Two Battleground Stocks Hit the No-Buy Zone

One Energy Stock, One Medical Device Stock

Since I started the Red Flag Alert, I've been experimenting with various ways to source ideas of stocks to avoid...

As a quick refresher, I do these alerts after shaving spent decades building a reputation largely on reminding investors of the risk buried in the hype.

It's something I think about whenever I'm recommending a stock at Empire Financial Research. If anything keeps me up at night, it's worrying about how I might have been bamboozled by a bullish story – something many investors lose sight of when stocks seem to be going up.

Or when a stock has been so pummeled it has just naturally seems like a bargain, when it really may be a trap.

The primary idea here is that with thousands of stocks to choose from, there are likely better ideas than the ones that wind up in The No-Buy Zone.

One increasingly invaluable source has been monthly screens developed Kailash Concepts (KCR), a so-called “quantamental” research firm. By virtue of showing up on any one of those screens a company has a higher probability of underperforming the market over the next 12 months. Hitting three screens ups the odds...

So far, these screens have proven to be exceptional at identifying companies that have gone on to underperform the market in a surprisingly short period of time. A few have even plunged – one the day after my report, on unexpectedly bad news.

Enter Bloom Energy (BE), which manufactures fuel cells that produce electricity, with an increased focus on hydrogen. This month it hit three KCR screens...

That shouldn't be entirely surprising. For a few years Bloom has been the center of a bull-bear battle, including a 2019 report by the activist short-selling firm, Hindenburg Research. This was when Hindenburg was still relatively unknown – a full year, in fact, before it made headlines by poking holes in claims by the company Nikola that it had produced a semi-truck that ran on hydrogen fuel cells.

With Bloom, Hindenburg raised a number of issues, including allegations that the company overstated its financials. The company claimed the report was "false and misleading" and the stock went on to double during the market's pandemic fueled melt-up.

But Bloom has continued to be a magnet for controversy, much of it tied to the numbers...

Look no further than how Bloom ranks in quality in the KCR small-midcap universe of stocks, where last month it was 1,569 out of 1,578 companies. To be fair, that's an improvement over the prior month's bottom-of-the-barrel rank of 1,585 out of 1,585 stocks... but it's still bad.

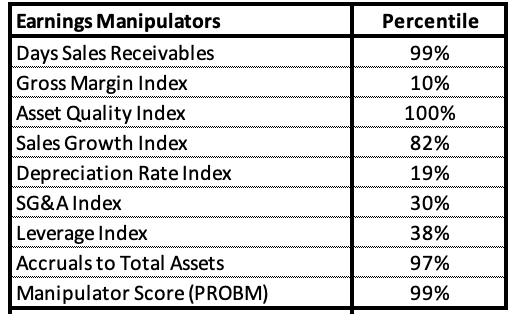

In fact, for months Bloom has been showing up in the KCR's Russell 2500 "bottom 25 short portfolio." It also has been a regular on its earnings manipulators list, with its so-called "M-Score" – a well-known tool used to identify manipulators – scoring 99% out of 100% last month.

That's not good, which is why KCR views Bloom as a "possible manipulator."

Here's where it gets interesting...

In February the M-Score was half that amount. But by April it had leaped into the danger zone – the high 90s – which coincided with the stock starting to tumble...

It gets worse, because the third KCR screen Bloom showed up on this month was "unattractive debt," which suggests a topsy-turvy balance sheet and financial statements. The chart below is Bloom's debt over two years...

Its debt is so dubious that it landed even landed on KCR's "financially fragile" list, which I highlighted several weeks ago. This is a list of companies that don't earn enough to cover their interest.

And its debt is spiking in the face of negative free cash flow, negative operating income and negative net income...

That combo isn't generally perceived to be a good setup... in the very least, regardless of the "story," suggests that Bloom is a financial high-wire act.

At the same time, according to its public filings, its share count is also rising (in other words, shareholders are getting diluted) as the company has over time resorted to issuing more shares to raise additional cash. That's because the only way it appears to be staying afloat is by issuing new shares or new debt... or both. Since 2018, shares outstanding have roughly doubled.

Something else to keep in mind: As of last quarter, three customers generated 70% of all sales. Such heavy concentration, regardless of the company, is always considered a risk.

As with all companies, there are industry nuances that can make numbers look better or worse than they really are. But at Bloom the numbers are the numbers and they're flashing in neon, bright.

One catch... More than 15% of the float of BE's stock is already short.

High short interest can be translated many ways. One is a warning sign for anybody who owns the stock because it suggests there really might be something wrong with the company. But it can also be a warning for shorts because good news could cause the stock to rally and force shorts to cover quickly – exacerbating not to mention exaggerating and potential rally.

The bottom line: The numbers suggest that Bloom's story is much better than its underlying business. Even though its stock has already imploded and its trading momentum is bearish, high short interest suggests it's not worth trying to be long or short. There's simply too much risk either way. My view: Avoid.

Bonus Round, one more stock from this month's crop...

Like Bloom, implantable eye lens manufacturer Staar Surgical (STAA) has a history of being a battleground stock over the years. Roughly half its sales come from China; only 5% from the U.S.

For a few months, it has shown up with some regularity on KCR's earnings manipulation screen as a possible manipulator.

But the overall quality of its earnings and balance sheet have been tumbling to the point the company now ranks 1,571 out of 1,579 small midcap companies.

The quality is so bad that this month it also showed up on KCR's "bottom 25 short" Russell 2500 screen but also on its growth at a reasonable price ("GARP") short screen... a screen that is almost the inverse of GARP. That's a screen of companies with high expectations, the nosebleed multiples to prove it and all kinds of other issues, such as possible earnings manipulation.

On the plus side the company has no debt. On the flipside, trading at 61 times trailing earnings it has negligible net income – the quality of which is iffy – and negative free cash flow.

Oh, and one customer generates more than half all revenue.

Like Bloom, short interest of 12% represents a risk for anybody short the stock if there's a stock-squeezing rebound. But if the shorts are right, it also can suggest risks for anybody long... even after the stock already has swooned. Avoid.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts, and should not be construed as investment advice.

(I write two investment newsletters for Empire Financial Research, Empire Real Wealth and Herb Greenberg’s Quant-X System. For more information, click here and here.)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.