Squeeze-O-Rama

Update on full Red Flag Alerts List, what you may have missed, highly evasive companies and more...

(No Black Friday or cyber-special sale here. In fact, my prices are going UP on January 1 for new subscribers. If you’re not yet a premium subscriber to Herb On the Street and my Red Flag Alerts, and wonder why you should subscribe, I explain right here. And this reminder, I also post on Notes and Bluesky.)

On the docket…

The week that was.

Sandbagged by Symbotic.

Too evasive for comfort.

Mystery company unveiled.

Good, bad, ugly: Updated Red Flag Alerts List.

1. The Week that Was

It has been two weeks since I updated the Red Flag Alerts list of stocks to avoid, and what a two weeks it has been...

I view the list, which now numbers 31 names – and which I include lower in this report for premium subscribers – as a proxy for shorts. As you might expect, it’s at its worst in the latest Squeeze-O-Rama. (For you newbies, I’m referring to mass short squeezes, which can cause heavily shorted stocks to show unrealistic and often unsustainably outsized gains, as short-sellers “cover” their positions to avoid further losses as stocks rise… creating a feeding frenzy of sorts.)

If the list was a proven technical indicator, based on its experience, it would be suggesting we’re near an inflection point.

But I’ve been doing this long enough to know that I don’t know – and neither does anybody else. Or as I responded to my old friend and chartist extraordinaire Helene Meisler on Bluesky over the weekend…

Which gets us back to the Red Flag Alerts list: Squeezes or no squeezes, while it is not a coverage list – instead a reminder of the risks out there – it has been a good collection of mostly hits.

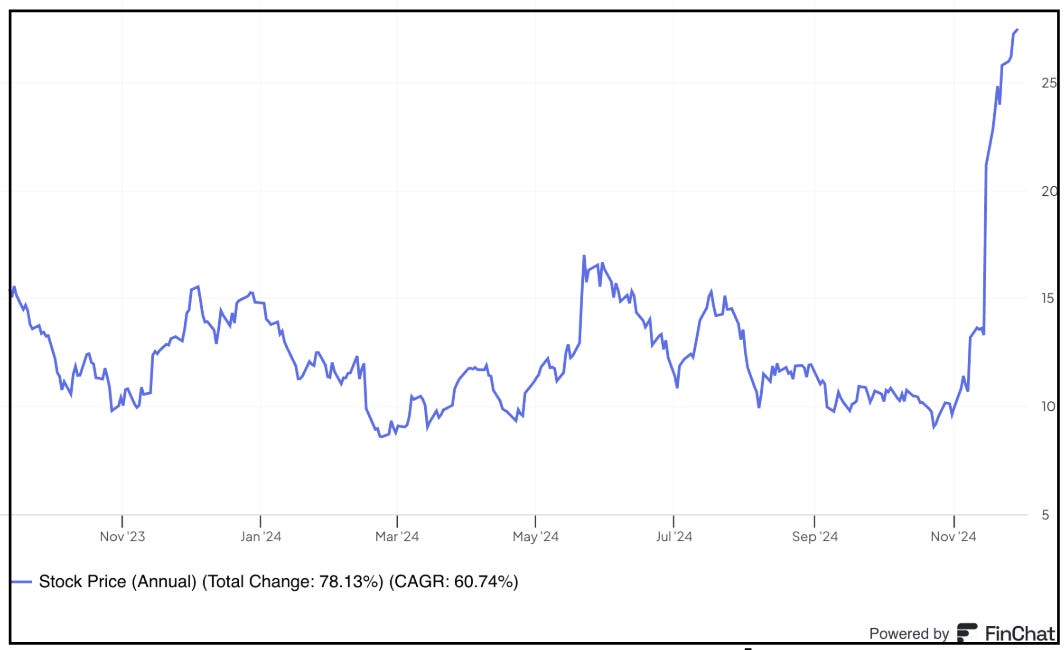

But it also has a few misses – some more notable than others. As the chart below from FinChat shows, one is up 170% over the past month – roughly 80% since added September of last year.

Rises like that on companies like this, which has a multi-billion-dollar market cap, are suspect…

I’ll give the name, and explain why, a little lower in this report.

But first…

2. Sandbagged by Symbotic

The plot has thickened considerably since I first flagged Symbotic last May, but nothing like this last episode, which caused the stock to implode. As I wrote at the time...

The quick rise and fall of Symbotic SYM 0.00%↑ is a reminder of the risk inherent in this market, and how a market driven by algos on “better-than-expected” results can miss the fine print, which despite the changes in market structure really matters. It’s a tale of this tape.

If you missed it, you can read my entire take here…

The stock bounced a bit subsequently, but then again – so have so many other heavily-shorted stocks.

3. Too Evasive For Comfort

Maybe you’ve seen me mention this in the past…

I’ve been playing around with a nifty new tool from Paragon Intel’s ManagementTrack that uses AI to spot evasion in earnings calls... and I’m pondering incorporating it as a regular “Too Evasive for Comfort” feature. While AI can’t replace human forensics – or can it? – it can certainly help short-cut the process of spotting deflection.

ManagementTrack takes it the next step by identifying outliers that are off their own baseline over the previous five quarters. In the process, it has created a database that can spot “predictive outliers,” which have proven to predict underperformance over the subsequent six months.

Paragon President Colby Howard told me that based on five year’s of data, it has a 60% hit rate.

The real trick is finding those that aren’t yet entirely “predictive” but whose stock prices are rising along with their evasiveness.

As you might guess, there is no shortage, but here are three that bear watching…