Symbotic – The Plot Thickens

Beyond a salacious short-seller's report is simple earnings quality

(This friendly reminder: My Red Flag Alerts and selected On the Street content are no longer free. But while the paint is still drying on my paywall, my introductory price remains the same. For more info, here’s more about my decision to go paid, and what to expect from my Red Flag Alerts.)

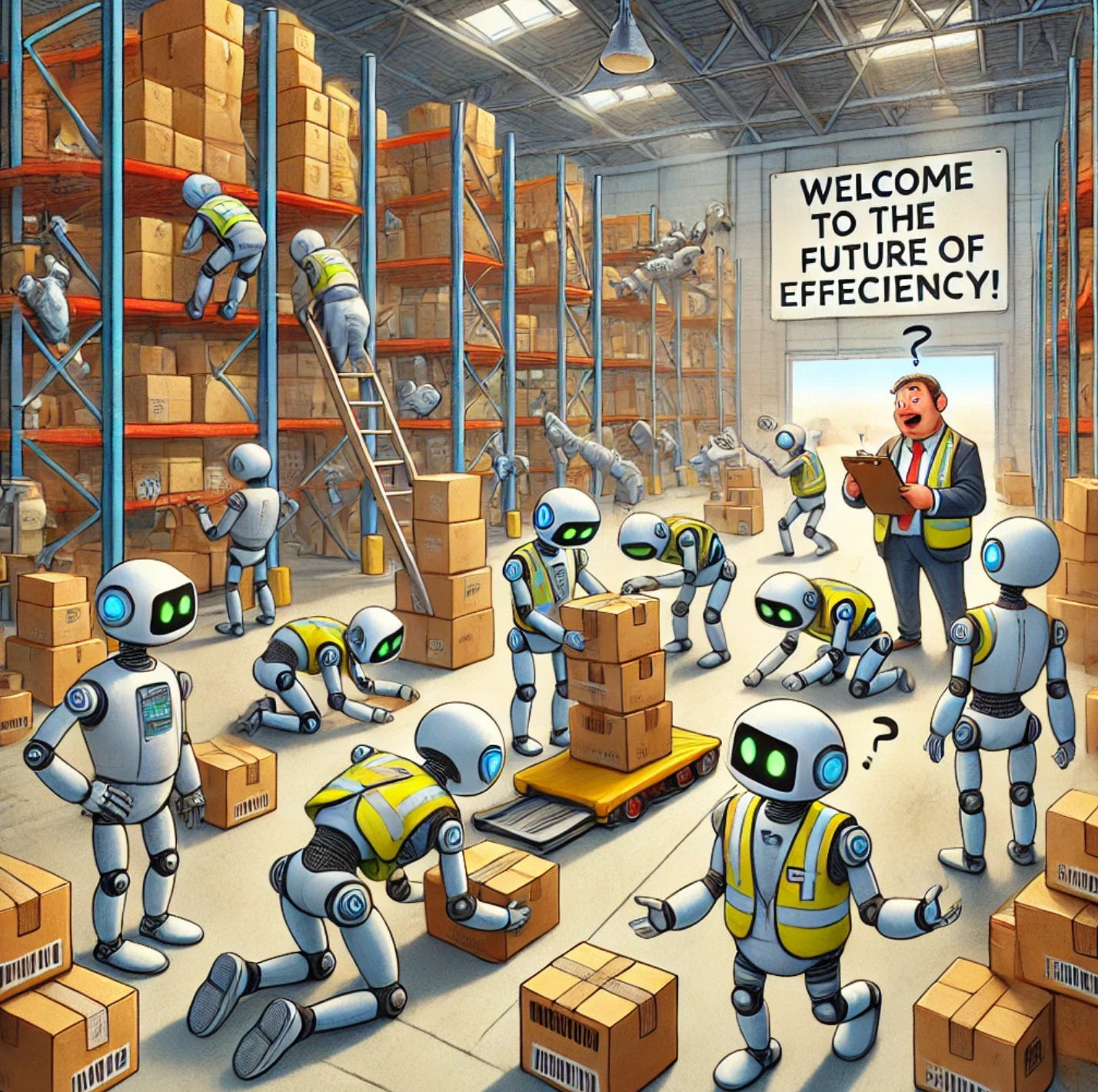

Symbotic, which makes warehouse automation systems, has lost more than half its value since I wrote my “hiding in the open” report on the company last May.

As it turns out, there’s more… much, much more.

Symbotic’s SYM 0.00%↑ stock took a greater hit today after an 80-page investigative report written by an anonymous shortseller started making the rounds. Headlined, “SYM’thing isn’t Right,” it made what I wrote look like a Cliff’s Notes version of a Cliff’s Notes version.

But a big part of the broader decline, since my report, occurred after the company’s latest earnings report at the tail-end of July.

As I do from time to time, I asked my friends Bill Whiteside and Jeff Middleswart of A Peek Behind the Numbers to take a peek at the company’s earnings quality.

‘Shocked’ by Low Short Interest

That’s their speciality, and after they did, they came back with the kind of response I hadn’t expected...

We are shocked that short interest is only 12%.

The comment had nothing to do with anything the short-seller found – they actually did their work earlier this week – but everything with the company’s earnings quality.

Top of their list was the amount the company is spending on R&D. As Bill and Jeff told me…