I’m still back on what I wrote last week about the latest crop of Chinese IPOs in my report about the increasingly silly art of spin…

It’s quite possible you would have missed it if you didn’t click the link in the email and read to the end. And if you’re a free subscriber, well, even if you did it was behind the paywall.

But the more I thought about it, the more I realized that there’s a really good story buried here that seems to be falling through the cracks of coverage… so consider this a repeat of sorts, but new and revised info lower in the story… so make sure you read beyond what you might have already read.

Back to the Future

For me, the more I thought about it, the more that this was like back to the future, when I was in the thick of reporting and among the few outing Chinese reverse mergers. These were Chinese companies that merged into shells of mostly non-existent U.S. companies for the sole purpose of being able to get in through the back door to trade here. (They were the focus of the documentary The China Hustle, where I play a bit role, including in the trailer, in the pivotal scene, where I say… “Hold onto your wallet!”)

Many were frauds and most have since disappeared.

Enter this cycle’s Chinese IPOs, which mostly appear to be IPOs, but with a good number of SPACs tossed in.

To be honest, in recent years I haven’t been paying attention to this entire genre until last week…

Here we were, in the thick of a trade war with China – on the day the U.S. lifted tariffs on China – and a company named Ruanyun Edai Technology RYET 0.00%↑ was front and center, ringing the opening bell at the Nasdaq. Talk about awkward…

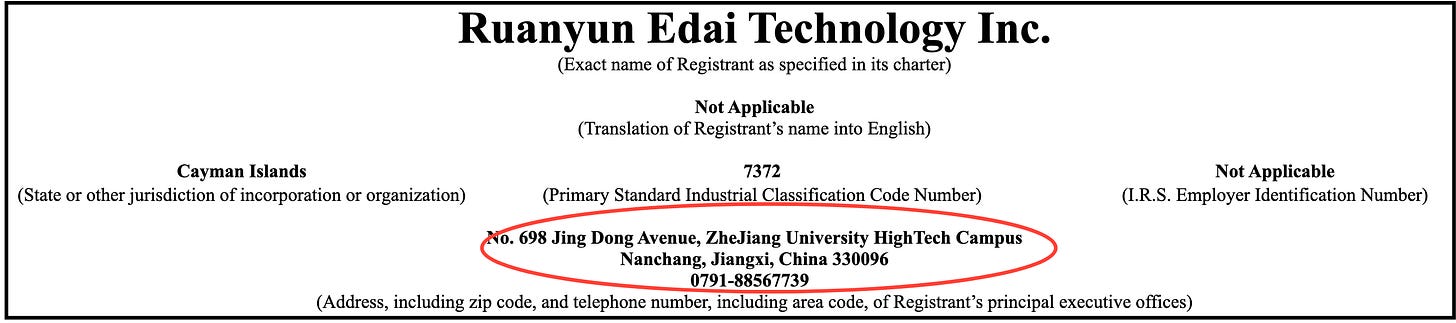

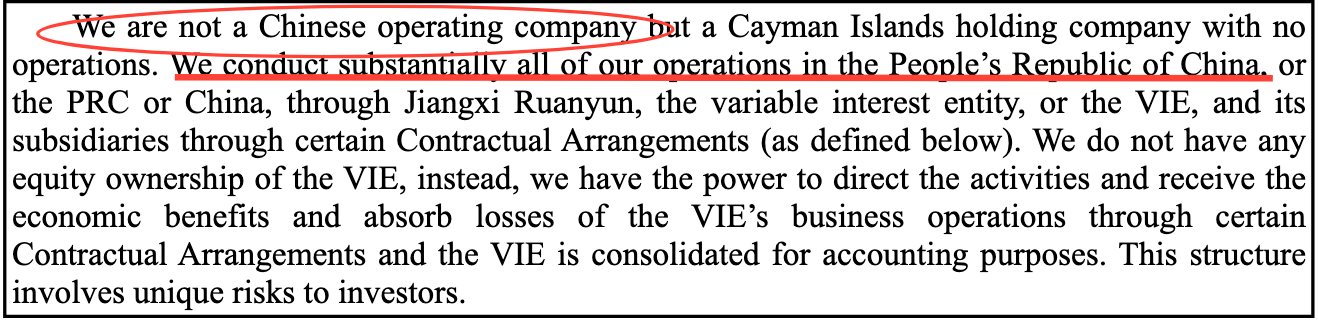

I’ve done zero work on Ruanyun – and it may be a fantastic investment. But for fun I went to its IPO prospectus, and this immediately stopped me…

Think about it. On one hand they say…

We are not a Chinese operating company.

On the other…

We conduct substantially all of operations in the People’s Republic of China.

And if you’re in any doubt, just look at the top of its SEC filing…

To say it’s not a Chinese operating company, while factually correct based on its incorporation, is also highly misleading and the ultimate example of the silly art of spin.

Hardly an Exception…

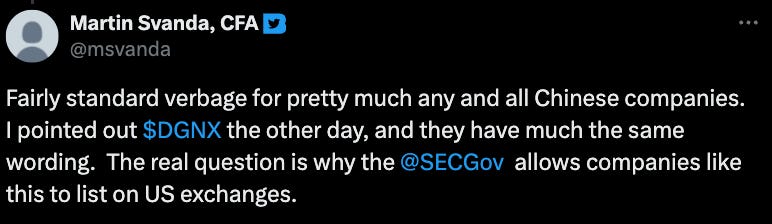

As Martin Svanda who writes the Short Ideas newsletter schooled me after I posted something on social media…

So, I decided to check…

Using my trusty AlphaSense, I ran a search on the phrase, “We are not a Chinese operating company.”

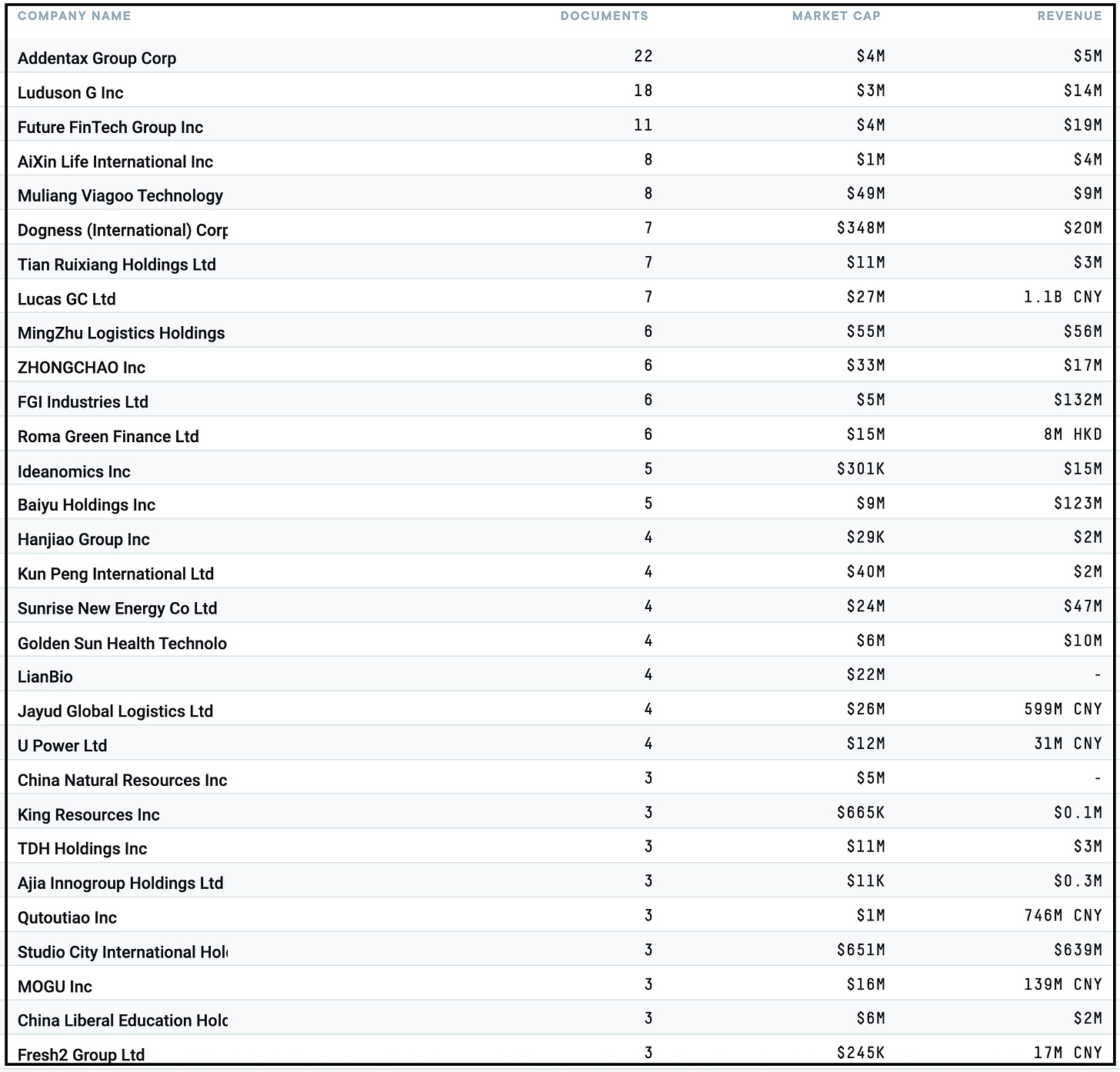

At first, I got 59 companies, which it appears started using the phrase in 2021. Here are a few, pretty much all companies you’ve never heard of and many of which don’t or no longer trade here – and if they do are shells of what they once were…

Then I expanded the search to a variation of phrases, including simply “not a Chinese operating company, “not a PRC operating company” and “we are not a Chinese or Hong Kong operating company” and – presto! – I wound up with 192 companies.

A Deeper Dive…

Of those, 146 have market values less than $100 million. But 24 are valued at more than $1 billion… but the market value of the all of them is (drumroll!) $338 billion.

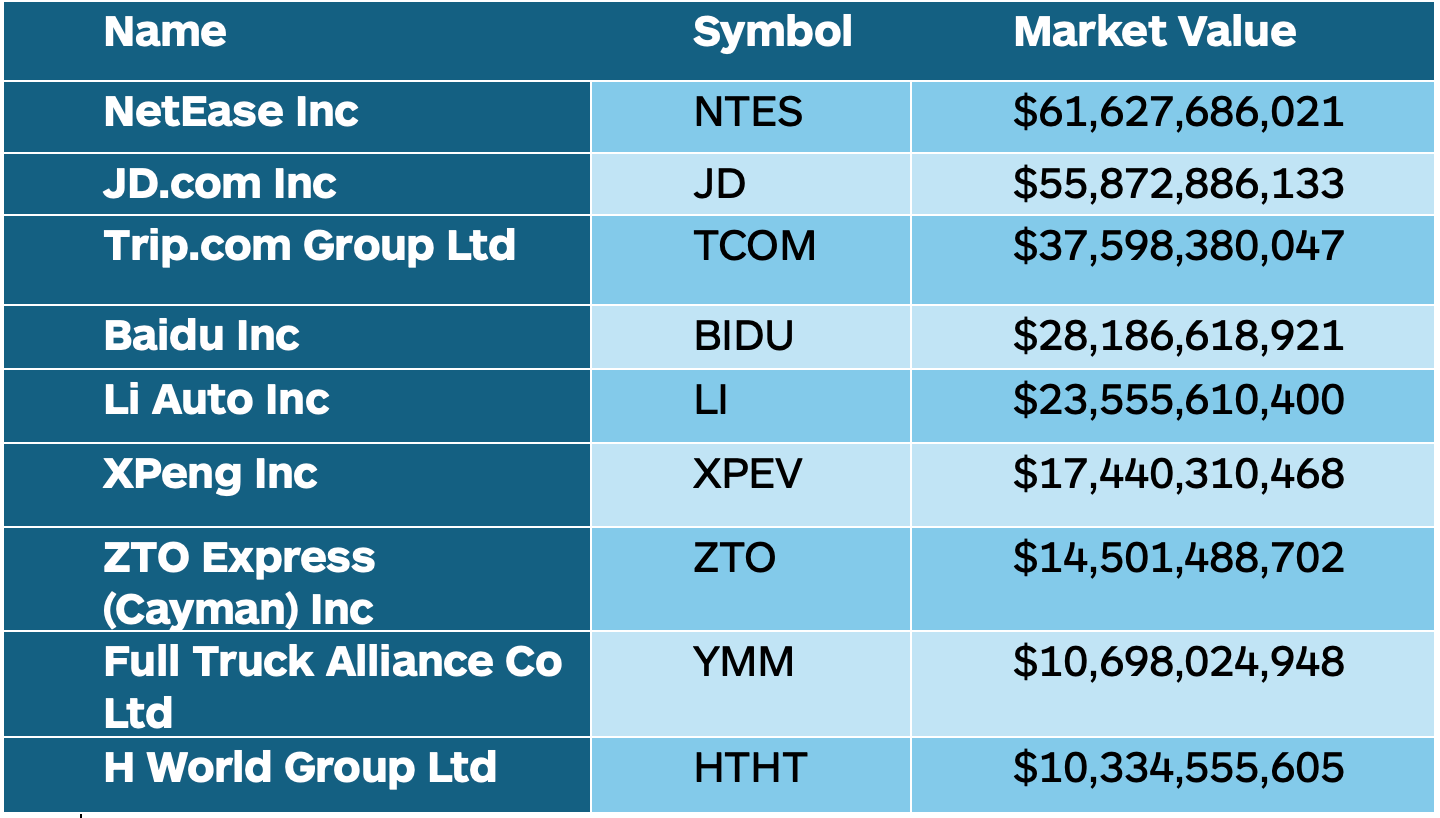

That’s because companies that use some version of “not a Chinese operating company” aren’t just recent IPOs but include some of the largest Chinese companies listed in the U.S., such as NetEase, JD.com, Trip.com and Baidu.

Notably missing is Alibaba, whose market value on its own is $257 billion, and which seeming goes out of its way not to use any version of that phrase.

Maybe that’s because, having been through the regulatory wringer in the past, it knows a red flag when it sees one. Like Alibaba, most if not all of these companies are incorporated in the Cayman Islands and have complicated variable interest entity structures. (I didn’t go through them one-by-one, but this appears to be the playbook.)

Realty Is…

By virtue of all that, they’re not legally Chinese operating companies.

But to repeat what I wrote earlier, it’s a misleading comment because it implies they’re not Chinese companies, even though all or most are headquartered either there or Hong Kong… which also happens to be where they do all or most of their business.

In other words, for U.S. investors, it’s just the latest in the never-ending China hustle.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in this stock.

I can be reached at herb@herbgreenberg.com.