The Bigger Mania: Blockchain or AI? Plus a Walk Down AI Memory Lane

I’m from the school of thought that “every picture tells a story...”

I wish I had included the charts and screenshots I’m about to show you in something I wrote earlier this week on the mania surrounding artificial intelligence (“AI”).

As is often the case, I didn’t think about it until after that piece was published.

But if nothing else, the charts help put this current mania in perspective. That’s especially true now that every company is jumping on the AI bandwagon, which leads to the questions: Which companies are really plays on AI… And when will we reach peak AI?

I actually had fun with that the other night on CNBC’s Last Call, where host Brian Sullivan asked the question about who is and who isn’t AI. (You can see the clip here.)

I have my own way of looking at it, which I talked about on the show...

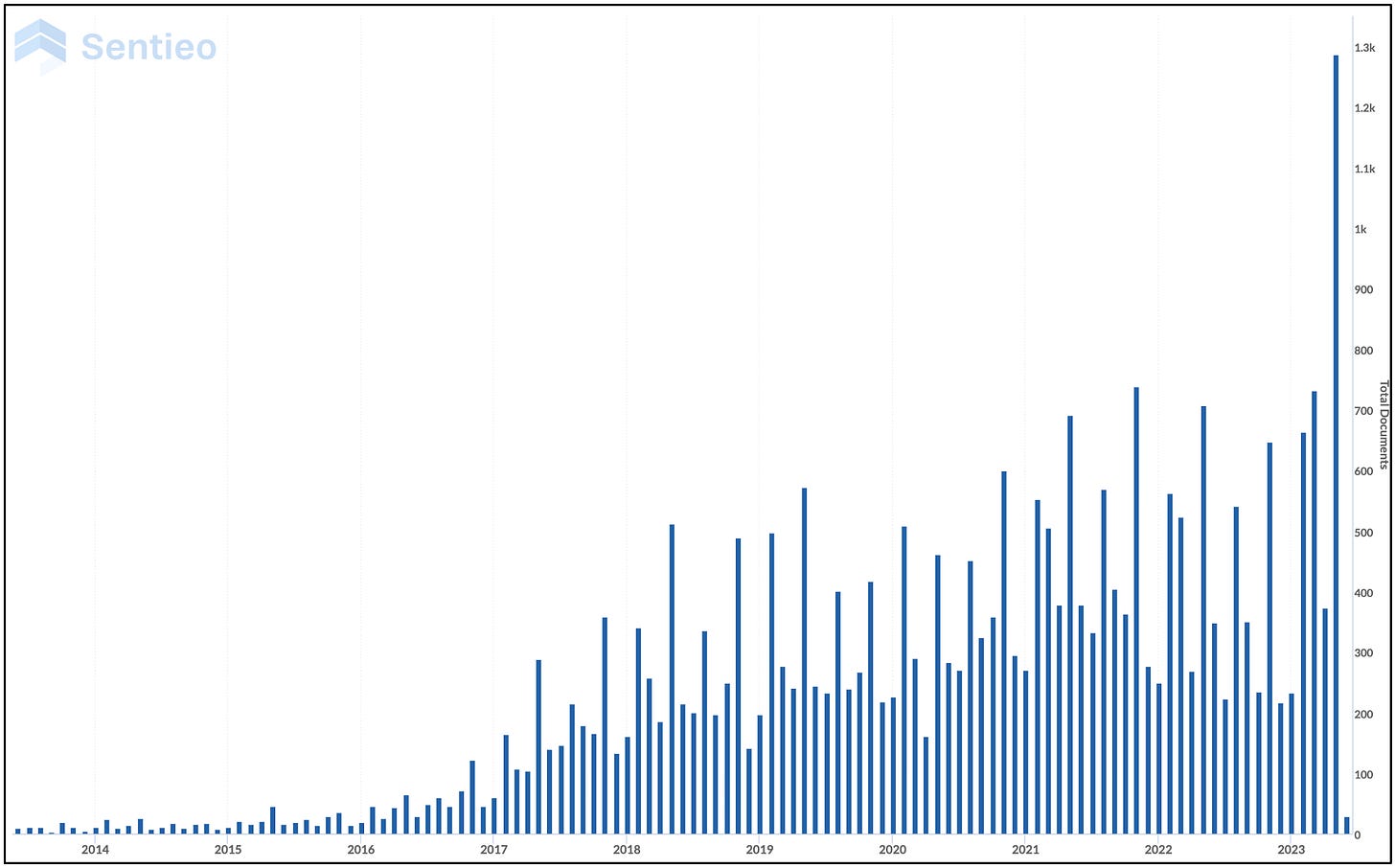

I like to go back and see how often companies mentioned AI in their SEC filings and on earnings calls in recent years.

The filings indicate what role AI officially played. The earnings transcripts reflect the true mania and hype... because that’s where it really becomes part of the conversation.

The chart below reflects mentions of either AI or artificial intelligence mentions in filings going back 10 years. As you can see, it started to perk up in 2019 and 2020 and peaked in 2021, with a resurgence starting this year.

Now let’s look at earnings call and investment conference transcripts....

That’s the real story. It’s as if last quarter everybody woke up. If you didn’t know better we were at peak AI.

For a clue on how this might go, I compared it with mentions of the blockchain.

First, here’s a chart showing mentions from the filings...

And here's one from the transcripts...

Beyond the fact that AI is mentioned in far more filings and transcripts, I’ll leave the interpretation up to you. But given the velocity of its rise, I’m guessing that with AI we’re not quite there... certainly not yet, at least..

There is no question that spending on AI, especially generative-AI, is in an explosive phase. But for most companies, AI very well may be more of an expense and an add-on rather than a revenue generator...as it has already been woven into so many businesses and products

And for those that are generating revenue, there’s the other question: If things are moving this fast – especially with generative-AI applications like chatbots – will we hit the “all in” moment, as I call it, faster than prior booms? By “all in” I’m talking the point of maturity and saturation.

But keep in mind, as I and others have been saying, AI isn’t new and it’s been the holy grail for investors and tech for decades.

Let’s take a quick trip down memory lane...

AI has been around since the 1950s, but didn’t really start to gain attention until Japan rolled out its so-called “Fifth Generation” project in 1982. As this story in the New York Times put it…

Computers imbued with such "artificial intelligence" could be used to diagnose diseases, analyze lawsuits and understand language.

Sound familiar? Well, it went nowhere, and as the story written in 1992 went on to explain…

The Fifth Generation effort did not yield the breakthroughs to make machines truly intelligent, something that probably could never have realistically been expected anyway. Yet the project did succeed in developing prototype computers that can perform some reasoning functions at high speeds, in part by employing up to 1,000 processors in parallel. The project also developed basic software to control and program such computers. Experts here said that some of these achievements were technically impressive.

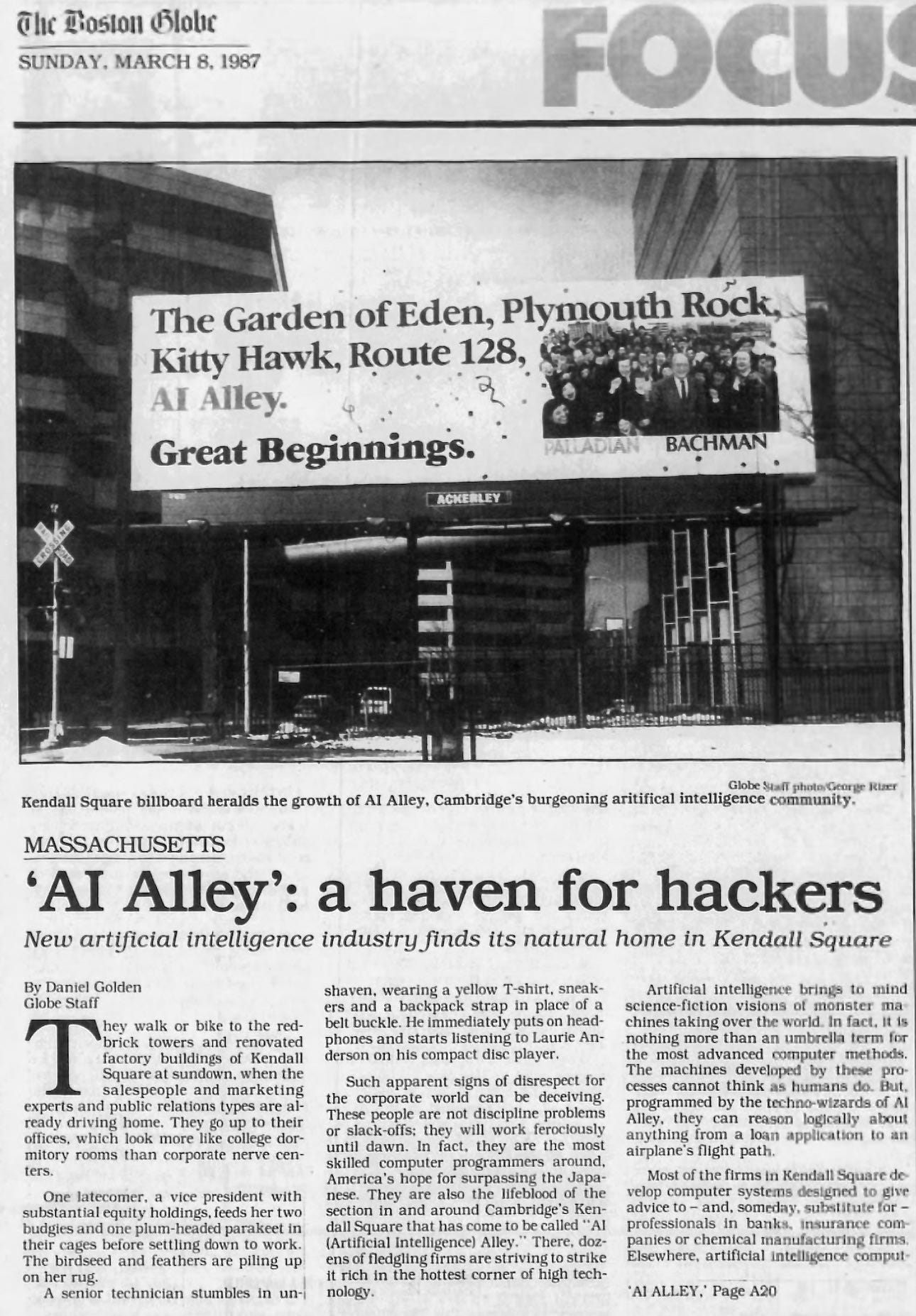

By the late 1980s, thanks to its proximity to the Massachusetts Institute of Technology, Boston became and AI mecca, with what became known as “AI Alley.”

Then, in the 1980s, IBM (IBM) developed a supercomputer known as "Deep Blue," which famously beat chess grandmaster Garry Kasparov in 1997.

That clearly caught the attention of investors. Within a year, AI was plastered on magazine covers such as in Forbes, which proclaimed, "Artificial Intelligence Gets Real" in reference to a story headlined "The New Face of Artificial Intelligence."

The focus of the story was a company called pcOrder.com, which went public a few months later…

But like so many other hot IPOs, shares of pcOrder went very cold very fast.

What happened? I asked Google’s Bard chatbot, but it feigned ignorance...

I'm not able to help with that, as I'm only a language model.

I then asked ChatGPT via Microsoft’s Bing, and – bingo....

pcorder.com was a company that provided e-commerce software solutions for businesses. The company was founded in 1996 and went public in 1999. In 2002, pcorder.com was acquired by Trilogy Software Inc. and became part of its enterprise software division. According to Crunchbase, pcorder.com is now closed. I hope this helps!

It wound up getting acquired by another company and while ChatGPT says the company is closed, I was told the founder bought it back. It’s unclear what happened after that.

Since then, there have been plenty of waves of mini AI manias, including 2019, when there were plenty of stories trying to poke holes in the hype du jour. Even Advertising Age – yes, Advertising Age – got into the act with a story headlined…

That brings us to where we are today...

There’s no question that this time AI has evolved at supersonic speeds, especially with generative AI and the impact it has had on coders. If you let your mind wander you can make a strong case that it’s the stuff of the scariest science fiction, except that it’s real.

As my pal Paul Kedrosky, of SK Ventures, an MIT fellow who is embroiled in all of this told me...

It now works in general applications for normal people on things we don't understand and haven't coded it to do.

At least not yet, which is where scary turns to frightening.

But since I'm about to head out on vacation for a few weeks, I think I'll leave talk of Armageddon until I get back. Besides... by then, Wall Street very well may have moved on from AI. Unless, of course, it hasn't.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter @herbgreenberg. Oh, and feel free to subscribe!