The Smartest Guys in the Room Weren't So Smart... And Supreme Irony at SVB and the SEC's Focus on Earnings Quality

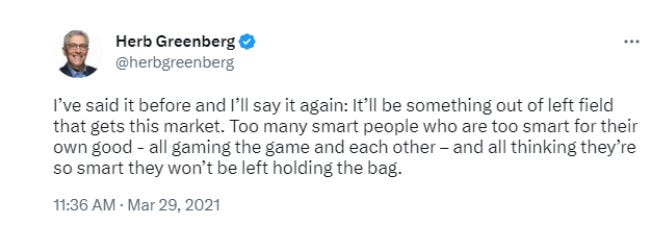

One theme I've been hammering away at since the bubble burst has been how the market had fooled the seemingly smartest of the smart...

As I tweeted back in March 2021...

The latest example, of course, is the failure of SVB Financial (SIVB), whose Silicon Valley Bank was the bank to the stars and starlets of Silicon Valley.

As is now well reported, the bank's comeuppance was largely the result of so-called "reaching for yield" with its own cash, back when interest rates were still low. SVB did this by purchasing somewhat higher-yielding long-term Treasury bonds rather than short-term Treasurys, which were yielding just above zero.

The rise in interest rates caused the value of those bonds to plummet, setting off a series of events that have since played out.

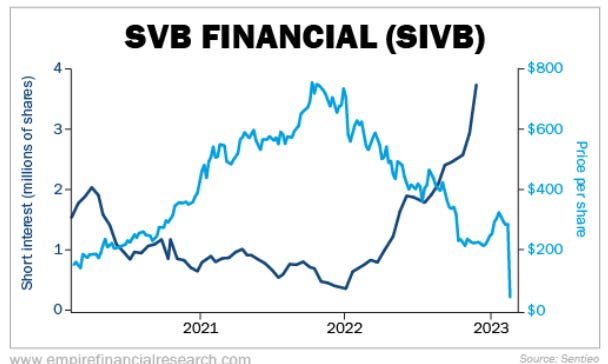

As the chart below shows, with a spike in short interest, short sellers picked up on the added risk, which the company disclosed in its regulatory filings.

And there were plenty of folks raising red flags well before last week – including Raging Capital Ventures, which wasn't just shorting the stock in January, but was laying out its case in a Twitter thread...

Likewise, in December, somebody who writes under the name "Cashflow Hunter" was sounding the alarm about SVB on Seeking Alpha. Here's the summary...

Potential losses in loan portfolio could severely impair book equity.

Unrealized losses in hold to maturity portfolio already equal to book equity.

Funding environment for start-ups will pressure deposit base adding even more pressure to the balance sheet.

Then there was the Wall Street Journal's Jonathan Weil, who warned in mid-November about the effect of rising interest rates on banks, with a special mention of SVB – writing (emphasis added)...

SVB Financial, the parent of Silicon Valley Bank, said the market value of its held-to-maturity bonds was $15.9 billion less than their balance-sheet value, as of Sept. 30. That gap was slightly more than SVB's $15.8 billion of total equity. SVB's chief financial officer, Dan Beck, said in an e-mail, "There are no implications for SVB because, as we said in our Q3 earnings call, we do not intend to sell our HTM [held to maturity] securities."

Right... famous last words.

And even earlier, there was Gator Capital sounding quite a loud siren...

But drilling down, which is easy to do in retrospect... SVB was the ultimate enabler of a market run amuck. Yes, it enabled innovation and startups and that entire ecosystem, but in doing so pumped hot air into the market as it bubbled until it burst.

Think about it...

While the focus of SVB's bust is on its Treasury bond portfolio, don't lose sight of the fact that it wasn't just a lender, but also an active purchaser of stocks and warrants in private and public companies it bankrolled, as well as venture funds.

As the below slide from the company's fourth-quarter investment presentation shows, that was an integral part of its business model...

And for a moment there, it looked downright genius – at least if you think it's genius to be creating a fantasy.

In reality, SVB was helping fuel an accelerating market rise that was simply unsustainable.

Even venture capitalists were sounding the alarm. As I said in the November 19, 2021 Empire Financial Daily...

Among the most ominous comments came from Scott Kleinman, co-president of private equity giant Apollo Global Management. He was quoted by Bloomberg last week as saying, "We are all in a state of collective delusion here. We will look back in 20 years from now and say, 'What were we all thinking?'"

Turns out, we didn't even have to wait 20 months...

It was all perhaps best summed up by my pal Peter Atwater in a note on Friday, when he said...

SVB was a highly leveraged, all-in bet on overconfidence!

Overconfidence, and yet another reminder of just how humbling hubris can be.

Speaking of SVB, here's some irony...

As is now obvious, when interest rates were yielding almost nothing, SVB got into trouble reaching for yield by investing in long-term government bonds rather than lower-yielding short-term Treasurys.

The irony...

Back in 2008, everybody seemed to be reaching for yield by investing in auction rate securities, which offered a sliver more yield than Treasurys. After all, auction rates were supposedly safe... until it turned out they weren't – trapping some of the supposedly smartest of the smart (there's that theme again).

In the so-called "forgotten crisis" of auction rate securities, SVB was the exception to getting swept up in these assets.

As I wrote in a Wall Street Journal column at the time...

From the "credit where credit is due" department: When the auction-rate-securities market went into its recent deep freeze, turning cash into what appears to be trash at many companies, Joe Morgan wasn't the least bit surprised.

As the head of portfolio management at San Francisco-based SVB Asset Management, a division of SVB Financial, he started warning corporate clients as far back as 2004 to steer clear of auction-rates as a virtually no-risk, slightly higher-yielding alternative to sleepy money-market funds, Treasurys, and even commercial paper.

SVB was so ahead of the curve that it published a buyer-beware commentary on its website, saying that the "risk profile of these securities is inconsistent with the investment priorities of risk-averse investors." With even greater prescience, SVB said that the triple-A rating of most of the auction-rates merely reflected the likelihood of getting back principal when the bonds mature, "and does not reflect the risk of a failed auction."

The list of companies learning that lesson the hard way appears to be growing by the day, as a new crop of annual and quarterly filings hits the Securities and Exchange Commission's online database with disclosures of cash getting stuck in the auction-rate logjam.

SVB actually lost clients because it refused to invest their money into auction rates. What could those clients possible have been thinking? Again, from my article...

Mr. Morgan thinks he knows: "In boom times, people get complacent, especially if they haven't been through a bust cycle." You can rest assured that won't happen again – until the next go-round. By then, let's hope the sensibilities of Mr. Morgan haven't been forgotten.

As we all know now, whether it repeats itself or merely rhymes, history has a way of coming full circle.

Finally, speaking of bubbles, there's something you can almost count on without fail after a mania...

It's news that the U.S. Securities and Exchange Commission ("SEC") is focusing on earnings manipulation. As the Wall Street Journal recently put it...

Regulators are scrutinizing whether companies are manipulating financial results to meet Wall Street targets, as a profit-squeeze amps up pressure on executives to "make the numbers."

This earnings season has been marked by falls in both reported profits and expectations of future returns. With more than 99% of S&P 500 companies having reported, fourth-quarter earnings are down 4.65%, according to FactSet. That is the first year-over-year decline since fall 2020, at the height of the pandemic.

Tough economic times have historically been fertile ground for earnings management. Executives use flexibility in the accounting treatment of items such as reserves for losses, or revenue recognition, to boost reported earnings per share.

In many instances, this is perfectly legal. It can, though, in some cases slide into securities-law violations or even fraud. Problematic tactics range from accounting changes that mask an underlying deterioration in the company's finances to numbers-juggling that falls outside generally accepted accounting principles.

Same as it ever was... same as it always will be. And that's before artificial intelligence gets into the act.

(This originally ran at Empire Financial Research, where I also write two investment newsletters, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)