Super Wacky, Super Micro

This is for anybody who has more important things to do than hang out on social media.

(This is a free report to all subscribers. If you’re not yet among the growing number of premium subscribers to Herb On the Street and my Red Flag Alerts, and wonder why you should subscribe, I explain right here. My prices are going up January 1. And this reminder, I also post on Notes and Bluesky.)

This Super Micro SMCI 0.00%↑ story is a wild and wacky one, for sure…

Other than marveling at the rapid rise of its stock, and musing privately to myself when Ernst & Young resigned as its auditor a month ago with a few choice words – I was in Madrid at the time eating garlic shrimp and drinking vermouth – I hadn’t been watching the story closely.

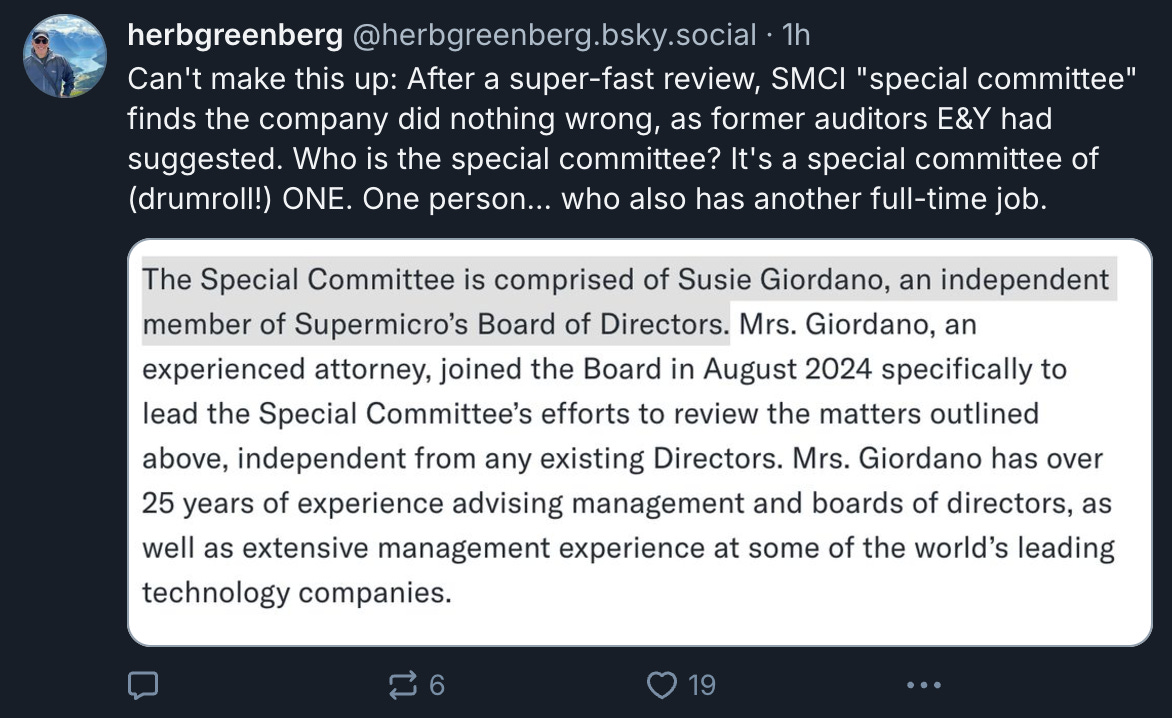

The resignation had led to an investigation by “an independent special committee.” This morning the company announced the committee’s investigation had been completed.

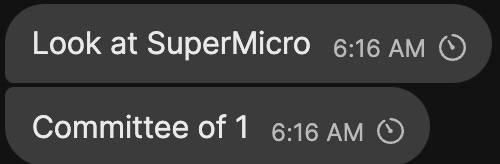

That’s when a friend pinged me saying only…

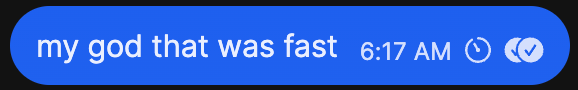

I responded…

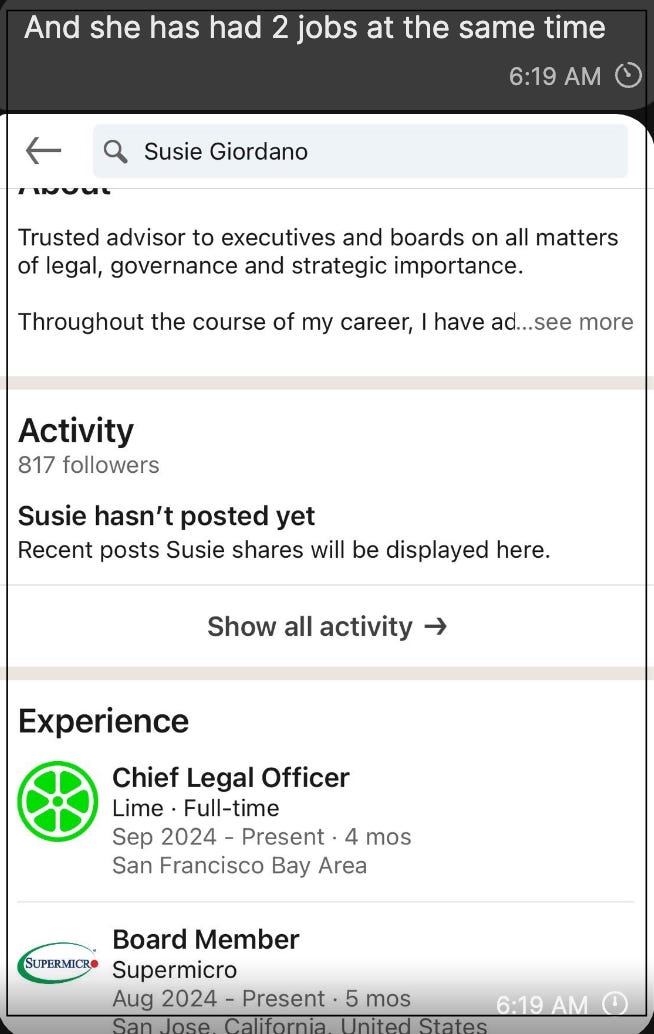

But he was pointing to the more compelling part of the story – not how fast the investigation had been, but that the independent special committee was one person:Susie Giordano, who had been named to Super Micro’s board in April. According to the press release, she – and only she – was “the independent special committee.”

He to me…

And it wasn’t even 6:30 yet here in San Diego…

Thankfully, I was already well-caffeinated. I quickly got up to speed, doing a quick run-through of the press release announcing that the company’’s “independent special committee” had “competed it’s review” of issues raised by E&Y.

I then posted…

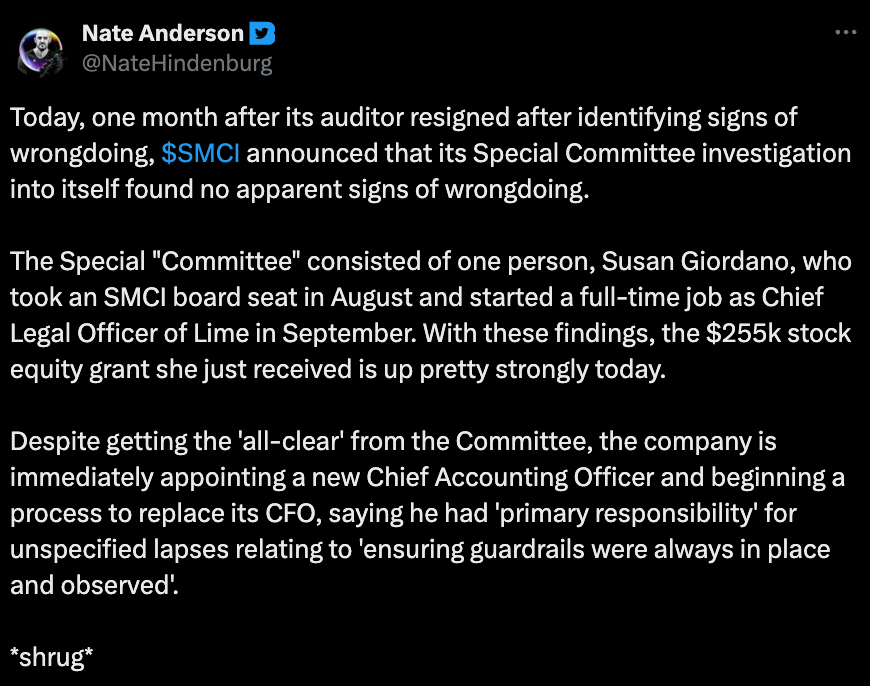

Nate Anderson of Hindenburg Research, whose own firm issued a report red-flagging accounting and other issues at Super Micro – and whose work is referred to in the report not by name, but as “a short-seller” – followed up shortly thereafter, posting…

Oh, but it gets better…

The kicker – or one of ‘em – is that one recommendation was to “appoint” a general counsel. Not a “new” general counsel, or “replace” the old general counsel but to appoint one.

As it turns out, or at least based on my review of the filings, Super Micro hasn’t had a full-time general counsel since 2018, when the prior GC – there for 11 years – retired.

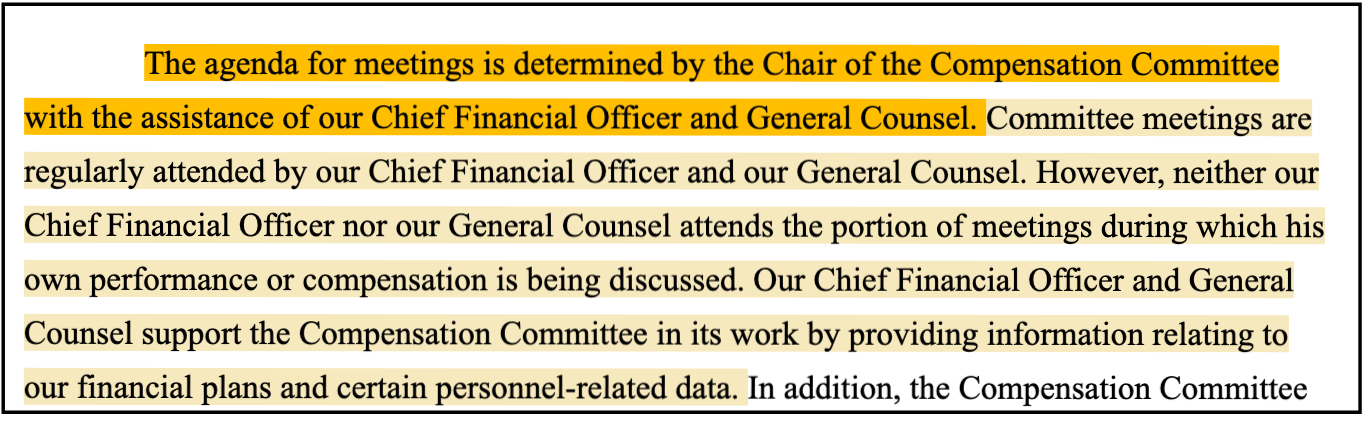

Instead, the company has relied on a “deputy” general counsel. Yet in its filings, it says…

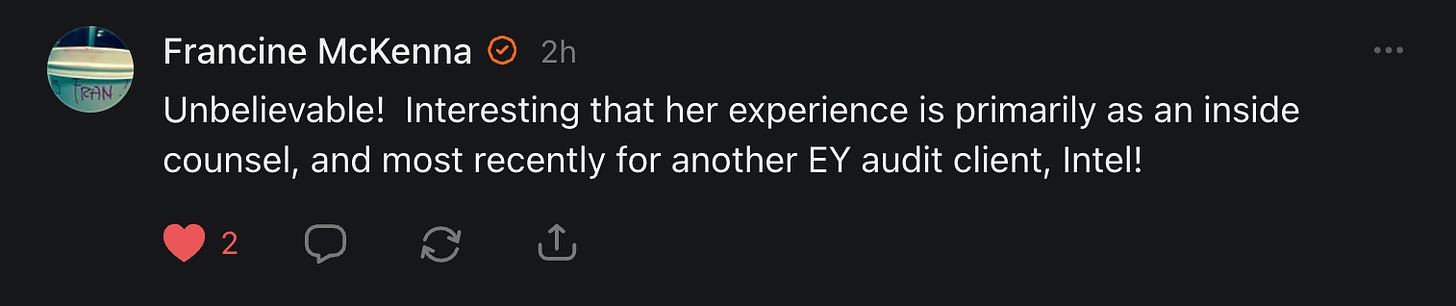

Which gets to one other point, as my friend Francine McKenna pointed out to me today In response to my comments on Notes. Francine, who writes The Dig on Substack, is the ultimate gadfly on all things accounting. She to me…

Not to worry: The findings were supported by the company’s outside counsel and an independent forensic firm hired by the board to oversee things.

Maybe there really was nothing untoward. Maybe the former auditors, who questioned the integrity and commitment of senior management and the board’s audit committee to ensure accurate financial statements, were a bunch of inexperienced rubes… and simply misread the filings and the room.

As for Hindenburg’s report: I mean - they’re short the stock. They say so themselves at the tippy-top of their full write-up. Would you believe somebody who is obviously biased and obviously wants is betting on the stock to fall?

Here’s what I know: This story isn’t over yet.

And that’s coming from me. And yes, I am a committee of one.

If you liked this please click the heart button below and feel free to share it with friends. And consider supporting my work by becoming a premium subscriber.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

I can be reached at herb@herbgreenberg.com.