RH Case Study: Another Case of Good Money Chasing Bad?

And why, by its own logic – and if it believes its own press clippings – RH should be backing up the truck to buy back MORE of its own stock

The debate over the wisdom (or lack, thereof) of buybacks is never-ending, and I can see both sides…

All too often, it’s good money chasing bad, even if by their own reckoning it’s at or less than intrinsic value.

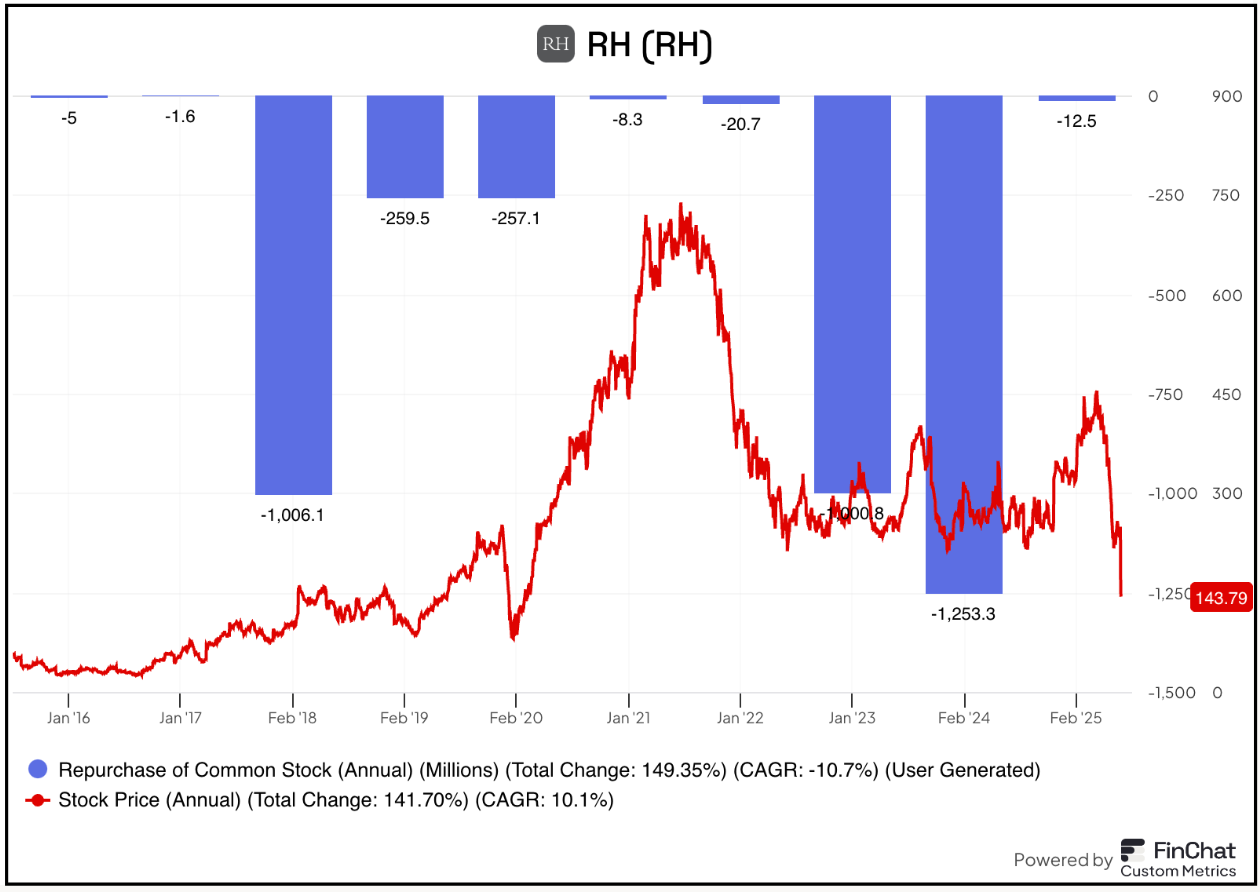

The best current example I can think of is RH RH 0.00%↑, the furniture retailer, which has been buying back its shares all the way up… and down… and all around.

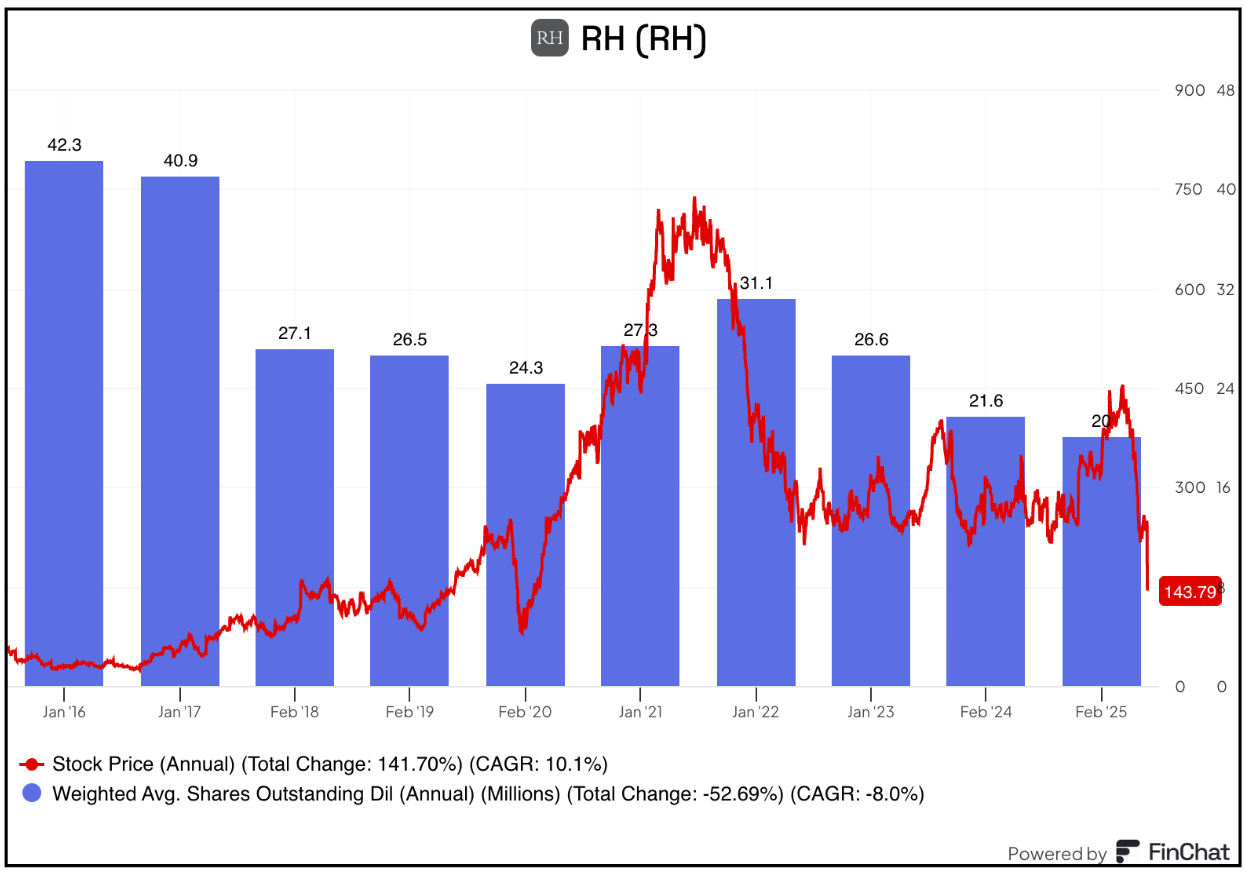

You can see that clearly in the below chart, which shows buybacks against the backdrop of the stock price...

Or put another way, diluted shares outstanding against the stock price…

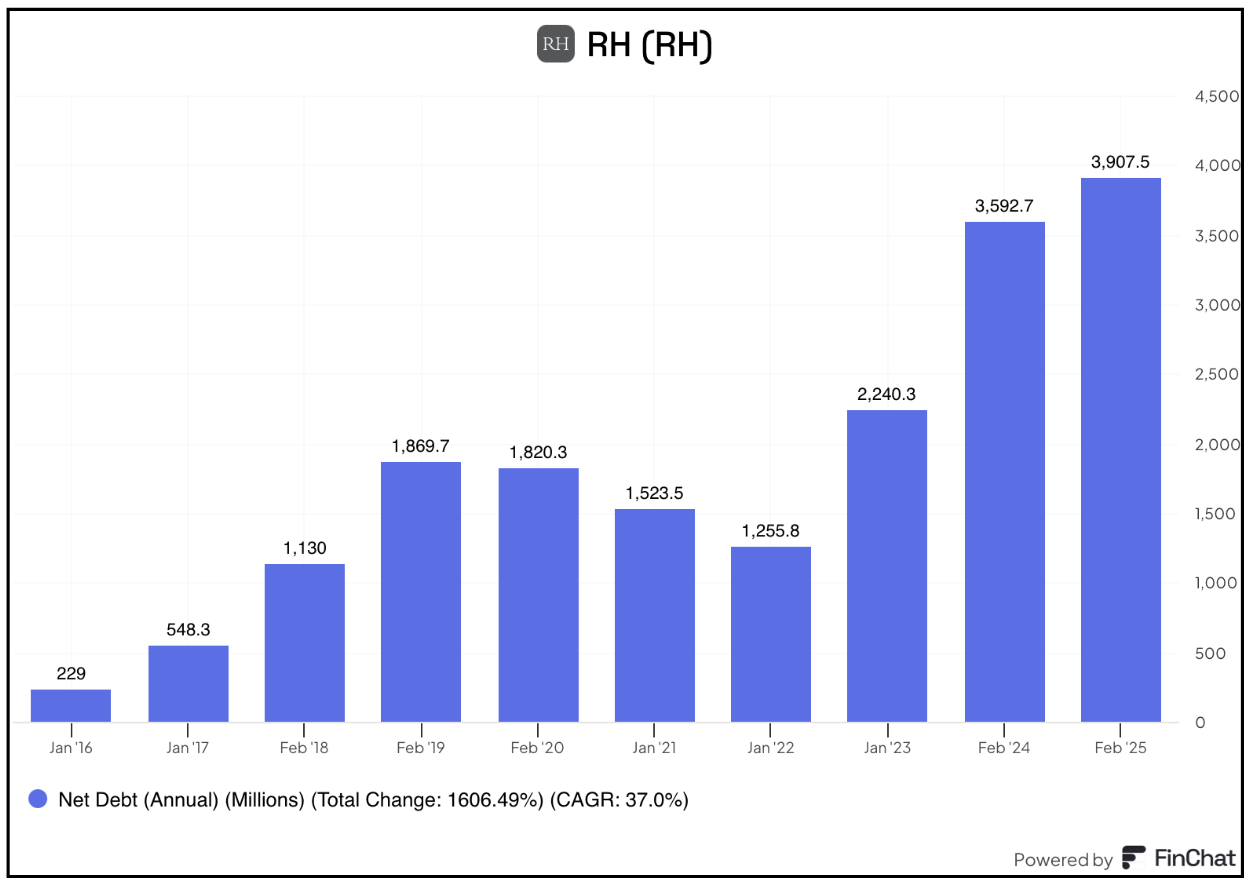

The trouble is that most of these buybacks have been done with debt, which has tripled over the past three years…

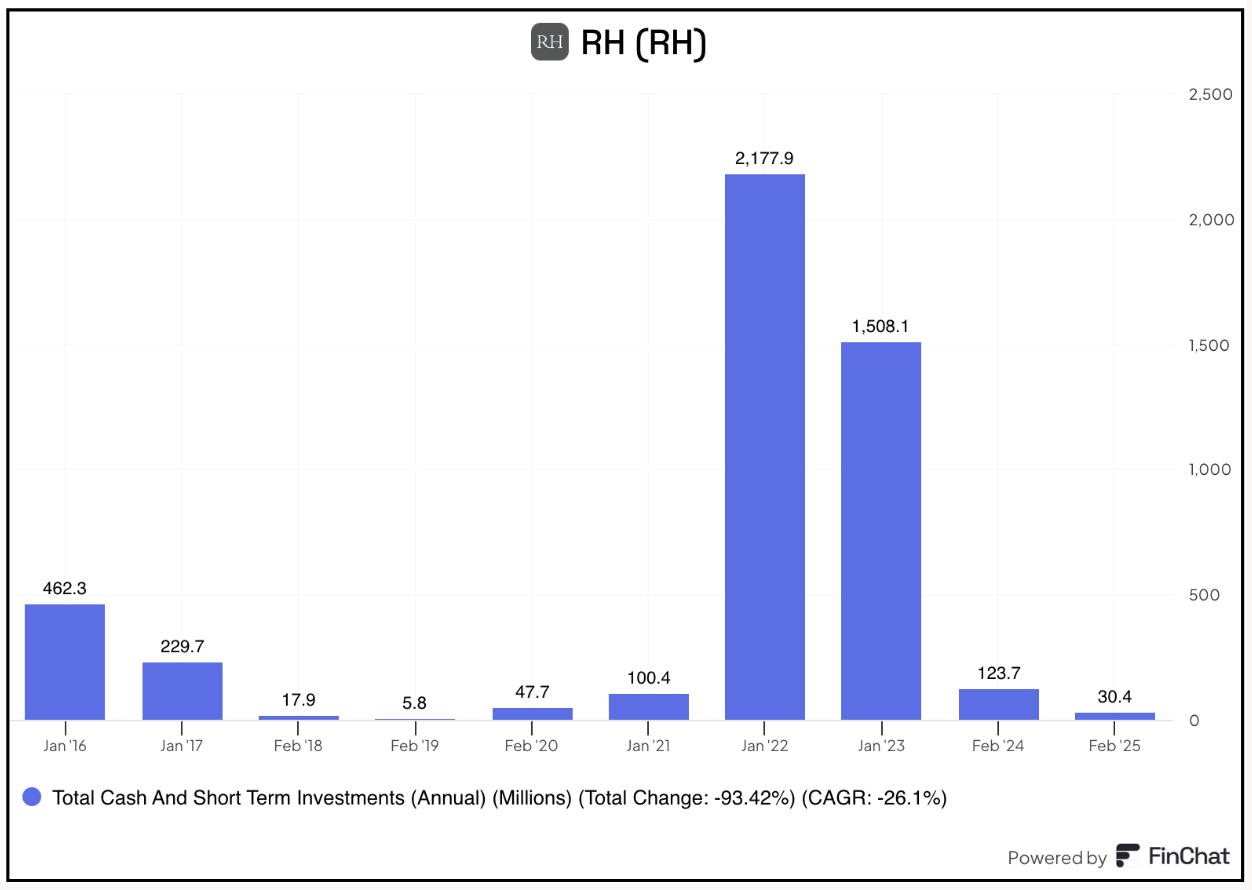

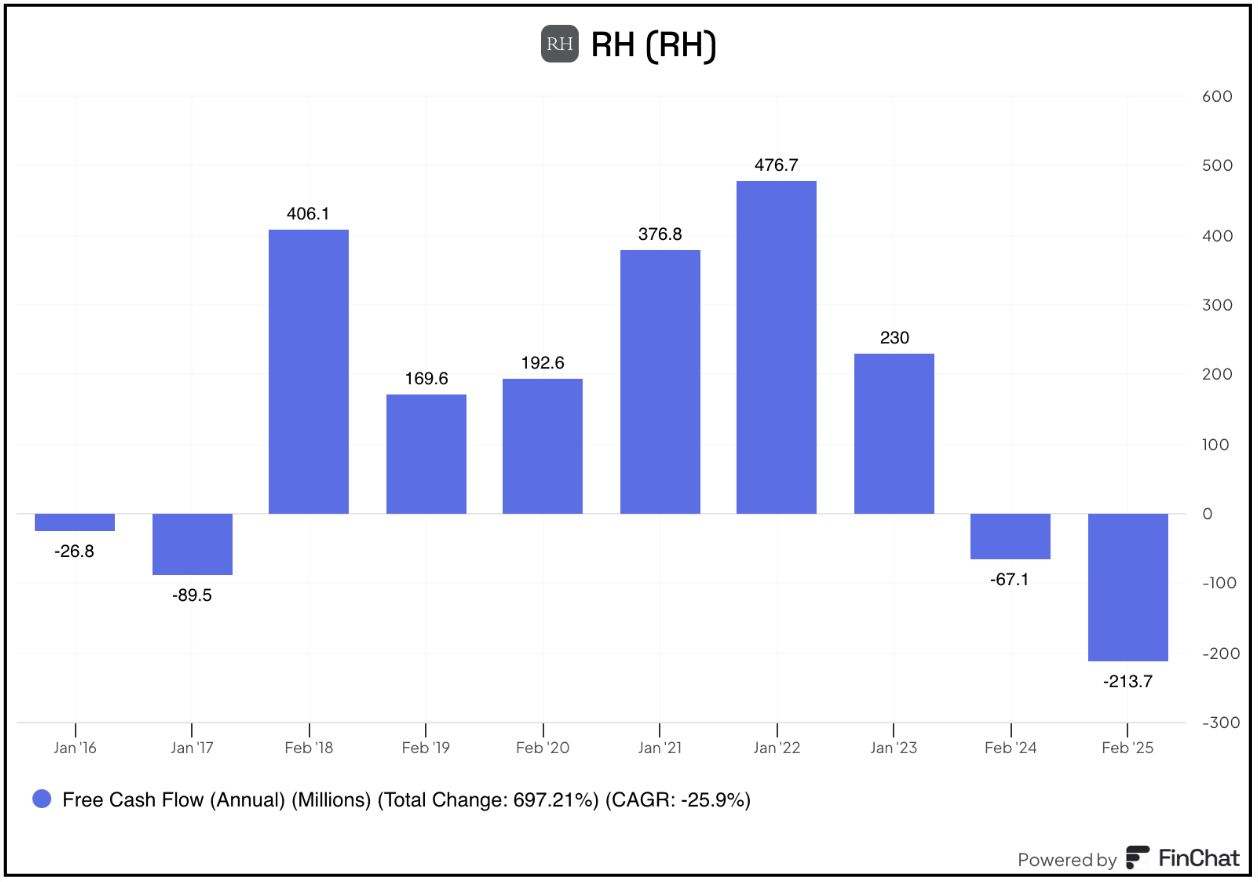

That’s because the company has so little cash…

Or free cash flow, currently negative, though the company said late Friday it will be a positive $250 million to $350 million this year…

CEO Gary Friedman doesn’t hide from any of this, telling investors on Wednesday’s earnings call...

While we ended the year with meaningful debt, mostly due to our stock repurchases of $2.2 billion, we also ended the year with incredible business momentum and meaningful assets.

But the debt, which has done nothing but rise, has been a growing concern among investors – or at least it was a quarter ago when one analyst asked...

Since earnings are constrained by about $9 in interest expense, any thoughts on the appetite for knocking out some of the debt and interest expense and the priority versus investment or buybacks or something else?

Friedman gave a long answer, but summed it up saying...

You could have asked the same question 2016, 2017, and we've done kind of two, three major buybacks here. But you don't see us doing like regular automatic buybacks. I think that's not a very smart thing to do. We can't looking at it like an investor. Yeah, we're buying back our stock at all-time highs. And we're opportunistic thinkers and investors. And so we believe this will prove to be a very wise decision.

Which gets us to where we are today. As of February RH still had $201 million left on its authorized share repurchase program. And Friedman has said he thinks it’s worth “$1,200 to $2,000 down the road.”

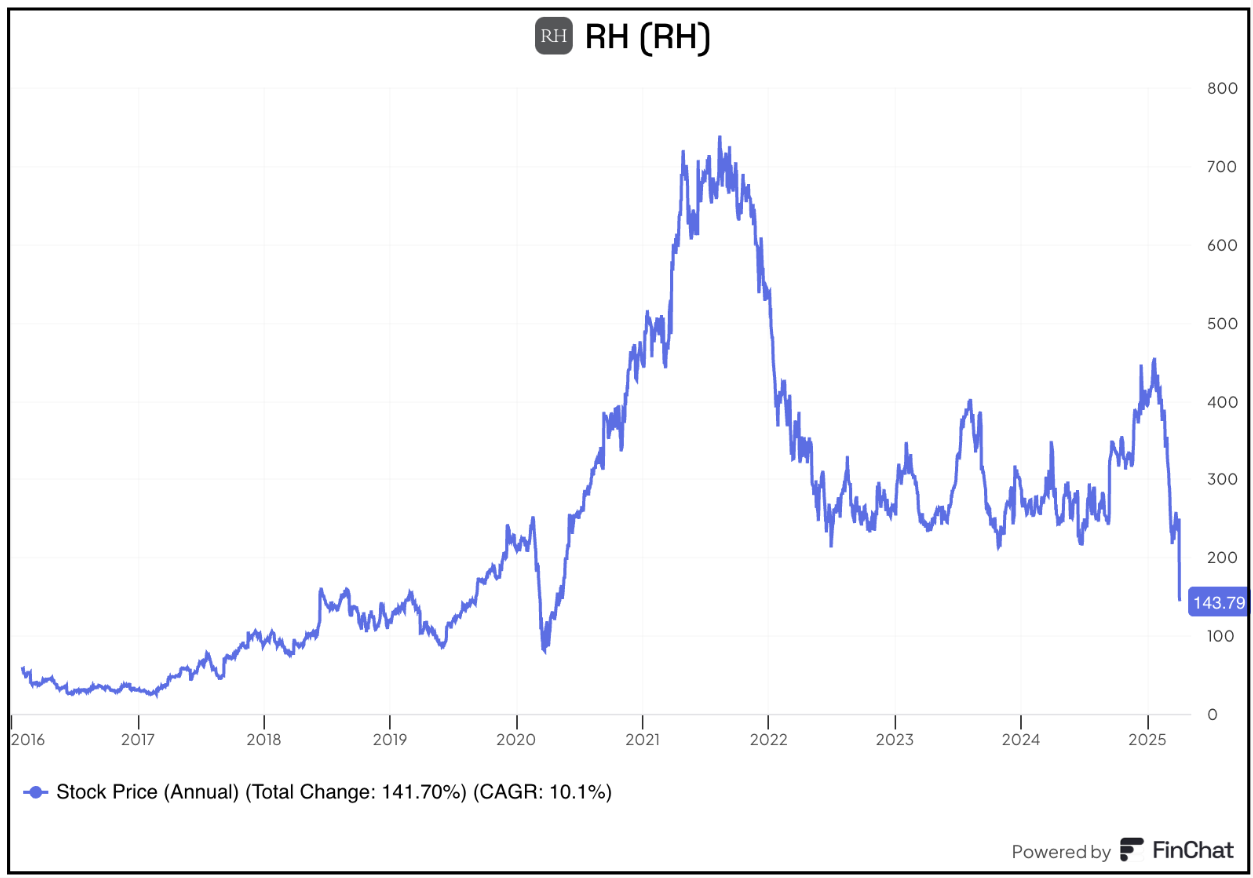

That’s a long way from where it is today…

Using management’s logic about repurchases in the past, with the price Friday at around $144, management should be backing up the truck.

As for the debt, not to worry: On RH’s last call Friedman said that “we've got real estate assets we can turn into cash.”

Easy, peasy. Kind of like burning the furniture to heat the house. And one thing RH has no shortage of is furniture.

One Other Thing

As I wrote in my original report on RH…

There’s clearly a roll-the-dice element to the latest developments at RH. After all, against all odds it worked before, so why not see if it’ll work again – only this time, go even bigger, with Europe and yet another “transformation”?

The question I have: Is this sheer creative genius or hubris gone wild… or maybe bit of both?

Friedman’s view, as he articulated on the company’s earnings call a year ago, is this…

Every act of creation is first an act of destruction, Pablo Picasso. We have spent the past 18 months destroying the former version of our self and are in the process of unleashing what we believe is an exponentially more inspiring and disruptive RH brand, inclusive of the most prolific product transformation and platform expansion in the history of our industry.

Except… Picasso wasn’t running a public company.

Interpret at will.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in this stock.

I can be reached at herb@herbgreenberg.com.