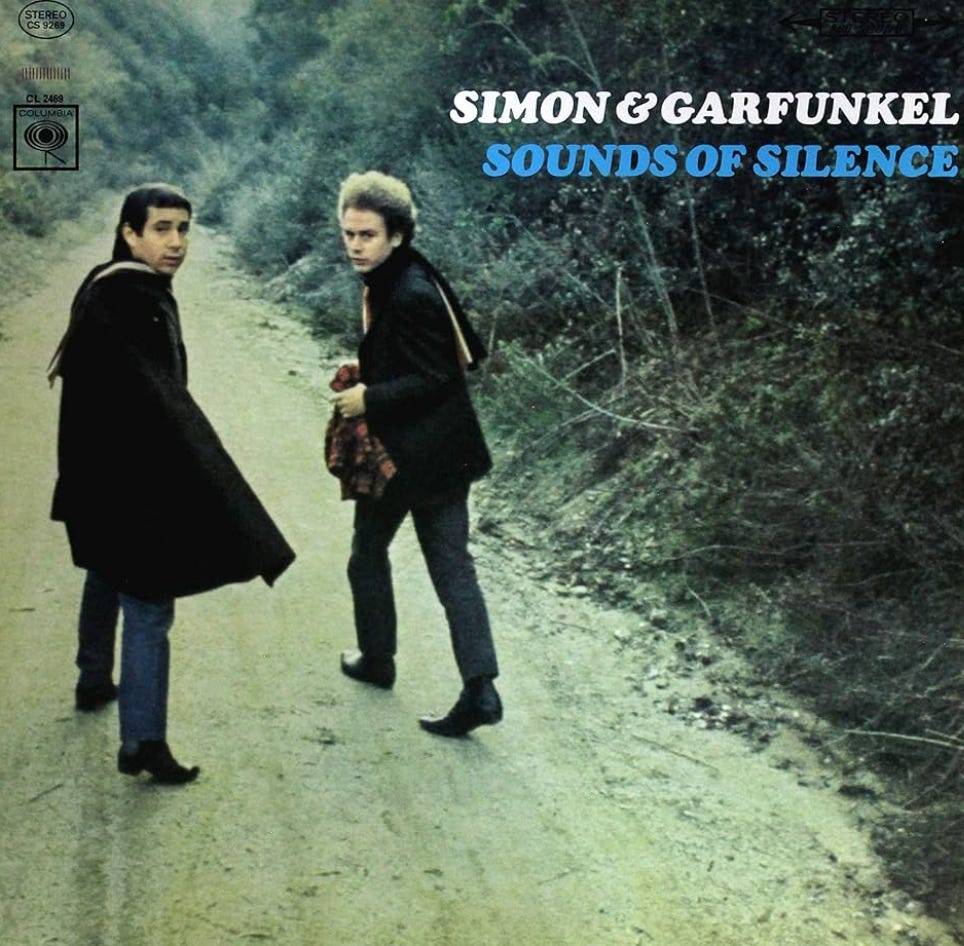

Sounds of Silence

Suddenly, nobody's talking about weight loss drugs. Also, a quick update on Danaher

Hear that?

Of course you don’t, because it’s the sounds of silence...

Suddenly, as if somebody pulled a switch, nobody is talking about the miracle of the new weight-loss drugs, and the impact they’re having on medtech, healthcare, restaurants... and even jet fuel.

That’s what happens with these stock market frenzies: they’re insanely loud until one day you look up and realize they’re gone...

Like generative AI, which was hot until it was not... knocked out of the spotlight by the narrative that new weight-loss drugs would take a chunk out of the Golden Arches.

I contributed to the noise myself with a few thoughts of my own, including this one and this one.

And even though we finally appear to be at that point when nobody cares anymore, I’m about to do it one last time...

You see, all of that hoopla about how everybody getting skinny would hurt restaurants was little more than Wall Street being Wall Street... taking a narrative to the outer reaches of reality.

I’m not saying that at some point the success of these drugs won’t possibly impact restaurant sales, I’m simply saying that if they do I’m not sure it will be in my lifetime. (Keep in mind that I’m 71, so I very well may look smart by default. But I digress…)

That’s because when it comes to restaurants and the food industry, anybody who has been around for more than a cycle has seen variations on this theme.

Just ask veteran restaurant industry analyst Roger Lipton...

He’s founder of Lipton Financial Services, which publishes Roger’s (unfiltered) Hospitality, Restaurant, Franchise Review.

I first started quoting Roger when I was covering restaurants a few decades ago for the Chicago Tribune. He wasn’t shy with opinions then, and he isn’t now… this time about what has happened to restaurant stocks in recent weeks. This is a case where perspective matters. As Roger writes…

Before jumping to conclusions, let’s consider:

In 2004, as Panera was at the peak of their growth trajectory, the low carb craze hit and their same store sales progress stalled. In spite of a great deal of anxiety in the marketplace, Panera, with some relatively minor adjustments to the menu, kept growing. JAB bought the chain in 2017 for $7.5 billion and is reportedly preparing to bring them public again soon.

In 2019, meatless burgers and other meatless proteins captivated Wall Street and worried the beef and chicken purveyors. Beyond Meat (BYND) came public at $25.00/share and ran to over $200 with a $12 billion valuation.

Back in ’19 we said: “The unanswered question is: how large is the demand, at restaurants, for a product that costs more, has the same calorie count and fat content, has a lot more sodium (which creates high blood pressure), but has no cholesterol and contains useful elements such as Thiamin…..B12..and Zinc.? We do not expect the introduction of meatless products to restaurant menus to improve sales in any meaningful way……. This, too, in terms of stock market excitement and restaurant industry focus, shall pass.”

The closest BYND got to annual profitability was $12M of pretax losses in ’20, reporting over $500M of losses in the last two years. The stock is $8/share, likely still overpriced with a market value of $600M.

Which gets us back to the quest to lose weight...

There’s no question America has an obesity problem, and while Roger says that “concern for the food purveyors is justified,” the problem is more immediate and obvious than weight loss drugs.

After all, have you seen prices at even a modest restaurant lately? Or news on the economy? As Roger puts it...

We are more concerned with the already obvious economic strain on the dining public than the undetermined reduction of food consumption because of the new medications.

Exactly... that’s the story. And, yes, I buried the lede.

Danaher’s Earnings – The Real Takeaway

If you missed it, my “Backdoor Play on Longevity” report, published Sunday, was about Danaher (DHR).

My comment on its earnings, which were reported today, is that there were no surprises. But there was an interesting tidbit – my ultimate takeaway, if you will – which I’ll get to in a moment...

The best part about the past two years of focusing on real companies that make real products and services and have real revenue, earnings and cash flow is that I didn’t need to worry about every twist and turn of every quarter… or even think about “earnings season.”

Instead, these companies needed to be monitored, which in my case meant making sure nothing was untoward. That meant checking forensic tools I have access to, but also doing such things as red-lining the quarterly filings and going through the earnings call transcripts… looking for anything that didn’t seem quite right. (I once dumped coverage of a smaller, more speculative company because the earnings call comments of the CEO – who had never before run a public company – suggested he was overly focused on the stock price… in a naive way. That’s always a red flag, and in this case the CEO ultimately “resigned” and the stock went on to lose roughly half its value.)

Danaher is in the “to be monitored” bucket… meant to be viewed over the long-term, with the quarters acting as checkpoints along the way.

The future of Danaher is tied heavily to the development of biologic drugs. (If that industry falls apart, it’s screwed!) Right now its biggest issues are excess inventory being worked down by some of its customers, who overbought during the heyday of the pandemic; and China, which represents about 12% of sales.

Management says the inventory issue is “sort of at a bottom.” As for China, CEO Rainer Blair said…

The demand in China, we're just at the tip of the iceberg of the demand in China for biologic drugs. And there's no question that we're currently going through a reset that's based on many of the things that occurred during the pandemic, if you think about the funds that were spent in the zero COVID effort over several years, if you look at how the pharmaceutical industry is playing out in China.

But all those things, over time, moderate and you come back to an end market which has an enormous demand of a population which has already a large and increasing middle class and is really demanding access to the most advanced medications in the world. So we continue to see China as an opportunity here in the mid and long term because the fundamentals are in the right place, although we are going through, if you will, a reset here with different funding sources and so forth in the short term.

What really caught my attention on the call – the “tidbit” I mentioned earlier – was (what else?) the weight-loss drugs, better known as GLP-1s.

While that’s all anybody could talk about in recent weeks and months, Blair said that the reality for Danaher is that they’re only expected to be “a modest tailwind over time.” That’s because biologic processes are only part of of how they’re made.

By contrast, Alzheimer’s drugs “are typically monoclonal antibodies and the use of our industry's products there is far greater than for instance and GLP-1 processes.”

He went on to say…

As those continue to make their way through the development pipelines through the regulators and ultimately get reimbursed and then adopted by patients, we expect that to be a more significant tailwind, certainly than GLP-1.

That, my friends, is the real takeaway of this earnings call. It’s not about this quarter or next… but ultimately, if everything goes right, all of them strung together going forward.

As always, if you liked this don’t feel shy about clicking the heart below. And please, feel free to share this with your friends, family and neighbors.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

Herb, you have the correct perspective and the investing insights you share are an improvement over Warren Buffet’s! However, my reference rock is www.buyselldonothing.com. Because its now 151 stock accumulated portfolio, from only buying and holding – never selling – equal-weight investments in 20 tickers every three months since June 2015, has outperformed the S&P 500’s total return (yet their portfolio doesn’t include any of the top 5 cap-weighted stocks of the S&P500). I only invest in stocks that are on its Complete Buy List; and I make sure I don’t sell stocks that are on its Hold, Don’t Sell List. The site’s About Us makes very clear the concepts it is intending to prove. And there are at least two unique insights the About Us contains. One is what can happen to a stock’s dividend over 30 years. And, the other is in the example using ticker LLY – and you are aware of what it has done more recently.

The market is moving too fast. By the time I do any due diligence on a new trend I just heard about, it's too late.