Talking SVV and HIMS... and Biotech

Hims remains well above where it was when I first flagged it, but red flags fly higher than ever. SVV - how low will it go?

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

This quick note…

First…

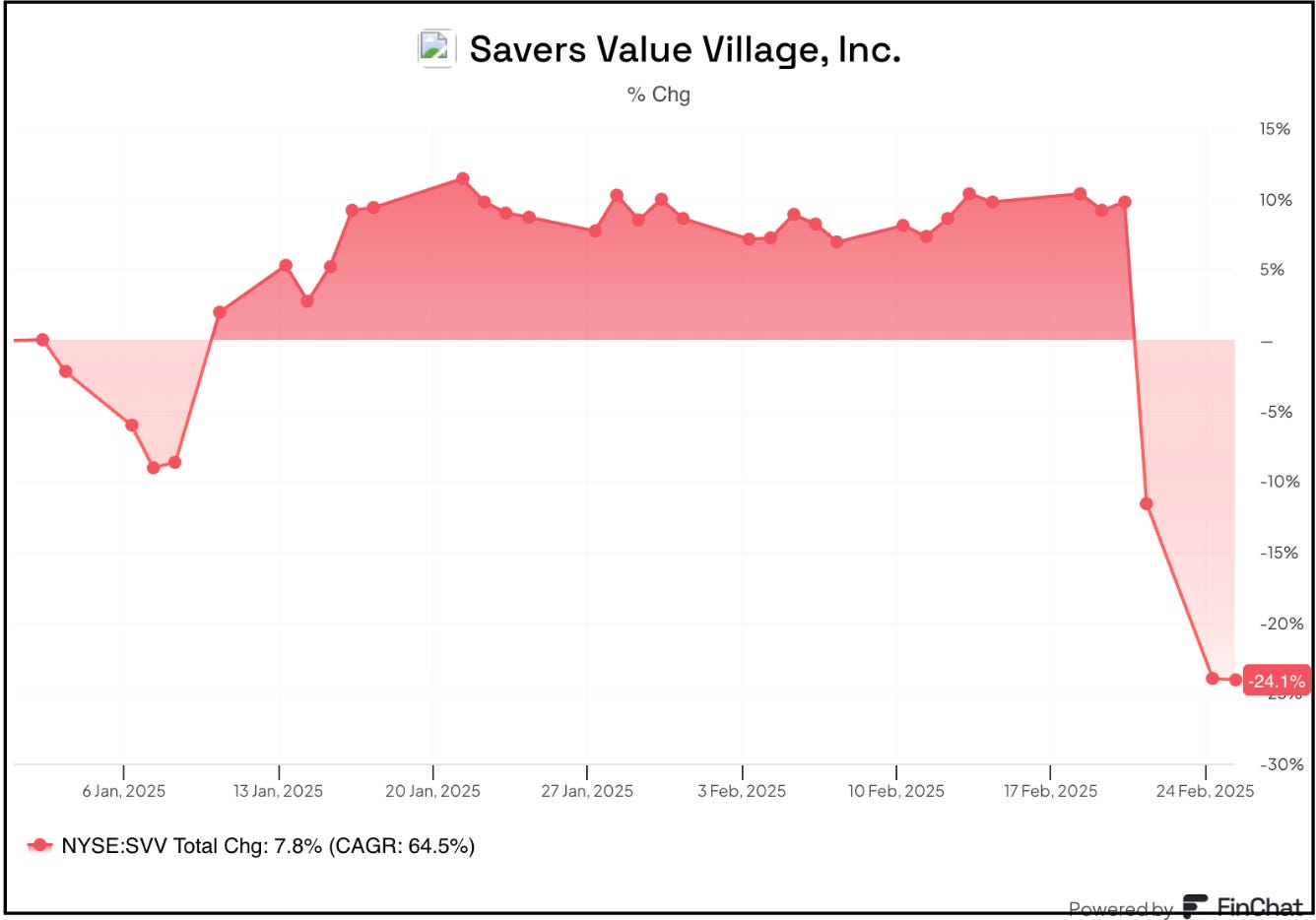

For premium subscribers: If you missed my note Saturday on Saver’s Value Village SVV 0.00%↑, the best commentary was after the paywall. It may explain, in part, why the stock took quite a tumble yesterday and why, as I mentioned, short-sellers were adding to their positions after the Q4 earnings. You can read it here.

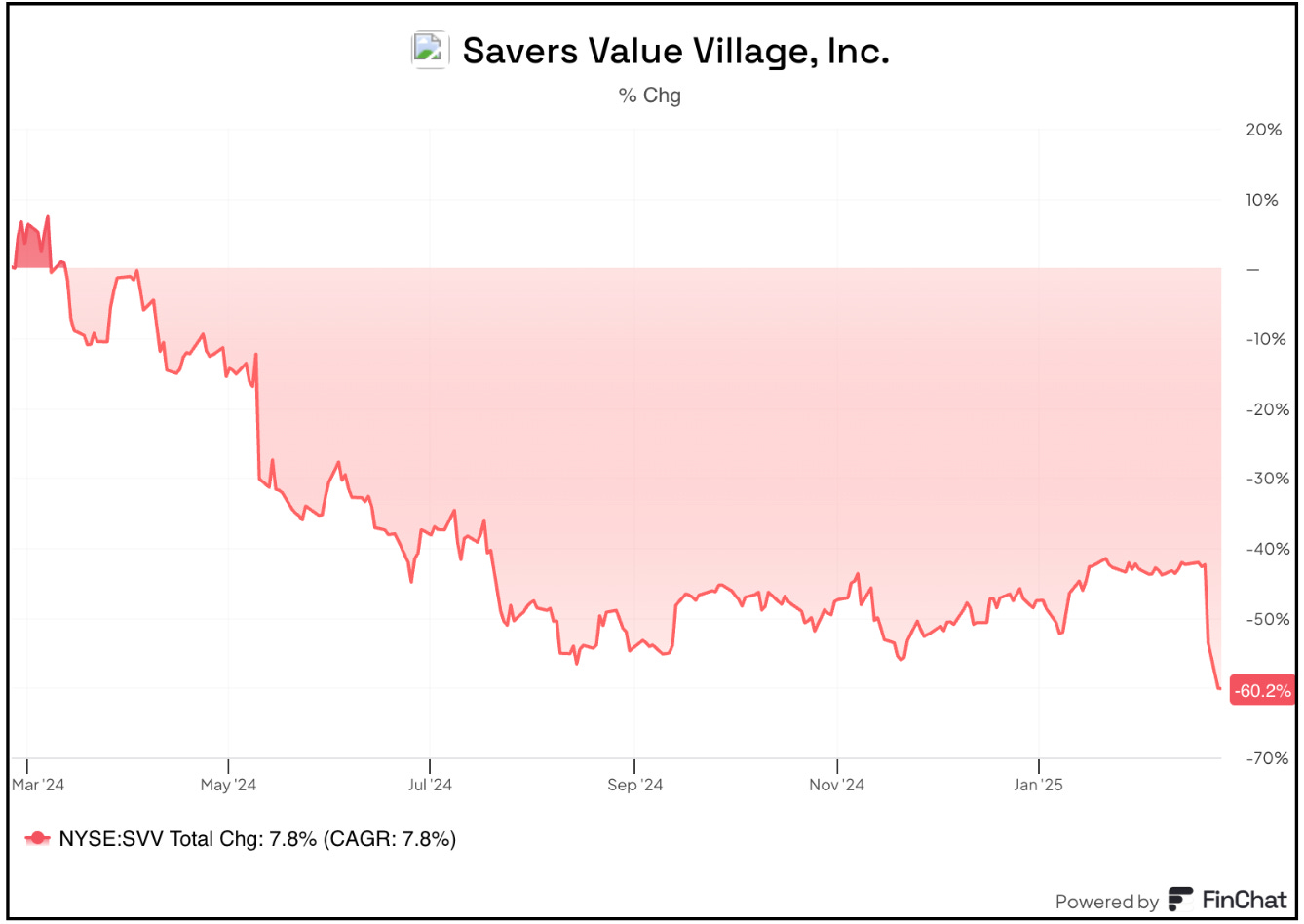

I originally wrote about Savers with the insight of my friend, Katherine Spurlock, herself a “thrifter”, on on March 3 of last year. Here’s a look at its stock over one year…

Or a better view, the drawdown…

And over the past month…

Second…

If you missed my generally positive take on biotech, you can read it here. But it got me thinking: With SO many vacant biotech buildings and so much empty lab space in San Diego, Boston and even San Francisco, which banks are most exposed - and SAY so in their filings? Feel free to DM me. Or comment at the bottom, if you’re a paying sub.

Third, and finally…

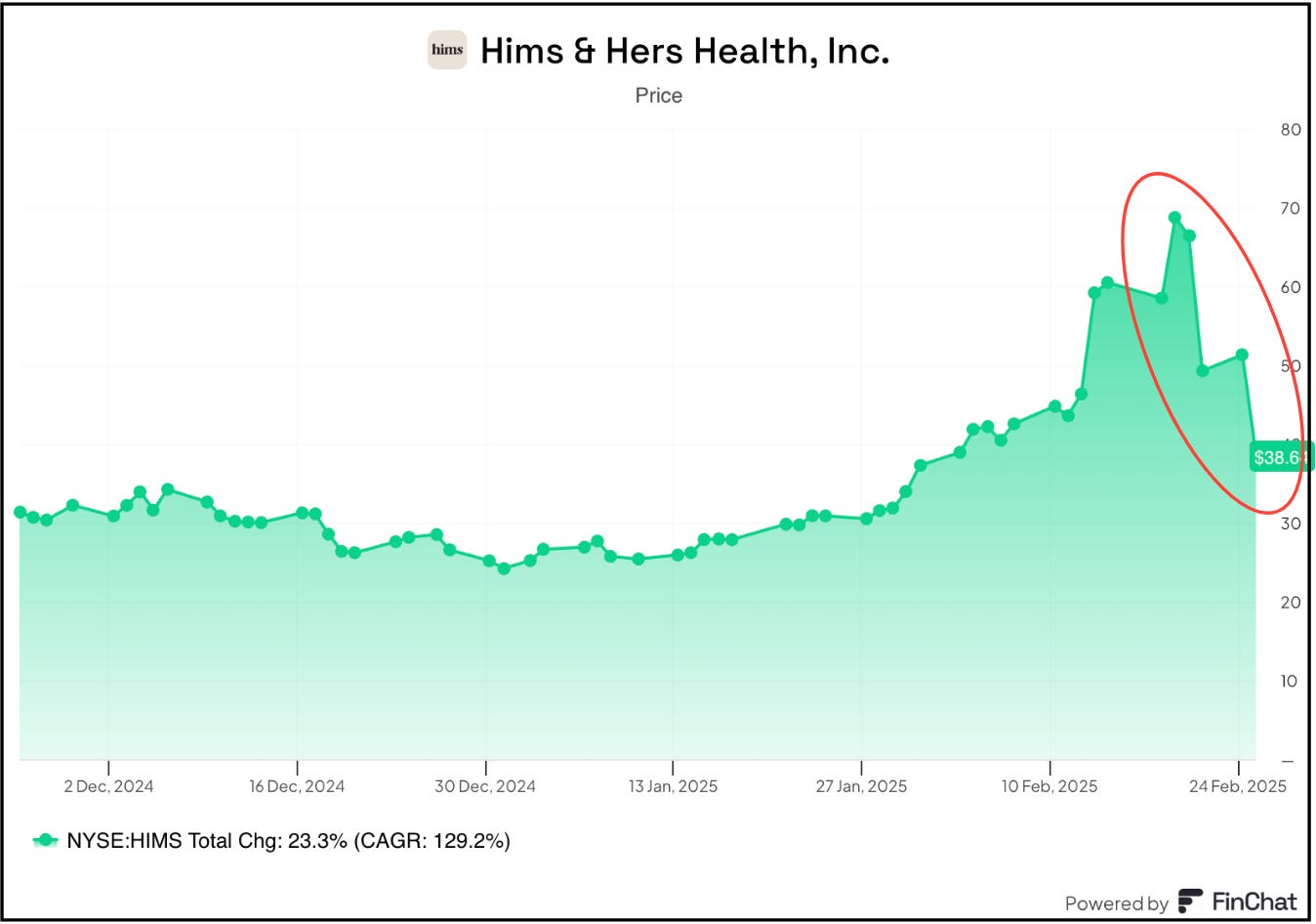

You just knew that Hims & Hers HIMS 0.00%↑ was headed for a cliff when it reported Q4 results the other day when CEO Andrew Dudhum posted this on social media over the weekend…

I put that one in the category I like to call, “if you knew nothing else"…”

This was an obvious effort to marshall a mob. Except… if everything is great there should be no need, because the fundamentals are the fundamentals. And as I wrote the other day, a company can’t be bailed out by a short squeeze. And investors shouldn’t confuse their own perceived genius with a stock rising into one, especially if the fundamentals lurking beneath are deteriorating. With a company valued as a growth stock, the one fundamental that counts most is… accelerating growth.

And while the headline numbers are clearly impressive, with growth companies like these they need to be blowout – certainly well above even management’s ambitious expectations.

They weren’t. After listening to the Hims earnings call, I have a few r thoughts. I’m sure Paul Cerro at

will go deeper, but my quick take…