Special Red Flag Alert – Blurring the Lines

Taking a deep peek into the largest for-profit operator of thrift stores

(Note: I’m thrilled to be collaborating on this report with my friend Katherine Spurlock, a research analyst and former shortseller, who is proud to call herself a “thrifter.”)

Where there's a market, Wall Street finds a way.

That’s the moral of today’s story...

Enter Savers Value Village ($SVV), a roll-up of for-profit thrift stores. It’s also the largest, with 300-plus units in the U.S. and Canada operating under the brands Savers, Value Village, Village des Valeurs, Unique and 2nd Ave.

The company’s IPO captured the attention of investors last year with its robust margins, claims of a “recession resistant” business model, and a forecast that its store base has the potential to ultimately grow to more than 2,000 units.

As it heads into earnings this week, its shares trade at a lofty 28x earnings. Management has primed investors to expect improved results, which is why it’s being added to the Red Flag Alerts list with a yellow flag… to be reassessed after earnings.

Keep in mind, with thousands of publicly traded companies to choose from, the Red Flag Alerts list highlights stocks to avoid. As of Friday, even with the market’s spiral higher, only seven of 18 red-flagged companies were positive, with the entire red-flagged list still a negative 22%. Adding in the two yellow-flagged companies, the list was a negative 19% in a market where everything that isn’t nailed down is flying.

In our view, Savers faces a variety of risks. They include…

Pricing, real estate, zoning and potential insider selling – some or none of which may turn into reality.

Perhaps the most interesting part of the story is an ongoing controversy about whether its business model blurs the line between the for-profit and non-profit worlds of donating goods to charity.

Brush with Bankruptcy

Before we go further, a little about the company...

Founded in 1954 at a former movie theater in the Mission District of San Francisco, Savers sold itself to private equity in 2000… and over the subsequent 19 years was resold to three different private equity firms.

The last one, Ares Capital, swooped in five years ago – just as it was about to sink into bankruptcy.

Two years later the company filed to go public, but it took another two years before the company could complete the deal.

Priced at $20 in June 2023, Savers’ IPO rode the coattails of the boom in the resale market, which was jump-started during the pandemic... as people cleaned out their closets. It also got a boost from being ESG-friendly as a recycler. That, in turn, has played to what it refers to as “conscious consumerism.”

Stock Soars

With that as a backdrop, and with the Ares selling only 15% of its stake, the deal was easily oversubscribed.

By its peak of August 2023, the shares had risen by 30%.

But no sooner was Savers public, then post-pandemic economic reality hit...

One of the key levers it used to bolster its results pre-IPO, thanks to the growing popularity of “thrifting,” as it’s called, was to raise prices. The company claimed the higher prices were necessary in the face of inflation… to counter higher labor and other costs.

'Obscene price Hikes’

Whatever the reason, the higher prices for secondhand merchandise didn’t go unnoticed...

Thrifters typically flock to thrift ships for bargains and the thrill of the “treasure hunt,” while others are lured by the feel-good nature of recycling. But stories started showing up, such as this one in Canada a few weeks ago, where more than half of Savers’ stores are located…

There’s even a Facebook group, with more than 52,000 members, dedicated to grousing about high prices...

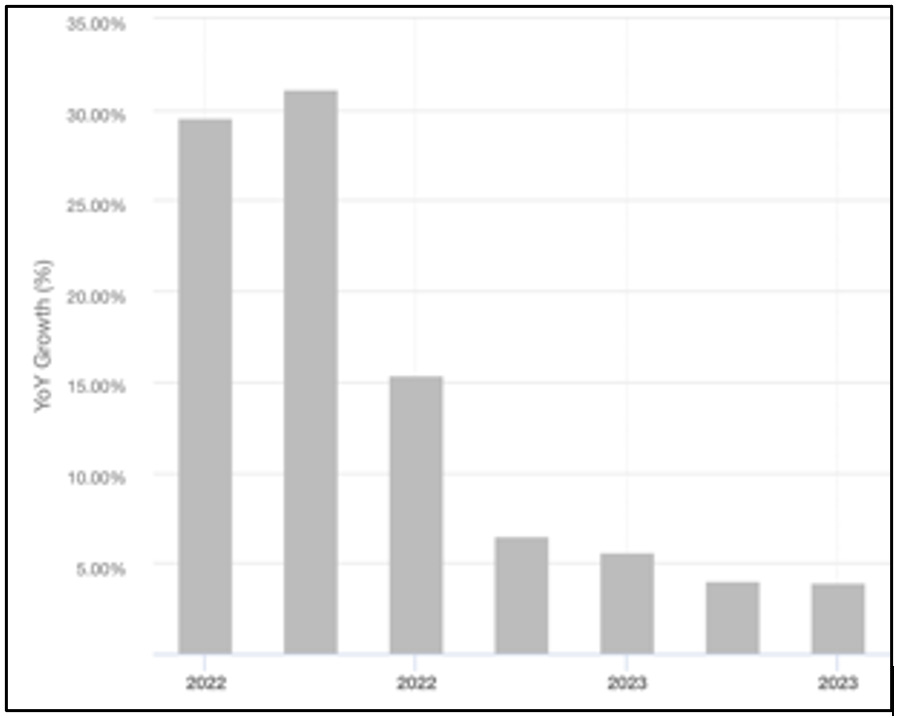

The impact can be seen in the numbers...

In its first quarterly report – the second quarter of 2023 – Savers experienced a 1% decrease in the size of its average basket. Since earnings beat expectations, investors ignored it... bidding the stock up.

Revenue Growth Tumbles

But, sales growth continued to slip... and slip... and slip.

By last year’s third quarter, sales growth had tumbled to 3.8% and the company lowered fiscal 2023 same-store sales to a 4% increase versus previous guidance of 5%. The company blamed the slowdown on weather, despite having said that the seasonality in its business does not follow that of traditional retailers.

And while CEO Mark Walsh said on the company’s November earnings call that pricing is “not an issue,” he also said...

We are monitoring both demand and pricing very closely to align expenses with sales and maintain profitability.

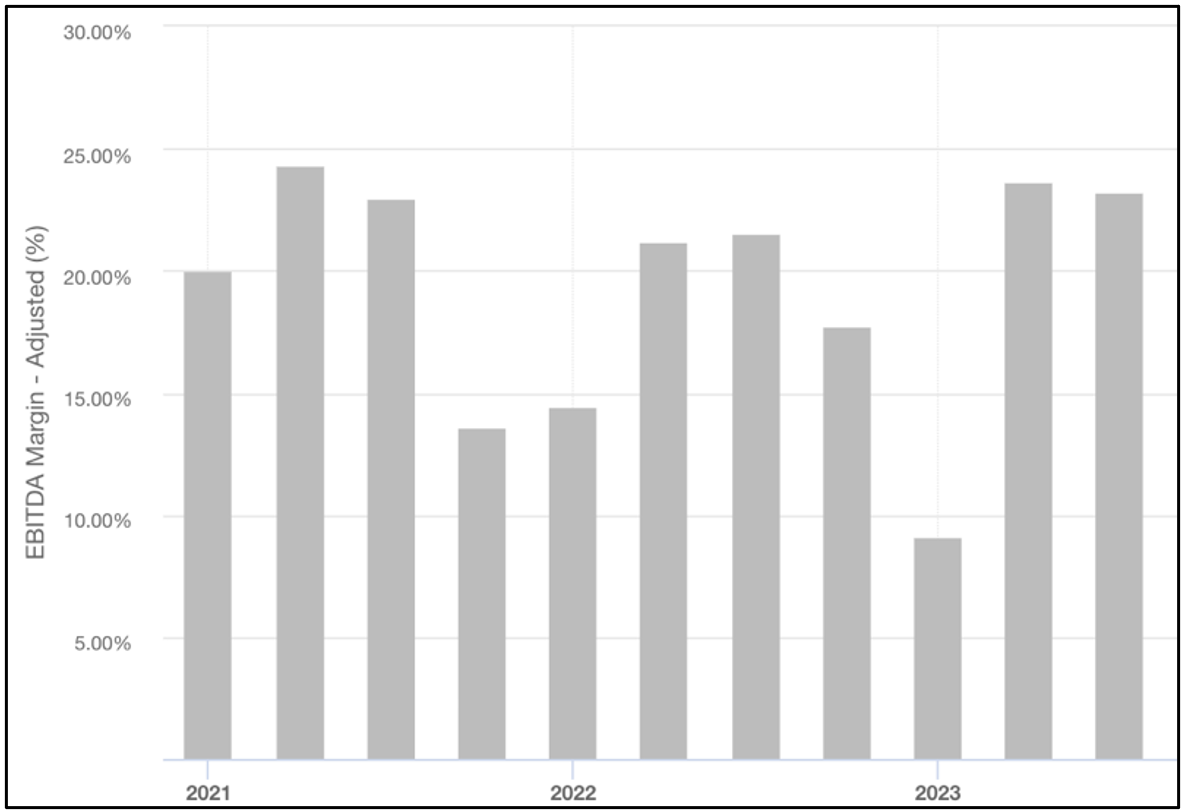

What’s clear is that despite sagging revenue growth, Savers has what management calls “a world class” EBITDA margin, which has remained robust at roughly 20%, along with a gross margin of nearly 60%.

One obvious question is whether margins can remain high if the company can’t continue to raise prices and/or continue to cut costs. While management says same-store sales accelerated in the quarter soon to be announced, thanks to improved weather, in our view the prospect of further price increases does not seem like a lever Savers can continue to pull.

The price of cotton also might also play a role here; it has fallen considerably from their post-pandemic highs.

Location, Location, Location

There’s something else...

After years of fairly tepid store growth, the company is chatting up its total addressable market, or “TAM”, and “whitespace.”

But there’s a catch...

In the world of thrifting, the best thrift stores are often right across the street from or near a fancy subdivision, where the donated goods are of better quality. Which, of course, means the best stores are in pricy locations that tend to have strict zoning laws.

Savers is trying to skirt this, for donations at least, with drop-off stations under the GreenDrop brand. These are mobile and stationary locations, which the company says it tries to put in " high-traffic affluent" locations.

There are currently slightly more than 60 GreenDrops, with plans for another 30 this year.

But as Chief Operating Officer Jubran Tanious conceded on the November earnings call, zoning permits for GreenDrops can be “challenging.” He should know…

Efforts to put a GreenDrop near his home in the tony Minneapolis suburb of Edina were recently denied by zoning officials.

Among those formally commenting in favor of the Edina location was none other than Tanious, an Edina resident, who did not identify himself as being with the company (which, for what it’s worth, is headquartered in Bellevue, Washington)...

Among the claims he cited was that...

That gets to the bigger issue...

Blurring the Lines

Savers’ for-profit business model relies heavily on its relationship with non-profit organizations... by purchasing used goods on behalf of non-profits.

In some cases, the non-profits collect the goods themselves and in turn sell them to Savers for a few cents per pound. In other cases, each store or drop box, including GreenDrop, is designated for a specific non-profit.

As a result, Savers has been accused, at times, of walking a blurry line between for-profit and non-profit…

On one hand, it competes with for-profit thrift and consignment shops and online sites, like the RealReal and ThreadUp; on the other, it goes head-to-head with the likes of the Salvation Army and Goodwill, the two leading non-profit thrift operations, which operate 8,000 locations and 3,000 locations, respectively.

Each non-profit is referred to as a “non-profit partner,” or NPP. In the company’s words, from its IPO filing...

Our relationships with our top 10 NPPs average 25 to 30 years. Over the last five years we have paid our NPPs more than $580 million for goods donated to them.

That five-year number – $580 million – has actually changed from "approximately $670 million” in 2021, when the company first filed to go public... even as total revenue over that period leaped by 78%. In addition, Savers processed 985 million pounds of goods in 2022, up 44% since 2020. For the nine months ended last September, that number slipped by 2% from a year earlier. While slide is noteworthy in an industry that is supposed to be booming, it’s still up considerably.

With the amount processed is rising, it’s unclear why the payments to NPPs were revised lower. But then again, Savers also discloses that “certain metrics presented in this prospectus, including the numbers of customers and NPPs and their donors, are based on market research, internally generated data, assumptions and estimates." (So, it may have been a guesstimate?)

Whatever the reason, it seems everybody wins: The non-profits get their money, and Savers gets what’s left, by selling half of what’s collected through its thrift shops and the rest to wholesalers.

Misleading Claims?

But there’s also a murkiness to it, which is why the company has found itself in the crosshairs of more than dozen state attorneys general.

In 2015, Savers agreed to pay $1.8 million to settle a dispute with the Minnesota attorney general, who had alleged that it “seriously misled the public about the extent to which donated clothes and merchandise benefit the for-profit retailer vs. the charity.”

Two years later, the Washington attorney general went further, charging that the company was “hiding its for-profit status behind a veneer of charitable goodwill.”

In addition, according to the Associated Press, 14 states, including Minnesota, filed a friend-of-the-court brief on Washington's behalf, arguing that authorities must be able to protect consumers from deceptive marketing practices because public trust is crucial to the work charities do. As the AP noted, the brief alleged:

The practice of for-profit companies masquerading as charities is therefore a significant threat to the public and the charitable sector.

In February 2023 the Washington Supreme Court ruled in the company’s favor, citing free speech grounds regarding the way it marketed itself. Washington state was also ordered to pay Savers $4.3 million in legal expenses.

But the controversy continued, with the non-profit Washington news outlet, Crosscut, writing last May...

And in its IPO filing, Savers cautioned...

In connection with our marketing and advertisement practices, we have been in the past, are currently and may in the future be, the target of claims relating to false or deceptive advertising, including under the auspices of the FTC and the consumer protection statutes of some states.

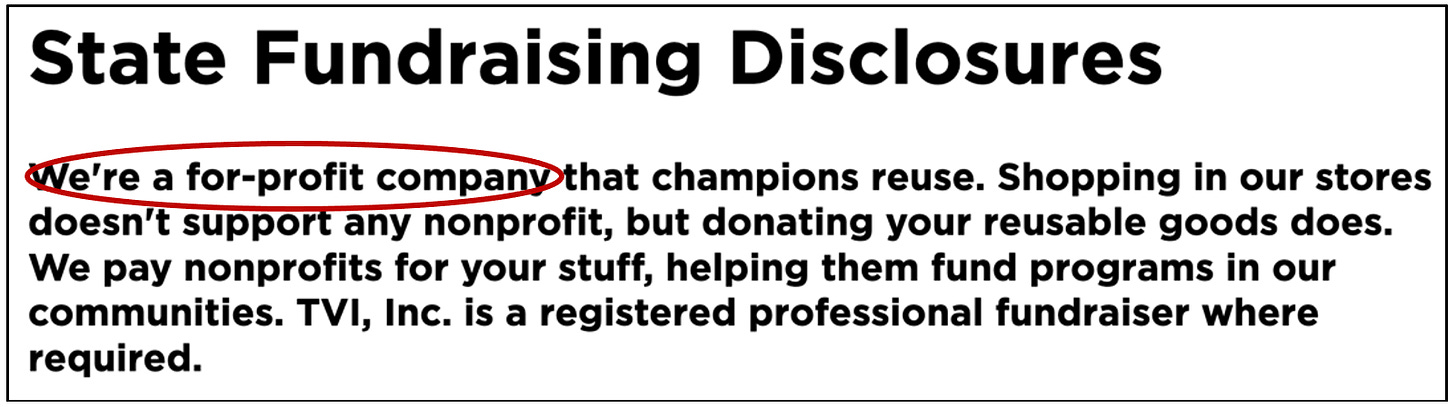

‘We Are For-Profit’

No wonder the company goes out of its way to tell anybody who will listen that it’s a for-profit venture.

It mentioned “for profit” 18 times in its IPO prospectus...

And if you missed it there, it’s at the top of every page on its website...

And if you missed it there, that same disclosure is in big, bold, black type on the “state fundraiser disclosures” page on its website....

And just in case, this disclosure appears at the bottom of all of the pages on its website..

A Few Other Things…

Even with those disclosures, a few other things caught our attention...

Ties that bind

On the State Fundraising Disclosures page on its website, Savers lists non-profit partners by state.

What caught our attention: While the company says that donations are credited to charities associated with a particular store, some actually flow through non-profit intermediaries... and then to the main charity. In some cases, there appears to be overlap in management between some primary and secondary non-profits. For example...

Savers says that donations in Hawaii go to the "National Kidney Foundation of Hawaii," via "TVI, Inc. d/b/a Savers,” which it describes as “a for-profit professional solicitor accepting donations of secondhand clothing and household goods on behalf of Kidney Friends Hawaii, Inc."

What caught our attention: Kidney Friends Hawaii is not the same as the National Kidney Foundation of Hawaii, Glen Hayashida, President of the Kidney Friends Hawaii, is also CEO of the National Kidney Foundation of Hawaii.

Then there’s the Hartsprings Foundation, which acts as a fundraiser for Big Brothers Big Sisters programs in Connecticut and Massachusetts. Savers cites Hartsprings, not Big Brothers in those states, as its non-profit partner. In turn, Hartsprings lists Savers stores that are anointed as Hartsprings drop off centers.

What caught our attention: Hartsprings Foundation's Secretary is David Beturne, according to its 2021 form 990 filed with the IRS. Beturne is also Executive Director at Big Brothers Big Sisters of Hampden County, a different non-profit, according to the 2021 form 990.

Yet another non-profit partner is Epilepsy Foundation New England. The tax receipt for the Epilepsy Foundation New England, however says donations benefit “Epilepsy Foundation New England Donation Center, LLC (Tax ID Number 22-2505819), a single-member LLC wholly owned by, and established to support the mission of, Epilepsy Foundation New England."

What caught our attention: Guidestar, which tracks non-profits, says the Epilepsy Foundation New England is an independent affiliate of Epilepsy Foundation of America.

Slowdown in the Secondhand Market

The secondhand market is slowing, but you wouldn’t know it based on the June IPO filings by Savers.

According to those filings, the U.S second hand market was booming. Its source was 2022 industry data from the research firm, GlobalData. That data, was included in the 2022 Resale Report published by ThreadUp, an online resale retailer. According to that report, the U.S. secondhand market was expected “to grow 127% by 2026” to $82 billion... from $35 billion in 2021.

However, the 2023 Resale Report published last May by ThreadUp, also using data from GlobalData, revised those estimates downward to $66 billion rather than $82 billion by 2026, and to hit $70 billion by 2027.

What caught our attention: While the revised numbers were available and published before its IPO, Savers went with the higher, older numbers.

Store Growth Potential

The company said in its IPO filing that it has “identified approximately 2,200 potential new stores…”

What caught our attention: It’s one thing to put up a store growth number, it’s another to give a time period. Every time we see ambitious location forecasts we’re reminded of the restaurant chain Buca di Beppo, whose CEO at the time of its 1999 IPO bragged the chain of 68 stores would ultimately have more 450. It never got to more than 100, and after a bizarre history that ultimately led to its sale, now has just 70.

Here a Bankruptcy, There a Bankruptcy

CEO Walsh’s bio on the company’s website talks about how he has been involved with a handful of “top brands” in apparel retailing, but a few details are missing. As Savers discloses in its IPO filing, he was also the CEO of Vestis Retail Group, which owned Bob’s Stores, Eastern Mountain Sports and Sport Chalet. While there, he “managed a Section 363 sale to Versa Capital and subsequent sale to UK-based Sports Direct through a debtor in possession process.”

In other words, Vestis filed for bankruptcy.

What caught our attention: Neither the bio in his prospectus nor his LinkedIn bio mention that subsequently he became CEO of Avenue Stores, on whose board he sat. A little more than a year later it, too, filed for bankruptcy. It’s unclear how long he was with Avenue.

He joined Savers after its brush with bankruptcy.

Finally... A big Overhang

One big question is what Ares will do with its 85% stake. It hasn’t sold a share, but its lockup agreement expired last December.

In a recent upgrade of Savers debt, Moody’s said a further upgrade “would require a reduction in its private equity ownership, such that it is no longer a controlled company and a large majority of its board members are independent.”

With trailing 12-month debt of $1,132 billion and trading at 4.45x EBITDA – and the number of stock deals being done right now with the market at its current levels – the questions are: Will Ares start selling? And if so, when?

Stay tuned.

If you liked this please click the heart button and feel free to share with your friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) Neither author has a position in this stock.

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

Thank you for the research.

The laughter reading that a company brags about "world class EBITDA" aka "World Class Made-up NON-GAAP Number" quickly fades moving through the piece. What begins in humor ends in a precarious and common affliction for so much of the "new" ideas today. Much of the story appears to rest on regulatory arbitrage around the profit/non-profit that one wonders about all the remaining claims about recycling etc. (emphasis on "appears", not alleging fraud). If this store didn't exist who would it hurt and who would it help? (honest question - thanks for any feedback!)