The Risk of EVERY "Risk" - The Signet Edition

Long activists and shorts often target the same company but hoping for different results.

Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club, now in the hundreds, who want to avoid the biggest mistake investors make… or just want to understand the concept of risk. You can find out more and how to subscribe right here. If you would prefer to pay with soft dollars, or participate in an upper tier, please contact me directly.

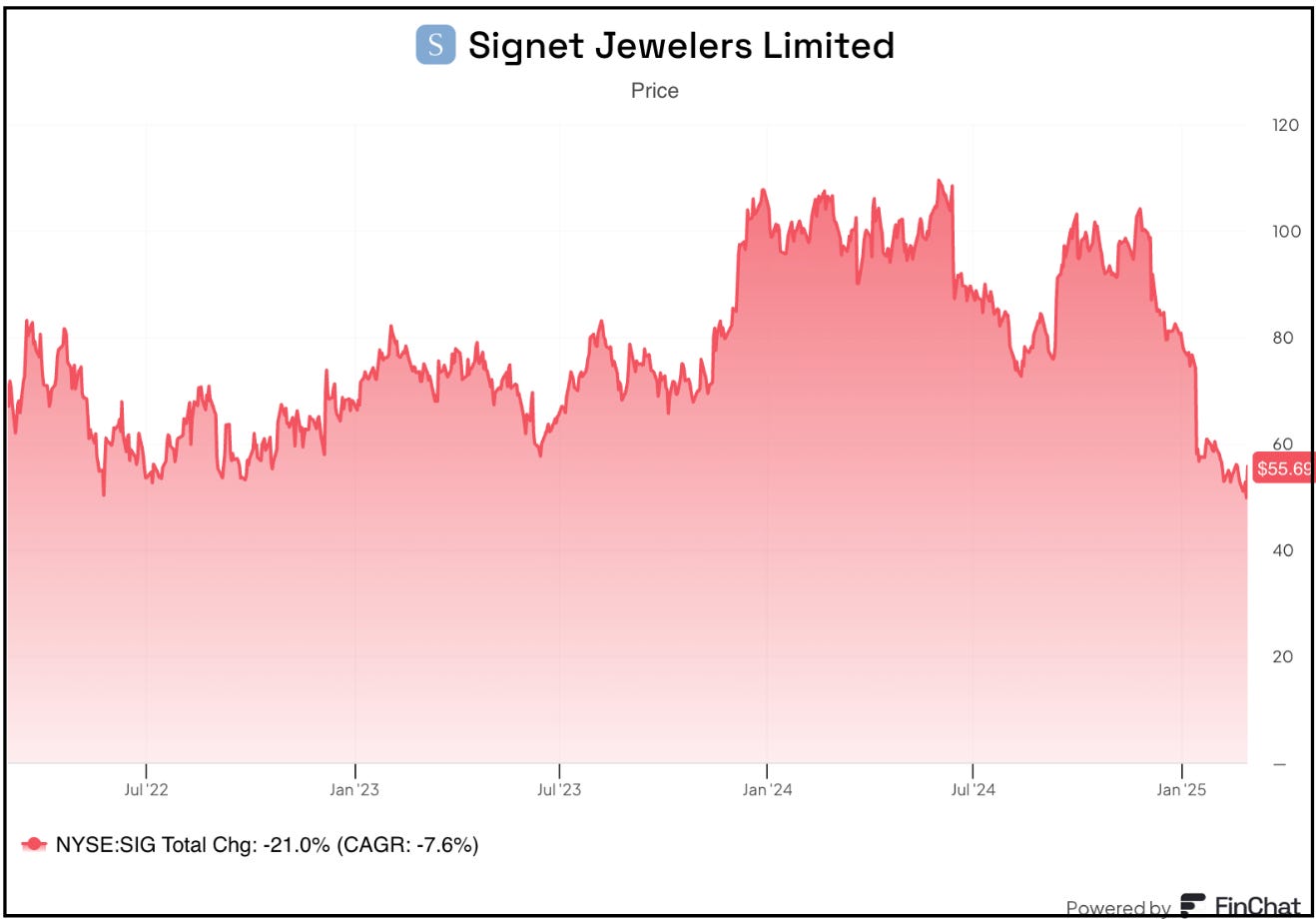

Since I tilt on pointing out the risks of publicly held companies, this quick note on Signet SIG 0.00%↑, which has been red-flagged here since last April…

If you missed it, longtime investor Select Equity filed a 13-D yesterday on the jewelry retailer, pushing for change. Key point from the filing…

The Reporting Persons believe that the Common Shares of the Issuer are undervalued, and that the Issuer would be better able to realize value for stockholders by exploring strategic options for the business, including its immediate sale.

More Specifically…

From a letter accompanying the filing:

The business has suffered same-store-sales declines in each of the last 11 quarters, well below the industry overall, an extraordinary run given Signet’s inherent franchise advantages;

Operating profit has declined in each of the last three years and fallen short of guidance in each of the last two years;

Management further hurt organic and online sales by botching the transition of James Allen and the recently acquired Blue Nile business onto a new technology platform just prior to the 2023 holiday selling season, which caused sales of those subsidiaries to drop by significant double-digit amounts for six consecutive quarters;

Management and the Board have a poor record of capital allocation, wasting nearly half a billion dollars in purchasing unprofitable businesses, including Blue Nile, as well as deploying cash in purchasing shares well above their current level;

Most recently, the CEO, Gina Drosos, departed with little warning. The Board communicated that Ms. Drosos would stay through the holiday season as a consultant to guarantee continuity, however, she was notably absent from any calls, investor meetings and public appearances, while the business badly missed its holiday guidance and continued to flounder; and,

At the same time, the Board has poorly aligned pay and performance, agreeing to large, multi-million-dollar payouts to the existing management team to retain them for a surprisingly short period of time (3-6 months) and paying an ou

Here’s the Thing…

As is often the case when activists show up, nothing may ever come of this. With Signet, there are plenty of fundamental issues simmering beneath the surface – not just with the company’s business model, but with its industry.

But this should serve as a reminder that the same screens and things that attract short-sellers can attract activists.

Or, as is the case with Select Equity, which is a disgruntled longtime investor that obviously didn’t heed the warnings. (Cue the Signet team at Select Equity, in unison: “He’s such a jerk! F*cking fool.” Yeah, yeah, take a number, stand in line..)

This is why, as boilerplate as it may seem, I often cite “takeover” as a risk of the risk. If I’ve learned nothing else over the decades, it’s that heels dug in to win a fight, long or short, can be the quickest way to lose money… or if you’re someone like me who writes about it, tarnish a reputation.

Signet’s shares, at their depth, fell more than 40% since Katherine Spurlock and I first red-flagged it.

As I’ve been known to say, sometimes just because a stock has been decimated doesn’t mean it can’t be obliterated.

But when the story changes, the best investors “re-underwrite” their thesis. For both sides, that can mean either exiting a position or gaining even more conviction. (That’s where the “heels dug in” comes in.)

The Likely Buyer?

In this case, the story hasn’t changed… yet, but with one big disgruntled investor pushing for change, the big question now is: Who would be the buyer of a company whose inventories are likely overvalued with a business strategy whose time very well may be broken?

Private equity would appear to be the likely answer, but would PE buy a structural problem? In checking with my friends who are or were short, there were two distinct schools of thoughts: