'For a restaurant open as recently as this one is, it should have been busier than it was'...

That was what restaurant consultant/analyst John Gordon of Pacific Management Consulting told me as we were walking away from a Sweetgreen (SG) restaurant just east of Del Mar in San Diego.

We've been getting together for lunch at least once a year, usually at this same burgeoning neighborhood strip center in San Diego, to chat restaurants – which John eats, breathes, and sleeps. He knows everybody... and if there are bodies buried, he knows where to find them.

We chose this Sweetgreen because it opened just a few weeks ago and we both wanted to check it out...

What's more, John said this specific center – which I take for granted since i’m there almost every day – would rank as one of the top 100 non-superpower suburban malls in the country… in large part because it’s surrounded by very high surrounding average per capita household income.

That makes it a perfect location for the likes of Sweetgreen, which went public a little less than two years ago...

It did so at the peak of the market's insanity in 2021, getting a high valuation after positioning itself as a tech company that happens to sell salad.

Pretty soon, people realized Sweetgreen was really little more than a salad chain that used technology – and an unprofitable one, at that, with slowing sales.

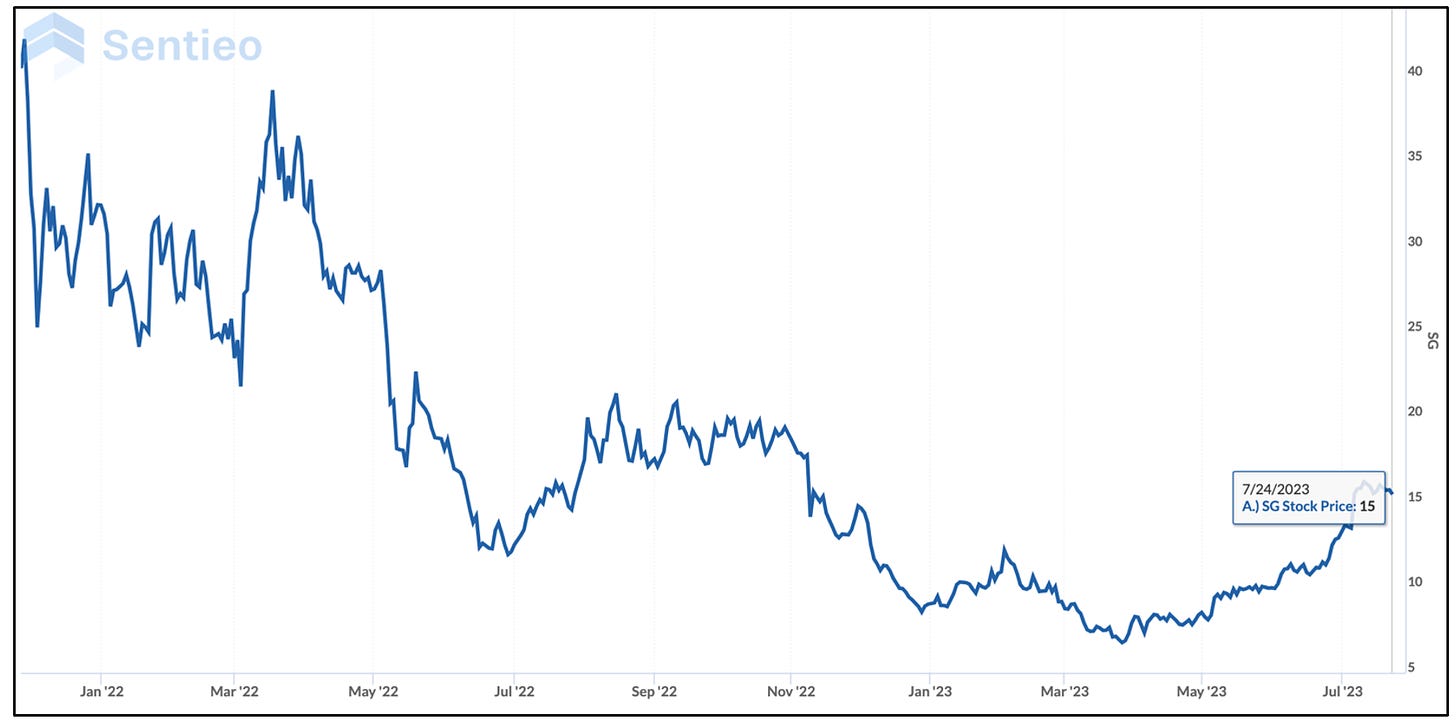

No wonder its stock has struggled, trading at nearly half its IPO price...

… and almost two-thirds below its post-IPO high.

It's not that the food isn't fine or that the staff wasn't friendly or well-trained (impressively so), but it’s the only place that serves up salads and bowls like this...

Sweetgreen charges $17.50 for a salad or a bowl. And in this center and within a five-minute walk, there's intense competition from the likes of Cava (CAVA) Tender Greens, and Mendocino Farms. There are also another dozen or so nearby local or regional chains, with similar price points and menus vying for the same customers... at the same time.

John's first words when he saw me were, "$17 salads and negative EBITDA."

As we sat having our salad, during the lunch hour, there was a steady flow of customers – just not the kind of overflow John would have expected to see at a place as new as this one.

Granted, this is one restaurant in one center. In fact, another Sweetgreen opened a few miles away at around the same time at a large, affluent mall in La Jolla...

But it still, it made me wonder...

What's really going on here?

John has a lot more experience at this than I do, so for him to seem less than impressed was noteworthy.

I’ve watched this neighborhood center evolve for more than 20 years, and I've seen packed competitors become less packed – certainly as more restaurants have opened.

And it's not because of a lack of people. A Philz Coffee shop a short walk away seemingly is always packed. (Let's see how long Philz can resist going public.) So, almost always, is the uber-trendy Vuori clothing store next to the Sweetgreen. (It's still private, too.)

The only explanation for what John and I noticed at lunch, it would seem, is simple supply and demand...

Or as Technomic managing principal Joe Pawlak told the Wall Street Journal's Spencer Jakab a few months ago...

Even before the pandemic, we had too many seats chasing too few butts.

As a result, there are fewer restaurants... but that obviously depends on where you live and what location we're talking about.

And while I've seen a few restaurants disappear at this center in recent years, there's always another new concept to take its place.

That's because new concepts need to grow to show they aren't just one-store or one-region wonders.

The same goes for restaurants that dare go public, except they need to grow even faster and more consistently – and not mostly from price increases, as is the case with Sweetgreen.

For perspective, Cava was dishing up considerably stronger same-store sales before its initial public offering ("IPO") last month – and doing so on a slightly larger base and with a bigger chunk of traffic. Then again, it hasn't even been public for a full quarter... or at least not its first quarterly earnings report.

But as Sweetgreen's management has already learned – and Cava's will soon find out – the high that comes from going public and ringing the opening bell is the fun and easy part... quarterly reports, not so much.

Which gets us back to Sweetgreen...

With more than 200 units in a few dozen states, the company is trying to open at least 35 units a year.

The good news: It has no debt. The bad news: Its cash is dwindling.

For a business under pressure to show growth, that can be a fickle recipe.

Moving on, in search of 'the next Chipotle'...

Investors are always looking for an easy comparison to justify a ridiculous valuation, especially for new restaurants and retailers.

Right now, the buzz is whether that Cava will be the next Chipotle Mexican Grill (CMG).

Folks, enough, already. It doesn't work that way... and those kinds of comparisons suggests that a new concept isn't really that new, rather a mere copycat dressed in different uniform.

Truly successful concepts are original. I would go so far as to say the worst thing is to be called "the next [insert business]," because it sets the concept up to fail.

If Cava is a huge hit, it will do so on its own merits...

Chipotle brilliantly carved out its own niche. And as I recall, it was never "the next" anything, other than the next big short that despite some significant indigestion long the way kept going higher..

By contrast, Burger King was always going to be the next McDonald's (MCD), and it has been No. 2 ever since.

Speaking of which…

I grew up a few blocks from the second BK ever built in my native Miami, where the chain started out. I watched it bounce from one owner to another, to another… all thinking they could make a better fry and make it better.

I would write about it when I was at the Chicago Tribune covering the food and restaurant industries. Pillsbury was on my beat. Few people remember that Burger King was once owned by Pillsbury. I even once did an interview with BK co-founder James McLamore.

The company is now owned by Restaurant Brands (RBI), and John thinks if anybody can make it work it will be RBI’s Executive Chairman Patrick Doyle, who turned Dominoes into Dominoes. But I digress…

The thing with restaurants, especially new concepts, is that they're always a crapshoot...

Years ago, I got to know the guys who ran P.F. Chang's – Richard Federico and Bert Vivian. They were great operators.

Much of what I wrote at the time tried to poke holes in the concept, yet unlike most executives, they always personally returned my calls. We even got together for lunch a few times when they were in town.

My favorite story was when I met Bert over lunch at one of their new Pei Wei Asian Market fast-food units in Encinitas, just north of San Diego.

They were just starting to roll out the concept. And since nobody had ever been successful with an Chinese-style fast-food restaurant, I questioned the concept's viability.

Without missing a beat, Bert looked at me, smiled and shot back with something like...

It may not. It's the restaurant business. You never know.

Here was the guy in charge of it admitting he really didn't know. That’s because restaurants are like movies... nobody knows how they’ll do until they’re live.

As it turns out, Pei Wei still exists, though it no longer has any units in San Diego. It has since been spun off by P.F. Chang's private equity owner but remains alive and claims to have nearly 200 units, with plans to add another 10 to 15 a year.

As far as John knows, it's not in the IPO rumor mill... at least not yet.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

One of the toughest businesses. Low margin, low barrier = Hi risk /reward. Generally a hard pass

Maybe this is the strategy of picking off upper income demographics. People in Del Mar can afford to eat healthy. And it works as long as wages increase and more blue-collar workers are upwardly mobile.