Red Flag Radar - Nuclear Gone Wild

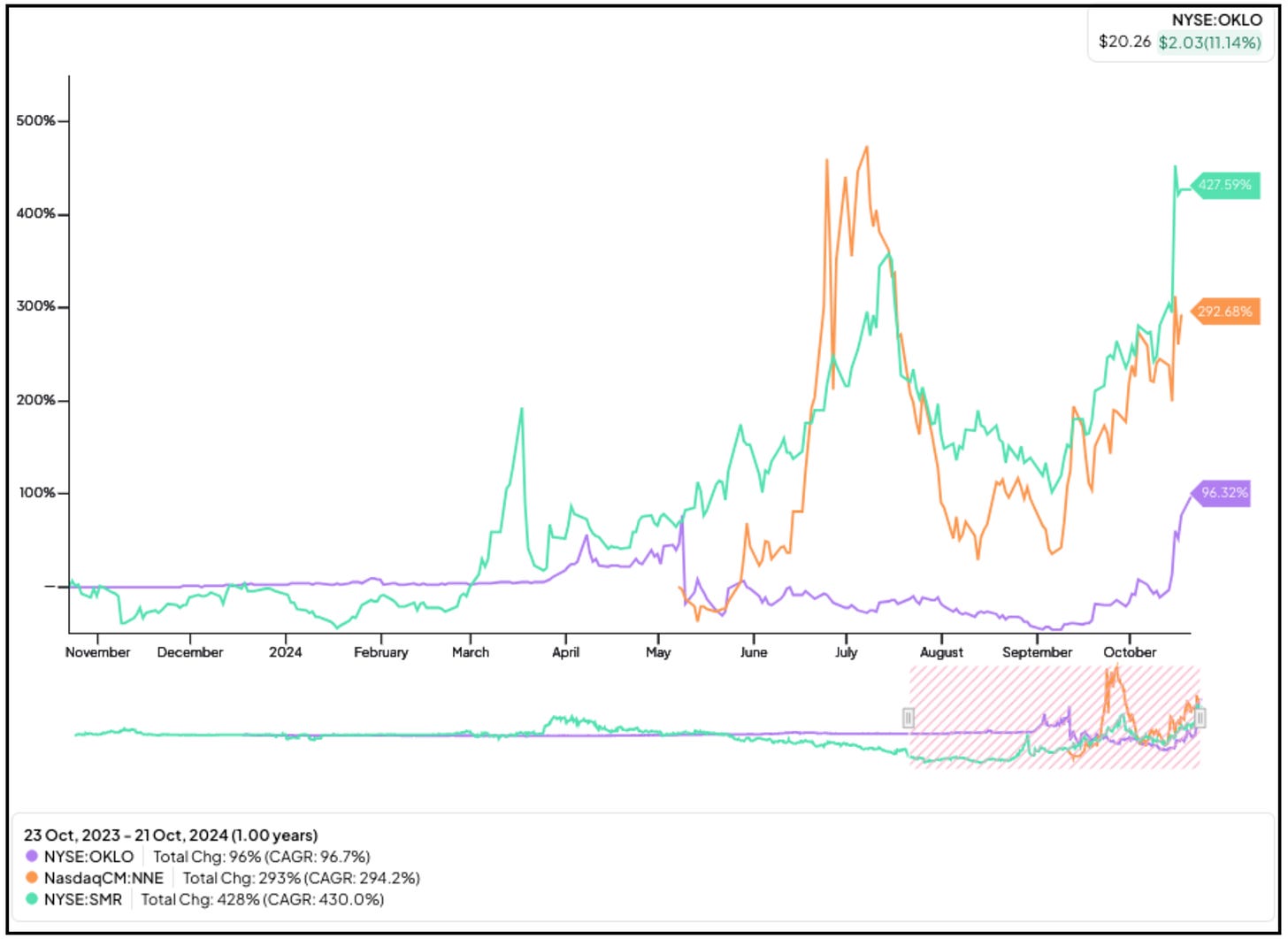

OKLO, NNE, SMR reflect yet another mania that is ultimately bound to be a bubble that will burst.

If you missed this from Sunday’s Watch List Weekly, here’s a revised version.

And this friendly reminder: My Red Flag Alerts and selected On the Street content are no longer free. But while the paint is still drying on my paywall, my introductory price remains. I will be raising prices. Here’s more on my decision to go paid, and what to expect from my Red Flag Alerts.

The sudden surge in newly public nuclear companies like Oklo OKLO 0.00%↑ , Nano Nuclear Energy NNE 0.00%↑and NuScale Power SMR 0.00%↑ reminds me of the hype surrounding every other hot bubble that has wound up bursting. Another, Centrus Energy LEU 0.00%↑ , is related but different… and is worth a separate focus.

Don’t get me wrong: the longer-term trend of nuclear is real. I own the VanEck Uranium and Nuclear ETF NLR 0.00%↑ for that very reason. (Not that I won’t sell it if it spikes ridiculously high on this nonsense.)

And make no mistake, the valuation spikes in these companies is total nonsense… like so much we’ve seen so many times before in so many different industries. These are stocks that get their 15-minutes – okay, maybe 15 days or even 15 weeks – of stardom ,whether its flying taxis, autonomous trucks or even anything remotely related to AI.

As with all of them, there will be survivors, even thrivers…

The need for small modular reactors made by the likes of Oklo, Nano and NuScale is only going to increase as data centers, big cloud service providers and even utilities embrace them as a solution to growing energy needs.

Except, there’s no guarantee any of them will be among the winners.

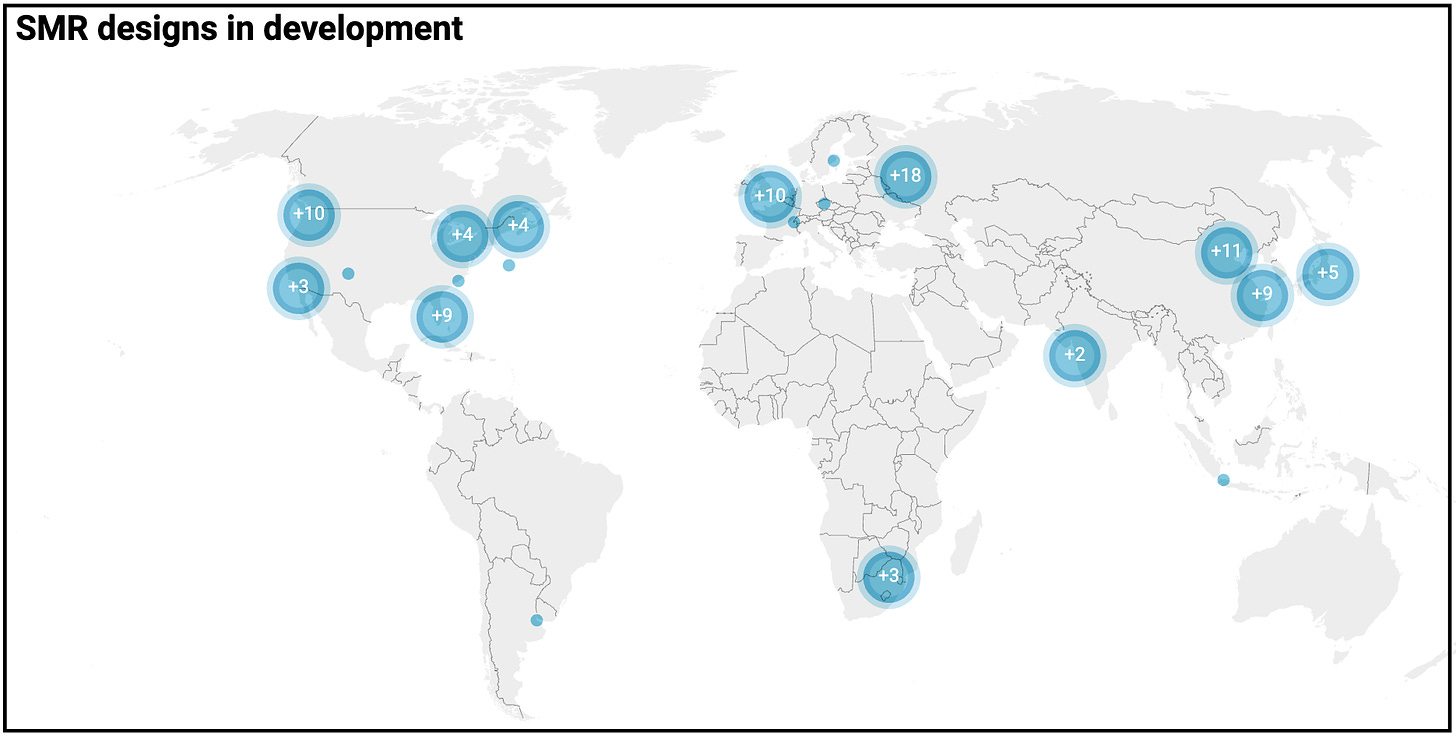

There’s simply so much competition, most of it private, and most of those companies will likely fail. And even those that succeed will only do so thanks to deep-pocketed backers who are willing to endure years of losses to, as one friend who has been researching the space says, “get the overall ball rolling.”

He goes on to say that based on his research, “I think they’ll be one of four or five that will make it. There are about 85 others right now who won’t.”

The Hype and Hope

Right now Oklo, Nano and NuScale are the only pure public plays on small modular reactors (SMR). NuScale, with the symbol “SMR,” went public via a SPAC two years ago; Nano, via an IPO, in May; ditto time-wise for Oklo, but like NuScale, via a SPAC.

All three have been swept up, almost overnight, by investor infatuation after Google GOOGL 0.00%↑Amazon AMZN 0.00%↑and Microsoft MSFT 0.00%↑ announced plans to invest billions…not into them, but into other private competitors.

But if investors have learned nothing else from mania to mania, it should be that early to the public markets doesn’t necessarily guarantee long-term success.

So far, activist shorts – Iceberg Research and Hunterbrook Media – have already been tearing Nuscale apart. And just last week my friend Anne Stevenson-Yang of J. Capital Research did a number on Nano Energy, which was also the focus of an earlier report by Hunterbrook.

That Leaves Oklo…

Oklo, meanwhile, benefits from the halo of OpenAI’s Sam Altman, who is co-founder and chairman. But beware…