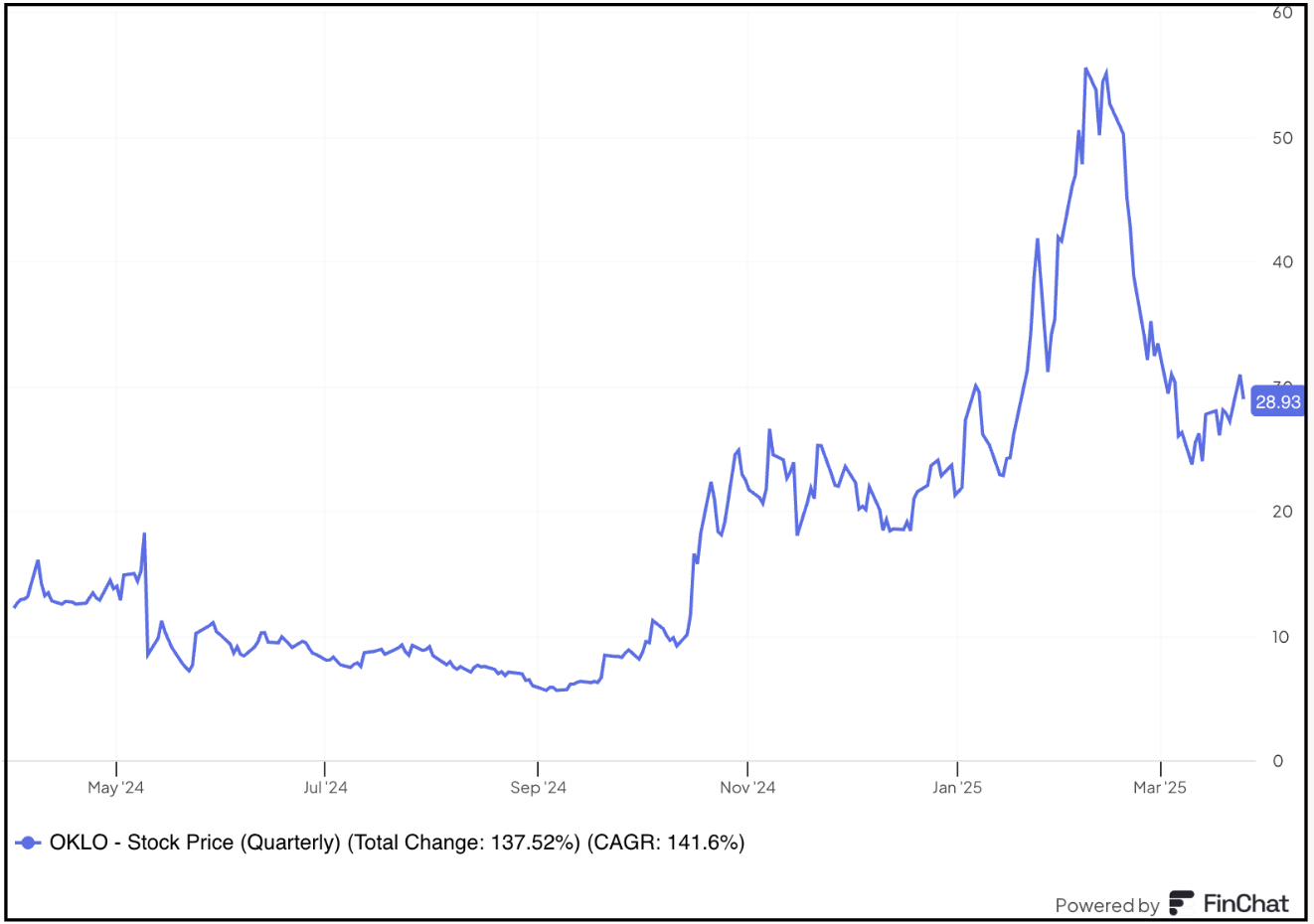

Since then, the stock almost immediately nearly tripled, leading me to write just a week ago…

As much as I believe in nuclear, these three are examples of what I called nuclear gone wild. And that’s after their stocks had already soared, on their way to outer space. Gravity has since taken hold, but OKLO remains unhinged… and is likely the one I will focus most on.

That was then. This is today (actually, as of the close yesterday)…

Oklo’s shares tumbled earlier this week after reporting Q4 results, followed by what I view as one of the silliest earnings calls I’ve heard. It was akin to a bunch of gibberish, since so much of what was being talking about – including the company’s purported “pipeline” – is hypothetical. There simply was no there, there.

Despite talk of deals, it was all in pencil, which is why management found itself trying to explain why there haven’t been any firm purchase agreements yet. The reason, of course, is because even they don’t know for sure. In the meantime…

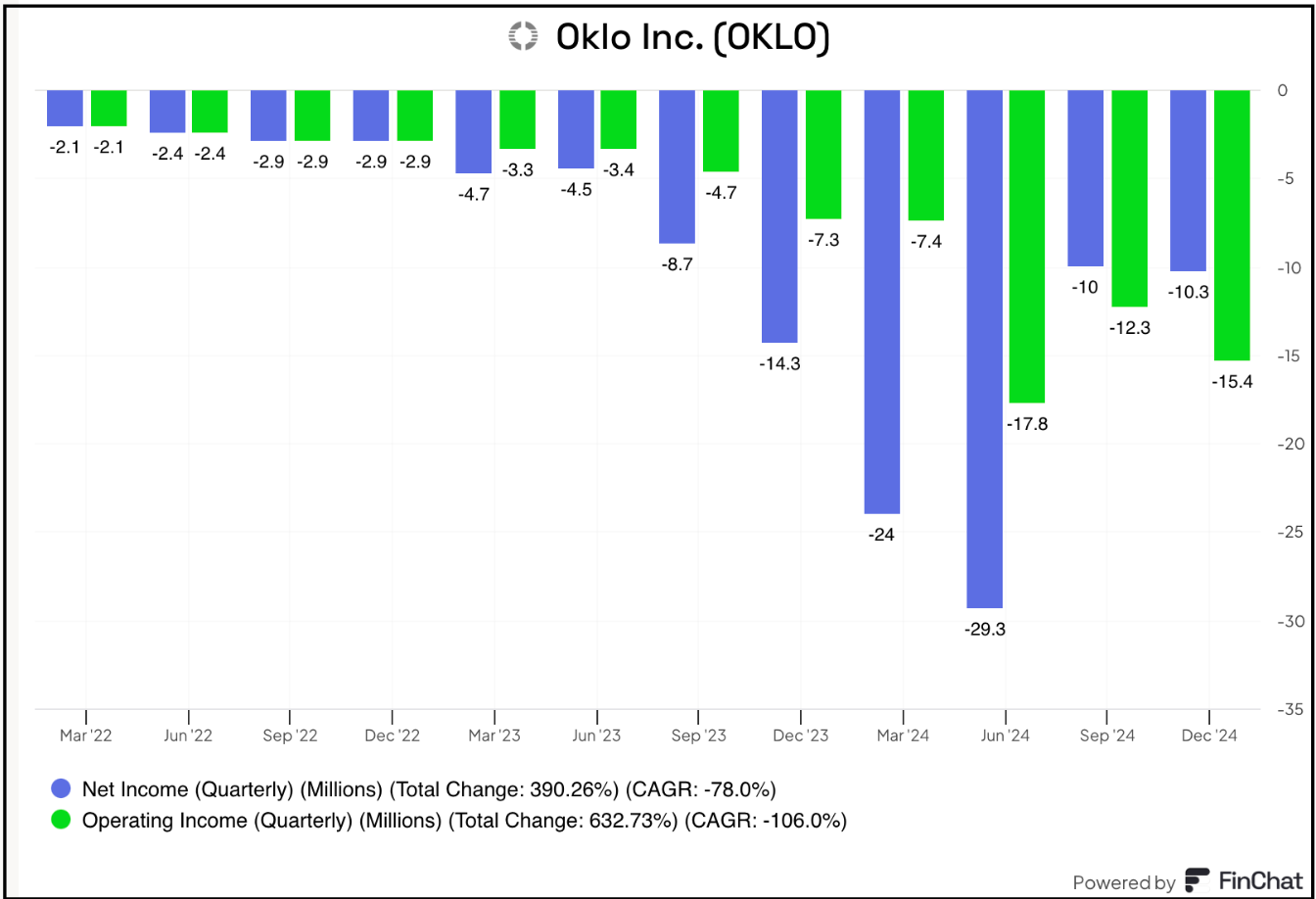

There is no revenue.

There is no cash flow (free or otherwise).

There are no earnings.

Just losses, and even they were worse than expected. The operating loss was actually worse than a year ago…

As a refresher, Oklo which was merged onto existence as a public company last May via – of all things – a SPAC. Its key selling point was and is that its chairman and co-founder is none other than ChatGPT’s Sam Altman.

As for any special insights: I have no fantastic edge here. There are plenty of others who have already flagged risks, including more than a few who are either steeped in or have dug deeply into nuclear. One of my favorites on Twitter, or X, is Adam Taub, who has a nose for sniffing out stench.

Then again, so do I. As a result, I have a few of my own observations. Among them…