They’re back. The meme stocks, that is.

And this time is different.

At least the setup is...

Last time meme stocks were the rage, interest rates were zero, and the temptation was too great for many investors to pass up.

Meme stocks were the ultimate Wall Street con and still sucked nearly everybody in. Investors thought they would be smart enough to get out before the bottom fell out... passing the empty bag along to the next sucker.

But here we are...

Back to the Future

On Friday Novavax NVAX 0.00%↑ was up 100% on news that it signed some kind of deal with Sanofi, rising another 47% today.

GameStop GME 0.00%↑ , meanwhile, ticked 75% higher on no news... other than the below tweet (seen and heard ‘round the market) by meme-stock guru Roaring Kitty.

You can’t make this stuff up, but to show what I don’t know, the tweet and the action in GME pulled along the likes of AMC AMC 0.00%↑ (+60%) and even our old friend, Tupperware TUP 0.00%↑ (+42%).

Human nature strikes again, but with rates sharply higher than they were when the memesters first became a thing. What am I missing?

As much as I hate talking about what everybody else is talking about, I made an exception because of the interest rate disparity.

‘Not a Normal Market’

The consensus seemed to be that regardless of where rates are – as Ben Brey of his family office Deductive Capital put it in his response...

Let’s say the original GameStop thing was January ‘21. We're now sitting May of 24, the government's pumped six trillion dollars extra in deficit spending and that money's got to go somewhere... and it sits around and It sloshes around like the end of the day that money's out there.

Ben added...

This isn't a normal market where things are anchored...the stuff we're seeing is very indicative of widespread speculation...

Whatever the reason, even before this latest round of irrational insanity, the indices were all in vertigo territory.

But rates are high, too – or at least considerably higher than they were back then, when they were 0%. That would seem to be an enormous disconnect, and while “the market” is still being driven by a relatively small number of stocks, the gamblers are clearly back to running the casino.

Who Knew What When?

Though were they really gambling? Or was something else going on?

Starting on April 25, volume in calls in GameStop – then 9 cents – started to tick higher... as did the price.

By April 26, on sharply higher volume, they were 28 cents.

By May 3, $1.61... and today, nearly $9.

Calling a Top?

But is this really the sign of a top? Beware, as my friend Peter Atwater said today in his Financial Insyghts newsletter...

What we witnessed this morning feels far more like a resurrection from the dead than the foundation of a new rally.

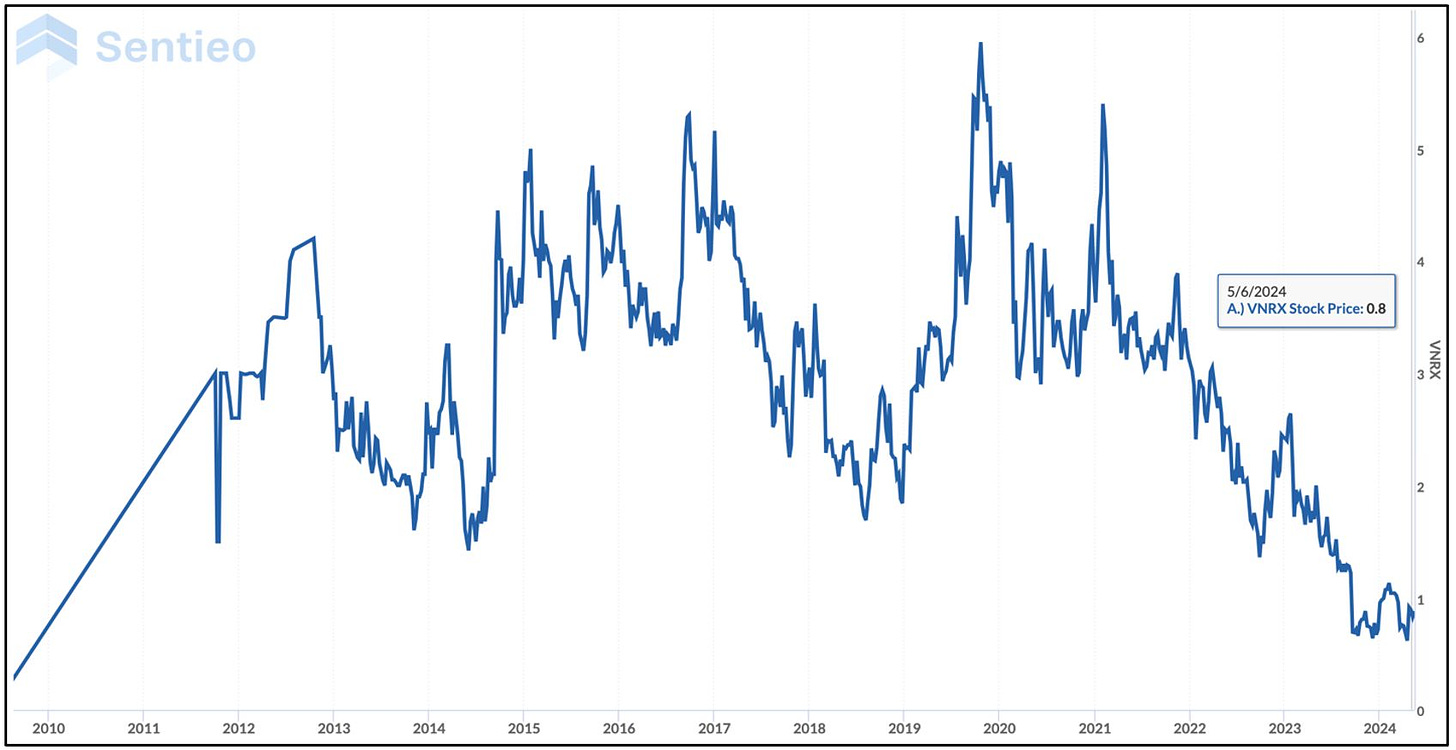

For evidence, he included the below chart...

He then added...

Consider that since the S&P peaked in the fall of 2022, every major surge in GameStop shares has coincided with a major peak in the broader market. Meme-stocking is the consequence of extreme confidence. It is what the crowd continues to overlook. It marked THE peak in mood in 2021. Like subprime lending before it, it arrived last to the party and left first.

Such a racket.

Speaking of ‘Signs’

Obviously, none of us knows if and when this market will crack, and I certainly pointed out a number of seemingly important mileposts... all the way up.

But if I had to pick one thing – just one – that caught my attention it was VolitionRX ($VNRX), which claims to be “revolutionizing healthcare...” In all likelihood it’s a company you have likely never heard of... and for good reason.

It has virtually no revenue, no profits, and what cash it does have – it’s net cash positive – has come from issuing new shares.

What got my attention...

In recent weeks a commercial has been showing up on financial TV about the company. Within eight seconds of the broadcast, the company’s name pops on the screen as the announcer says, “VolitionRX, any NYSE company, stock symbol, VNRX...”

And if you didn’t hear it the first time, a tag at the end of the 30-second spot reminds you, “VolitionRX – VNRX...”

Pennies Lane

We are talking about an 87-cent stock that peaked in 2019 at roughly $5.50. And just before these commercials started, it was 60 cents.

In the category of “if you knew nothing else,” this would be it…

Not a Seal of Approval

After all, just because a company is on the New York Stock Exchange it doesn’t mean it has received some Good Housekeeping seal of approval. It merely means it qualified to be listing and can afford the listing fees.

When penny stocks start spending money on TV commercials to promote their shares, watch out.

Maybe VolitionRX will go on to greatness. (It says it helps detect cancer in dogs, so I hope it does.) What I do know is that running TV commercials to promote its shares appears to be more like a sign of desperation... not to mention a sign of where we are in this market.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

I can be reached at herb@herbgreenberg.com.

I’m waiting for the meme of a gamer sitting back into the original position

Here are the comments you removed:

As far as I'm concerned, here is a better sign of where this market is: Apple Inc - whose reported Equity as of 3/31/2024 was $74.2 billion (see finance.yahoo.com) - announces a $110 billion buyback, which at its current price will result in approximately 4% of the shares being bought back and the remaining 96% of the shares owned by the continuing shareholders will possibly own 100% of a deficit Equity. If you do the math of how much of that $74.2 billion Equity per share is owned by all the current shares before the buyback (approx. $4.84 per share), you will realize that $107 billion of the $110 billion reduction in total Equity is "cash" Equity, the most real of book-values, owned by the former 96%, that now are so lucky to own 100% of possibly $0 of Equity!! Oh, and because there has been a buyback, of course the Market should bid up the price of Apple - or any other stock that does a buyback, which is the Market's normal reward to the ignorance of those remaining shareholders, exhibited by the remaining shareholders failure to sue managements failure of its fiduciary duty to them!!!!!!!!!

My comment is an elaboration of the logic provided in this pdf link found in the header of the website BuySellDoNothing.com: https://www.buyselldonothing.com/image/catalog/230828%20Investing%20Without%20Risk%20-%20an%20IMPORTANT%20UPDATE%20TO%20OUR%20RECOMMENDATIONS.pdf