The Next Shoe That Might Not Drop for Banks.

The Next Shoe That Might Not Drop for Banks. Plus More Heart Mail...

(This originally ran at Empire Financial Research.)

Now that the big banks have started reporting earnings, the news has been better than expected...

The big question is whether regional banks – you know, the smaller banks in your hometown – are where the bad news will be buried.

The general thought is that after the Silicon Valley Bank ("SVB") debacle, deposits have likely been fleeing to the larger, perceived-to-be-safer big banks... especially from commercial customers.

And based on commentary from JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) on their earnings calls last week, some of this shift could have started.

But there's more to that story, and it's summed up in a tweet from Brad Safalow of PAA Research...

I've known Brad for years. He does exceptional work, so I was surprised his tweet didn't go viral... because it should have.

It suggests that when regional bank earnings are released, they won't show a mass exodus of small business clients.

One reason, I suspect, is that small business owners are simply too busy to stop everything and redo their banking relationships.

It's not just the time and effort that goes into switching banks... First, it's deciding which bank, and then it's changing everything that goes along with a switch – from payroll to online bill payments to getting new checks. If you've ever run a small business, no matter how small, time really is money... and extra energy, which you likely don't have.

I'm also sure that regional banks did a good job convincing businesses not to leave, dangling long-standing personal relationships in front of them – including business loans, mortgages, and personal relationships that can come in handy when times get tough.

There's something else...

I'm just putting this out there, because it's something I said on CNBC's Last Call on Friday night...

Could it be that future bank failures might not have the impact of the recent round of flops? I ask because, as with so much in a world where news cycles that keep changing every five minutes, could it be that bank failures are rapidly normalized?

Thanks (or no thanks) to social media and the firehose of information directed our way every minute of every day, it's increasingly hard to tell where one crisis ends and the next one begins.

SVB, after all, has disappeared from newspaper headlines as fast as it appeared.

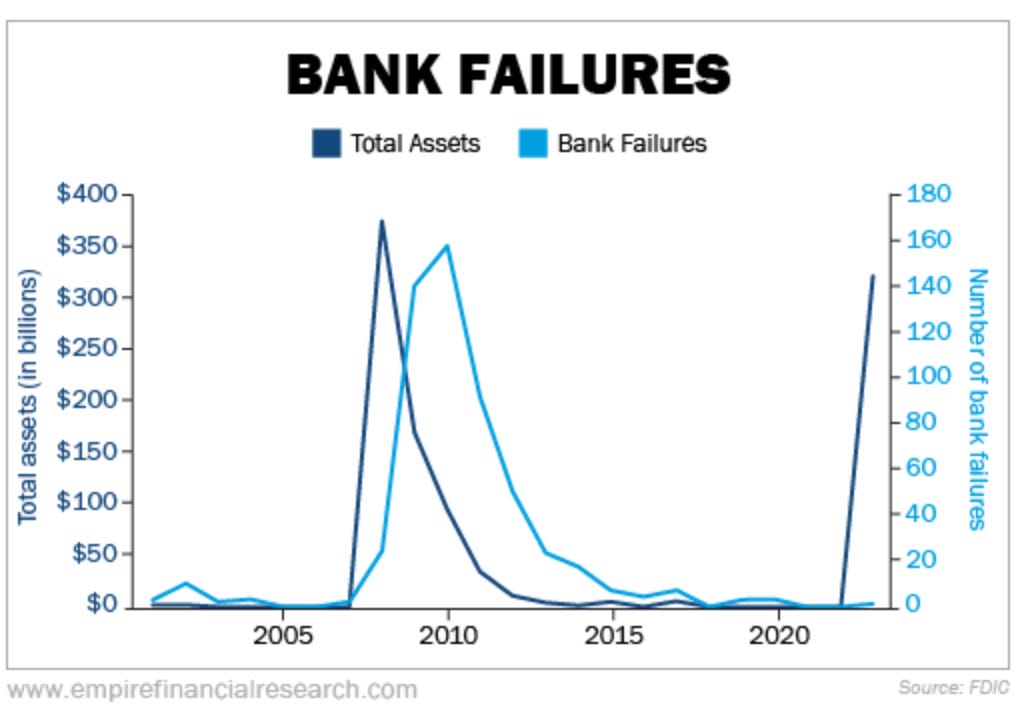

What we know is that banks will fail, as they always have...

Since 2001, there have only been five years with no failures.

The system was shocked, and it survived... again.

Speaking of banks, part of the issue they're facing is the number of regular folks who are moving money out of zero percent checking to something with higher yields...

For years, there was little we could do. Checking, savings, U.S. Treasurys, certificates of deposit ("CDs")... they all paid about the same: Zero.

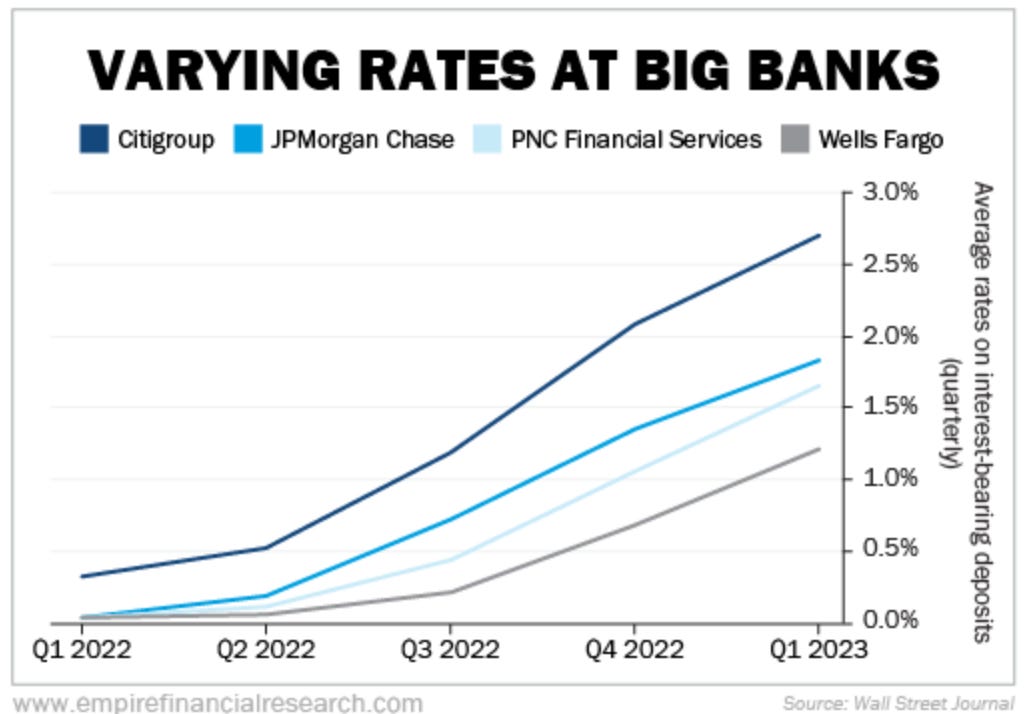

Now, banks are finally paying more on savings – nowhere near as much as you can get on promotional CDs or a brokerage money market, but more nonetheless. And the biggest moves have happened fast, as in over the past month or so. As the Wall Street Journal reported over the weekend...

The average yield for online savings accounts rose to about 3.75% in March, according to indexes from Deposits Online, compared with 0.5% a year ago. Online one-year certificates of deposits on average offered an annual percentage yield of nearly 4.75%, up from less than 1% in 2022.

And it pays to shop around, as this chart from the Journal points out so well...

As you can see, even as rates have been rising, there's a wide range in what the banks pay on interest-bearing accounts. No surprise, Wells Fargo – seemingly the big bank struggling the most – is at the bottom of the list.

What's clear is that more and more customers are willing to go through the hassle to move money from bank to bank to get higher rates.

JPMorgan CFO Jeremy Barnum said as much on the bank's earnings call last week when he acknowledged that an inflow of deposits may be just that...

It's a competitive market. And it's entirely possible that people temporarily come to us, and then over time, decide to go elsewhere. So for all of those reasons, we're just being realistic about the stickiness of those...

Years of getting zero percent will do that.

(This originally ran at Empire Financial Research, where I also write two investment newsletters, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)