Looking back, those were fun times when special purpose acquisition companies ('SPACs') ruled the market...

I was thinking about the "good old days" last week when I was on CNBC's Last Call to talk about a few of yesteryear's most popular SPACs that were warning they might not be able to stay in business...

Looking back... What could we possibly have been thinking?

Even before most of us knew what the "SPAC" acronym even meant – indicating a "blank check" company in search of a business to take public via a special merger – the market was getting flooded by them.

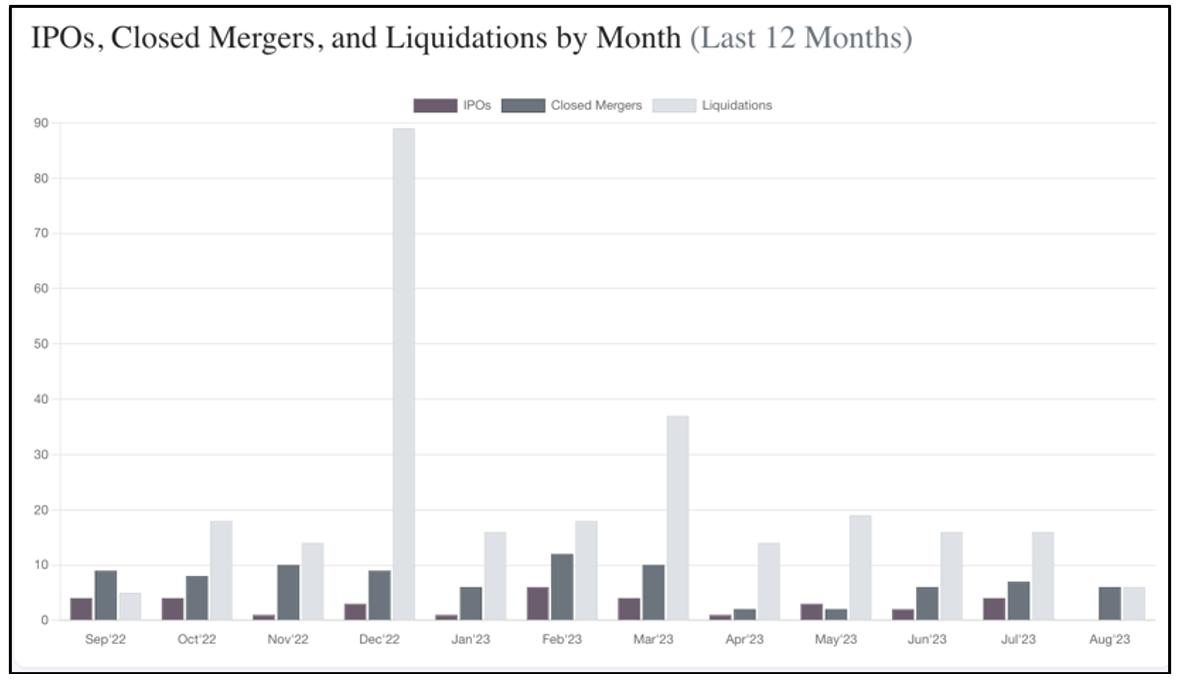

It reached the point that there were more companies than acquisition targets. So many, in fact, that so far this year SPAC Track says 142 SPACs were liquidated without ever finding a business to merge with. That compares to 144 in all of last year.

What made SPACs so special was the 'investor presentation' included in the merger filings after the SPAC found a company to combine with...

Usually toward the tail end there would be a financial projection – often going out years.

As it turns out, many (or most) of these companies’ grand projections were nothing but fantasy.

Such as WeWork (WE), which owns and operates co-working spaces across the country... and which warned last week that there's doubt it can stay in business.

In the below slide from its investor presentation in regulatory filings, here's what the company projected regarding liquidity and adjusted earnings before interest, taxes, depreciation, and amortization ("EBITDA")...

WeWork was expecting positive liquidity to the tune of $2.1 billion at the end of last year, rising to $2.5 billion this year. Oops, not even close.

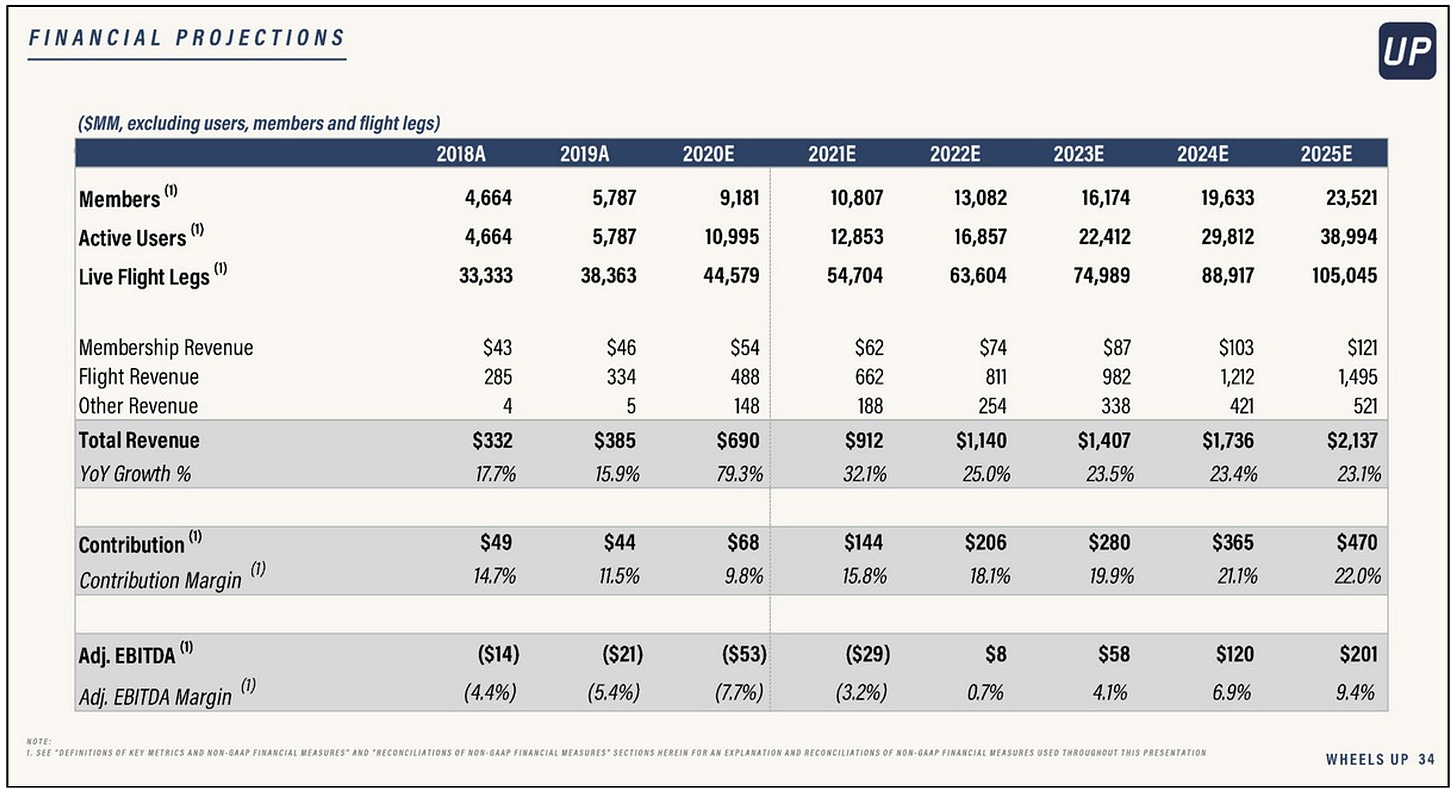

Then there’s private jet chartering company Wheels Up Experience (UP)...

Here's the slide on financial projections from the company's investor presentation in regulatory filings...

By now, Wheels Up was supposed to have more than $1.1 billion in revenue... But as of the end of last year, revenue was barely above $1.5 billion. But EBITDA was nowhere near projections and active users have also fallen short. But so-called "flight legs" are a fraction of what they were supposed to be.

No surprise then, like WeWork, Wheels Up filed last week that it may go belly-up.

And these are just the most recent examples of SPACs that overpromised and didn't just underdeliver, but may not be around for the full length of their projections.

And if they don't make it, they won't be alone...

There were simply so many. Like Lordstown Motors, with its snazzy electric-powered pickup trucks. Projections of grandeur sent this stock to more than $400 per share at its peak.

By now, according to the forecast in its investor presentation, the company should have been producing more than 30,000 units and revenue of $3.5 billion and EBITDA of $10 million... on its way to $298 million this year.

Instead, its stock was delisted from the Nasdaq exchange and moved to the over-the-counter ("OTC") market. It now trades under the ticker RIDEQ, with the "Q" standing for bankruptcy.

But wait, there’s more…

Back in 2021 someone on Twitter known as HFMajorTom tweeted the below, which included claims made by ESS Tech’s (GWH) in its investor presentation…

As you can see, they were projecting revenues WAY out to 2027. Based on this forecast, the company should have ended last year with $2 million, well on its way to $300 million this year. Impressive!

But as HFMajorTom tweeted the other day, after I asked for examples of some of the most memorably misleading SPACs…

2021 Revenues: $0. 2022: $894,000. Just a bit off.

And then (drumroll, please) there was Romeo Power…

Romeo claimed to be a leader in battery technology. Its cast of characters involved a Who’s Who of the investment community.

Its claims didn’t go unnoticed by our friend @HFmajorTom, who tweeted at the time…

Let me save you the trouble of squinting: By the end of 2021 the company was supposed to have done $134 million in revenue. Instead, it did $17 million.

Here’s the kicker: Last year Romeo was acquired by Nikola (of all companies) for $144 million.

It gets better… Last month Nikola said it was liquidating the company.

The kicker to the kicker: When things were their absolute zaniest in SPAC world Romeo CEO Lionel Selwood did an interview on YouTube, where said…

This is not a pump-and-dump…this is a set-it-and-forget it…

You can forget it, alright: It’s gone! And that clip… it’s gold! (If you want to see the video for yourself, click here. It opens just before he utters those lines.)

Here's the crazy part...

The U.S. Securities and Exchange Commission ("SEC") proposed new rules regarding SPAC projections in March 2022. Based on anything I could find, nothing has come of it... so far.

And yet, there are still some businesses making grand financial projections.

Maybe regulators are letting the markets take care of it, because that appears to be what's happening...

The number of new SPACs being filed is slowed to a trickle... and even with all of the liquidations, there are still 362 active SPACs. The number of actual mergers that are occurring has also slowed to a trickle, which suggests more liquidations are likely.

And while there still a few new SPACs going public, the public clearly has wised up... because more than 300 of those from the classes of 2019 to 2022 are trading below their merger prices.

At the same time, keep in mind that not all SPACs are headed for the junk heap...

Quite a few from earlier years did fine. And 43 that did mergers during the frenzy years are trading above their merger prices.

The biggest gainer since their so-called “de-SPAC” – their official merger with a real company and the SPAC – is MoonLake Immunotherapeutics (MLTX), up 469%... followed by Symbotic (SYM), up 343%... Vertiv (VRT), up 246%... DraftKings (DKNG), up 193%... and MP Materials (MP), up 129%.

On CNBC, I was asked whether I would buy new SPACs today, my answer was... no. After all – given everything that has happened – if that's the only way a company can go public, you have to wonder why.

That, my friends, is simple common sense.

P.S.: VinFast Auto, a Vietnamese electric vehicle manufacturer I had never heard of, soared 68% on its first day of trading after merging with a SPAC. If only I had written this piece a day earlier. It would’ve been the angle! Onward…

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg.

Excellent report, Herb. FYI, this is now a couple years old, but here is a well done legal history of SPACs by a senior law student who knew the market: history of SPACs: "MONEY FOR NOTHING, SHARES FOR FREE: A Brief History of the SPAC" by Ross Greenspan (May 2021), available for free at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3832710

The SEC will get around to investigating in 2027. They don't have the dollar or employee resources to even scratch the surface of what has been done over the last 5 years.