The Hype, Hope, and Reality of AI

Careful about conflating the stocks with the technology

There's no question that AI has been and will continue to impact much of what we do and how we do it...

It's still early innings, as they say...

Yet Wall Street being Wall Street, there's a tendency to lump everything together – creating a fear of missing out – and then overdo it.

Like AI, as if it's something new.

It's not. "Old AI," as you might call it, has been around and evolving for decades. As one friend who is a longtime observer and investor of the tech investing scene puts it...

There is the AI you don't see, but that has been in production for years... the "IT infrastructure stuff," for lack of a better term. That has been proceeding at a standard evolutionary tech pace.

Largely without fanfare, old AI has been organically integrated into all aspects of whatever industry you can think of. Think of it as a key component automation.

What is new is generative AI – chatbots like ChatGPT from OpenAI and Bard from Alphabet's (GOOGL) Google...

As my tech-savvy friend explained...

[Generative AI] showed up out of nowhere when the public beta started... and has been evolving and organically integrated into various aspects of our lives for many years.

This gets us to where we are now: in his words, "the mania phase."

You know you're there because "suddenly everything is AI all of a sudden," seemingly all the time... much of it what he calls "fake AI."

As he goes on to observe...

I have investments in three startups. Three years ago they were all business or software companies. Now they are all "AI." Same for every public company that reports and says "AI" 50 times. And Goldman Sachs calling Walgreen an AI winner!

That's always the sign of a frenzy...

This frenzy has one other element, which makes it different among stock market frenzies: Among public companies, the number of true AI companies is tiny... currently a highly concentrated group, which is led by Alphabet, Nvidia (NVDA), and Microsoft (MSFT). When chipmaker ARM goes public next week, it will be part of that group, too.

This past February, in fact, I recommended Microsoft in my Empire Real Wealth newsletter, saying that AI would drive what I called "the third coming of Microsoft." (Subscribers who followed my advice are up 32% so far.)

Beyond those soon to be four, and arguably just a few others – including Amazon (AMZN), Meta Platforms (META), and Apple (AAPL) – there's a wide gap because most other companies are their customers. And for them, as another friend explains, it's "a cost-out" technology, which helps companies cut costs. (Translation, people.)

Just because a company uses the technology doesn't make it an AI company. In fact, in Empire Real Wealth, I recently identified two that I refer to as "stealth" AI companies. That's because they're using proprietary AI to vastly improve their products, such as medical imaging... or they have something, like data, which the chatbots need to get themselves to the next level. (If you aren't already an Empire Real Wealth subscriber, you can find out how to gain access to these recommendations right here.)

Even then – it's one thing to have the technology, it's another to build a business around it...

Or as the Wall Street Journal recently pointed out, even venture capitalists – eager to invest in generative AI – are challenged to connect the two.

Generative AI is at such an early stage that Sunil Dhaliwal, a general partner at Amplify Partners, which is an active investor in AI startups, told the Journal...

We've moved from a moment of "How big can this be?" to "How do we make it work?"

The story also quoted Frank Slootman, of the data storage company Snowflake (SNOW), as saying...

We cannot sort of unleash AI and have no business model to pay for it.

The Journal went on to quote John Luttig, an investor at Founders Fund – a longtime investor in AI – as saying that "there is a ton of VC propaganda" about the investment potential in AI. As he added...

It's an unequivocal optimism without asking any of the hard questions on product, user interface, distribution, or end markets.

Put another way, generative AI – with all its bells, whistles, potentials, and pitfalls – is a technology still in search of a business...

Lots of companies are testing it, but it's too early to say how many will implement it... and if they do, to what extent.

For example, earlier this summer I received an e-mail from Mercedes asking if I wanted to join its "beta" testing program of integrating ChatGPT into infotainment systems. I jumped at the chance... but have heard nothing since then. When I try to use it, the current system seems to respond the way it always has – routing me to some place 3,000 miles away.

More broadly, you can see all of this in the numbers, with visits to ChatGPT and similar services starting to slide. That's confirmed by Google Trends, which tracks search terms...

Now that seemingly everybody has played with it, almost as if it's a toy, they're getting back to their old habits... except where generative AI makes a difference.

And for most of us, it has happened in less than a year...

For example, I like to ask questions (an occupational hazard of spending decades as a journalist!) so now I use Google's Bard search tool – which lets me seek an answer – as part of my regular search process. If nothing else, it's a jump start to deeper digging. (Accuracy remains an issue.)

I've also used ChatGPT for brainstorming purposes, and I use generative AI (mostly the free version of DALL-E via Microsoft's Bing) to illustrate many essays I write on Substack and LinkedIn.

And that brings me to one last point...

It's almost as if what generative AI spits out has risen to a level of mediocrity, where everything is starting to look and sound alike...

Or as Paul Kedrosky and Eric Norlin of SK Ventures mention in a recent report, we've hit that point where, in their words, "AI isn't good enough."

It's at the point where they believe "we are at the tail end of the first wave of large language model-based AI," which will likely end "in the next year or two with the kinds of limits people are running up against." They went on to say...

It ends partly because of constraints inherent in the current approach, but also because of technological and cost limits related to training models, whether wide or narrow.

This wave has been terrific for a few companies, especially Nvidia, but it will be thought of in the future as mostly about piping the AI house, at most.

The key component of this current wave is that it is characterized by scarcity – training data, models, chips, and AI engineers – and the accompanying high costs that scarcity brings.

Bottom line of all this...

As with all technological revolutions and evolutions, this one has combined hype, hope, and reality.

There's a fine line between each – with investors often buying on the hype, convincing themselves they're right with hope and then being hit by reality.

For AI, the reality is that the promise of the technology is very real but for investors so is the ongoing risk.

There's an important distinction between the two that often gets lost in all the noise.

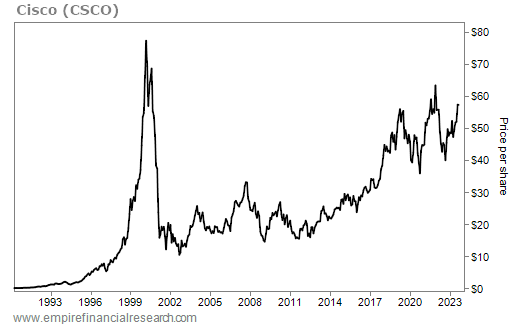

What nobody knows this time around will, say, Nvidia be the AI version of Cisco – the poster child of the ultimate in excess valuations during the dot-com bubble? As the chart below shows, it has taken Cisco more than 20 years to get within a stone's throw of its dot-com bubble highs...

Then again, will Nvidia instead go on to be the one we wished we had all bought... even here?

What I do know is this: I’m not smart enough to know, and neither is anybody else when it comes to where Nvidia is headed.

It’s one thing to assume during the pandemic that Zoom’s valuation might not be sustainable; it’s harder with Nvidia, where there very well could have been a pull-forward of billions of dollars in revenue, that could crimp future sales growth. Or not… or whether there is a new wave of demand that hasn’t hit yet. These are the kinds of questions investors need to ask.

And that’s not even taking into account chatter on social media of potentially nefarious activity, which may or may not amount to anything.

There's something else...

During the dot-com bubble, I had something I called the Greenberg Garbage Index™. It was right up there with my Hostile React-O-Meter™, which I would roll out whenever I dared poke holes in whatever the equivalent of a meme stock was back then. (I still rev it up every now and then.)

The Garbage Index was for the real garbage out there that somehow was getting swept up in the latest retail-driven euphoria… usually little stocks with big market values. Back then it was message boards. Today its the meme stock crowd.

Maybe it's time to dust off the Garbage Index, too...

If this upcoming ARM initial public offering ("IPO") is everything it's cracked up to be, it very well may open the IPO floodgates for questionable companies... in turn giving the Greenberg Garbage Index a new lease on life.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

Reminds me of the dot com boom when we started selling 35mm cameras via the internet. Spoiler alert - it did not slow the digital revolution lol

Just four letters. NVDA