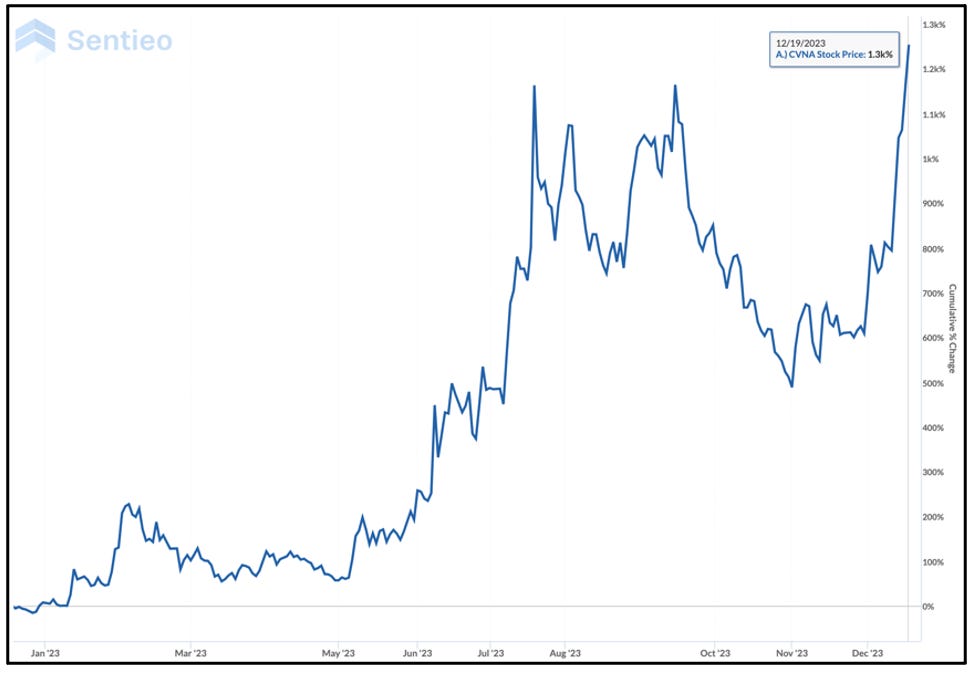

There’s no getting around that this has been quite a year for Carvana (CVNA)...

The used car dealer, perhaps best known for its car “vending machines,” went from near death to being one of if not the best-performing of all stocks in 2023.

The big question is the obvious: Is it out of the woods? My friend Fil Zucchi, who writes Fil’s Randoms of the Markets on Substack, has a thought or two. In a post headlined, “Carvana Reality Check”, he wrote (with mild editing by me):

I was going to write this post a while ago, but with Carvana’s (CVNA) stock getting squeezed hard, right now it’s probably an even better time.

CVNA first squeeze back in July came on the heels of a debt restructuring, which according to the company “slashed $1.3b of debt”.

With more than 35% of the float short, it mattered not that the restructuring did nothing of the sort. What it did do, was literally to 1) mortgage the company into oblivion 2) jack up the interest rate the company has to pay, and 3) not reduce at all the principal amount it almost certainly will owe.

The first two items are easy to see from the company’s cheery press releases: the old unsecured bonds have been exchanged for first lien debt, and the cash coupon rates went from about 5% to 9%.

But the real kick-in-the-ass is that the company has the “option” to pay-in-kind the interest for the first two years at an average PIK rate of 13%. If the company chooses that “option” (perhaps because there are few scenarios in which it will be able to make cash interest payments), the accrued PIK interest over the two years will be just about the $1.3b the company is so happy to have “reduced”.

Now comes the hard part: what do they do for an encore? Fil will be the first to say he doesn’t know, but looking at the stock’s technicals, he adds...

Many smart twitter chartists have kept me from shorting the stock for the last several months, but with many shorts already torched, stiff resistance levels in the $55 zone, and DeMark upside exhaustion levels 2-3 weeks away from completing, the flip of the calendar to the new year might prove just too tempting.

On paper, at least!

SPACtacular

Moving on…

If you missed it, the Wall Street Journal ran a story yesterday about EV startups that are running out of cash. It noted that most had gone public via a SPAC. That got me wondering about the status of the 2023 class of SPACs...

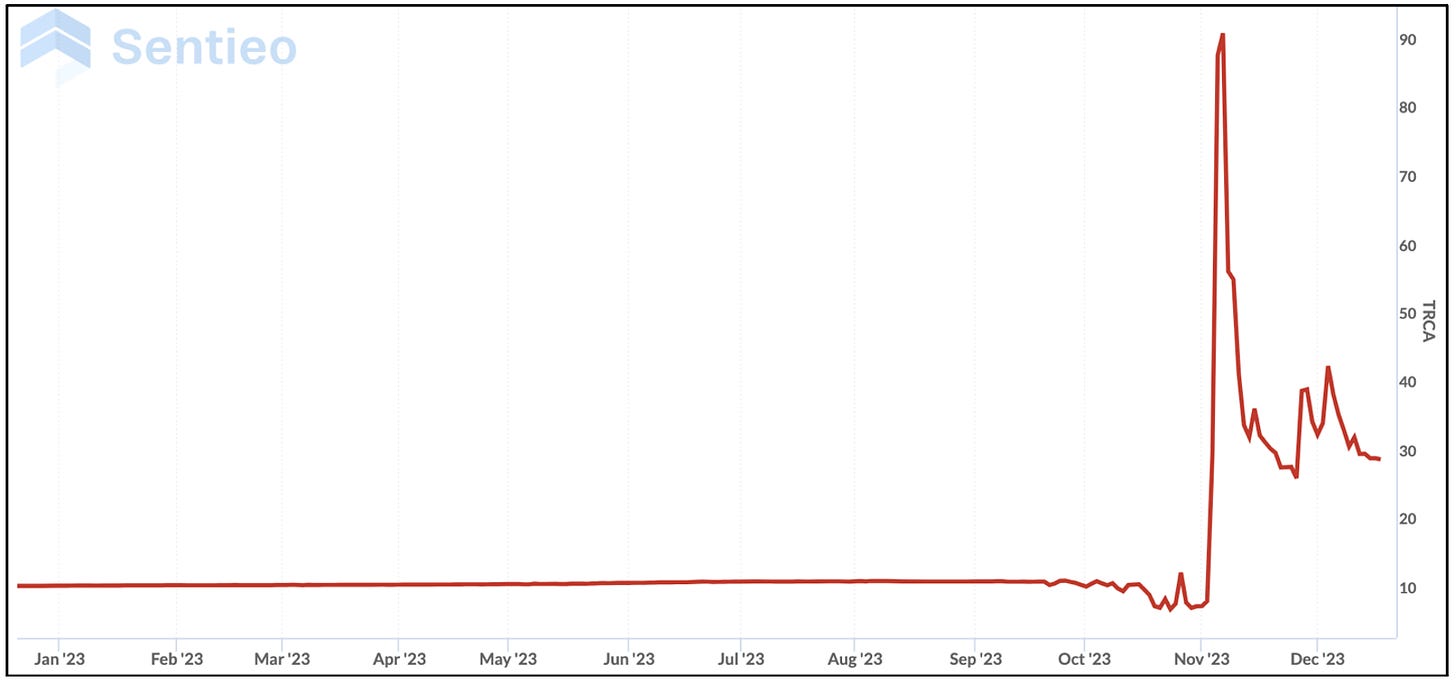

The best known, of course, is likely VinFast (VFS), the Vietnamese EV maker that spun out of a Vietnamese conglomerate, which in the span of days shot from around $10 into the 80s, before crashing back below where it started.

Eyeballing the numbers on Spactrack, it appears that 87 companies went public this year via a SPAC. Of those, eight are still above their $10 IPO price and only two are not in the 10s... and one is much higher, nearly $30.

As is often the case, when something is that far off the baseline, there’s more to the story...

That company, Carbon Revolution PLC (CREV), went public in November – a full year after striking a merger deal with the original SPAC, Twin Ridge Capital Investment Corp. (TRCA).

Flawed Structure

I had never heard of Carbon Revolution before, but decided to dig in...

As expected, there’s a saga, and it’s a reminder of just how flawed the SPAC structure is, especially when there are so many companies chasing so few deals, with a deadline to find a partner.

In this case, Twin Ridge was formed as the SPAC market peaked in early 2021. It was led by the late Dale Morrison, former CEO of Campbell Soup Co., with executives and advisors from the food and consumer products industry, including the former CEOs of Sysco, Kellogg, Newell.

According to its early SEC filings, its strategy was to “identify, acquire and build a company in the consumer or distribution sector that complements the experience of our management team, Industry Advisors and directors and that can benefit from their collective operational experience of over 200 years.” It went on to say....

We will evaluate a broad range of targets across all segments of the consumer and distribution industries including, without limiting our scope, businesses that focus on the food, food distribution, and other food-related industries.

But when it came time to do a deal, the target had nothing to do with food, and nothing to do with distribution...

Instead, Carbon Revolution, which was trading for pennies in Australia, manufactures carbon fiber wheels for cars. It has 650 employees.

What’s more, it’s based in Australia, domiciled in Ireland... and trades in the U.S. Even with the reverse split, it’s highly illiquid. (A menagerie of red flags, if there ever was one! But I digress...)

A scan through its investor presentation shows rapidly rising sales. Just this week the company announced that its backlog “has more than doubled...to $730 million.”

Sounds good, until you scan through the 43 pages of “risk factors”...

Not only is the company profitless, but it’s hanging by a “going concern” thread, given its dire needs to raise additional cash. Or as it says at the end of its very first word of warning (emphasis added)....

Based on the factors above, a material uncertainty exists which may cast significant doubt as to whether the Company will continue as a going concern and therefore whether they will realize their assets and discharge their liabilities in the normal course of business and at the amounts stated in the financial statements.

You always have to wonder, especially if a company goes public via a SPAC now rather than an IPO...why?

With Carbon Revolution, now we know.

P.S.: Just before going public in the U.S., the company added 91-year-old legendary auto exec, Bob Lutz, to its board. Lutz knows more than most people have forgotten about autos, and maybe he sees something here. But if investors have learned nothing else it should be that high-profile board members guarantee nothing more than the company was able to lure in a big name. And Lutz, while bigger than big in the auto world, doesn’t always get it right. After all, 21 years ago he was chairman of Exide Technologies when it filed for bankruptcy.

Sign-O-The-Times

Finally, this just in, courtesy of Reuters (emphasis added)…

ProShares expects to launch an exchange-traded fund (ETF) Wednesday that uses the short-dated options commonly referred to as "zero days to expiry" on the Standard & Poor's 500 index.

The fund's goal is to offer investors both the additional income that traditional options contracts may sacrifice, as well as upside potential should the stock market extend its rally.

This is actually just the latest in a growing number of various types of “covered call” options ETFs being rolled out. As Reuters wrote…

Such covered call strategies are not a new phenomenon. For decades, investors, financial advisors and money managers have written options on securities they hold in order to earn premium income.

But it’s this line that caught my attention, quoting a ProShares exec…

ProShares hopes to deliver more of the stock market's upside than either a monthly-based options expiry strategy or than one based on put options may offer…

Or as my pal Ben Brey of Deductive Capital and

puts it…Give the people what they want.

Indeed, and right now as MyLongbow’s Doomsday Dozen Fear/Greed index shows, they’re as greedy as ever…

Buyer, beware.

If you liked this, please click the heart button below… and comments are open!

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Threads @herbgreenberg.

CREV's trading is just a product of it's float. There are only 50k shares. You'll notice it's warrants, currently $15 ITM are trading at 5c.

Great advice – as usual – but two “unfortunately” come to mind.

The first, I’m sure you’re very much aware of: There is a huge amount of “ego” involved with “active investing”! Consequently, receiving good advice is one thing; taking that good advice is a whole other matter!!

The second, most of the “investment community” isn’t aware of (and it isn’t to the advantage of those that are to have the matter discussed, because it just might interfere with the advantage they take of the knowledge): Only approximately 2% of individuals with brokerage accounts are “active investors” and can actually read and understand their brokerage statements and have actually ever – at least one-time – completed the keystrokes to accomplish a buy or sell transaction with their brokerage account!!!

I’m in my 80s and I just learned this accidentally, about 8 years ago, when I created a group of 400+ (of what I thought would be “active investors” like me, from a community of 18,000 senior residents). The group’s intended purpose was “active investment” education and “discussion”. Until the Covid shut-down, thirty-eight well attended 1.5-hour monthly programs (95% began with one of The Great Courses 30-minute videos, and a handout summary). The “discussion” part was the tough part. It eventually became clear that, although the attendees had brokerage accounts, someone else was doing all the activity involved with 98% of those accounts!

A conclusion I was able to confirm, because, from time to time (after the formal program) a few would come up to ask me a question. Usually, their questions were so uninformed that I would suggest they bring the appropriate brokerage statement to the next meeting, so that I could better respond.

Looking, one-on-one, at their brokerage statements made it very clear almost no one could read their statements, and no one had done any of the transactions! They really were attending the meetings so that they could, probably, sleep better, feeling that they had been responsible about their investments by coming to a program about investing, independent of their advisor or broker!!

Think my 2% active, versus 98% uninformed is an exaggeration? Consider the claim of the American Association of Individual Investors: since its founding in 1978 “AAII has educated over two million investors”. Now divide that number by the hundreds of million individual brokerage accounts that were created over the same timeframe (because FINRA estimates that approximately one-third of “US Adults” have at least one brokerage account).

Herb, don’t misunderstand the above, you’re doing a great job of trying to help – keep it up!