Red Light, Green Light

One stock to avoid, one to own and my comment on Xitter regarding bitcoin that caused the Hostile React-O-Meter to spin outta control!

(If you’re not yet a full subscriber to Herb On the Street and my Red Flag Alerts, and wonder why you should subscribe, I explain right here.)

Hi Everybody:

If you missed it, this week I had two posts you might find interesting, not to mention the hornet’s nest I inadvertently stirred regarding bitcoin…

1. AeroVironment Gets a Red Flag Alert

The first was an update on AeroVironment, AVAV 0.00%↑, the drone maker, which I elevated from the Red Flag Radar to Red Flag Alert.

As you know, the concept of Red Flag Alert is to identify stocks to avoid. But the smartest investors I know read everything – not necessarily because the specific stock interests them, but because it triggers other ideas. I’ve heard that my entire career, especially from former hedge fund subscribers to my institutional short-biased research. Reality is, sometimes the best ideas aren’t the ones you’re researching or reading about, but the ones you stumble on along the way… even stumbling on a long while researching a short, or vice-versa.

Reality is, sometimes the best ideas aren’t the ones you’re researching or reading about, but the ones you stumble on along the way… even stumbling on a long while researching a short, or vice-versa.

That’s exactly what happened with subscriber Paul S., who was kind enough to write me saying…

I think on Thursday you posted about AVAV and you mentioned Red Cat RCAT 0.00%↑ in the article (also think you mentioned it as potentially sketchy).

While I was looking at RCAT, I noticed that Palladyne AI PDYN 0.00%↑ provided the software to some of their products. They had also done some offerings around where the stock price was sitting and of course the AI at the end of the company name.

I bought some as I thought maybe it would be a nice trade (i.e. AI, Drone, micro-cap, stock price was around offering price and had not already made a large move) and it went up 130% on Friday!

I'm out, of course, with my best one-day gain of the year as that is just crazy without any real news but just wanted to point out that your AVAV article ended up being a nice winner for me just because you added a bunch of info that included RCAT, which lead me to PDYN.

Mission accomplished!

2. New Long Idea – Ceragon

As negative as my report on AeroVironment might have been perceived to be, as a stock to consider avoiding, my report yesterday on micro-cap Ceragon CRNT 0.00%↑was just the opposite.

And that should serve as a reminder: While much of what I write about is stocks to avoid, from time-to-time I also thoroughly enjoy flagging “off the radar” long ideas.

If you sift through my archives, you’ll find quite a few, including…

AppLovin APP -0.39%↓, +478% since I wrote about it in February.

Bel Fuse BELFB 0.00%↑, +147% since April 2023.

Danaher DHR 0.00%↑, +15% from its first mention in October 2023 (down from +40% at its recent peak).

Triumph Financial TFIN 0.00%↑, +40% from its first mention in January and +27% from its second in October… and remains a work in progress.

With my longs, i tread extra carefully. As I wrote in “Why Subscriber to Herb on the Street”…

I practice what I preach – always thinking to myself: Is this a name my short-seller friends will be hopping on?

So far… still knocking on wood!

3. Fun with Bitcoin

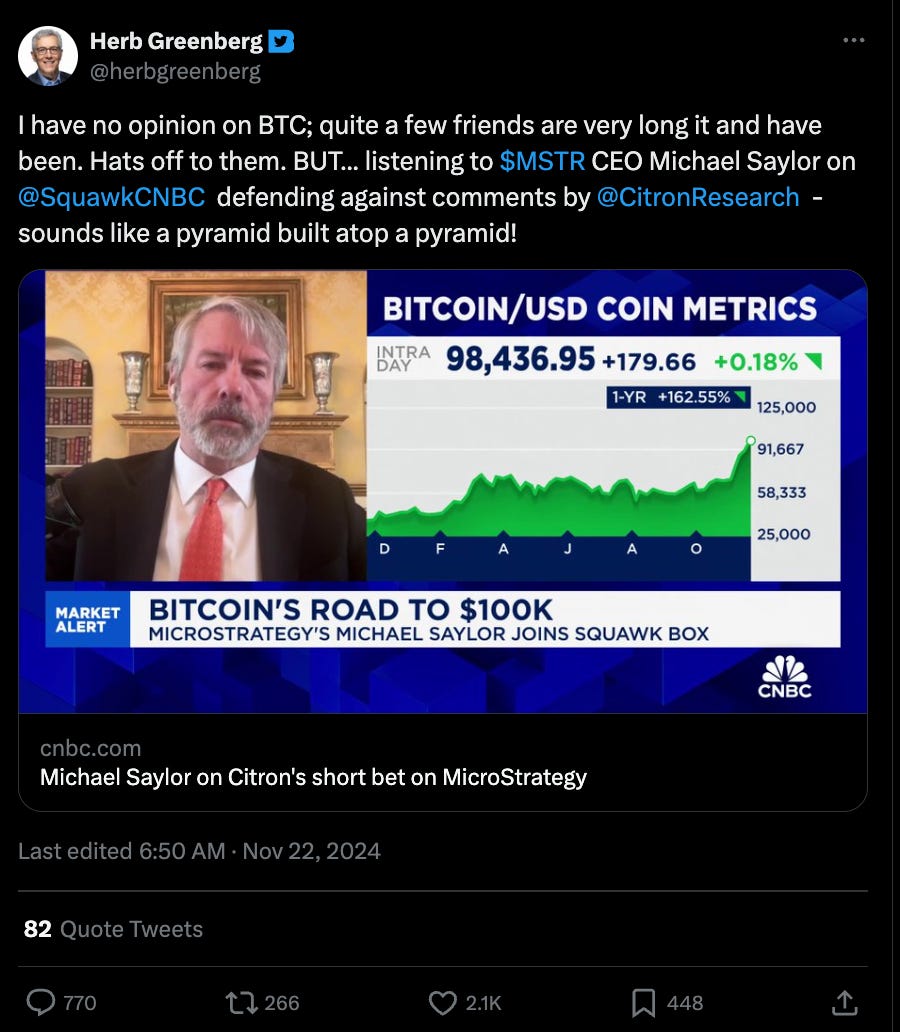

After seeing MicroStrategy CEO Michael Saylor on CNBC on Friday, I put this simple post up on X (which will always be Twitter to me)…

Within hours it took on a life of its own, causing the Hostile React-O-Meter to spin outta control – outta control, I tell ya.

By this morning the post had been seen more than 700,000 times. That’s likely the most ever for any of my posts in the 16 years I’ve been on the platform.

Here’s the thing, much as it sparked high emotion from bitcoin lovers, it also triggered plenty of agreement, which is what makes this so fascinating: Some of the smartest folks I know are long bitcoin; others having done the work – disagree with their assessment, and have avoided it.

Quite a few nasty-o-grams insisted that by saying I don’t have an opinion on bitcoin means I do have an opinion. Which is absurd, since the only opinion I have is that belt-and-suspenders guy that I am, I haven’t spent the kind of time required on it to have an opinion.

My favorite post came from my friend, J.C. Parets, who runs All Star Charts and Stock Market TV. In response to all of the posts, he wrote…

I responded…

Period.

4. Speaking of Xitter…

Like so many others, I’ve become far more engaged with Bluesky as an X/Twitter alternative. As many others have said, it has the look, feel and vibe of Twitter in its early days. I currently actively post there as well as here on Substack’s Notes.

5. Finally, It’s That Time of Year Again…

Barring something that simply can’t wait, I’m taking this week off with a house full of family here for the holidays. For those in the U.S., have a great Thanksgiving!

Cheers,

Herb

P.S. If you liked this feel free to click the heart button below and share with your friends. Better yet, if you’re not a paid subscriber, consider subscribing. I’m entirely readers supported, and I will soon be raising my rates.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I currently own shares in Ceragon, Danaher and Triumph Financial.

I can be reached at herb@herbgreenberg.com.

Have a great Thanksgiving Herb.